Pet Food Ingredients Market Share

Pet Food Ingredients Market Research Report By Category (Conventional, Rendered), By Ingredient (ADX, Antimicrobials), By Use-Case (Dog Food, Cat Food, Fish Food, Others), By Distribution Channel (Direct, Indirect) and By Regional (North America, Europe, South America, Asia Pacific, Middle East and Africa) - Forecast to 2035.

Market Summary

As per Market Research Future Analysis, the Global Pet Food Ingredients Market is experiencing robust growth, driven by increasing pet ownership and a shift towards premium, health-conscious pet food options. The market size was estimated at 51.65 USD Billion in 2024 and is projected to reach 51.65 USD Billion in 2024, with a significant increase to 118.26 USD Billion by 2035. The market is characterized by trends towards natural and organic ingredients, sustainability, and technological advancements in production.

Key Market Trends & Highlights

The Pet Food Ingredients Market is marked by dynamic trends driven by consumer demand for health, sustainability, and innovation.

- Market Size in 2024: 51.65 USD Billion; projected to grow to 51.65 USD Billion in 2024.

- CAGR from 2025 to 2035: 7.82%; expected to reach 118.26 USD Billion by 2035.

- Over 67% of U.S. households own pets, driving demand for premium ingredients.

- More than 65% of pet owners are willing to pay a premium for sustainably sourced products.

Market Size & Forecast

| 2024 Market Size | USD 51.65 Billion |

| 2035 Market Size | USD 118.26 Billion |

| CAGR (2025-2035) | 7.82% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Key players include Natural Balance Pet Foods, General Mills, Blue Buffalo, Merrick Pet Care, Cargill, Hill's Pet Nutrition, Smithfield Foods, Mars, Sunshine Mills, Nestlé, Ainsworth Pet Nutrition, Diamond Pet Foods, WellPet, and The J.M. Smucker Company.

Market Trends

The Pet Food Ingredients Market is experiencing significant trends driven by changing consumer preferences and increasing pet ownership worldwide. One major market driver is the rising demand for natural and organic pet food ingredients, as pet owners become more health-conscious about their pets' diets. This trend aligns with a broader emphasis on sustainability and transparency in food sourcing, prompting manufacturers to adopt cleaner labels and reduce artificial additives.

Additionally, the growth of the pet humanization trend is influencing the market, as owners seek premium ingredients that mirror their dietary habits, such as high-quality proteins and functional additives that promote overall pet health.Opportunities in the market are expanding as companies explore innovative ingredient sourcing and production methods. The surge in e-commerce channels has created a platform for niche brands to promote specialized ingredients that cater to specific dietary needs, such as grain-free, hypoallergenic, and breed-specific formulations.

In sum, the Pet Food Ingredients Market is marked by dynamic trends driven by consumer demand for health, sustainability, and innovation, with significant opportunities for growth and diversification.

The ongoing evolution of consumer preferences towards natural and organic ingredients in pet food is reshaping the landscape of the pet food ingredients market, indicating a shift towards healthier and more sustainable options for pet nutrition.

U.S. Department of Agriculture

Pet Food Ingredients Market Market Drivers

E-commerce Growth

The rapid growth of e-commerce is transforming the Global Pet Food Ingredients Market Industry. Online shopping platforms provide consumers with convenient access to a wide range of pet food products, including specialized ingredients. This shift towards digital retail is particularly pronounced among younger pet owners who prefer the convenience of online purchasing. E-commerce also allows for better price comparison and access to niche products that may not be available in traditional retail settings. As a result, the market is likely to see increased sales through online channels, further driving growth and innovation in pet food ingredients.

Rising Pet Ownership

The increasing trend of pet ownership globally contributes significantly to the Global Pet Food Ingredients Market Industry. As more households adopt pets, the demand for high-quality pet food ingredients rises. In 2024, the market is projected to reach 51.6 USD Billion, reflecting the growing consumer preference for premium pet food products. This trend is particularly evident in urban areas where pet ownership rates have surged. The desire for healthier and more nutritious options for pets drives manufacturers to innovate and diversify their ingredient offerings, thereby enhancing the overall market landscape.

