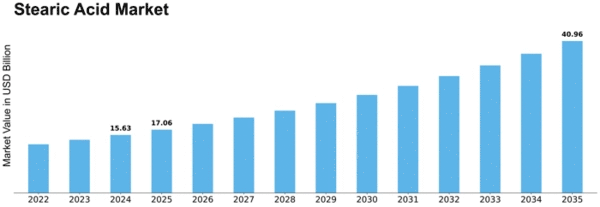

Stearic Acid Size

Stearic Acid Market Growth Projections and Opportunities

Stearic acid, a saturated fatty acid commonly found in animal and vegetable fats, is a versatile compound with a wide range of industrial applications. The market for stearic acid is influenced by various factors that shape its supply, demand, and pricing dynamics. One of the primary market factors affecting stearic acid is the overall demand for consumer goods and industrial products. As stearic acid is used in the production of many everyday items such as cosmetics, soaps, detergents, candles, and rubber products, fluctuations in consumer spending and industrial activity can have a significant impact on its market.

Stearic acid is also known as octadecanoic acid, is a colorless, waxy solid. It is found in the fats and oils of plants and animals. It is widely used in the production of personal care, soaps & detergents, agrochemicals, food products, pharmaceuticals, and textile sizing.

Moreover, the availability and pricing of raw materials used in the production of stearic acid also play a crucial role in determining its market dynamics. Since stearic acid can be derived from both animal and vegetable fats, the prices of these feedstocks, as well as their availability, influence the cost of production for stearic acid manufacturers. Fluctuations in agricultural markets, changes in weather patterns affecting crop yields, and shifts in global trade policies can all affect the availability and pricing of these raw materials, thereby impacting the stearic acid market.

Furthermore, technological advancements in stearic acid production processes can influence market dynamics by affecting production costs and product quality. Innovations in manufacturing techniques, such as the development of more efficient catalysts or novel reactor designs, can enable producers to enhance their competitiveness by reducing production costs or improving product attributes. Additionally, advancements in downstream applications, such as the formulation of new stearic acid-based products or the discovery of alternative uses, can create new opportunities for market growth.

The regulatory environment also plays a significant role in shaping the stearic acid market. As stearic acid is commonly used in products intended for human consumption, such as food additives and pharmaceuticals, regulatory standards and requirements governing its use and production can impact market dynamics. Changes in regulations related to food safety, environmental protection, or product labeling can require stearic acid manufacturers to adapt their processes or formulations, potentially affecting production costs and market competitiveness.

Moreover, geopolitical factors and global economic conditions can influence the stearic acid market by affecting trade flows, currency exchange rates, and overall market sentiment. Shifts in political alliances, trade agreements, or geopolitical tensions can disrupt supply chains and trade patterns, leading to volatility in stearic acid prices and market dynamics. Similarly, macroeconomic factors such as changes in interest rates, inflation rates, or economic growth rates can affect consumer purchasing power, industrial activity, and investment decisions, thereby influencing demand for stearic acid and its derivatives.

Lastly, environmental and sustainability considerations are increasingly becoming important market factors for stearic acid. As concerns over climate change, deforestation, and environmental degradation grow, there is growing pressure on industries to adopt more sustainable practices and reduce their environmental footprint. This trend is driving demand for renewable and eco-friendly alternatives to traditional stearic acid derived from animal fats or petroleum sources. Manufacturers are thus exploring innovative solutions such as producing stearic acid from sustainable feedstocks like palm oil or using advanced biotechnological processes to produce bio-based stearic acid.

Leave a Comment