Market Trends

Introduction

The Intraoral Cameras Market will be going through a transformation by 2024. Technological advancements, particularly in terms of the quality of the image and the integration of the digital workflow, are changing the way dental professionals diagnose and treat patients. Also, regulatory pressures are affecting the market as compliance with stringent health and safety standards becomes a priority. In addition, changes in patient behavior, where patients are demanding more transparency and involvement in their dental care, are driving dental practices to adopt more advanced diagnostic tools. These trends are strategic for stakeholders as they not only improve patient outcomes but also enhance operational efficiencies and position themselves strategically in a rapidly changing landscape.

Top Trends

-

Integration with AI Technology

AI is increasing the diagnostic accuracy of intraoral cameras. There is a development of image analysis software for the early detection of dental disorders. In a study, the diagnostic accuracy of the image analysis increased by 30 percent. Industry leaders are investing in AI, resulting in improved patient outcomes and efficiencies. Future developments may include real-time analysis of procedures, further streamlining workflows. -

Tele-dentistry Adoption

Teledentistry has given rise to the demand for a televising camera that can be inserted into the mouth to enable a remote consultation. A recent survey revealed that seventy per cent of dental practices are now equipped with teledentistry equipment that allows them to examine their patients virtually. This trend is reshaping both the business and the patient relationship models, and it is also reducing the cost of overheads. The future ramifications of this trend are likely to include the possibility of remote patient monitoring and follow-up care. -

Enhanced Imaging Quality

Advances in imaging technology have resulted in a greater resolution and clarity in intraoral cameras. There are now companies that produce cameras with a 4K resolution that can increase diagnostic accuracy by up to 25%. This trend is essential for dentists wishing to provide a superior level of care. Future developments could include miniaturization and portability, which would make high-quality imaging available in more settings. -

Wireless Connectivity Features

The trend towards wireless intraoral cameras is gaining momentum, with 60% of new models featuring either Bluetooth or Wi-Fi technology. This trend makes it possible to improve work efficiency, enabling easy integration with practice management software. As dental practices are increasingly focused on mobility and ease of use, the demand for wireless solutions is set to grow. Eventually, the cloud may even be used to store and share patient data. -

Focus on Ergonomics and Design

The manufacturers are increasingly concerned with the comfort and ease of use of their intraoral cameras. A study showed that a reduction of up to 40 per cent in the fatigue of the operator by means of an appropriate instrument was accompanied by an increase in overall productivity. This trend is reflected in the development of products and is aimed at achieving a better user experience. Future devices may have features that can be adapted to the individual requirements of the operator. -

Increased Regulatory Compliance

The regulatory authorities have tightened the standards for dental imaging devices, which has forced the manufacturers to improve their compliance measures. The recent guidelines have put the emphasis on safety and performance, and this has resulted in an increase in compliance costs of about twenty per cent. The trend has changed the product development cycle and the commercial strategy. There may be further increases in the costs of testing and certification of new products. -

Sustainability Initiatives

The market for intraoral cameras is also increasingly concerned with the environment. Companies are increasingly using materials and processes that are more sustainable. A survey found that 50% of consumers prefer to buy from companies that are committed to protecting the environment. This trend is having a major influence on the strategies of companies, which are trying to be in line with what consumers want. In the future, we may see innovations in recyclability and energy-efficient production processes. -

Integration with Practice Management Software

Intraoral cameras in combination with dental practice management software are making the working process in dental practices easier and more efficient. Some 65 percent of practices report an increase in efficiency, and almost all of them cite improved patient records management as a result of this combination. This trend is creating a growing demand for multifunction devices that offer increased efficiency. In the future, further developments may well focus on interoperability with different software platforms to increase usability. -

Training and Education Programs

Training programmes for dental professionals on the effective use of intraoral cameras are being developed. According to a survey of industry members, 75% of dental professionals feel more confident after attending such courses. This trend is helping to create a culture of lifelong learning and improving the quality of care for patients. Further initiatives will include the introduction of online training and certification to increase access. -

Customization and Personalization Options

Customization of intraoral cameras is increasingly gaining popularity, enabling practices to optimize their devices for their individual needs. According to a study, 40 percent of dental practices are looking for features that are tailored to their specific work processes. This trend has influenced product offerings, with manufacturers now addressing the varied requirements of individual practices. Future developments may include a modular design that makes it easy to modify or expand the device.

Conclusion: Navigating the Intraoral Camera Landscape

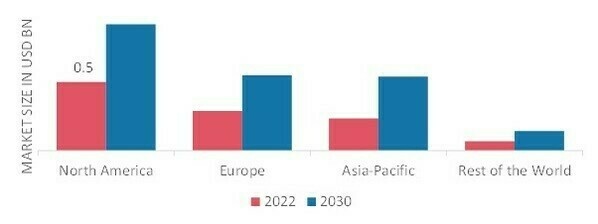

In the market for intraoral cameras, the competition is strong and the fragmentation is considerable. The trend is to increase demand in North America and Europe, driven by technological progress in the dental field and increasing patient awareness. The vendors must strategically position themselves by using the potential of artificial intelligence to enhance the quality of images, automation to optimize processes and sustainability to meet the growing expectations of consumers. In addition, the product range must be flexible so that the dental practice can adapt to the changing needs of the patient. The companies that focus on these three abilities are likely to be the ones that shape the future of intraoral photography.

Leave a Comment