Offshore Supply Vessels Size

Market Size Snapshot

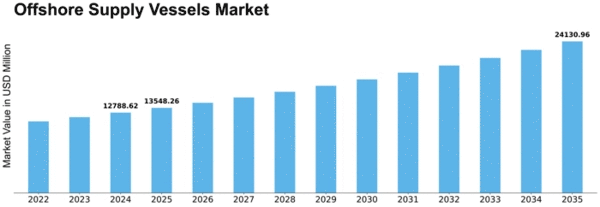

| Year | Value |

|---|---|

| 2024 | USD 12788.62 Billion |

| 2032 | USD 20286.0 Billion |

| CAGR (2024-2032) | 5.94 % |

Note – Market size depicts the revenue generated over the financial year

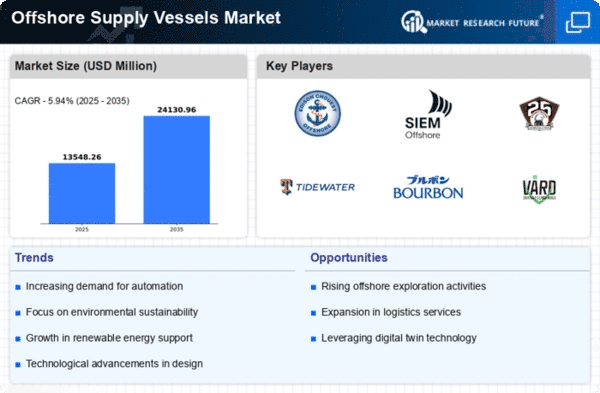

OFFSHORE SURVEYORS The offshore support vessels (OSV) market is expected to reach a significant growth in the future. The current market size for OSV is expected to reach $20,286,000 in 2032. The market will grow at a CAGR of 5.94 % between 2024 and 2032. The growing demand for offshore oil and gas exploration and the increasing investment in offshore wind farms are the main driving forces for this market. The integration of automation and digitalization in shipbuilding is also expected to enhance the efficiency and safety of ship operations, which will also drive the market. Among the major players in the OSV market, Tidewater Inc., Hornbeck Offshore Services and SEACOR Marine Holdings are actively pursuing strategies to take advantage of these opportunities. For example, more and more companies are forming alliances to develop eco-friendly ships and investing in new technology. These efforts are not only in line with the industry's current trend towards greening, but also meet the changing needs of customers in a highly competitive environment. The market is expected to continue to grow, and companies must focus on technological innovation and strategic cooperation to maintain growth momentum.

Regional Market Size

Regional Deep Dive

The offshore supply vessel market is experiencing high growth across regions, owing to the increasing offshore exploration and production activities, especially in the oil and gas sector. Each region has its own unique characteristics, influenced by the regulations, economic conditions, and technological developments. Moreover, the demand for specialized vessels, such as anchor-handling tug supply (AHTS) and platform supply vessel (PSV), is on the rise, indicating the growing need for effective offshore logistics and support. And as the industry moves towards greater sustainability, regions are seeing a shift towards greener technology and practices in vessel operations.

Europe

- Europe is witnessing a significant shift towards renewable energy, with companies like Ørsted and Equinor leading offshore wind projects, thereby increasing demand for specialized supply vessels.

- The European Union's Green Deal and associated funding programs are incentivizing the development of eco-friendly vessels, which is expected to reshape the supply vessel market towards sustainability.

Asia Pacific

- Countries like China and India are ramping up their offshore exploration efforts, with state-owned enterprises such as CNOOC and ONGC expanding their fleets to support these initiatives.

- The region is also seeing increased investment in technological advancements, such as autonomous vessels, driven by companies like Mitsui O.S.K. Lines, which are expected to enhance operational efficiency.

Latin America

- Brazil's pre-salt oil fields are attracting significant investment, with companies like Petrobras expanding their offshore operations, thereby increasing the demand for supply vessels.

- The region is also experiencing a rise in partnerships between local and international firms, aimed at enhancing operational capabilities and compliance with local regulations.

North America

- The U.S. Gulf of Mexico remains a critical hub for offshore oil and gas activities, with companies like Tidewater Inc. and Hornbeck Offshore Services investing in modernizing their fleets to meet environmental regulations.

- Recent regulatory changes, including stricter emissions standards from the Environmental Protection Agency (EPA), are pushing operators to adopt cleaner technologies, which is expected to drive innovation in vessel design and operations.

Middle East And Africa

- The Middle East, particularly the UAE and Saudi Arabia, is focusing on diversifying its economy away from oil dependency, leading to increased investments in offshore projects and supply vessels.

- Regulatory frameworks in the region are evolving, with initiatives like Saudi Vision 2030 promoting local content and sustainability, which is expected to boost the demand for locally operated supply vessels.

Did You Know?

“Did you know that the offshore supply vessel fleet is increasingly incorporating advanced technologies such as dynamic positioning systems and automated systems to enhance operational efficiency and safety?” — International Maritime Organization (IMO)

Segmental Market Size

The offshore supply vessel (OSV) market plays a crucial role in supporting offshore oil and gas exploration and production activities, and is currently experiencing a steady growth. The main drivers of demand are the growing need for energy security and the rise in offshore wind projects, especially in Europe and North America. Moreover, regulations aimed at reducing carbon emissions are pushing operators to adopt more efficient and environmentally-friendly vessels. In this respect, the OSV market is currently in a mature phase of development, with Tidewater Inc. and Bourbon leading the way in fleet modernization and green initiatives. The main applications of OSVs are the support of offshore drilling operations, subsea construction and maintenance services. Moreover, offshore wind farms, particularly in the North Sea, are an important application of OSVs. The growing shift towards the use of renewable energy sources and the resulting regulatory requirements are set to fuel this market. The use of dynamic positioning and hybrid propulsion systems is shaping the evolution of OSVs, improving their operational efficiency and reducing their environmental impact.

Future Outlook

Offshore Supply Vessels (OSV) Market from 2024 to 2032, the value of the market is expected to rise from $13,078,000,000 to $20,291,400,000, indicating a robust compound annual growth rate (CAGR) of 5.94%. The growth of this market is mainly due to the increase in the exploration of offshore oil and gas, especially in deep sea and ultra-deep sea regions. Also, with the increasing demand for offshore wind energy, the use of offshore support vessels for offshore wind farm installation and maintenance is expected to grow rapidly, which will further drive the market. Moreover, the integration of automation and digitalization in the operation of vessels will greatly increase the efficiency of operation and reduce costs, thus making the OSVs more attractive to operators. The emergence of green regulations has also prompted the industry to invest in more eco-friendly vessels and equipment. This is expected to further drive the market. The industry is also paying more and more attention to the safety and efficiency of the operation of vessels. At the same time, the remoteness and harshness of the offshore environment will lead to an increase in the demand for offshore support vessels, and the number of advanced OSVs is expected to increase rapidly, and by 2032, it is estimated that more than 60% of the fleet will have advanced equipment. In short, the OSV market is expected to develop rapidly in the future, driven by the demand for energy, the development of technology, and the impact of the regulatory environment.

Leave a Comment