Transition Metals Size

Transition Metals Market Growth Projections and Opportunities

The significant numbers of factors have a tremendous impact on the Transition metals Market in turn influence its dynamics. Along with world demand which originates in the wide implementation of the transiting metals in almost every sector of our economy. These metals among others such as iron, copper and zinc are the critical metals for the development of engineering, production and technology sections. This leads to the fact that the crucial economic parameters, such as growth, industrial production, and technical improvements, impact significantly the demand for transition metals. The cyclical seasons of these industries combine that instability in demand that we observe in the transectional metal market time and again.

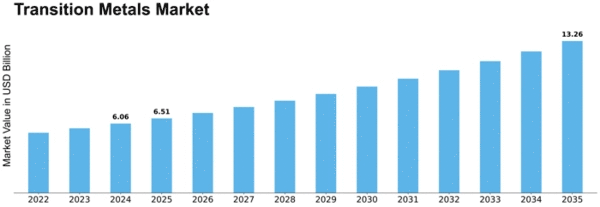

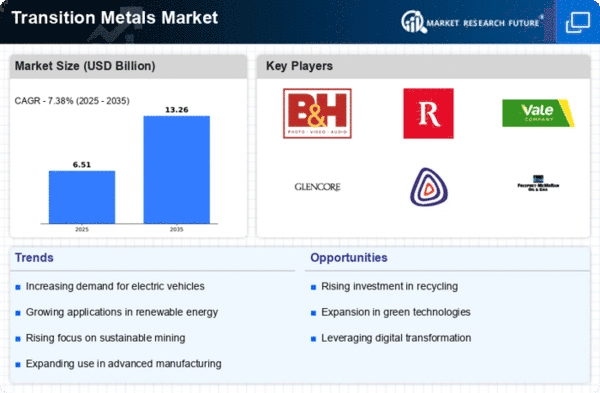

According to the estimation of the analysts, Transition Metals Market shall demonstrate a CAGR more than 4.2% by the year 2030 to achieve an approximate of USD 1,369.46 billion.

Supply-side forces also prove to be potent in the determination of the prices in this market. Changing the dynamics of mining activities, exploring new territories as well as political stability on key producing region will have direct influence on the supply of transition metals. Alterations in mining rules, environmental acts and geo-political uncertainties can shift the supply chain, move the prices, in restaurant manner. Further to this, the disappearance of existing mines and the investigation of newer reserves can provide a pathway to predict the future supply levels through which the interplay of demand supply can be more obvious.

The other crucial external factor among currency exchange is involved in the transition metal trade. As these metals are trading in world scale, any fluctuations in currency can throw unmatched effects on pricing and market competitiveness. Instability of exchange rates could increase production costs, manipulate import and export balances, and cause the turbulence of the market. Exchange rate fluctuations are thereby attainable due to this sensitivity to the currency movements, and the market of transition metals would be thereby vulnerable to macroeconomic factors such as interest rates and inflation rates.

Although environmental problems are only relatively new in the modern world, they have gained popularity recently, provoking a transition in the market for the metals of transitional elements. Strict environmental sanctions, and enlightened understanding of the need to implement eco-friendly devices and facilities take place throughout the industry in order to be in accord with the natural circle of life. With the turn towards sustainable resource-use, these transtion metals find their demands respond to them in the best way of those with less environmental burden. The recycling campaigns and better technologies for environmentally fit mining industries serve the purpose of building the market outlook.

The geopolitical events have a magnifying effect via global linkages to the transition metal sphere of markets. Squabbles, sanctions, and political intrigueness caused by major companies in consuming or producing countries can manifest as market insecurities. Trade sectors disagreement among nations may cause the addition of tariffs and barriers, what in turn stimulates the outgo of transition metals and ends up with market disturbance. The political circumstances add an unpredictable element to the flow of payments; therefore the market participants tend to watch the international politics.

Leave a Comment