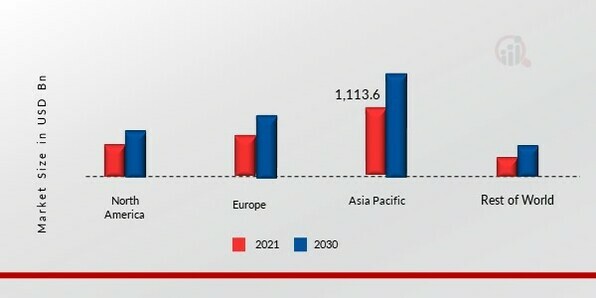

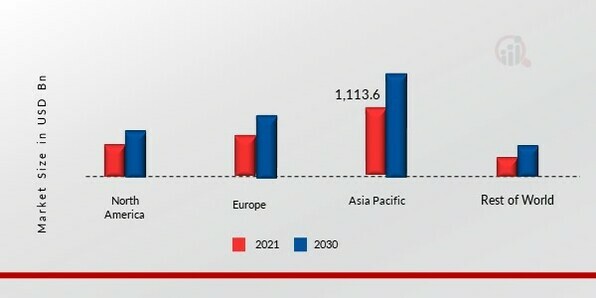

By Region, the study provides market insights for Molded Fiber Packaging into North America, Europe, Asia-Pacific and the Rest of the World. Asia Pacific Molded Fiber Packaging market accounted for USD 1113.6 million in 2021 and is expected to exhibit a significant CAGR growth during the study period. Due to its enormous population and rising disposable income levels, China's Molded Fiber Packaging Market has the largest food and beverage market in Asia, accounting for 53.5% of the Region's total sales.

The China Chain Store & Franchise Association released research claiming that the country's food and beverage market would grow dramatically in 2019 and reach $595 billion, up 7.8% from 2018. Growing single-use plastic packaging issues are caused by the nation's expanding food and beverage industry. As a result, there is a demand for environmentally friendly packaging options such as molded pulp packets to boost the Asia Pacific Molded Fiber Packaging industry.

Further, the major countries studied in the market report for Molded Fiber Packaging are The U.S., Canada, Germany, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: MOLDED FIBER PACKAGING MARKET SHARE BY REGION 2023 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

North America Molded Fiber Packaging market is the fastest growing region, as home to many food service businesses, including restaurants, fast food chains, and catering services, was the second-largest Molded Fiber Packaging Market in 2021. The need for product packaging solutions is anticipated to increase due to the increased incidence of eating outside the house brought on by busy lives and higher per capita disposable income. Further, the U.S. Molded Fiber Packaging market held the largest market share, and the Canada Molded Fiber Packaging market was the fastest-growing in this Region.

European Molded Fiber Packaging market held the second fastest-growing region. One million restaurants and mobile food services operate in the E.U., projected to rise throughout the projection period. The need for sustainable packaging solutions is anticipated to rise along with the number of restaurants and other food outlets. The E.U.'s member nations uphold strict regulatory standards to prevent negative environmental effects from trash disposal, particularly plastics, fostering a healthy market for molded pulp packaging. Moreover, the Germany Molded Fiber Packaging market held the largest market share, and the U.K. Molded Fiber Packaging market was the fastest-growing in this Region.