Market Analysis

In-depth Analysis of Integrated Cardiology Devices Market Industry Landscape

The integrated cardiology devices market encompasses a wide array of medical devices designed to diagnose, monitor, and treat cardiovascular conditions. Market dynamics within this sector are influenced by a multitude of factors, including technological advancements, regulatory frameworks, demographic shifts, and evolving healthcare systems.

Technological innovations play a pivotal role in shaping the landscape of the integrated cardiology devices market. As advancements in medical technology continue to accelerate, manufacturers are constantly developing new devices with enhanced capabilities. These innovations include implantable cardioverter-defibrillators (ICDs), cardiac monitors, pacemakers, and cardiac catheters, among others. The integration of cutting-edge features such as wireless connectivity, remote monitoring capabilities, and miniaturization has spurred the demand for these devices, driving market growth.

Moreover, regulatory requirements and compliance standards exert significant influence on market dynamics. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose stringent guidelines to ensure the safety and efficacy of integrated cardiology devices. Compliance with these regulations not only affects the time-to-market for new products but also influences manufacturers' investment decisions in research and development (R&D). Stricter regulatory scrutiny may pose challenges for smaller companies seeking market entry, while established players navigate the complexities of obtaining approvals for their products.

Demographic trends also contribute to the dynamics of the integrated cardiology devices market. With an aging population and a rising prevalence of cardiovascular diseases globally, the demand for cardiac intervention and monitoring devices continues to escalate. As the incidence of conditions such as coronary artery disease, arrhythmias, and heart failure rises, healthcare providers seek advanced solutions to diagnose and manage these ailments effectively. Additionally, increasing awareness about preventive cardiology and the adoption of healthier lifestyles drive demand for screening and monitoring devices, further propelling market growth.

Furthermore, the evolving landscape of healthcare systems and reimbursement policies significantly impact market dynamics. Healthcare reforms, cost-containment measures, and shifts towards value-based care models influence purchasing decisions and adoption rates of integrated cardiology devices. Reimbursement policies for medical procedures and devices vary across different regions, impacting market accessibility and affordability. Manufacturers must navigate these complexities and tailor their strategies to align with evolving reimbursement trends and healthcare priorities.

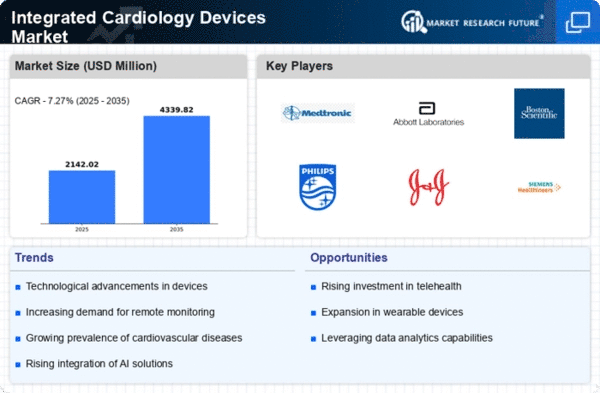

Competition within the integrated cardiology devices market is intense, with numerous players vying for market share. Established multinational corporations, including Medtronic, Abbott Laboratories, Boston Scientific Corporation, and Biotronik, dominate the market with a diverse portfolio of products and extensive distribution networks. These companies invest heavily in R&D, strategic partnerships, and acquisitions to maintain their competitive edge and expand their market presence.

In addition to multinational corporations, a growing number of startups and smaller companies are entering the market, leveraging disruptive technologies and innovative business models to challenge incumbents. These emerging players focus on niche segments, such as wearable cardiac monitors, remote patient monitoring solutions, and minimally invasive devices, catering to evolving patient preferences and healthcare delivery models.

Collaboration and partnerships between industry players, healthcare providers, and academic institutions are increasingly common, driving innovation and facilitating technology transfer. Strategic alliances enable companies to pool resources, share expertise, and accelerate the development and commercialization of integrated cardiology devices.

Leave a Comment