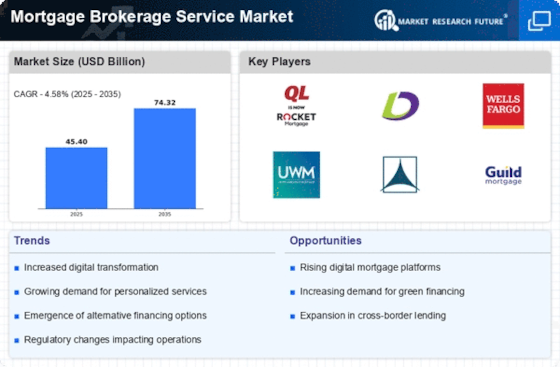

Market Growth Projections

The Global Mortgage Brokerage Service Market Industry is poised for substantial growth, with projections indicating a market value of 74.9 USD Billion by 2035. This anticipated growth reflects a compound annual growth rate (CAGR) of 4.65% from 2025 to 2035. Such figures underscore the increasing reliance on mortgage brokers as intermediaries in the home financing process. As the market expands, brokers are likely to enhance their service offerings, adapt to changing consumer needs, and leverage technological advancements to maintain competitiveness. This growth trajectory suggests a robust future for the Global Mortgage Brokerage Service Market Industry, driven by evolving market dynamics and consumer preferences.

Increasing Demand for Homeownership

The Global Mortgage Brokerage Service Market Industry experiences a notable surge in demand for homeownership, driven by a growing population and urbanization. As more individuals seek to purchase homes, the role of mortgage brokers becomes increasingly vital in facilitating access to financing options. In 2024, the market is valued at approximately 45.4 USD Billion, reflecting this trend. Mortgage brokers provide essential services, guiding clients through the complexities of mortgage products and helping them secure favorable terms. This trend is expected to continue, as homeownership remains a key aspiration for many, further propelling the growth of the Global Mortgage Brokerage Service Market Industry.

Rising Interest Rates and Market Adaptation

The Global Mortgage Brokerage Service Market Industry is currently navigating a landscape of rising interest rates, which can impact borrowing costs and consumer behavior. As rates increase, potential homebuyers may become more cautious, leading to a shift in demand for mortgage products. However, mortgage brokers can leverage their expertise to help clients find suitable financing options that align with their financial situations. This adaptability is crucial in maintaining market stability and ensuring continued growth. The ability of brokers to provide tailored solutions amidst fluctuating rates may enhance their value proposition, thereby supporting the overall growth of the Global Mortgage Brokerage Service Market Industry.

Regulatory Changes and Compliance Requirements

Regulatory frameworks play a crucial role in shaping the Global Mortgage Brokerage Service Market Industry. Changes in lending regulations and compliance requirements can create both challenges and opportunities for mortgage brokers. Stricter regulations may necessitate enhanced transparency and accountability, compelling brokers to adopt more rigorous practices. Conversely, favorable regulatory environments can stimulate market growth by facilitating easier access to financing for consumers. As the industry adapts to these evolving regulations, brokers who remain compliant and informed are likely to thrive, contributing to the overall expansion of the market, which is projected to grow at a CAGR of 4.65% from 2025 to 2035.

Technological Advancements in Mortgage Processing

Technological innovations significantly influence the Global Mortgage Brokerage Service Market Industry, enhancing efficiency and customer experience. The integration of digital platforms and automated systems streamlines the mortgage application process, reducing turnaround times and improving accuracy. For instance, online mortgage applications and electronic document submissions have become commonplace, allowing brokers to serve clients more effectively. As technology continues to evolve, it is likely to attract a broader client base, including tech-savvy millennials. This shift could contribute to the projected growth of the market, with an anticipated value of 74.9 USD Billion by 2035, indicating a robust trajectory for the Global Mortgage Brokerage Service Market Industry.

Diverse Financing Options and Consumer Preferences

The Global Mortgage Brokerage Service Market Industry benefits from an expanding array of financing options that cater to diverse consumer preferences. As borrowers seek personalized mortgage solutions, brokers play a pivotal role in matching clients with suitable lenders and products. This diversification includes conventional loans, government-backed loans, and alternative financing options, which appeal to various demographics. The increasing awareness of different mortgage products empowers consumers to make informed decisions, thereby driving demand for brokerage services. As the market evolves, the ability of brokers to navigate this complexity will be essential for sustaining growth and meeting the needs of an increasingly discerning clientele.