Tungsten Carbide Market Share

Tungsten Carbide Market Research Report Information By Application (Cemented Carbide, Coatings, Alloys, and Others), By End User (Aerospace and Defence, Automotive, Mining, and Construction, Electronics, and Others) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

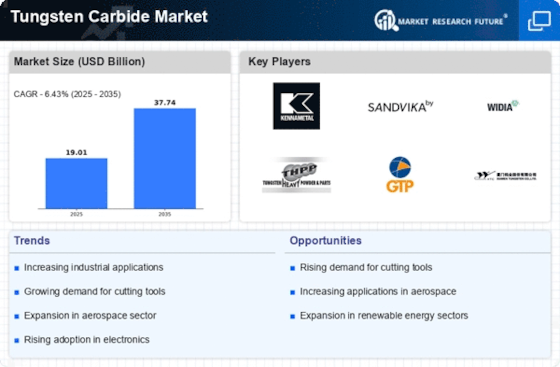

As per Market Research Future Analysis, the global Tungsten Carbide market was valued at USD 19.01 Billion in 2024 and is projected to reach USD 37.74 Billion by 2035, growing at a CAGR of 6.43% from 2025 to 2035. Key drivers include increased mining activities, rising industrialization, and growing demand for metals and minerals. The market is significantly influenced by urbanization, infrastructural developments, and government investments in emerging economies. The automotive sector leads in end-user applications, while cemented carbide dominates in terms of application. However, health concerns related to tungsten carbide dust may restrain market growth.

Key Market Trends & Highlights

The Tungsten Carbide market is witnessing significant growth driven by urbanization and industrial demands.

- Market Size in 2024: USD 19.01 Billion

- Projected Market Size by 2035: USD 37.74 Billion

- CAGR from 2025 to 2035: 6.43%

- Automotive sector holds the largest end-user market share

Market Size & Forecast

| 2024 Market Size | USD 19.01 Billion |

| 2035 Market Size | USD 37.74 Billion |

| CAGR (2024-2035) | 6.43% |

Major Players

Key players include Sandvik AB, HC Starck, Jenmar, Xiamen Tungsten Co Ltd., Hitachi Metals, and Mitsubishi Material Corporation.

Market Trends

Growing urbanization is driving the market growth

Market CAGR for tungsten carbide is being driven by rising urbanization. There is a significant increase in infrastructural developments and mining activities throughout the world. There is an increase in the shipment of tungsten carbide powder due to the fast industrialization and urbanization happening in developing countries globally. The government of the emerging economies' investment in infrastructure projects is anticipated to boost the application of tungsten carbide powder in mining and construction.

The section of mining is witnessing significant growth due to the increasing requirement for minerals and metals throughout different industrial sections. The tungsten carbide is the material of choice for the mining equipment in the high-pressure down-the-hole (DTH) hammer drilling section, including buttons, carbide inserts, and tips which can be utilized for petroleum tunneling, drilling, and mining. The high hardness, super wear resistance, and best impact toughness of the tungsten carbide mining tools enhance the operating performance.

The mining of granite, sandstone, and limestone from other materials is apt for tungsten carbide inserts due to their high drilling speed and longer service life, which minimizes labor costs and fastens the engineering processes. This global tungsten can be applicable in deep-hole drilling or heavy-duty rock drilling. The increasing demand for tungsten carbide products, inclusive of cobalt powder, titanium carbide powder, welding powder, and other products, is anticipated to boost market growth.

The tungsten carbide is largely utilized to develop high-performance auto parts that have the ability to withstand high stress and heat, like brakes, ball joints, crankshafts, and studs for tires. It has a large product used to manufacture cutting tools that are utilized to make automotive engines, axels, transmission, and steering assemblies is leading to factor for the growth of the market. The increasing adoption of 3D printing to create cost-effective and efficient high-performance parts is boosting the growth of the market.

It also has applications in the medical section for generating surgical instruments like, blade handles, scissors, hemostats, graspers, forceps, cautery, and others. Thus, driving the Tungsten Carbide market revenue.

The factors like inhalation of dust and lung fibrosis similar to silicosis are the main cautions related to tungsten carbide, resulting in restraining the growth of the market. The cobalt-cemented tungsten carbide can lead to human carcinogens and other effects like major respiratory issues, vision issues, and skin allergies upon inhaling them. All these factors can hamper the market growth of the tungsten carbide.

April 2024

The limited liability company known as "Zhetysu Tungsten" is now in the process of developing a mining enterprise at the Bugutinskoe deposit, which is situated in the Almaty region. For the Bugutinskoe deposit, there is a mineral extraction contract that has been granted with the number 4608-TPI. This contract was issued on June 2, 2015, and it is valid for a term of twenty-five years.

The construction and mining operations are now going ahead at a quick rate, and it is projected that the commissioning will take place by the end of the year 2024. One thousand new jobs are expected to be created as a direct consequence of the installation of the mine and the processing plant, according to speculation.

The Global Tungsten Carbide Market appears poised for growth, driven by increasing demand in various industrial applications, particularly in manufacturing and construction sectors.

U.S. Geological Survey (USGS)

Tungsten Carbide Market Market Drivers

Technological Advancements

Technological innovations in the production and application of tungsten carbide are significantly influencing the Global Tungsten Carbide Market Industry. Advances in manufacturing techniques, such as additive manufacturing and improved sintering processes, enhance the performance and efficiency of tungsten carbide products. These innovations not only reduce production costs but also expand the range of applications, from aerospace to medical devices. As a result, the market is poised for growth, with projections indicating a compound annual growth rate (CAGR) of 6.43% from 2025 to 2035. This suggests that technological progress will play a crucial role in shaping the future landscape of the Global Tungsten Carbide Market Industry.

Market Trends and Projections

Growth in Construction Activities

The Global Tungsten Carbide Market Industry is also benefiting from the surge in construction activities worldwide. Tungsten carbide is utilized in various construction tools, including drills and saws, which are essential for infrastructure development. As urbanization accelerates and governments invest in infrastructure projects, the demand for high-performance tools is likely to increase. This trend is underscored by the projected market growth, with estimates suggesting a rise to 37.7 USD Billion by 2035. Consequently, the construction sector's expansion is expected to significantly bolster the Global Tungsten Carbide Market Industry.

Increasing Demand in Manufacturing

The Global Tungsten Carbide Market Industry is experiencing heightened demand driven by its extensive applications in manufacturing sectors. Tungsten carbide is favored for its hardness and wear resistance, making it ideal for cutting tools, mining, and drilling applications. As industries seek to enhance productivity and reduce downtime, the adoption of tungsten carbide tools is likely to rise. This trend is reflected in the projected market value, which is expected to reach 19.0 USD Billion in 2024. The ongoing industrialization in emerging economies further supports this growth, indicating a robust future for the Global Tungsten Carbide Market Industry.

Rising Demand in Oil and Gas Sector

The oil and gas industry is a significant contributor to the Global Tungsten Carbide Market Industry, as tungsten carbide is extensively used in drilling and exploration activities. The durability and strength of tungsten carbide tools make them suitable for harsh environments, thereby enhancing operational efficiency. With the anticipated increase in global energy demand, investments in oil and gas exploration are likely to rise, further driving the demand for tungsten carbide products. This sector's growth is expected to contribute substantially to the market's expansion, reinforcing the industry's relevance in the coming years.

Environmental Regulations and Sustainability

Increasing environmental regulations are shaping the Global Tungsten Carbide Market Industry, as industries seek sustainable alternatives. The push for eco-friendly practices has led to innovations in tungsten carbide recycling and the development of greener production methods. Companies are increasingly focusing on sustainability to comply with regulations and meet consumer preferences for environmentally responsible products. This shift not only enhances the market's appeal but also positions tungsten carbide as a viable option in various applications. The emphasis on sustainability is likely to drive growth in the industry, aligning with global trends towards responsible manufacturing.

