Market Share

Introduction: Navigating the Competitive Landscape of Population Health Management

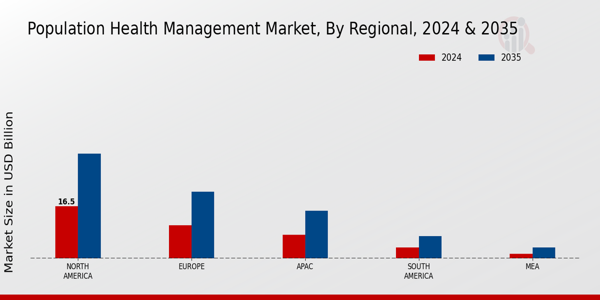

The population health management market is experiencing unprecedented growth, a result of the speed with which technology is being adopted, the evolution of regulatory frameworks and the growing demand for personal health care. Leading players, such as IT system builders, systems integrators, medical device manufacturers and new AI start-ups, are competing for leadership by developing and deploying advanced capabilities such as AI-driven analytics, automation and IoT integration. These technology-driven differentiators are not only enhancing operational efficiency, they are also reshaping the patient experience, and are influencing market positioning. Biometrics and green IT are becoming increasingly important to compliance and to the achievement of the desired outcome. In addition, new opportunities are opening up in the regions, especially in North America and Asia-Pacific, where strategic investments in digital health solutions are set to reshape care delivery by 2024–25. These are the key developments that C-level executives must keep abreast of if they are to seize the transformative potential of this market.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate various aspects of population health management, enabling healthcare organizations to streamline operations and improve patient outcomes.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| UnitedHealth Group | Extensive healthcare network and resources | Integrated health services | North America |

| Cerner | Robust EHR and analytics capabilities | Health information technology | Global |

| Epic Systems | Leading EHR platform with interoperability | Electronic health records | North America |

| McKesson | Comprehensive supply chain solutions | Pharmaceutical distribution and healthcare management | North America |

| Optum | Data-driven insights and analytics | Health services and technology | North America |

Specialized Technology Vendors

These vendors focus on niche technologies that enhance specific aspects of population health management, such as analytics, patient engagement, and care coordination.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| HealthCatalyst | Data warehousing and analytics expertise | Data analytics and performance improvement | North America |

| Change Healthcare | Innovative revenue cycle management solutions | Healthcare technology and analytics | North America |

| Caresyntax | Surgical data analytics platform | Surgical data management | North America |

| Cognizant Technology Solutions | IT services with healthcare focus | Healthcare IT and consulting | Global |

Life Sciences and Health Innovation

These vendors leverage advanced technologies and research to drive innovation in population health management, focusing on improving health outcomes through data and technology.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Verily Life Sciences | Strong focus on data-driven health solutions | Life sciences and health technology | Global |

| IBM Watson Health | AI-driven insights for healthcare | Artificial intelligence in health | Global |

| Medtronic | Innovative medical devices and solutions | Medical technology and devices | Global |

| Philips Healthcare | Integrated health technology solutions | Healthcare technology and imaging | Global |

| Anthem | Comprehensive health insurance services | Health insurance and management | North America |

Emerging Players & Regional Champions

- Health Catalyst (US): Provides data analysis and population health management, aimed at improving clinical outcomes and reducing costs. Challenges the established players, such as Epic and Cerner, with a more flexible solution.

- Qventus, Inc. (US): Provides artificial intelligence solutions to hospitals, which optimize the flow of patients and the management of hospital resources. Recently, Qventus has been able to sign a contract with several hospitals in the region, and it is now in a position to compete with the established EHR suppliers, by integrating with existing systems.

- The Cureatr system (USA) offers a medication management platform that enhances care coordination and reduces readmissions. Its recent implementation in a large urban hospital has shown how it can be integrated into existing IT systems while challenging the more traditional pharmacy management solutions.

- CARESYNTAX (Germany): Surgical data analysis and operating room efficiency. This recent entry into the US market gives them a chance to compete with established players by offering specialized solutions to improve surgical outcomes and reduce costs.

- Luma Health (USA) : Offers a patient engagement platform that facilitates communication and care coordination. Recent collaborations with community health organizations highlight the company’s role in improving care and its challenge to the traditional patient management system.

Regional Trends: In 2024, the use of population health management solutions increases in North America and Europe, driven by the need for better patient outcomes and cost savings. Artificial intelligence (AI)-based solutions are used to enhance the performance of existing systems. Emerging players focus on offering niche solutions in the form of AI-based analytics, patient engagement, and operational efficiency, which complement existing systems and challenge the traditional vendors. Moreover, in urban areas, the integration of social determinants of health into population health strategies is growing.

Collaborations & M&A Movements

- The partnership between Cerner and Optum is to provide the integration of advanced analytics into their EHRs, in order to improve the outcomes of patients and simplify care coordination, thereby strengthening their position in the population health management market.

- UnitedHealth Group acquired Change Healthcare in a strategic move to expand its data analytics capabilities, which is expected to significantly increase its market share and enhance its ability to deliver value-based care solutions.

- IBM Watson Health and Philips entered into a collaboration to leverage AI and machine learning for improved chronic disease management, positioning both companies to better address the growing demand for innovative population health solutions.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Data Integration | Epic Systems, Cerner, Allscripts | Epic excels in integrating EHRs with population health tools and in enabling seamless data transfer. But Cerner’s platform is interoperable, enabling real-time data sharing across different health systems, as it has done with the VA in improving care for veterans. |

| Analytics and Reporting | IBM Watson Health, Optum, Health Catalyst | Using artificial intelligence, IBM Watson Health enables physicians to identify at-risk populations. Optum’s analytics platform is known for its robust reporting capabilities and has been successfully used by a number of large health systems to improve decision-making. |

| Patient Engagement | MyChart (Epic), HealthLoop, WellDoc | MyChart provides a friendly, engaging interface that delivers a personal health record. HealthLoop's automatic check-ins have been shown to improve patient adherence to treatment plans, as demonstrated by studies of chronic disease management. |

| Care Coordination | CareCloud, Maven Clinic, Caresyntax | CareCloud has provided the tools for effective care coordination among the different professionals, which has been crucial for managing complex cases. The Maven Clinic platform enables coordinated care across specialties, which has led to better outcomes. |

| Risk Stratification | Cognizant, McKesson, Verily Health | Using machine learning, Cognizant’s risk stratification tools have successfully identified high-risk patients in several ACOs. The Cognizant solutions are recognized for their comprehensive data analytics capabilities, which support effective risk management. |

| Telehealth Integration | Teladoc Health, Amwell, Doxy.me | Having built a strong telehealth platform that is easily integrated with existing health systems, Teladoc Health has enhanced access to care. Amwell's solutions have been widely adopted, particularly during the flu pandemic, and have proven their effectiveness and scalability in the remote care of patients. |

Conclusion: Navigating the Competitive Landscape Ahead

As the year 2024 draws near, the population health management market is characterized by a high degree of competition and fragmentation. Both the traditional and the new players are competing for market share. The growing importance of localized solutions is forcing vendors to develop products and services tailored to the health needs of local communities. These companies are deploying their established reputations and vast data resources to create differentiation. The new players are deploying their innovation capabilities, such as artificial intelligence, automation and sustainability. In this fast-changing market, the ability to provide flexible services will be key to the vendors that succeed. The ability to be agile will also be a key to success. Those responsible for population health management solutions must therefore focus on these capabilities to stay ahead of the competition and be responsive to the changing demands of the market.

Leave a Comment