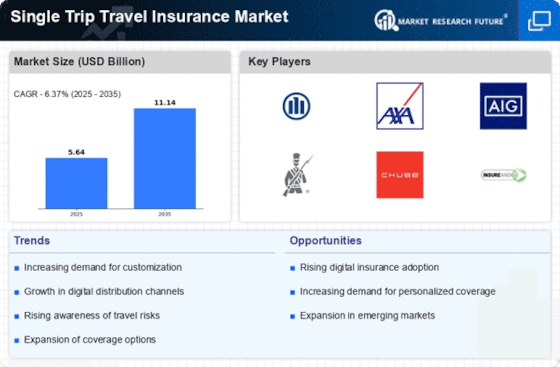

The competitive landscape of the Single Trip Travel Insurance Market is characterized by a multitude of players striving to offer diverse and tailored insurance solutions for travelers embarking on one-time journeys. Various factors such as customer needs, market trends, and technological advancements drive competition in this sector. Companies are increasingly focusing on enhancing their offerings by providing comprehensive and user-friendly policies that include coverage for a wide range of travel-related risks, like trip cancellations, medical emergencies, and lost baggage.

The evolving preferences of consumers towards digital platforms for purchasing insurance has also shaped competition, compelling providers to adopt innovative technologies and improving customer engagement through online channels and mobile applications. As a result, the market is steadily growing, with new entrants and established firms vying to capture consumer attention and loyalty through competitive pricing and efficient service. World Nomads enjoys a solid position in the Single Trip Travel Insurance Market, with a strong focus on catering to the unique needs of adventurous travelers.

The company has carved a niche for itself by offering policies that specifically cover a wide array of adventure activities that traditional insurers might exclude. Its strengths lie in its straightforward online policy purchasing process, extensive coverage options, and customer-centric approach. World Nomads also empowers travelers by providing access to a community of like-minded individuals and valuable travel guides, making it more than just an insurance provider.

This dual approach contributes significantly to its competitive edge as it aligns with the values and interests of its target demographic, fostering brand loyalty and trust among customers who prioritize safety and adventure during their travels. AIG possesses a considerable presence in the Single Trip Travel Insurance Market, recognized for its extensive experience and broad range of insurance products. The company has made significant inroads by emphasizing comprehensive coverage plans that are designed to protect travelers against various unforeseen events, catering to both leisure and business travelers alike.

AIG's strengths are rooted in its global footprint and reputation for reliability, offering policies that include robust support networks and access to emergency assistance worldwide. This global accessibility ensures that customers can travel with peace of mind, knowing they have supported no matter where they are. Additionally, AIG's use of advanced technology for claims processing and policy management enhances customer experience, helping to build a solid reputation in an increasingly competitive market where customer service plays a pivotal role.