Market Growth Projections

The Global Pet Food Ingredients Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 7.82% from 2025 to 2035. This growth trajectory suggests a robust demand for diverse and high-quality pet food ingredients as pet owners continue to prioritize nutrition and wellness. The market is expected to expand from 51.6 USD Billion in 2024 to an impressive 118.2 USD Billion by 2035. This upward trend reflects the evolving landscape of pet ownership and the increasing willingness of consumers to invest in premium pet food products.

Health and Wellness Trends

Health and wellness trends among pet owners are reshaping the Global Pet Food Ingredients Market Industry. Pet owners increasingly seek products that promote the health and longevity of their pets. This shift towards natural and organic ingredients is evident in the rising demand for grain-free, high-protein, and functional pet foods. As a result, manufacturers are investing in research and development to create products that align with these health-conscious preferences. The market is expected to grow significantly, with projections indicating a rise to 118.2 USD Billion by 2035, driven by the emphasis on pet nutrition and well-being.

Sustainability and Ethical Sourcing

Sustainability and ethical sourcing are becoming paramount in the Global Pet Food Ingredients Market Industry. Consumers are increasingly concerned about the environmental impact of pet food production and are favoring brands that prioritize sustainable practices. This includes sourcing ingredients from responsible suppliers and utilizing eco-friendly packaging. Companies that adopt sustainable practices not only enhance their brand image but also tap into a growing segment of environmentally conscious consumers. This trend is likely to influence market dynamics as more players align their operations with sustainability goals, potentially leading to increased market share and consumer loyalty.

Technological Advancements in Production

Technological advancements in production processes are significantly impacting the Global Pet Food Ingredients Market Industry. Innovations in ingredient processing, preservation, and formulation are enabling manufacturers to enhance product quality and shelf life. Techniques such as extrusion and freeze-drying are becoming more prevalent, allowing for the creation of nutrient-rich pet foods that appeal to health-conscious consumers. These advancements not only improve the efficiency of production but also cater to the evolving preferences of pet owners. As the market continues to evolve, these technologies are expected to play a crucial role in shaping the future of pet food ingredients.

Market Segment Insights

Pet Food Ingredients Market Category Insights

The Pet Food Ingredients Market is experiencing significant growth, with a market valuation reaching 51.65 USD Billion in 2024 and expected to rise to 118.21 USD Billion by 2035. This market is primarily categorized into two key segments Conventional and Rendered products, each playing a vital role in the overall dynamics of the industry. The Conventional segment holds a dominant position, boasting a value of 32.0 USD Billion in 2024, projected to grow to 70.0 USD Billion by 2035, demonstrating a majority holding in the market.

The significance of the Conventional segment lies in its wide acceptance and usage in various pet food formulations, resulting from its ability to provide essential nutrients and meet consumer preferences for familiar and traditional ingredients.In contrast, the Rendered segment, valued at 19.65 USD Billion in 2024 and anticipated to grow to 48.21 USD Billion by 2035, also holds an important place within the Pet Food Ingredients Market due to its efficiency in recycling animal by-products into high-quality ingredients. This segment caters to a growing demand for sustainable practices within pet food production, appealing to environmentally conscious consumers.

Both segments are driven by trends such as the rising pet ownership rates globally and increased spending on premium pet food, presenting ample opportunities within the market for growth and innovation.However, challenges such as fluctuating raw material prices and regulatory scrutiny regarding food safety and quality might impede market progress. Overall, the Pet Food Ingredients Market is poised for further expansion, and its segmentation into Conventional and Rendered categories highlights the various paths towards meeting the evolving needs of pet owners worldwide.

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Pet Food Ingredients Market Ingredient Insights

The Pet Food Ingredients Market is experiencing notable growth, with expectations of reaching a value of 51.65 USD Billion by 2024 and continuing its upward trend through 2035. Ingredients play a crucial role in this expansive market, as they directly influence the nutritional quality and overall health of pet food. Within this framework, categories such as ADX and Antimicrobials hold significant importance.

