Market Analysis

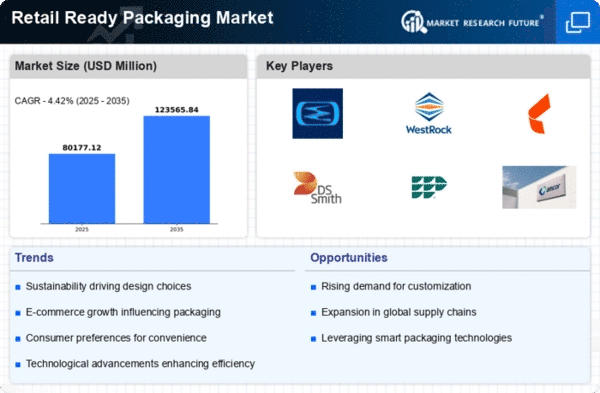

Retail Ready Packaging Market (Global, 2024)

Introduction

The ready-to-use packaging market is in a period of change. It is being driven by the changing demands of consumers and the retail environment. Brands are striving to improve product visibility and supply chain efficiency. Ready-to-use packaging is proving to be a key solution, not only enabling easy handling and display but also enabling sustainability. In this market, the key features are: a) designs which combine aesthetics with functionality, b) the reusability of packaging materials and c) the use of the latest printing and decoration techniques. The growing importance of e-commerce and omni-channel retailing also increases the need for packaging which can withstand the stresses of transportation and yet maintain product integrity. Strategic importance is being given to ready-to-use packaging by all the players in the supply chain. As a result, the market is developing at a rapid pace and is bound to reflect the general trends in consumer behaviour and concern for the environment.

PESTLE Analysis

- Political

- In 2024, the market for ready-to-use packaging will be influenced by a number of political factors, including government regulations on the use of packaging materials. For example, the European Union has imposed a directive on the manufacturers that by 2025 all packaging must be recyclable. The manufacturers have therefore had to adjust their ready-to-use packaging to this directive. Moreover, import duties on packaging materials have increased the costs of the manufacturers, with a duty of up to 25% on certain imported plastics, which in turn has affected the price policy of the ready-to-use packaging market.

- Economic

- The economics of 2024 show a growing demand for retail-ready packaging. This is a result of the expected growth in the world’s spending, which is expected to reach $ 15 tera-million. The rise in spending power, especially in emerging economies, has increased the turnover of retail trade, and in the United States alone the turnover has increased by five percent. Retailers are investing in RRP solutions, which increase product visibility and reduce costs by reducing the time spent replenishing shelves by as much as thirty percent.

- Social

- In 2024, social trends are pointing to a growing consumer concern for the environment and the use of biodegradable materials. A survey has shown that 65% of consumers are willing to pay more for products that are packed in sustainable packaging. This has prompted retailers to adopt solutions that are in line with these values. Meanwhile, the growth of e-commerce has also changed consumer expectations. Seventy per cent of consumers say that they prefer products that are easy to handle and display. This has had a major influence on the design and functionality of the retail ready packaging.

- Technological

- In 2024, the development of the retail-ready packaging market will be influenced by technological changes. The development of printing technology will allow the development of high-quality graphics on packaging, and the ability of digital printing will increase by 40% in the next five years. Also, smart packaging, such as QR codes and NFC tags, will be integrated into the package. By 2024, about one quarter of the products will have this technology to increase consumer participation and provide information.

- Legal

- In 2024, the regulatory framework of the retail-ready packaging market will be characterized by stringent regulations on the use of materials for packaging. For example, the Food and Drug Administration (FDA) has issued new guidelines on the use of food packaging that will be free of harmful chemicals. This will have a direct impact on the choice of materials for retail-ready packaging. It is necessary to comply with these regulations, as non-compliance with them will result in a fine of up to $100,000 per infringement. Therefore, companies will be forced to invest in compliance with the packaging solutions.

- Environmental

- In 2024, the RRP market will be increasingly influenced by the environment. The worldwide trend towards sustainability has led to a 30% increase in the use of biodegradable materials in the packaging industry. Moreover, 80% of consumers expect brands to take responsibility for their packaging waste. RRP solutions that reduce waste and make use of recycled materials are now widely used. These solutions support the global target of reducing plastic waste by 50% by 2030.

Porter's Five Forces

- Threat of New Entrants

- The retail ready-packaging market will face a moderate threat of new entrants in 2024. There is a significant growth potential in the market, but the market is also characterized by strong brand awareness and customer loyalty, which can discourage new entrants. Furthermore, the high investment in production and equipment can be a barrier to entry. But technological development and the growing importance of e-commerce can reduce these barriers and make it easier for new entrants to compete effectively.

- Bargaining Power of Suppliers

- In general, suppliers in the ready-made packaging market have a low bargaining power. The market is characterized by a large number of suppliers offering similar materials and services, which weakens the influence of individual suppliers. Moreover, companies can easily change suppliers without incurring major costs, which means that suppliers are forced to compete on price to retain customers.

- Bargaining Power of Buyers

- In 2024, the buyers in the retail-ready packaging market will have a high bargaining power. They can easily compare prices and quality, which increases the pressure on suppliers to offer the best price and innovation. Also, the big retailers and brands often have agreements on group buying, which increases their bargaining power even more.

- Threat of Substitutes

- The threat of substitutes in the retail ready packaging market is moderate. There are alternative packaging solutions, such as the use of old-fashioned packing and bulk shipment, but the unique advantages of retail ready packaging, such as easy handling and attractive displays, make it the preferred option for many retailers. However, with the growing concern for the environment, some buyers may start to consider the use of sustainable alternatives, which will increase the threat of substitutes over time.

- Competitive Rivalry

- Competition in the Retail Ready Packaging Market is High in 2024. There are many key players in the market, and the competition is fierce in terms of price, innovation and customer service. Companies are constantly investing in research and development to enhance their products and meet the needs of consumers, which will further intensify competition.

SWOT Analysis

Strengths

- Enhances product visibility and shelf appeal for retailers.

- Reduces packaging waste through efficient design.

- Facilitates easier handling and transportation for retailers.

- Supports brand recognition and marketing efforts.

- Can lead to cost savings in logistics and storage.

Weaknesses

- Higher initial investment costs for manufacturers.

- Limited customization options for unique product requirements.

- Potential for increased complexity in supply chain management.

- Dependence on consumer trends which can be volatile.

- Risk of over-packaging leading to sustainability concerns.

Opportunities

- Growing demand for sustainable packaging solutions.

- Expansion into emerging markets with increasing retail sectors.

- Technological advancements in packaging materials and design.

- Collaboration opportunities with retailers for tailored solutions.

- Increased focus on e-commerce driving demand for innovative packaging.

Threats

- Intense competition from traditional packaging solutions.

- Regulatory changes impacting packaging materials and processes.

- Economic downturns affecting retail spending and packaging demand.

- Shifts in consumer preferences towards minimalism.

- Supply chain disruptions affecting material availability.

Summary

Retail Ready Packages are distinguished by their advantages in enhancing product visibility and reducing waste, both of which are of utmost importance to retailers. High initial costs and supply chain complexities are the challenges facing the market. Opportunities include sustainable packaging and technological advancements. Threats include competition and regulatory changes. Strategic focus on innovation and collaboration with retailers can be the best way to tackle these challenges and opportunities.

Leave a Comment