Tortilla Size

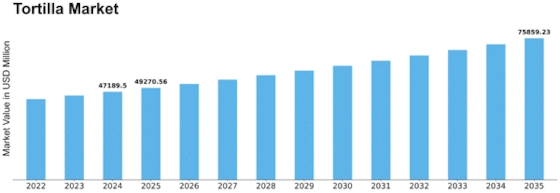

Tortilla Market Growth Projections and Opportunities

The tortilla market is influenced by various factors that contribute to its dynamics and growth. One of the primary drivers of the tortilla market is the increasing popularity of diverse and international cuisines. The present situation in consumer demand for various tastes and dining experiences, the demand for tortillas as a versatile meal resulting in increase in tortillas production and consumption.

Changing eating habits and the importance of healthier eating options are major factors which drive the tortilla market. option of alternative tortillas such as the whole wheat and multigrain are appetizing to health conscious consumers who desire nutritious options that are rich in fiber. For some, especially those accepting a new healthy way to go to lunch or dinner serving tortillas instead of traditional bread, the driving force to incorporate tortillas into diverse diets is derived from that impression.

Demographic shifts are very important in the tortilla market. Multiculturalism has come to the rise today, and though people combine other countries way of cooking, Si, these cultures are getting into mainstream food culture. Consequently, tortillas are not only eaten with other traditional Mexican meals but also serve as wraps, chips, and taco shells that can be incorporated into hundreds of culinary inventions. The multicultural environment affecting product innovation is the introduction of forms that are colored, flavored, and textured to suit changing customer tastes by manufacturers.

Cultural and regional effects are also displayed, since in different countries people not only like the tortilla but they concoct it in other ways. For instance, corn tortillas are more common in Mexican cuisine and round-fours are normally found in dishes which are of Tex-Mex combination. It is essential to comprehend such cultural subtleties, as the companies working in the tortilla market have to design their products and market tactics according to the tastes in the region.

The tortilla market is determined by competitive factors such as branding, marketing and strategic alliances. Established brands leverage their recognition and reputation, while newer entrants focus on differentiation through product innovation and creative marketing campaigns. Collaborations with restaurants, foodservice providers, and chefs contribute to the visibility and popularity of tortilla products, influencing consumer preferences and purchasing decisions.

Leave a Comment