ADX is particularly influential due to its ability to enhance flavor and palatability, ensuring that pets are attracted to their food, thereby improving consumption rates.On the other hand, Antimicrobials contribute to improved shelf-life and safety, making them essential for maintaining product integrity in the market. The strong focus on natural and organic ingredients is propelling demand for these segments, as pet owners increasingly seek high-quality and health-enhancing options for their pets.

This trend aligns with the shift towards more transparent labeling and ingredient sourcing, reflecting a broader consumer preference for sustainability and health-conscious choices in the Pet Food Ingredients Market.As the industry evolves, these ingredients are poised to adapt, providing opportunities for innovation and growth within the market landscape.

Pet Food Ingredients Market Use-Case Insights

The Pet Food Ingredients Market is projected to witness substantial growth, with a value of 51.65 USD Billion in 2024 and is expected to continue its upward trajectory, reaching 118.21 USD Billion by 2035. This growth is fueled by increasing pet ownership and a rising demand for high-quality pet food, directly influencing the overall segment dynamics. Among the diverse use-case segments, dog food, cat food, and fish food play critical roles, with dog food often dominating due to the popularity of dogs as companions.

The demand for premium and specialized diets in these categories has risen significantly, reflecting changes in pet owners' preferences towards health-focused ingredients.In addition, the growing awareness regarding pet nutrition drives the expansion of fish food, which ranks increasingly in importance due to the rising trend of aquaristics. The inclusion of human-grade ingredients in pet food formulations further underscores the evolving market landscape. Challenges such as stringent regulations and fluctuating ingredient prices persist but present opportunities for innovation within the Pet Food Ingredients Market.

Overall, the market's segmentation signals a robust industry outlook, underpinned by evolving consumer trends and a commitment to quality nutrition for pets.

Pet Food Ingredients Market Distribution Channel Insights

The Pet Food Ingredients Market is significantly shaped by its Distribution Channel segment, which includes both Direct and Indirect channels. As of 2024, the market is valued at 51.65 USD Billion, reflecting strong growth potential driven by a rising pet ownership trend globally. Direct distribution channels provide suppliers an opportunity to connect directly with consumers, ensuring greater control over product quality and customer relationships.

Meanwhile, Indirect channels, such as retail partnerships and e-commerce, are crucial for reaching a wider audience and enhancing market penetration.This dual approach enables effective market coverage, as both channels play significant roles in shaping consumer preferences and buying behaviors. The Pet Food Ingredients Market data highlights a shift towards e-commerce platforms, furthers market growth, and provides convenience for pet owners. As the industry adapts to changing consumer behavior, both distribution methods are expected to gain prominence, creating opportunities for innovation in product offerings and marketing strategies.

The overall Pet Food Ingredients Market segmentation points towards a balanced reliance on various distribution methods to meet increasing demand.

Get more detailed insights about Pet Food Ingredients Market Research Report – Forecast to 2035

Regional Insights

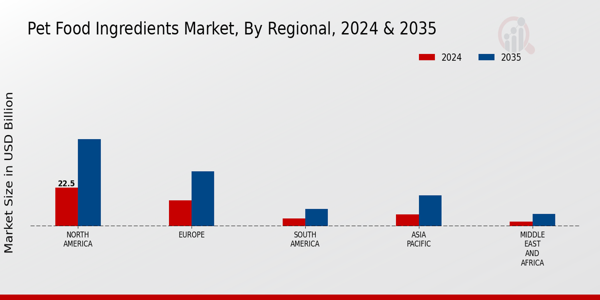

The Pet Food Ingredients Market is projected to demonstrate significant growth across various geographic regions. By 2024, North America will hold a substantial market share with a valuation of 22.5 USD Billion, ensuring its dominance in the Pet Food Ingredients Market revenue landscape. Europe follows closely, valued at 15.0 USD Billion, reflecting the region's strong demand for high-quality pet food products.

South America, while smaller, is anticipated to grow to 4.5 USD Billion, indicating a promising upward trend in pet ownership and food diversification.The Asia Pacific region will see a notable increase, with a valuation projected at 7.0 USD Billion by 2024, driven by rising disposable incomes and changing dietary preferences among pet owners. Meanwhile, the Middle East and Africa are expected to contribute a further 2.65 USD Billion, a segment that is gradually expanding due to increased awareness about pet nutrition and health.

The various trends in pet food customization and organic ingredients are shaping the market dynamics, creating opportunities for innovation and growth across regions.Overall, this market segmentation illustrates varying levels of market maturity and growth potential, with North America significantly holding the majority share.

Source Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Pet Food Ingredients Market has experienced significant growth and transformation over the years, driven by changing consumer preferences and a growing focus on pet health and wellness. With a variety of ingredients ranging from high-quality proteins to functional components like vitamins and minerals, the market is characterized by intense competition among key players. Companies strive to differentiate themselves through innovation, sustainability, and product quality, which are increasingly prioritized by pet owners. The competitive landscape is shaped by various factors, including the emergence of natural and organic ingredients, shifts towards premium products, and increased awareness about pet nutrition.

In this dynamic environment, businesses are also leveraging technology and research to develop new offerings that meet the evolving needs of consumers, while maintaining rigorous standards of safety and efficacy.Natural Balance Pet Foods stands out in the Pet Food Ingredients Market due to its commitment to providing wholesome and high-quality pet food solutions. Known for its diverse range of products that include grain-free formulas and recipes tailored to food sensitivities, the company has established a strong reputation for excellence in ingredient selection and safety.

Natural Balance Pet Foods emphasizes the importance of balanced nutrition for pets, highlighting its strengths in research and development focused on pet health. Their market presence is reinforced by a loyal customer base that appreciates the transparency in sourcing and the quality of ingredients, which include real meats and vegetables. The company's strategy focuses on maintaining a reputable image among consumers, leveraging its extensive expertise in pet nutrition to strengthen its competitive position globally.General Mills, a significant player in the Pet Food Ingredients Market, actively showcases its diverse portfolio of pet food brands tailored for various animal needs.

Among its key products are brands that emphasize nutritional balance and palatability, featuring premium ingredients designed to cater to the health-conscious pet owner. General Mills benefits from a robust market presence bolstered by strategic mergers and acquisitions that expand its reach and enhance product offerings. With an emphasis on innovation, the company continually seeks to incorporate new ingredient technologies that respond to consumer trends towards health-focused pet options. The strengths of General Mills in this market lie in its established distribution network, strong brand loyalty, and commitment to sustainability, as well as investments in research that refine ingredient quality.

Overall, the company's proactive strategies ensure a competitive edge in the dynamic landscape of the Pet Food Ingredients Market.

Key Companies in the Pet Food Ingredients Market market include

Industry Developments

- Q2 2024: U.S. Pet Food Growth Continues Amid Potential 2025 Challenges In 2024, U.S. pet food exports rebounded, growing 3.7% to $2.49 billion, with China posting a 15% increase in imports to $296 million and Southeast Asia up 7.5%, signaling renewed momentum in key global regions.

- Q2 2024: 2025 Pet Food Production and Ingredient Analysis report released The Pet Food Institute published its 2025 report, revealing that U.S. pet food manufacturers purchased $13.2 billion in farm products for ingredients in 2024, supporting thousands of jobs in agriculture, manufacturing, and logistics.

- Q2 2024: 2025 pet food ingredient report reveals $51.7B market, rising demand for premium nutrition A collaborative report from industry associations in late 2024 highlighted a surge in demand for premium pet food ingredients, with marine ingredients increasing by 95% and meat and poultry ingredients by 34% since 2019.

Future Outlook

Pet Food Ingredients Market Future Outlook

The Global Pet Food Ingredients Market is projected to grow at a 7.82% CAGR from 2025 to 2035, driven by increasing pet ownership and demand for premium ingredients.

New opportunities lie in:

- Develop plant-based protein sources to cater to health-conscious pet owners.

- Invest in sustainable sourcing practices to enhance brand reputation and consumer trust.

- Leverage technology for personalized pet nutrition solutions, targeting specific dietary needs.

By 2035, the market is expected to reach a robust position, reflecting evolving consumer preferences and innovation.

Market Segmentation

Pet Food Ingredients Market Category Outlook

- ADX

- Antimicrobials

Pet Food Ingredients Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Pet Food Ingredients Market Use-Case Outlook

- Direct

- Indirect

Pet Food Ingredients Market Ingredient Outlook

- Dog Food

- Cat Food

- Fish Food

- Others

Pet Food Ingredients Market Distribution Channel Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | 51.65(USD Billion) |

| Market Size 2035 | 118.26 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 7.82% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Natural Balance Pet Foods, General Mills, Blue Buffalo, Merrick Pet Care, Cargill, Hill's Pet Nutrition, Smithfield Foods, Mars, Sunshine Mills, Nestle, Ainsworth Pet Nutrition, Diamond Pet Foods, WellPet, The J.M. Smucker Company, Champion Petfoods |

| Segments Covered | Category, Ingredient, Use-Case, Distribution Channel, Regional |

| Key Market Opportunities | Natural and organic ingredients demand, Increased pet humanization trends, Growth in online pet food sales, Innovations in plant-based ingredients, Customizable pet food formulations |

| Key Market Dynamics | Increasing pet ownership, Rising health consciousness, Demand for natural ingredients, Growth in premium pet food, Regulatory compliance pressures |

| Countries Covered | North America, Europe, APAC, South America, MEA |

| Market Size 2025 | 55.69 (USD Billion) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the expected market size of the Pet Food Ingredients Market in 2024?

The Pet Food Ingredients Market is expected to be valued at 51.65 USD Billion in 2024.

How large is the Pet Food Ingredients Market projected to grow by 2035?

By 2035, the market is projected to reach a value of 118.21 USD Billion.

What is the compound annual growth rate (CAGR) for the Pet Food Ingredients Market from 2025 to 2035?

The market is expected to grow at a CAGR of 7.82% during the forecast period from 2025 to 2035.

Which region holds the largest market share for the Pet Food Ingredients Market in 2024?

North America holds the largest market share with a valuation of 22.5 USD Billion in 2024.

What will the market size of the European region be in 2035?

The European market size is expected to reach 32.0 USD Billion by 2035.

Who are the key players in the Pet Food Ingredients Market?

Major players in the market include Natural Balance Pet Foods, General Mills, Blue Buffalo, and Mars.

What is the expected market size for Conventional pet food ingredients in 2035?

Conventional pet food ingredients are projected to reach a market size of 70.0 USD Billion by 2035.

What is the market size for Rendered pet food ingredients in 2024?

Rendered pet food ingredients are valued at 19.65 USD Billion in 2024.

Which region is anticipated to have the fastest growth in the pet food ingredients market?

The Asia Pacific region is expected to exhibit significant growth, reaching 18.0 USD Billion by 2035.

What are the anticipated growth drivers for the Pet Food Ingredients Market?

Key growth drivers include rising pet ownership and increasing awareness of pet nutrition.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

PET FOOD INGREDIENTS MARKET, BY CATEGORY (USD BILLION)

- Conventional

- Rendered

-

PET FOOD INGREDIENTS MARKET, BY INGREDIENT (USD BILLION)

- ADX

- Antimicrobials

-

PET FOOD INGREDIENTS MARKET, BY USE-CASE (USD BILLION)

- Dog Food

- Cat Food

- Fish Food

- Others

-

PET FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (USD BILLION)

- Direct

- Indirect

-

PET FOOD INGREDIENTS MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Pet Food Ingredients Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Pet Food Ingredients Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

Natural Balance Pet Foods

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

General Mills

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Blue Buffalo

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Merrick Pet Care

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cargill

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hill's Pet Nutrition

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Smithfield Foods

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mars

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sunshine Mills

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nestle

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ainsworth Pet Nutrition

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Diamond Pet Foods

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

WellPet

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

The J.M. Smucker Company

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Champion Petfoods

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Natural Balance Pet Foods

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 3. NORTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 4. NORTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 5. NORTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 6. NORTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 7. US PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 8. US PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 9. US PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 10. US PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 11. US PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 12. CANADA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 13. CANADA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 14. CANADA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 15. CANADA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 16. CANADA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 17. EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 18. EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 19. EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 20. EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 21. EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 22. GERMANY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 23. GERMANY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 24. GERMANY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 25. GERMANY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 26. GERMANY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 27. UK PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 28. UK PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 29. UK PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 30. UK PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 31. UK PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 32. FRANCE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 33. FRANCE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 34. FRANCE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 35. FRANCE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 36. FRANCE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 37. RUSSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 38. RUSSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 39. RUSSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 40. RUSSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 41. RUSSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 42. ITALY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 43. ITALY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 44. ITALY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 45. ITALY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 46. ITALY PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 47. SPAIN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 48. SPAIN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 49. SPAIN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 50. SPAIN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 51. SPAIN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 52. REST OF EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 53. REST OF EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 54. REST OF EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 55. REST OF EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 56. REST OF EUROPE PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 57. APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 58. APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 59. APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 60. APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 61. APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 62. CHINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 63. CHINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 64. CHINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 65. CHINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 66. CHINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 67. INDIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 68. INDIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 69. INDIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 70. INDIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 71. INDIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 72. JAPAN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 73. JAPAN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 74. JAPAN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 75. JAPAN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 76. JAPAN PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 77. SOUTH KOREA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 78. SOUTH KOREA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 79. SOUTH KOREA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 80. SOUTH KOREA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 81. SOUTH KOREA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 82. MALAYSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 83. MALAYSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 84. MALAYSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 85. MALAYSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 86. MALAYSIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 87. THAILAND PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 88. THAILAND PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 89. THAILAND PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 90. THAILAND PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 91. THAILAND PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 92. INDONESIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 93. INDONESIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 94. INDONESIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 95. INDONESIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 96. INDONESIA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 97. REST OF APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 98. REST OF APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 99. REST OF APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 100. REST OF APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 101. REST OF APAC PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 107. BRAZIL PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 108. BRAZIL PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 109. BRAZIL PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 110. BRAZIL PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 111. BRAZIL PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 112. MEXICO PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 113. MEXICO PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 114. MEXICO PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 115. MEXICO PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 116. MEXICO PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 117. ARGENTINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 118. ARGENTINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 119. ARGENTINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 120. ARGENTINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 121. ARGENTINA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 127. MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 128. MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 129. MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 130. MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 131. MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 142. REST OF MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY CATEGORY, 2019-2035 (USD BILLIONS)

- TABLE 143. REST OF MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENT, 2019-2035 (USD BILLIONS)

- TABLE 144. REST OF MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY USE-CASE, 2019-2035 (USD BILLIONS)

- TABLE 145. REST OF MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 146. REST OF MEA PET FOOD INGREDIENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA PET FOOD INGREDIENTS MARKET ANALYSIS

- FIGURE 3. US PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 4. US PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 5. US PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 6. US PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 7. US PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 9. CANADA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 10. CANADA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 11. CANADA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 12. CANADA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE PET FOOD INGREDIENTS MARKET ANALYSIS

- FIGURE 14. GERMANY PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 15. GERMANY PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 16. GERMANY PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 17. GERMANY PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 18. GERMANY PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 20. UK PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 21. UK PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 22. UK PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 23. UK PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 25. FRANCE PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 26. FRANCE PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 27. FRANCE PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 28. FRANCE PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 30. RUSSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 31. RUSSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 32. RUSSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 33. RUSSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 35. ITALY PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 36. ITALY PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 37. ITALY PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 38. ITALY PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 40. SPAIN PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 41. SPAIN PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 42. SPAIN PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 43. SPAIN PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 45. REST OF EUROPE PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 46. REST OF EUROPE PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 47. REST OF EUROPE PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 48. REST OF EUROPE PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC PET FOOD INGREDIENTS MARKET ANALYSIS

- FIGURE 50. CHINA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 51. CHINA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 52. CHINA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 53. CHINA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 54. CHINA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 56. INDIA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 57. INDIA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 58. INDIA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 59. INDIA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 61. JAPAN PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 62. JAPAN PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 63. JAPAN PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 64. JAPAN PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 66. SOUTH KOREA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 67. SOUTH KOREA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 68. SOUTH KOREA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 69. SOUTH KOREA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 71. MALAYSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 72. MALAYSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 73. MALAYSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 74. MALAYSIA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 76. THAILAND PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 77. THAILAND PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 78. THAILAND PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 79. THAILAND PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 81. INDONESIA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 82. INDONESIA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 83. INDONESIA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 84. INDONESIA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 86. REST OF APAC PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 87. REST OF APAC PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 88. REST OF APAC PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 89. REST OF APAC PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA PET FOOD INGREDIENTS MARKET ANALYSIS

- FIGURE 91. BRAZIL PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 92. BRAZIL PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 93. BRAZIL PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 94. BRAZIL PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 95. BRAZIL PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 97. MEXICO PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 98. MEXICO PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 99. MEXICO PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 100. MEXICO PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 102. ARGENTINA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 103. ARGENTINA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 104. ARGENTINA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 105. ARGENTINA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 107. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 108. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 109. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 110. REST OF SOUTH AMERICA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA PET FOOD INGREDIENTS MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 113. GCC COUNTRIES PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 114. GCC COUNTRIES PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 115. GCC COUNTRIES PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 116. GCC COUNTRIES PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 118. SOUTH AFRICA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 119. SOUTH AFRICA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 120. SOUTH AFRICA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 121. SOUTH AFRICA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 122. REST OF MEA PET FOOD INGREDIENTS MARKET ANALYSIS BY CATEGORY

- FIGURE 123. REST OF MEA PET FOOD INGREDIENTS MARKET ANALYSIS BY INGREDIENT

- FIGURE 124. REST OF MEA PET FOOD INGREDIENTS MARKET ANALYSIS BY USE-CASE

- FIGURE 125. REST OF MEA PET FOOD INGREDIENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 126. REST OF MEA PET FOOD INGREDIENTS MARKET ANALYSIS BY REGIONAL

- FIGURE 127. KEY BUYING CRITERIA OF PET FOOD INGREDIENTS MARKET

- FIGURE 128. RESEARCH PROCESS OF MRFR

- FIGURE 129. DRO ANALYSIS OF PET FOOD INGREDIENTS MARKET

- FIGURE 130. DRIVERS IMPACT ANALYSIS: PET FOOD INGREDIENTS MARKET

- FIGURE 131. RESTRAINTS IMPACT ANALYSIS: PET FOOD INGREDIENTS MARKET

- FIGURE 132. SUPPLY / VALUE CHAIN: PET FOOD INGREDIENTS MARKET

- FIGURE 133. PET FOOD INGREDIENTS MARKET, BY CATEGORY, 2025 (% SHARE)

- FIGURE 134. PET FOOD INGREDIENTS MARKET, BY CATEGORY, 2019 TO 2035 (USD Billions)

- FIGURE 135. PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2025 (% SHARE)

- FIGURE 136. PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019 TO 2035 (USD Billions)

- FIGURE 137. PET FOOD INGREDIENTS MARKET, BY USE-CASE, 2025 (% SHARE)

- FIGURE 138. PET FOOD INGREDIENTS MARKET, BY USE-CASE, 2019 TO 2035 (USD Billions)

- FIGURE 139. PET FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2025 (% SHARE)

- FIGURE 140. PET FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2019 TO 2035 (USD Billions)

- FIGURE 141. PET FOOD INGREDIENTS MARKET, BY REGIONAL, 2025 (% SHARE)

- FIGURE 142. PET FOOD INGREDIENTS MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

- FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

Pet Food Ingredients Market Segmentation

- Pet Food Ingredients Market By Category (USD Billion, 2019-2035)

- Conventional

- Rendered

- Pet Food Ingredients Market By Ingredient (USD Billion, 2019-2035)

- ADX

- Antimicrobials

- Pet Food Ingredients Market By Use-Case (USD Billion, 2019-2035)

- Dog Food

- Cat Food

- Fish Food

- Others

- Pet Food Ingredients Market By Distribution Channel (USD Billion, 2019-2035)

- Direct

- Indirect

- Pet Food Ingredients Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Pet Food Ingredients Market Regional Outlook (USD Billion, 2019-2035)

- North America Outlook (USD Billion, 2019-2035)

- North America Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- North America Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- North America Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- North America Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- North America Pet Food Ingredients Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

- US Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- US Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- US Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- US Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- CANADA Outlook (USD Billion, 2019-2035)

- CANADA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- CANADA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- CANADA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- CANADA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- North America Pet Food Ingredients Market by Category Type

- Europe Outlook (USD Billion, 2019-2035)

- Europe Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- Europe Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- Europe Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- Europe Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- Europe Pet Food Ingredients Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

- GERMANY Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- GERMANY Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- GERMANY Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- GERMANY Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- UK Outlook (USD Billion, 2019-2035)

- UK Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- UK Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- UK Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- UK Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- FRANCE Outlook (USD Billion, 2019-2035)

- FRANCE Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- FRANCE Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- FRANCE Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- FRANCE Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- RUSSIA Outlook (USD Billion, 2019-2035)

- RUSSIA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- RUSSIA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- RUSSIA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- RUSSIA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- ITALY Outlook (USD Billion, 2019-2035)

- ITALY Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- ITALY Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- ITALY Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- ITALY Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- SPAIN Outlook (USD Billion, 2019-2035)

- SPAIN Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- SPAIN Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- SPAIN Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- SPAIN Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

- REST OF EUROPE Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- REST OF EUROPE Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- REST OF EUROPE Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- REST OF EUROPE Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- Europe Pet Food Ingredients Market by Category Type

- APAC Outlook (USD Billion, 2019-2035)

- APAC Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- APAC Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- APAC Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- APAC Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- APAC Pet Food Ingredients Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

- CHINA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- CHINA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- CHINA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- CHINA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- INDIA Outlook (USD Billion, 2019-2035)

- INDIA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- INDIA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- INDIA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- INDIA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- JAPAN Outlook (USD Billion, 2019-2035)

- JAPAN Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- JAPAN Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- JAPAN Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- JAPAN Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

- SOUTH KOREA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- SOUTH KOREA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- SOUTH KOREA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- SOUTH KOREA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- MALAYSIA Outlook (USD Billion, 2019-2035)

- MALAYSIA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- MALAYSIA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- MALAYSIA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- MALAYSIA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- THAILAND Outlook (USD Billion, 2019-2035)

- THAILAND Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- THAILAND Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- THAILAND Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- THAILAND Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- INDONESIA Outlook (USD Billion, 2019-2035)

- INDONESIA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- INDONESIA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- INDONESIA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- INDONESIA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- REST OF APAC Outlook (USD Billion, 2019-2035)

- REST OF APAC Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- REST OF APAC Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- REST OF APAC Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- REST OF APAC Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- APAC Pet Food Ingredients Market by Category Type

- South America Outlook (USD Billion, 2019-2035)

- South America Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- South America Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- South America Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- South America Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- South America Pet Food Ingredients Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

- BRAZIL Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- BRAZIL Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- BRAZIL Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- BRAZIL Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- MEXICO Outlook (USD Billion, 2019-2035)

- MEXICO Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- MEXICO Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- MEXICO Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- MEXICO Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- ARGENTINA Outlook (USD Billion, 2019-2035)

- ARGENTINA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- ARGENTINA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- ARGENTINA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- ARGENTINA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

- REST OF SOUTH AMERICA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- REST OF SOUTH AMERICA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- REST OF SOUTH AMERICA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- REST OF SOUTH AMERICA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- South America Pet Food Ingredients Market by Category Type

- MEA Outlook (USD Billion, 2019-2035)

- MEA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- MEA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- MEA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- MEA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- MEA Pet Food Ingredients Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

- GCC COUNTRIES Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- GCC COUNTRIES Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- GCC COUNTRIES Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- GCC COUNTRIES Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- SOUTH AFRICA Outlook (USD Billion, 2019-2035)

- SOUTH AFRICA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- SOUTH AFRICA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- SOUTH AFRICA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- SOUTH AFRICA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- REST OF MEA Outlook (USD Billion, 2019-2035)

- REST OF MEA Pet Food Ingredients Market by Category Type

- Conventional

- Rendered

- REST OF MEA Pet Food Ingredients Market by Ingredient Type

- ADX

- Antimicrobials

- REST OF MEA Pet Food Ingredients Market by Use-Case Type

- Dog Food

- Cat Food

- Fish Food

- Others

- REST OF MEA Pet Food Ingredients Market by Distribution Channel Type

- Direct

- Indirect

- MEA Pet Food Ingredients Market by Category Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment