Micro Robots Size

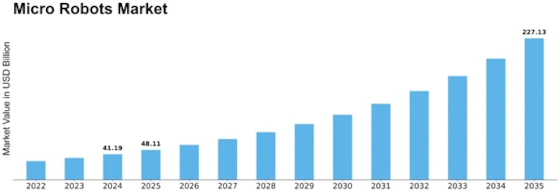

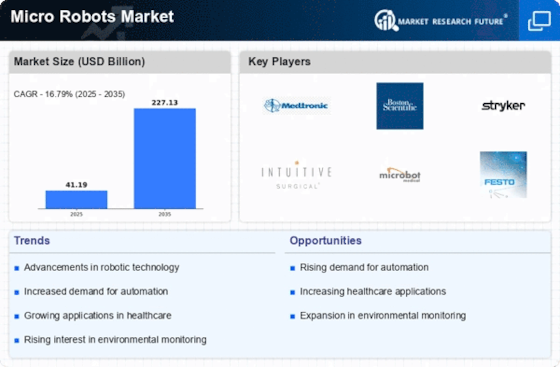

Micro Robots Market Growth Projections and Opportunities

The ultra-modern Pharmaceutical Micro Robots Market has greatly revolutionized the pharmaceutical and healthcare industry with miniature robotic systems for microscale medicine. This is an innovative approach to drug delivery, diagnostic and surgical procedures that can be achieved through the use of tiny robots called micro robots measuring between a few millimetres to sub-millimeter in diameter. These devices have the capability of traversing the human body to specific destinations better than any other equipment.

Another way pharmaceutical micro robots are employed is through targeted drug delivery. These small-sized robots may be engineered to transport drugs directly into certain cells or tissues hence minimizing systemic toxicities as well as improving therapeutic efficiency. The fact that these micro-robots can go through complex biological settings, including blood vessels and organs, makes it possible to reach areas where diseases come from more accurately.

Pharmaceutical Micro Robots Market is also transforming surgical procedures. Micro robots allow for minimally invasive surgeries thereby reducing traditional invasive surgical approaches which take longer time to heal. Small sized gadgets like these are able to move along intricate anatomical structures performing actions like suturing or removing damaged cells. Indeed, there are prospects that this could reduce damages on patients’ bodies, hasten healing as well as improve outcomes.

In addition, Pharmaceutical Micro Robots Market enhances diagnostic capabilities. For instance, microscopic bots can be fitted with imaging and sensing devices making it possible for doctors perform real-time monitoring and see internal parts of our bodies in picture form. This aids in early detection of diseases as well as facilitate treatment planning and intervention by having enough data about them. In effect, their ability to access remote areas within the body creates new possibilities for diagnostics using such minuscule robots.

One major obstacle in the Pharmaceutical Micro Robots market involves how these miniature products are designed and controlled since they are always complicated. It requires highly developed engineering skills together with control systems that ensure both movement accuracy and functional effectiveness at such scales (microscale). Moreover, biocompatibility and the possibilities of immune response towards these microbots must also be carefully examined. Engineers, biomedical scientists, and healthcare practitioners are continuously working on overcoming these challenges through research partnerships that enhance the market.

Moreover, there is a growing focus in developing swarm robotics as the Pharmaceutical Micro Robots Market continues to advance – groups of micro-robots working together to perform complex tasks. This emulates natural processes in which various microbial species work together for efficient and adaptive functions. By employing swarm robotics in medicine, it would be possible to increase the potential of individual micro robots to act collectively for purposes like tissue healing or drug delivery as well as diagnostics.

Another driving force towards evolving this market involves the exploration into biohybrid micro robots-combining biological with man-made elements. These hybrid systems merge biological cells with robotic structures in order to tap on specific functionalities of living cells such as self-propulsion or target cell attraction by incorporating them in artificial labs. The complexity of human body biology can be bridged by using Biohybrid-microbotics which combine precision surgical skills among others typical of robotics.

Leave a Comment