Marine Interiors Market Trends

Marine Interiors Market Research Report Information By Ship Type (Commercial and Defense), By Product (Ceilings & Wall Panels, Lighting, Galleys & Pantries, Furniture, and Others), By Application (Passenger Area, Public Area, Crew Area and Utility Area) and By Region (North America, Europe, Asia-Pacific, Rest of the World - Forecast till 2035

Market Summary

As per Market Research Future Analysis, the Global Marine Interiors Market was valued at USD 3549.36 million in 2024 and is projected to reach USD 10666.19 million by 2035, growing at a CAGR of 10.52% from 2025 to 2035. The market is driven by increasing demand for cruise ships, eco-friendly materials, and advancements in maritime tourism. The Commercial segment is expected to dominate the market, while Ceilings & Wall Panels will hold the largest product share. The Public Area application segment is also anticipated to lead in market share, reflecting a trend towards sustainable and innovative designs.

Key Market Trends & Highlights

Key trends driving the Marine Interiors Market include:

- Growing demand for cruise ships, with an estimated 30 million passengers globally by 2022.

- Commercial segment expected to hold the larger market share, focusing on cargo and passenger vessels.

- Ceilings & Wall Panels projected to dominate product share, emphasizing aesthetic appeal and insulation.

- Public Area segment anticipated to lead in application share, driven by sustainable materials and eco-conscious solutions.

Market Size & Forecast

| 2024 Market Size | USD 3549.36 million |

| 2035 Market Size | USD 10666.19 million |

| CAGR (2025-2035) | 10.52% |

| Largest Regional Market Share in 2024 | Europe |

Major Players

Key players in the Marine Interiors Market include ALMACO Group, Aros Marine, Bolidt Systems, Forbo Flooring Systems, Kaefer GmbH, Marine Interiors Spa, Mivan Marine Ltd, NORAC AS, R&M Group, and Trimline Ltd.

Market Trends

Cruise ships require various Interiors components and solutions to provide passengers with a comfortable and luxurious experience. According to a Cruise Lines International Association (CLIA) report, the cruise industry is expected to carry an estimated 30 million passengers globally by 2022, up from 28.5 million in 2018. This growth in the cruise industry is driving demand for innovative and customized Interiors solutions that meet cruise passengers' specific needs and preferences. Furthermore, marine Interiors companies are developing new materials, designs, and technologies to enhance the passenger experience and improve efficiency in cruise ship Interiors.

Moreover, cruise ships are increasingly incorporating smart technology to improve cabin comfort, automate functions, and provide personalized services to passengers. These innovative solutions are making cruising a more attractive and comfortable experience for passengers, leading to higher demand for cruises and, in turn, driving demand for marine Interiors. For instance, in 2020, Norwegian Cruise Line introduced its "Cruise Norwegian" mobile app, which allows passengers to book and manage their cruise experience from their smartphones. The app also provides contactless features like mobile check-in and keyless stateroom entry.

The Global Marine Interiors Market appears to be evolving towards increased sustainability and innovation, driven by a growing emphasis on eco-friendly materials and advanced design technologies.

U.S. Department of Commerce

Marine Interiors Market Market Drivers

Market Growth Projections

The Global Marine Interiors Market Industry is poised for substantial growth, with projections indicating a market value of 10.7 USD Billion by 2035. The compound annual growth rate of 10.52% from 2025 to 2035 suggests a robust expansion driven by various factors, including rising disposable incomes and increased leisure spending. This growth trajectory reflects the industry's adaptability to changing consumer preferences and technological advancements. As the market evolves, stakeholders must remain vigilant to emerging trends and opportunities that could shape the future landscape of marine interiors.

Growth of the Cruise Industry

The Global Marine Interiors Market Industry is significantly influenced by the expansion of the cruise industry, which continues to attract millions of travelers annually. As cruise lines invest in modernizing their fleets, the demand for innovative and luxurious interiors rises. This trend is particularly evident in the design of public spaces and cabins, where comfort and aesthetics are paramount. The cruise sector's growth is expected to contribute substantially to the market, with projections indicating a robust increase in interior design projects. This dynamic environment presents opportunities for designers and manufacturers to showcase their capabilities.

