Market Trends

Introduction

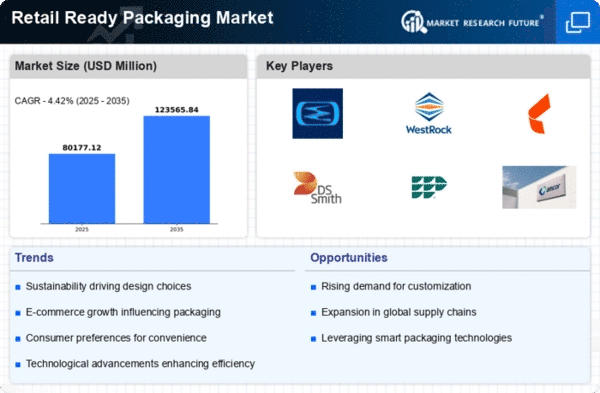

At the beginning of 2024, the RRP market is undergoing a major transformation, driven by a combination of macro-economic factors. Technological developments are radically changing the appearance and functionality of packaging, enabling more efficient production processes and greater consumer engagement. Meanwhile, regulatory pressures are increasing, pushing companies to adopt sustainable practices and materials in response to growing concern for the environment. A third trend is the shift in consumer behaviour, with an increasing demand for convenience and eco-friendly products. These are all strategic issues for the RRP industry, as it navigates a highly competitive market, tries to meet the new expectations of consumers and comply with new regulations.

Top Trends

-

Sustainability Initiatives

The governments of the world are imposing more and more stringent regulations on the disposal of packaging. This is pushing companies towards a more sustainable approach. The European Union, for example, has set itself the target of making all packaging in circulation by the year 2030, either re-usable or re-cyclable. A recent study by the German Research Institute for Chemistry and the Environment shows that over seventy per cent of consumers prefer packaging that is sustainable. Companies are therefore investing in biodegradable and re-cyclable solutions. This could lead to lower costs and greater brand loyalty. -

Digital Printing Technology

ROP is in the process of being revolutionized by the development of digital printing. This technology allows for greater personalization and shorter production runs. The leaders of the industry are using this technique to develop unique and recognizable ROP. Reports have shown that digital printing can reduce lead times by up to 50%. This trend enables companies to respond to market changes and to be more responsive to customers. -

E-commerce Growth

The growth of e-commerce has required the development of a new kind of packaging which ensures the safety of the products during the journey. The companies are innovating to reduce the damage rate, which is currently 5% of all e-commerce orders. This more secure packaging not only increases customer satisfaction but also reduces return costs, and therefore encourages investment in a more solid retail-ready packaging. -

Smart Packaging Solutions

Brands are increasingly turning to smart packaging with NFC and QR codes to enhance the interaction between the brand and consumers. This technology enables real-time tracking, while giving consumers access to product information and enhancing transparency. A study has shown that consumers are more likely to buy a product with smart packaging. This trend will lead to the design and functionality of the package to be further improved. -

Focus on Supply Chain Efficiency

Efficiency in the supply chain is becoming increasingly important in order to reduce costs and improve delivery times. The new RR packaging is designed for easy stacking and handling. This can reduce costs by up to 20 percent. In this way, the cooperation between manufacturers and retailers can be improved, which ultimately increases market readiness and competitiveness. -

Health and Safety Regulations

Health and safety regulations, especially after the pandemic, are influencing the design of packages in order to ensure hygiene and safety. For example, the Food and Drug Administration has introduced guidelines for the packaging of foodstuffs to reduce the risk of contamination. The trend is towards easy-to-open, tamper-evident packaging that enhances consumers’ trust and ensures compliance with regulatory requirements. -

Consumer-Centric Design

There is a growing demand for consumer-oriented packaging that enhances the experience. According to research, the design of the package is a decisive factor in the purchasing decision for 75 per cent of consumers. The companies are focusing on intuitive designs that facilitate ease of use, which can lead to increased sales and customer loyalty. This trend will continue to drive innovation in both aesthetics and functionality. -

Recyclability and Circular Economy

Brands are putting the recyclability of their packaging at the top of their priority list. In this way, they are responding to the call for a circular economy, for example from the Ellen MacArthur Foundation's New Plastics Economy. Statistics show that 50% of consumers are willing to pay more for products with a recyclability label. This trend will reshape product development strategies and supply chain practices. -

Automation in Packaging Processes

It is a process which is becoming more and more essential to the packaging industry, enabling it to become more efficient and to reduce the cost of labour. It has been calculated that the increase in productivity by a machine which can do the work of two or three workers is up to thirty per cent. This trend is dictated by the need to meet the growing demand for products and to produce them faster. In the future, it is likely that there will be systems based on artificial intelligence, which will optimize the design of the package and the logistics. -

Globalization of Packaging Standards

As markets become more international, the need for standardized packaging solutions that meet international regulations increases. Companies are adapting their packaging to meet the various market requirements, which makes exports easier. A survey has shown that 65% of companies see compliance as a strategic issue in their packaging. This trend may lead to industry collaboration to develop universal standards.

Conclusion: Navigating the Retail Ready Packaging Landscape

The Retail Ready Packages Market in 2024 will be characterized by high competition and significant fragmentation. Both the established and the new players will compete for the market share. Regional trends will continue to push for more sustainable and consumer-oriented product development. The established companies will continue to rely on their distribution network and brand loyalty, while the new companies will focus on speed and new technology. In particular, the main features of the market, such as the use of artificial intelligence for analysis, automation of the production process, and sustainable materials, will be decisive for market leadership. As the decision-makers navigate this changing landscape, they will need to make strategic investments in the flexibility and responsiveness to the needs of consumers.

Leave a Comment