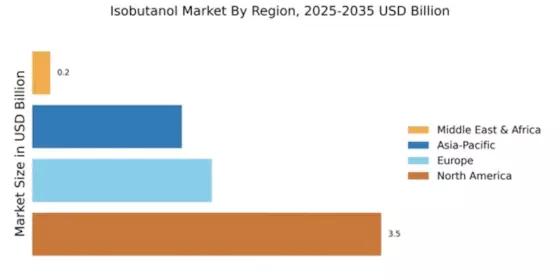

Market Growth Projections

The Global Isobutanol Market Industry is poised for substantial growth, with projections indicating a rise from 3.47 USD Billion in 2024 to 8.53 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.52% from 2025 to 2035, reflecting the increasing adoption of isobutanol across various sectors. The market dynamics are influenced by factors such as rising demand for biofuels, expanding applications in chemicals, and regulatory support for green initiatives. These projections highlight the potential for isobutanol to play a pivotal role in the transition towards sustainable industrial practices.

Growing Demand for Biofuels

The increasing emphasis on renewable energy sources is driving the Global Isobutanol Market Industry. Isobutanol Market, being a versatile biofuel, is gaining traction due to its potential to reduce greenhouse gas emissions. In 2024, the market is projected to reach 3.47 USD Billion, reflecting a growing preference for sustainable alternatives in the transportation sector. Governments worldwide are implementing policies to promote biofuels, which further enhances the demand for isobutanol. This trend is expected to continue, with the market potentially expanding as consumers and industries alike seek greener energy solutions.

Expanding Applications in Chemicals

Isobutanol Market is increasingly utilized as a solvent and intermediate in the production of various chemicals, which is propelling the Global Isobutanol Market Industry. Its role in manufacturing paints, coatings, and adhesives is particularly noteworthy, as these sectors are experiencing growth due to rising construction activities globally. The versatility of isobutanol allows it to be integrated into numerous formulations, enhancing product performance. As industries continue to innovate and expand, the demand for isobutanol as a key ingredient is likely to rise, contributing to the market's projected growth to 8.53 USD Billion by 2035.

Rising Demand from Automotive Sector

The automotive industry is a significant driver of the Global Isobutanol Market Industry, as isobutanol is increasingly being used as a fuel additive. Its properties enhance engine performance and reduce emissions, aligning with the industry's shift towards more environmentally friendly solutions. As the global automotive market evolves, the demand for isobutanol is expected to grow, particularly in regions focusing on stringent emission regulations. This trend may contribute to a compound annual growth rate of 8.52% from 2025 to 2035, reflecting the automotive sector's commitment to sustainability and innovation.

Regulatory Support for Green Chemicals

Government regulations promoting the use of green chemicals are significantly impacting the Global Isobutanol Market Industry. Policies aimed at reducing carbon footprints and encouraging the adoption of bio-based products are creating a favorable environment for isobutanol. These regulations often provide incentives for industries to transition towards more sustainable practices, thereby increasing the demand for isobutanol as a renewable alternative. As regulatory frameworks evolve, the market is likely to see a surge in interest and investment, contributing to its growth trajectory and aligning with global sustainability goals.

Technological Advancements in Production

Advancements in production technologies are enhancing the efficiency and cost-effectiveness of isobutanol manufacturing, thereby influencing the Global Isobutanol Market Industry positively. Innovations such as fermentation processes and catalytic conversion methods are being developed to optimize yields and reduce production costs. These technological improvements not only make isobutanol more accessible but also align with the increasing demand for sustainable chemical processes. As production becomes more efficient, the market is expected to benefit from lower prices and increased availability, further driving growth in the coming years.