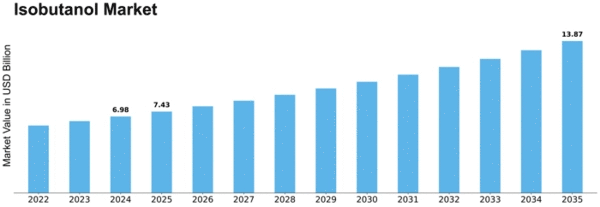

Isobutanol Size

Isobutanol Market Growth Projections and Opportunities

The isobutanol market is influenced by a variety of market factors that impact its supply, demand, and pricing dynamics. These factors include raw material availability, technological advancements, regulatory policies, competition, and end-user industries.

Isobutanol is a colorless, mobile, neutral liquid with a characteristic odor that is used in organic synthesis. It has similar properties to n-butyl alcohol and can be used as a supplement or replacement for them in many application. Solvent, isobutanol is widely used to decrease the viscosities in of many formulations and simultaneously promote the leveling and flow.

One of the primary market factors affecting the isobutanol market is the availability and cost of raw materials. Isobutanol is typically produced from fossil fuels such as petroleum or natural gas, as well as renewable sources like biomass. Fluctuations in the prices of these raw materials can directly impact the production cost of isobutanol, thereby affecting its market price and competitiveness.

Technological advancements play a significant role in shaping the isobutanol market. Advances in production processes, such as the development of more efficient catalysts or fermentation techniques, can improve the yield and quality of isobutanol while reducing production costs. These technological innovations can enhance the competitiveness of isobutanol as an alternative to traditional solvents or fuel additives.

Regulatory policies also have a substantial impact on the isobutanol market. Government regulations regarding environmental standards, biofuel mandates, and chemical safety regulations can influence the demand for isobutanol as a renewable and eco-friendly alternative to conventional solvents and gasoline additives. Incentives such as tax credits or subsidies for biofuel production can further stimulate demand for isobutanol and drive market growth.

Competition within the isobutanol market is another crucial factor influencing its dynamics. As the market continues to grow, new players may enter the market, increasing competition among producers. Additionally, the presence of alternative bio-based chemicals or fuels can pose a competitive threat to isobutanol. Price competitiveness, product quality, and distribution networks are key factors that determine the market share of different players in the isobutanol market.

The demand for isobutanol is also influenced by various end-user industries. Isobutanol is used as a solvent in coatings, paints, and adhesives, as well as a fuel additive in gasoline and jet fuel. The growth of these industries, particularly in emerging markets, can drive the demand for isobutanol. Additionally, the increasing adoption of bio-based chemicals and fuels as part of sustainability initiatives by companies and governments can further boost the demand for isobutanol.

Market factors such as raw material availability, technological advancements, regulatory policies, competition, and end-user industries interact with each other to shape the dynamics of the isobutanol market. Producers, investors, and policymakers need to closely monitor these factors to anticipate market trends, identify opportunities, and mitigate risks in the rapidly evolving isobutanol market. Overall, the isobutanol market is poised for growth driven by increasing demand for renewable and eco-friendly chemicals and fuels amid growing environmental concerns and regulatory pressures.

Leave a Comment