Rising Demand for Luxury Yachts

The Global Marine Interiors Market Industry experiences a notable surge in demand for luxury yachts, driven by affluent consumers seeking bespoke experiences. As the market evolves, the interiors of these vessels are increasingly designed to reflect personal style and comfort. In 2024, the market is valued at approximately 3.55 USD Billion, with projections indicating a growth trajectory that could see it reach 10.7 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 10.52% from 2025 to 2035, suggesting a robust expansion in the luxury segment of marine interiors.

Technological Advancements in Design

Technological innovations play a pivotal role in shaping the Global Marine Interiors Market Industry. Advanced materials and design techniques enhance both aesthetics and functionality, allowing for more efficient use of space and improved durability. Innovations such as 3D printing and virtual reality are revolutionizing the design process, enabling designers to create intricate and personalized interiors. These advancements not only cater to the growing demand for customization but also align with sustainability trends, as eco-friendly materials gain traction. The integration of technology is likely to attract a broader clientele, further fueling market growth.

Sustainability and Eco-Friendly Practices

Sustainability emerges as a critical driver within the Global Marine Interiors Market Industry, as stakeholders increasingly prioritize eco-friendly materials and practices. The shift towards sustainable design reflects a broader societal trend towards environmental responsibility. Manufacturers are adopting green technologies and sourcing renewable materials to meet consumer expectations for environmentally conscious products. This trend is likely to resonate with both luxury and commercial segments, as regulations and consumer preferences evolve. The emphasis on sustainability not only enhances brand reputation but also opens new avenues for innovation, potentially leading to increased market share.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are essential drivers in the Global Marine Interiors Market Industry. As maritime regulations evolve, manufacturers must adapt their designs to meet stringent safety requirements. This includes the use of fire-resistant materials, ergonomic designs, and improved ventilation systems. Compliance not only ensures passenger safety but also enhances the overall quality of marine interiors. The increasing focus on safety standards may lead to higher costs initially; however, it is likely to foster innovation and improve market competitiveness in the long run.

Market Segment Insights

MARINE INTERIORS MARKET SEGMENT Insights:

MARINE INTERIORS MARKET SEGMENT INSIGHTS:

Marine Interiors Ship Type Insights

Marine Interiors Ship Type Insights

By Ship Type, the Marine Interiors market has been categorized as Commercial and Defense. According to MRFR analysis, the Commercial segment is expected to hold the larger market share.

Commercial segment includes cargo vessels, passenger vessels and others. The interiors of commercial ships is designed for the specific needs of the ship type. For instance, passenger's vessels have cabins, restaurants, and entertainment areas, while cargo ships have storage areas. A cargo vessel is a commercial ship designed for transporting goods and cargo across the world's oceans. Commercial ships include a wide range of vessels used for business and trade purposes, including container vessels, tankers, tankers, bulk carriers, and general cargo ships.

It is a key part of the global supply chain, carrying raw materials, finished products, and consumer goods between ports and countries. They are typically operated by shipping companies, which contract with cargo owners to transport their goods.

Marine Interiors Product Insights

Marine Interiors Product Insights

By Product, the Marine Interiors market has been categorized as Ceilings & Wall Panels, Lighting, Galleys & Pantries, Furniture, and Others. According to MRFR analysis, the Ceilings & Wall Panels segment is projected to hold the largest market share in the Marine Interiors market.

Ceilings and wall panels are crucial components of the marine interiors market, providing aesthetic appeal, insulation, and soundproofing to various vessels. Various companies focus on providing innovative and sustainable solutions for marine vessels. Developing lightweight and fire-resistant panels made from natural fibers will further drive demand in this segment. For instance, in 2019, the Finnish company, Spinnova, developed a new sustainable material made from wood pulp that can be used to manufacture lightweight and fire-resistant panels for marine interiorss. The material is produced using a patented process that involves spinning cellulose fibers into a durable and versatile yarn.

The resulting yarn can be woven into various textiles, including wall and ceiling panels, that are both environmentally friendly and fire-resistant.

Marine Interiors Application Insights

Marine Interiors Application Insights

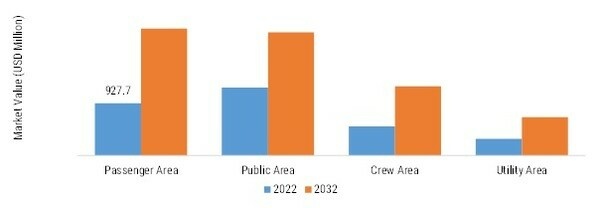

By Application, the Marine Interiors market has been categorized as Passenger Area, Public Area, Crew Area and Utility Area. According to MRFR analysis, the Public Area segment is projected to hold the largest market share in the Marine Interiors market.

This segment includes products and services related to interiors design and furnishing public spaces on ships and boats, such as lobbies, reception areas, conference rooms, and dining areas. Using sustainable and environmentally-friendly materials to create more eco-conscious and cost-effective solutions will further drive demand in this segment. For instance, in 2021, the French company, Gurit, introduced a new range of fire retardant and sustainable composite panels for use in marine public areas. The panels are made from recycled PET foam and natural flax fibers, making them lightweight, durable, and environmentally friendly.

The panels also meet the highest safety standards for fire protection, making them a safe and reliable solution for use in public areas.

FIGURE 2: MARINE INTERIORS MARKET SHARE BY APPLICATION 2022 (%)

Get more detailed insights about Marine Interiors Market Research Report - Global Forecast till 2034

Regional Insights

By Region, the study segments the market into North America, Europe, Asia-Pacific, Rest of the World.

The market is led by Europe. The adoption of sustainable materials and practices in marine interior design will drive demand in this region. For instance, in October 2020, the Finnish company Norsepower announced that it had installed two of its Rotor Sails on a ferry operated by the Danish shipping company DFDS. The sails use wind power to reduce fuel consumption and emissions, and the installation was part of a wider program to reduce the environmental impact of shipping.

In addition, several companies in Europe are developing new materials and technologies for marine interiors that are more sustainable and environmentally friendly. For example, in September 2020, the Swedish company Polykemi launched a new range of recycled plastic materials for use in marine interior design.

The North America marine interiors market has been growing steadily over the past few years due to an increase in the demand for luxury cruises and yachts. For instance, in September 2021, Celebrity Cruises announced that it had partnered with Berkus to design the new Celebrity Beyond, the third ship in its Edge series. Berkus and his team were responsible for designing the ship's stunning interiors, including its suites, restaurants, lounges, and more.

The Asia-Pacific marine interiors market is a dynamic and rapidly growing industry that is driven by a variety of factors, including the increasing demand for luxury yachts and cruise ships, the growing focus on sustainability and eco-friendliness, and the desire for innovative and culturally relevant designs.

FIGURE 3: MARINE INTERIORS MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Industry Developments

March 2021 - ALMACO Group announced the opening of a new production facility in Brazil to expand their presence in the South American market.

Marine Interiors

Future Outlook

Marine Interiors Market Future Outlook

The Global Marine Interiors Market is projected to grow at a 10.52% CAGR from 2025 to 2035, driven by technological advancements, increasing demand for luxury vessels, and sustainability initiatives.

New opportunities lie in:

- Develop eco-friendly materials for interior design to meet sustainability demands.

- Leverage smart technology integration for enhanced user experience in marine interiors.

- Expand customization services to cater to diverse consumer preferences in luxury yachts.

By 2035, the market is expected to exhibit robust growth, reflecting evolving consumer needs and technological innovations.

Market Segmentation

Regional Outlook

- US

- Canada

- Mexico

Marine Interiors Product Outlook:

- Ceilings & Wall Panels

- Lighting

- Galleys & Pantries

- Furniture

- Others

Marine Interiors Ship Type Outlook:

- Commercial

- Defense

Marine Interiors Application Outlook:

- Passenger Area

- Public Area

- Crew Area

- Utility Area

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 3549.36 million |

| Market Size 2025 | USD 3922.76 million |

| Market Size 2035 | 10666.19 |

| Compound Annual Growth Rate (CAGR) | 10.52% (2025 - 2035) |

| Base Year | 2024 |

| Forecast Period | 2025 - 2035 |

| Historical Data | 2020-2023 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Ship Type, Product , Application |

| Geographies Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

| Countries Covered | The U.S, Canada, Mexico, Germany, France, UK, China, Japan, India, Australia, South Korea, UAE, and Brazil |

| Key Companies Profiled | ALMACO Group, Aros Marine, Bolidt Systems, Forbo Flooring Systems, Kaefer GmbH, Marine Interiors Spa, Mivan Marine Ltd, NORAC AS, R&M Group, and Trimline Ltd |

| Key Market Opportunities | · Adoption of additive manufacturing to produce marine interiors · Technology advancements |

| Key Market Dynamics | · Growing demand for cruise ships · Environmental regulation growing demand for eco-friendly materials and technology · Growing maritime tourism industry |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Marine Interiors market?

USD 3211.5 Million in 2023

What is the market size for 2034, for the Marine Interiors Market?

USD 9650.90 Million in 2034

What is the growth rate of the Marine Interiors market?

10.5%

Which region held the largest market share in the Marine Interiors market?

Europe

Who are the prominent players in the Marine Interiors market?

ALMACO Group, Aros Marine, Bolidt Systems, Forbo Flooring Systems, Kaefer GmbH, Marine Interiors Spa, Mivan Marine Ltd, NORAC AS, R&M Group, and Trimline Ltd

-

EXECUTIVE SUMMARY

- GLOBAL MARINE INTERIORS MARKET, BY REGION

-

MARKET INTRODUCTION

- SCOPE OF THE STUDY

- RESEARCH OBJECTIVE

- MARKET STRUCTURE

- DATA MINING

- SECONDARY RESEARCH

-

PRIMARY RESEARCH

- BREAKDOWN OF PRIMARY RESPONDENTS

-

RESEARCH METHODOLOGY FOR MARKET SIZE ESTIMATION

- BOTTOM-UP APPROACH

- ASSUMPTIONS & LIMITATIONS

-

IMPACT OF COVID-19

- IMPACT OF COVID-19 ON GLOBAL ECONOMY

- IMPACT OF COVID-19 ON MARINE INTERIORS MARKET

- SUPPLY CHAIN IMPACT

-

MARKET DYNAMICS

-

DRIVERS

- INCREASING GROWING DEMAND FOR CRUISE SHIPS

-

RESTRAINT

- HIGH DOWNTIME IN RETROFITTING SHIPS

- TECHNOLOGY LIMITATIONS

-

OPPORTUNITIES

- TECHNOLOGY ADVANCEMENTS

-

DRIVERS

-

MARKET FACTOR ANALYSIS

-

VALUE CHAIN ANALYSIS/SUPPLY CHAIN ANALYSIS

- RAW MATERIALS & SUPPLIERS

- MANUFACTURERS

- DISTRIBUTION & SALES CHANNEL

- END-USERS

- THREAT OF SUBSTITUTES

- INTENSITY OF RIVALRY

-

VALUE CHAIN ANALYSIS/SUPPLY CHAIN ANALYSIS

-

GLOBAL MARINE INTERIORS MARKET, BY SHIP TYPE

-

INTRODUCTION

- CARGO VESSELS

- PASSENGER VESSELS

- DEFENSE

-

INTRODUCTION

-

GLOBAL MARINE INTERIORS MARKET, BY PRODUCT

- INTRODUCTION

- LIGHTING

- GALLEYS & PANTRIES

- FURNITURE

- INTRODUCTION

- PASSENGER AREA

- PUBLIC AREA

- UTILITY AREA

-

GLOBAL MARINE INTERIORS MARKET, BY REGION

-

INTRODUCTION

- US

- CANADA

- GERMANY

- FRANCE

- UK

- ITALY

-

ASIA PACIFIC

- CHINA

- INDIA

- AUSTRALIA

- BRAZIL

- REST OF LATIN AMERICA

- UAE

- REST OF MIDDLE EAST & AFRICA

- COMPETITIVE OVERVIEW

- COMPETITOR DASHBOARD

- MAJOR GROWTH STRATEGY IN THE GLOBAL MARINE INTERIORS MARKET

- COMPETITIVE BENCHMARKING

- MARKET SHARE ANALYSIS

-

INTRODUCTION

-

COMPANY PROFILES

-

ALMACO GROUP

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

- PRODUCTS OFFERED

- SWOT ANALYSIS

- KEY STRATEGY

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- COMPANY OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGY

- PRODUCTS OFFERED

- SWOT ANALYSIS

- KEY STRATEGY

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- COMPANY OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGY

-

NORAC AS

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

TRIMLINE LTD

- COMPANY OVERVIEW

- PRODUCTS OFFERED

- KEY STRATEGY

-

ALMACO GROUP

-

GLOBAL MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

(USD MILLION)

-

NORTH AMERICA MARINE INTERIORS MARKET, BY OTHERS, 2025-2034 (USD MILLION)

-

NORTH AMERICA MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

US MARINE INTERIORS MARKET, BY SHIP TYPE, 2025-2034 (USD MILLION)

-

US MARINE INTERIORS MARKET, BY OTHERS, 2025-2034 (USD MILLION)

-

US MARINE INTERIORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

-

CANADA MARINE INTERIORS MARKET, BY COMMERCIAL, 2025-2034 (USD MILLION)

-

CANADA MARINE INTERIORS MARKET, BY DEFENSE, 2025-2034 (USD MILLION)

-

EUROPE MARINE INTERIORS MARKET, BY COMMERCIAL, 2025-2034 (USD MILLION)

-

EUROPE MARINE INTERIORS MARKET, BY DEFENSE, 2025-2034 (USD MILLION)

-

GERMANY MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

FRANCE MARINE INTERIORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

-

UK MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

ITALY MARINE INTERIORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

-

REST OF EUROPE MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

ASIA PACIFIC MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

CHINA MARINE INTERIORS MARKET, BY SHIP TYPE, 2025-2034 (USD MILLION)

-

CHINA MARINE INTERIORS MARKET, BY OTHERS, 2025-2034 (USD MILLION)

-

JAPAN MARINE INTERIORS MARKET, BY COMMERCIAL, 2025-2034 (USD MILLION)

-

JAPAN MARINE INTERIORS MARKET, BY DEFENSE, 2025-2034 (USD MILLION)

-

INDIA MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

LATIN AMERICA MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

BRAZIL MARINE INTERIORS MARKET, BY SHIP TYPE, 2025-2034 (USD MILLION)

-

BRAZIL MARINE INTERIORS MARKET, BY OTHERS, 2025-2034 (USD MILLION)

-

SAUDI AFRICA MARINE INTERIORS MARKET, BY OTHERS, 2025-2034 (USD MILLION)

-

UAE MARINE INTERIORS MARKET, BY PRODUCT, 2025-2034 (USD MILLION)

-

THE MOST ACTIVE PLAYER IN THE GLOBAL MARINE INTERIORS MARKET

-

ALMACO GROUP: PRODUCTS OFFERED

-

ALMACO GROUP: KEY DEVELOPMENTS

-

AROS MARINE: PRODUCTS OFFERED

-

BOLIDT SYSTEMS: PRODUCTS OFFERED

-

BOLIDT SYSTEMS: KEY DEVELOPMENTS

-

FORBO FLOORING SYSTEMS: PRODUCTS OFFERED

-

FORBO FLOORING SYSTEMS: KEY DEVELOPMENTS

-

KAEFER GMBH: PRODUCTS OFFERED

-

MARINE INTERIORS SPA: PRODUCTS OFFERED

-

MARINE INTERIORS SPA: KEY DEVELOPMENTS

-

MIVAN MARINE LTD: PRODUCTS OFFERED

-

MIVAN MARINE LTD: KEY DEVELOPMENTS

-

NORAC AS: PRODUCTS OFFERED

-

NORAC AS: KEY DEVELOPMENTS

-

R&M GROUP: PRODUCTS OFFERED

-

R&M GROUP: KEY DEVELOPMENTS

-

TRIMLINE LTD: PRODUCTS OFFERED

-

TRIMLINE LTD: KEY DEVELOPMENTS

-

List of Tables and Figures

- FIGURE

- 1 GLOBAL MARINE INTERIORS MARKET ANALYSIS BY SHIP TYPE 15

- FIGURE 2 GLOBAL MARINE INTERIORS MARKET ANALYSIS BY PRODUCT 16

- FIGURE 3 GLOBAL MARINE INTERIORS MARKET ANALYSIS

- BY APPLICATION 17

- FIGURE 4 GLOBAL MARINE

- INTERIORS MARKET ANALYSIS BY REGION 18

- FIGURE

- 5 GLOBAL MARINE INTERIORS MARKET: STRUCTURE 20

- FIGURE

- 6 BOTTOM-UP AND TOP-DOWN APPROACHES 25

- FIGURE

- 7 MARKET DYNAMIC ANALYSIS OF THE GLOBAL MARINE INTERIORS MARKET 30

- FIGURE 8 DRIVER IMPACT ANALYSIS 32

- FIGURE

- 9 RESTRAINT IMPACT ANALYSIS 33

- FIGURE 10

- VALUE CHAIN: GLOBAL MARINE INTERIORS MARKET 36

- FIGURE

- 11 PORTER’S FIVE FORCES MODEL: GLOBAL MARINE INTERIORS MARKET 38

- FIGURE 12 GLOBAL MARINE INTERIORS MARKET, BY SHIP

- TYPE, 2018 TO 2032 (USD MILLION) 40

- FIGURE

- 13 GLOBAL MARINE INTERIORS MARKET, BY TECHNIQUE TYPE, 2018 TO 2032 (USD MILLION)

- 44

- FIGURE 14 GLOBAL MARINE INTERIORS MARKET,

- BY GUIDANCE TECHNIQUE, 2018 TO 2032 (USD MILLION) 47

- FIGURE 15 GLOBAL MARINE INTERIORS MARKET, BY REGION, 2018 TO 2032 (USD

- MILLION) 50

- FIGURE 16 NORTH AMERICA: MARINE

- INTERIORS MARKET SHARE, BY COUNTRY, 2024 (% SHARE) 51

- FIGURE 17 EUROPE: MARINE INTERIORS MARKET SHARE, BY COUNTRY, 2024 (%

- SHARE) 62

- FIGURE 18 ASIA PACIFIC: MARINE

- INTERIORS MARKET SHARE, BY COUNTRY, 2024 (% SHARE) 84

- FIGURE 19 LATIN AMERICA: MARINE INTERIORS MARKET SHARE, BY COUNTRY, 2024

- (% SHARE) 106

- FIGURE 20 MIDDLE EAST &

- AFRICA: MARINE INTERIORS MARKET SHARE, BY COUNTRY, 2024 (% SHARE) 117

- FIGURE 21 CONTRACTS & AGREEMENTS: THE MAJOR STRATEGY

- ADOPTED BY KEY PLAYERS IN GLOBAL MARINE INTERIORS MARKET 133

- FIGURE 22 BENCHMARKING OF MAJOR COMPETITORS 134

- FIGURE 23 MAJOR MANUFACTURER MARKET SHARE ANALYSIS, 2022 135

- FIGURE 24 ALMACO GROUP: SWOT ANALYSIS 139

- FIGURE 25 AROS MARINE: SWOT ANALYSIS 141

- FIGURE 26 BOLIDT SYSTEMS: SWOT ANALYSIS 143

- FIGURE 27 FORBO FLOORING SYSTEMS: SWOT ANALYSIS 145

- FIGURE 28 KAEFER GMBH: SWOT ANALYSIS 147

- FIGURE 29 MARINE INTERIORS SPA: SWOT ANALYSIS 149

- FIGURE 30 MIVAN MARINE LTD: SWOT ANALYSIS 151

- FIGURE 31 NORAC AS: SWOT ANALYSIS 153

- FIGURE 32 R&M GROUP: SWOT ANALYSIS 155

- FIGURE 33 TRIMLINE LTD: SWOT ANALYSIS 157

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment