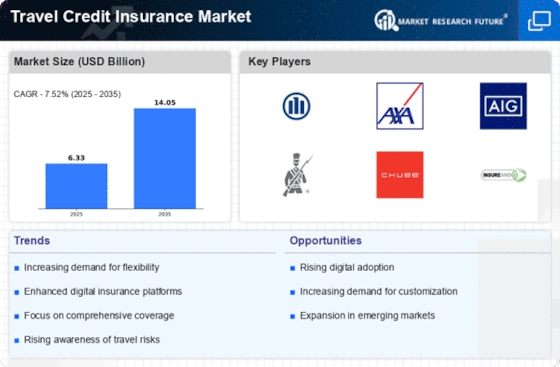

Market Growth Chart

Rising Global Travel Demand

The Global Travel Credit Insurance Market Industry is experiencing growth driven by an increase in global travel demand. As international travel continues to rebound, more travelers are seeking protection against unforeseen events that could disrupt their plans. In 2024, the market is projected to reach 6.32 USD Billion, reflecting the heightened awareness of travel risks. This trend is likely to persist as travelers prioritize safety and security, leading to a greater uptake of credit insurance products. The increasing number of travelers, particularly in emerging markets, suggests a robust future for the industry.

Increased Awareness of Travel Risks

There is a growing awareness among travelers regarding the potential risks associated with travel, which is positively impacting the Global Travel Credit Insurance Market Industry. As travelers become more informed about issues such as trip cancellations, medical emergencies, and lost luggage, the demand for insurance products is likely to rise. Educational campaigns by insurers and travel agencies play a crucial role in this awareness. This trend indicates that consumers are increasingly recognizing the value of credit insurance as a safeguard against financial loss, thereby driving market growth.

Technological Advancements in Insurance

Technological innovations are reshaping the Global Travel Credit Insurance Market Industry. The integration of digital platforms and mobile applications facilitates easier access to insurance products, allowing consumers to compare policies and purchase coverage seamlessly. Insurers are leveraging data analytics to tailor offerings to individual needs, enhancing customer satisfaction. As technology continues to evolve, it is expected that the market will see an influx of new entrants and innovative products. This digital transformation is likely to attract a younger demographic, further expanding the market's reach and contributing to its growth trajectory.

Regulatory Support for Insurance Products

Regulatory frameworks are evolving to support the Global Travel Credit Insurance Market Industry. Governments are recognizing the importance of consumer protection in travel-related financial products, leading to the establishment of guidelines that promote transparency and fairness. Such regulations encourage insurers to develop comprehensive policies that cater to diverse traveler needs. As regulatory support strengthens, it is anticipated that more consumers will feel confident in purchasing travel credit insurance, contributing to the market's expansion. This supportive environment is likely to foster innovation and competition among insurers.

Projected Market Growth and Future Potential

The Global Travel Credit Insurance Market Industry is poised for substantial growth, with projections indicating a market size of 14.7 USD Billion by 2035. This growth is underpinned by a compound annual growth rate (CAGR) of 7.95% from 2025 to 2035. Factors such as increasing disposable incomes, a rise in travel frequency, and the ongoing development of insurance products tailored to consumer needs are expected to drive this expansion. As the market matures, it may witness the emergence of new trends and opportunities, further solidifying its position in the global insurance landscape.