Market Segment Insights

Tungsten Carbide Application Insights

The Tungsten Carbide market segmentation, based on application, includes Cemented Carbide, Coatings, Alloys, and Others. The cemented carbide segment dominates the market, accounting for the largest of market revenue as these are metallurgical materials in powder form, which is a composite of tungsten carbide particles and a binder full of metallic cobalt. It is also utilized for wood machining, composite materials, metal cutting, plastics, soft ceramics, chipless shaping in the building and mining industries, wear parts, structural parts, and military parts.

Further, tungsten carbide has distinctive physical and mechanical characteristics, like high-temperature wear resistance, tensile strength, abrasion resistance, and comprehensive strength, making it the first option for many industries.

Figure 1: Tungsten Carbide Market, by Application, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Tungsten Carbide End User Insights

The Tungsten Carbide market segmentation, based on end users, includes Aerospace and Defence, Automotive, Mining, Construction, Electronics, and Others. The automotive category dominates the market because of the rising requirement for innovation and flexibility in the development and manufacturing of new machines. In the year 2021, the amount of tungsten carbide exported from the US was 25%. Further, the aerospace industry is expected to be the fastest-growing segment due to the large-scale requirements for commercial planes.

Get more detailed insights about Tungsten Carbide Market Research Report- Forecast till 2032

Regional Insights

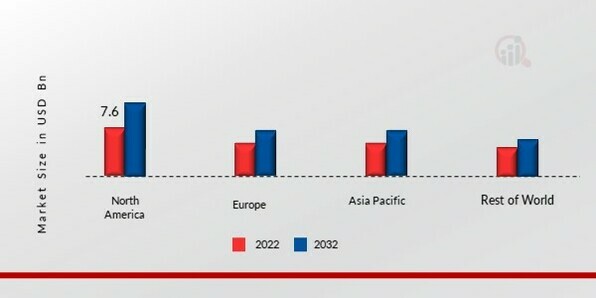

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Tungsten Carbide market due to the increasing mining activities in this region and the increasing infrastructural activities and transportation in the region. The US has the largest contribution to the growth of the tungsten carbide market in the North American region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Tungsten Carbide MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Europe's Tungsten Carbide market accounts for the second-largest market share due to the expansion of the oil and gas industry and the growth of infrastructure in the region. Further, the German Tungsten Carbide market held the largest market share, and the UK Tungsten Carbide market was the rapid-growing market in the European region.

The Asia-Pacific Tungsten Carbide Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to the emerging demand for construction, metallurgy, and automotive markets and the rising transportation activities throughout the developing countries in this region. Moreover, China’s Tungsten Carbide market held the largest market share, and the Indian Tungsten Carbide market was the rapid-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Tungsten Carbide market grow even more. Market participants are also undertaking a various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Tungsten Carbide industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Tungsten Carbide industry to benefit clients and increase the market sector. In recent years, the Tungsten Carbide industry has offered some of the most significant advantages to infrastructure organizations. Major players in the Tungsten Carbide market, including Sandvik AB, HC Starck, Jenmar, Xiamen Tungsten Co Ltd., Hitachi Metals, Mitsubishi Material Corporation, Federal Carbide Company, American Elements, Manu & Sales Corporation, Sumitomo Corporation, Xiamen tungsten Co Ltd., and others, are attempting to increase market demand by investing in research and development operations.

CERATIZIT Group was created in the year 2002 by merging the companies CERAMETAL and Plansee Tizit, headquartered in Luxembourg. The company is a high-technology engineering group specializing in cutting tools and hard material solutions. In September 2022, the acquisition of all the shares of AgriCarb SAS, a worldwide leader in tungsten carbide agriculture wear parts for the last 35 years, was announced by CERATIZIT SA. This acquisition will assist the company in coming into new markets, with a high degree of added expertise and value in the hybrid tools fields made of tungsten carbide and steel.

Further, the company also announced the acquisition of the remaining % of the Stadler Mettale shares, which is the prime source of secondary raw materials to manufacture tungsten carbide powder and tungsten.

Sandvik AB, founded in 1862, is a Swedish multinational engineering company, employing over 40,000 employees and providing services in over 150 countries. The company specializes in products and services for mixing, rock drilling, rock excavation, rock processing, machining, and metal cutting. The Sandvik Group conducts operations in three different businesses for production, research and development, and sales of their respective service and products. In January 2019, the company completed the purchase of Dura-Mill, a United States-based company that manufactures precision cemented carbide end mills.

The working experience of the Dura-Mill may rise with specialized end mills as a part of the Sandvik AB subsidiary.

Key Companies in the Tungsten Carbide Market market include

Industry Developments

July 2022: A agreement was signed with Nyobolt by HC Starck for investing about 52 million dollars. The company is popular for its tungsten-intensive battery business.

February 2020: XCAL Industries was launched by an Australian-based company Jenmar. XCAL Industries produces tungsten carbide blanks. The company aimed to raise the range of its product offerings of tungsten carbide blanks and cutting tools for the tunneling and mining sections of North America.

September 2018: National Mineral Developmental Corporation aims to produce huge bucks of tungsten carbide owing to rising demand in the market and its easy production ways. The mining facilities also assist in the storage and production of the same.

In 2024 Kennametal released advanced tungsten carbide cutting tools designed for high-precision applications.

In 2023 Element Six introduced new tungsten carbide products with enhanced hardness and durability for industrial use.

Future Outlook

Tungsten Carbide Market Future Outlook

The Global Tungsten Carbide Market is poised for growth at 6.43% CAGR from 2025 to 2035, driven by advancements in manufacturing technologies and increasing demand in various industries.

New opportunities lie in:

- Invest in R&D for innovative tungsten carbide applications in aerospace and automotive sectors.

- Expand production capabilities to meet rising demand in oil and gas drilling.

- Leverage strategic partnerships to enhance distribution networks in emerging markets.

By 2035, the Tungsten Carbide Market is expected to demonstrate robust growth, solidifying its position as a key material in industrial applications.

Market Segmentation

Tungsten Carbide End User Outlook

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Tungsten Carbide Regional Outlook

- US

- Canada

Tungsten Carbide Application Outlook

- Cemented Carbide

- Coatings

- Alloys

- Others

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 19.01Billion |

| Market Size 2035 | 37.74 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 6.43% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Application, End User, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Sandvik AB, HC Starck, Jenmar, Xiamen Tungsten Co Ltd., Hitachi Metals, Mitsubishi Material Corporation, Federal Carbide Company, American Elements, Manu & Sales Corporation, Sumitomo Corporation, Xiamen Tungsten Co Ltd. |

| Key Market Opportunities | Rising industrialization and urbanization in the developing economies. |

| Key Market Dynamics | Increased application in different sections and demand for metals and minerals. |

| Market Size 2025 | 20.23 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Tungsten Carbide Market?

The Tungsten Carbide Market size was valued at USD 17.70 Billion in 2023.

What is the growth rate of the Tungsten Carbide Market?

The Tungsten Carbide Market is foreseen to grow at a CAGR of 6.43% during the forecast period, 2024-2032.

Which region held largest market share in the Tungsten Carbide market?

North America had the largest share of the Tungsten Carbide Market.

Who are the key players in the Tungsten Carbide Market?

The key players in Tungsten Carbide Market are Sandvik AB, HC Starck, Jenmar, Xiamen Tungsten Co Ltd., Hitachi Metals, Mitsubishi Material Corporation, Federal Carbide Company, American Elements, Manu & Sales Corporation, Sumitomo Corporation, Xiamen Tungsten Co Ltd.

Which application led the Tungsten Carbide Market?

The cemented carbide category dominated the Tungsten Carbide Market in 2023.

Which end-user had largest market share in the Tungsten Carbide Market?

Automotive had the largest share of the Tungsten Carbide Market.

-

Table of Contents

-

Executive Summary

-

Scope of the Report

- Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

- Markets Structure

-

Market Research Methodology

- Research Process

- Secondary Research

- Primary Research

- Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Segment rivalry

- Value Chain/Supply Chain of Global Tungsten carbide Market

-

Porter’s Five Forces Analysis

-

Industry Overview of Global Tungsten carbide Market

- Introduction

- Growth Drivers

- Impact analysis

- Market Challenges

-

Market Trends

- Introduction

- Growth Trends

- Impact analysis

-

Global Tungsten carbide Market by Grade Type

- Introduction

-

General purpose grade

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Metal foaming and wear grades

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Submicron grades

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Rotary drilling and mining grades

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Corrosion resistant grades

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Global Tungsten carbide Market by End user industry

- Introduction

-

Mining and Construction

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Oil & gas

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Electrical and electronics

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Automobile

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Defense

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Others

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Global Tungsten carbide Market by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Grade Type, 2023-2032

- Market Estimates & Forecast by End user industry, 2023-2032

- U.S.

- Mexico

- Canada

-

Europe

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Grade Type, 2023-2032

- Market Estimates & Forecast by End user industry, 2023-2032

- Germany

- France

- Italy

- Spain

- U.K

- Rest of Europe

-

Asia Pacific

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Grade Type, 2023-2032

- Market Estimates & Forecast by End user industry, 2023-2032

- China

- India

- Japan

- Australia

- New Zealand

- Rest of Asia Pacific

-

The Middle East & Africa

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Grade Type, 2023-2032

- Market Estimates & Forecast by End user industry, 2023-2032

- Turkey

- Israel

- North Africa

- GCC

- Rest of the The Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Grade Type, 2023-2032

- Market Estimates & Forecast by End user industry, 2023-2032

- Brazil

- Argentina

- Rest of Latin America

-

Company Landscape

-

Company Profiles

-

Sandvik AB

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Kennametal Inc

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Ceratizit S.A

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Extramet AG

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Federal Carbide Company

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Guangdong Xianglu Tungsten Co., Ltd.

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Nanchang Cemented Carbide Co., Ltd

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Jiangxi Yaosheng Tungsten Co., Ltd

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Japan New Metal Co., Ltd

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

China Tungsten

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Eurotungstene

- Company Overview

- Grade Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Sandvik AB

-

Conclusion

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 World Population by Major Regions (2023 To 2032)

- Table 2 Global Tungsten carbide Market: By Region, 2023-2032

- Table 3 North America Tungsten carbide Market: By Country, 2023-2032

- Table 4 Europe Tungsten carbide Market: By Country, 2023-2032

- Table 5 Asia Pacific Tungsten carbide Market: By Country, 2023-2032

- Table 6 The Middle East & Africa Tungsten carbide Market: By Country, 2023-2032

- Table 7 Latin America Tungsten carbide Market: By Country, 2023-2032

- Table 8 Global Tungsten carbide by Grade Type Market: By Regions, 2023-2032

- Table 9 North America Tungsten carbide by Grade Type Market: By Country, 2023-2032 Table10 Europe Tungsten carbide by Grade Type Market: By Country, 2023-2032 Table11 Asia Pacific Tungsten carbide by Grade Type Market: By Country, 2023-2032 Table12 The Middle East & Africa Tungsten carbide by Grade Type Market: By Country, 2023-2032 Table13 Latin America Tungsten carbide by Grade Type Market: By Country, 2023-2032 Table14 Global Tungsten carbide by End user industry Market: By Regions, 2023-2032 Table15 North America Tungsten carbide by End user industry Market: By Country, 2023-2032 Table16 Europe Tungsten carbide by End user industry Market: By Country, 2023-2032 Table17 Asia Pacific Tungsten carbide by End user industry Market: By Country, 2023-2032 Table18 The Middle East & Africa Tungsten carbide by End user industry Market: By Country, 2023-2032 Table19 Latin America Tungsten carbide by End user industry Market: By Country, 2023-2032 Table20 Global Tungsten carbide by End user industry Market: By Regions, 2023-2032 Table21 Global Grade Type Market: By Region, 2023-2032 Table22 Global End user industry Market: By Region, 2023-2032 Table23 Global End-use Market: By Region, 2023-2032 Table24 North America Tungsten carbide Market, By Country Table25 North America Tungsten carbide Market, By Grade Type Table26 North America Tungsten carbide Market, By End user industry Table27 North America Tungsten carbide Market, By End-use Table28 Europe: Tungsten carbide Market, By Country Table29 Europe: Tungsten carbide Market, By Grade Type Table30 Europe: Tungsten carbide Market, By End user industry Table31 Europe: Tungsten carbide Market, By End-use Table32 Asia Pacific: Tungsten carbide Market, By Country Table33 Asia Pacific: Tungsten carbide Market, By Grade Type Table34 Asia Pacific: Tungsten carbide Market, By End user industry Table35 Asia Pacific: Tungsten carbide Market, By End-use Table36 The Middle East & Africa: Tungsten carbide Market, By Country Table37 The Middle East & Africa Tungsten carbide Market, By Grade Type Table38 The Middle East & Africa Tungsten carbide Market, By End user industry Table39 The Middle East & Africa: Tungsten carbide Market, By End-use Table41 Latin America: Tungsten carbide Market, By Country Table42 Latin America Tungsten carbide Market, By Grade Type Table43 Latin America Tungsten carbide Market, By End user industry Table44 Latin America: Tungsten carbide Market, By End-use LIST OF FIGURES

- FIGURE 1 Global Tungsten carbide Market Segmentation

- FIGURE 2 Forecast Methodology

- FIGURE 3 Five Forces Analysis of Global Tungsten carbide Market

- FIGURE 4 Value Chain of Global Tungsten carbide Market

- FIGURE 5 Share of Global Tungsten carbide Market in 2023, by country (in %)

- FIGURE 6 Global Tungsten carbide Market, 2023-2032,

- FIGURE 7 Sub segments of Grade Type

- FIGURE 8 Global Tungsten carbide Market size by Grade Type, 2023

- FIGURE 9 Share of Global Tungsten carbide Market by Grade Type, 2023-2032

- FIGURE 10 Global Tungsten carbide Market size by End user industry, 2023

- FIGURE 11 Share of Global Tungsten carbide Market by End user industry, 2023-2032

Tungsten Carbide Application Outlook (USD Billion, 2018-2032)

- Cemented Carbide

- Coatings

- Alloys

- Others

Tungsten Carbide End User Outlook (USD Billion, 2018-2032)

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Tungsten Carbide Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

North America Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

North America Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

US Outlook (USD Billion, 2018-2032)

US Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

US Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

CANADA Outlook (USD Billion, 2018-2032)

CANADA Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

CANADA Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Europe Outlook (USD Billion, 2018-2032)

Europe Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Europe Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Germany Outlook (USD Billion, 2018-2032)

Germany Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Germany Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

France Outlook (USD Billion, 2018-2032)

France Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

France Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

UK Outlook (USD Billion, 2018-2032)

UK Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

UK Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

ITALY Outlook (USD Billion, 2018-2032)

ITALY Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

ITALY Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

SPAIN Outlook (USD Billion, 2018-2032)

Spain Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Spain Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Rest Of Europe Outlook (USD Billion, 2018-2032)

Rest Of Europe Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

REST OF EUROPE Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Asia-Pacific Outlook (USD Billion, 2018-2032)

Asia-Pacific Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Asia-Pacific Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

China Outlook (USD Billion, 2018-2032)

China Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

China Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Japan Outlook (USD Billion, 2018-2032)

Japan Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Japan Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

India Outlook (USD Billion, 2018-2032)

India Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

India Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Australia Outlook (USD Billion, 2018-2032)

Australia Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Australia Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

Rest of Asia-Pacific Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Rest of Asia-Pacific Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Rest of the World Outlook (USD Billion, 2018-2032)

Rest of the World Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Rest of the World Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Middle East Outlook (USD Billion, 2018-2032)

Middle East Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Middle East Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Africa Outlook (USD Billion, 2018-2032)

Africa Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Africa Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Latin America Outlook (USD Billion, 2018-2032)

Latin America Tungsten Carbide by Application

- Cemented Carbide

- Coatings

- Alloys

- Others

Latin America Tungsten Carbide by End User

- Aerospace and Defence

- Automotive

- Mining and Construction

- Electronics

- Others

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment