Market Trends

Introduction

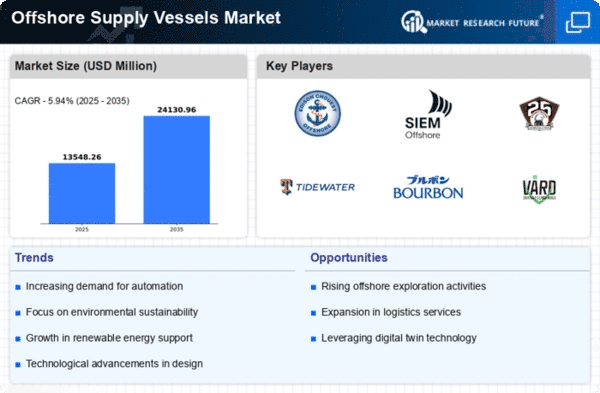

In the year 2024, the offshore supply vessel market will be undergoing a major transformation, due to a confluence of macroeconomic factors. Technological innovations, particularly automation and digitalization, are reshaping the operational efficiency and safety of the industry. Meanwhile, the regulatory pressures to reduce carbon emissions and increase the level of environmental protection are compelling the industry to adopt greener practices and invest in new ship designs. Furthermore, the shifts in consumer preferences, especially the growing demand for renewable energy, are influencing the types of offshore services and vessels that will be required. These macroeconomic trends are essential for industry stakeholders to understand, because they will determine not only the competitive positioning of the industry, but also the strategic investments and operational adjustments that are required to adapt to the changing landscape.

Top Trends

-

Increased Demand for Renewable Energy Support

The shift to renewable energy sources, especially offshore wind power, has increased the demand for specialized supply vessels. In Europe and Asia, governments are investing heavily in offshore wind farms, with the European Union aiming for a total of three hundred gigawatts of offshore wind power by 2030. The trend is pushing companies to adapt their fleets, which means increased operating costs and new sources of revenue. In the future, hybrid vessels might be designed to support these initiatives. -

Digitalization and Smart Vessels

The introduction of digital technology on offshore supply vessels is transforming operations, enhancing efficiency and safety. IoT and AI are increasingly being used for preventive maintenance. Studies show that this could result in a 20 per cent reduction in downtime. The trend is being led by the industry’s leading companies, who are investing in smart vessel technology. These developments could lead to a shift towards fully autonomous vessels, with consequent implications for crewing and operating procedures. -

Sustainability and Environmental Regulations

OFFSHORE - Stricter regulations for the environment are pushing the offshore supply market to a greener approach. The IMO's 2023 goals for reducing greenhouse gas emissions are forcing companies to invest in environmentally friendly technology. At first, this will increase operating costs, but long-term fuel savings may be achieved. In the future, there may be a general use of alternative fuels such as hydrogen and lng. -

Consolidation and Strategic Partnerships

The offshore supply vessel market is being consolidated as companies seek to optimize operations and reduce costs. Mergers and acquisitions are becoming more frequent, and a number of major players are forming strategic alliances to share resources and technology. This trend should lead to more efficient operations but may also reduce competition. In the long term, the industry may become more oligopolistic, with implications for pricing strategies. -

Focus on Crew Welfare and Training

There is a shortage of qualified hands on board, and the industry is concentrating on training and welfare. The companies are investing in advanced training facilities and psychological support, because they know that a well-trained crew increases safety and efficiency. According to research, an increase of 15 per cent in productivity can be achieved by improved crew welfare. Future developments may see the integration of virtual reality in the training of offshore crews to prepare them for offshore challenges. -

Emergence of Autonomous Vessels

In the course of time, and owing to the advancement of technology and the need for economy, the development of self-governing ships is becoming more and more common. In fact, companies are experimenting with unmanned supply ships for normal operations, which would cut down on crew expenses considerably. Testing has shown that ships under auto-control can operate at a cost of up to thirty per cent less than ships with crews. As these ships become more and more common, their regulation and safety standards may become more complex. -

Increased Focus on Safety and Risk Management

The offshore supply vessel market continues to be one where safety is paramount. Companies are investing in advanced risk management systems. In particular, the implementation of real-time monitoring and data analysis is reducing accidents and improving compliance with safety regulations. Statistics show that companies with strong safety policies can reduce the accident rate by as much as 40 per cent. Future developments may include the use of artificial intelligence to assist with risk assessment and decision-making. -

Geopolitical Influences on Supply Chains

Geopolitical tensions affect the offshore supply vessel market, influencing the supply chain and the operational strategy. In regions such as the South China Sea and the Arctic, companies are adapting to changing regulations and trading conditions. This leads to increased operating costs and requires a flexible supply chain strategy. In the future, companies may diversify their operational bases to mitigate geopolitical risks. -

Investment in Advanced Vessel Designs

In recent years, the trend has been towards a greater investment in advanced vessel designs that improve efficiency and reduce the impact on the environment. These vessels are also required to be built in such a way as to meet the new regulations and be profitable. The reports indicate that modern designs can improve the efficiency of the ship by up to 25 per cent. In the future, new developments will be able to further improve the performance of the vessel by using new materials and new designs. -

Expansion into Emerging Markets

Offshore supply vessels are finding a growing market in the developing world, particularly in Africa and Southeast Asia, where oil and gas exploration is growing. These new opportunities are being taken up by companies, despite the risks. The figures show that investment in these markets brings high returns, but also requires a knowledge of the complex regulatory environment. Competition is likely to intensify in future, and a local strategy may be required.

Conclusion: Navigating Competitive Waters in 2024

The market for offshore supply vessels is characterised by high competitive intensity and significant fragmentation, with both established and new entrants competing for a share of the market. The regional trends indicate a shift towards more sustainable practices and advanced technology, which requires suppliers to adapt their strategies accordingly. The major companies are focusing on their extensive experience and established networks to gain a foothold in the market. The newcomers are using innovation, especially in the field of artificial intelligence and automation, to establish a position in the market. In this new business landscape, the ability to integrate sustainability and flexibility into the operations will be critical for a leadership position. While navigating these complexities, the decision-makers will have to prioritise investments in advanced capabilities in order to remain competitive and to meet the needs of a rapidly changing market.

Leave a Comment