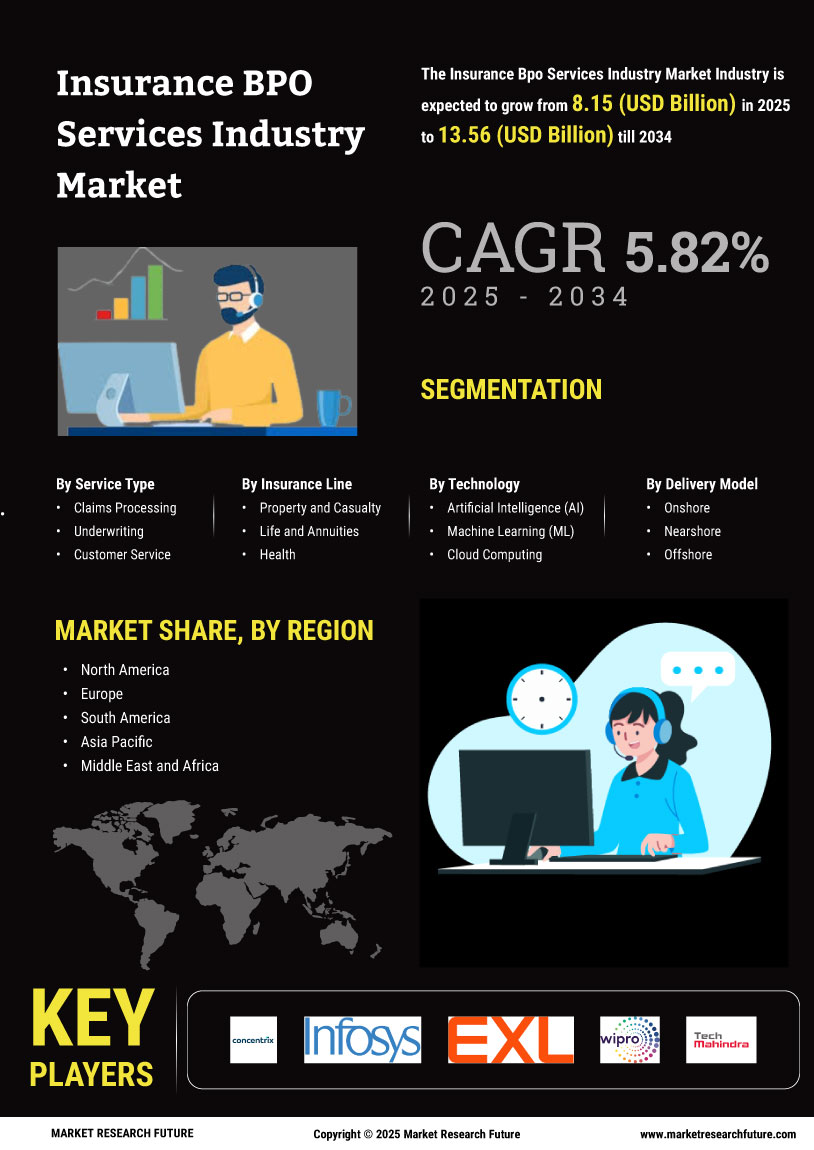

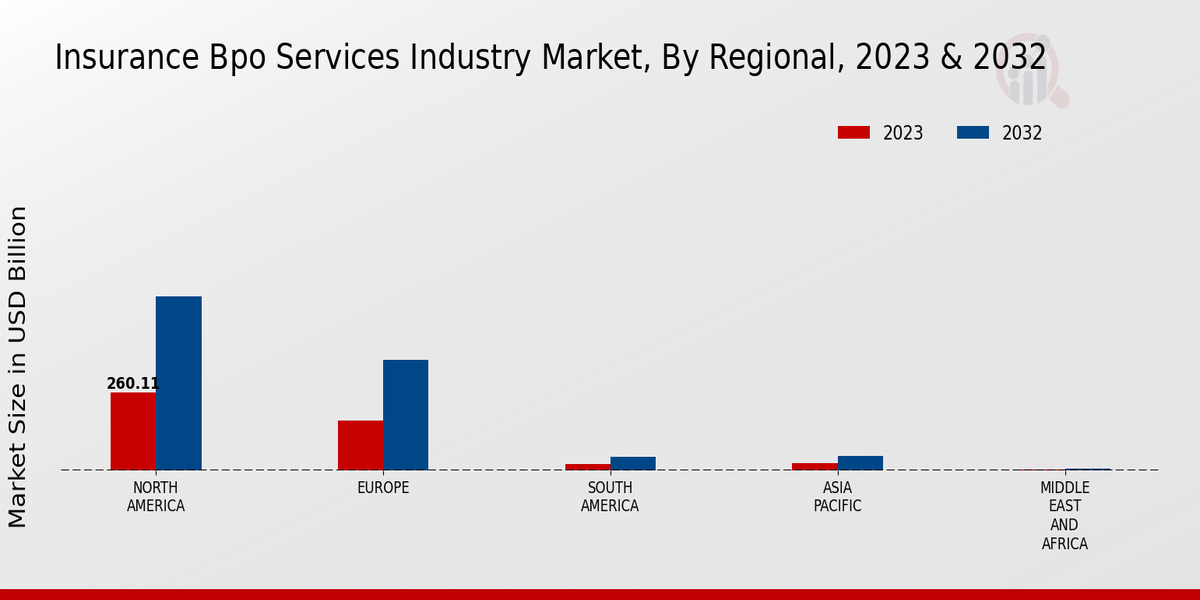

Market Growth Projections

The Global Insurance BPO Services Industry is poised for substantial growth, with projections indicating a market size of 235.94 USD Billion in 2024 and an anticipated increase to 541.32 USD Billion by 2035. This growth trajectory suggests a robust demand for outsourcing services within the insurance sector, driven by factors such as cost efficiency, technological advancements, and regulatory compliance. The industry is expected to experience a compound annual growth rate of 7.84% from 2025 to 2035, reflecting the increasing reliance on BPO services as insurers seek to enhance operational efficiency and customer satisfaction. This positive outlook underscores the industry's potential for expansion.

Focus on Core Competencies

The Global Insurance BPO Services Industry is driven by the increasing emphasis on core competencies among insurance providers. By outsourcing ancillary functions, insurers can concentrate on their primary business objectives, such as underwriting and claims management. This strategic focus allows companies to enhance their competitive edge and improve customer service. As the industry evolves, the ability to streamline operations through BPO services is becoming increasingly vital. Insurers that successfully leverage these services may experience improved operational efficiency and customer satisfaction, which are essential for sustaining growth in a competitive market. This trend is indicative of a broader shift towards specialization within the industry.

Technological Advancements

Technological advancements play a crucial role in the Global Insurance BPO Services Industry, facilitating improved service delivery and operational efficiency. Innovations such as artificial intelligence, machine learning, and automation are increasingly integrated into BPO processes, enhancing data management and customer interactions. For instance, AI-driven chatbots are utilized for customer service, significantly reducing response times and improving customer satisfaction. As the industry adapts to these technologies, it is expected that the market will grow at a CAGR of 7.84% from 2025 to 2035, potentially reaching 541.32 USD Billion by 2035. This technological evolution is likely to redefine operational paradigms within the industry.

Rising Demand for Cost Efficiency

The Global Insurance BPO Services Industry experiences a growing demand for cost efficiency as insurance companies seek to optimize their operational expenditures. By outsourcing non-core functions, insurers can focus on their primary business activities while reducing overhead costs. This trend is particularly evident as the industry is projected to reach a valuation of 235.94 USD Billion in 2024, highlighting the financial benefits of outsourcing. Companies that leverage BPO services can potentially reduce costs by up to 30%, allowing them to allocate resources more effectively and enhance profitability. As the market evolves, this driver will likely remain pivotal in shaping the industry's landscape.

Globalization of Insurance Markets

The globalization of insurance markets significantly influences the Global Insurance BPO Services Industry, as companies expand their operations across borders. This trend necessitates the adoption of BPO services to manage diverse regulatory environments and customer expectations effectively. As insurers enter new markets, they often rely on local BPO providers to navigate cultural and operational nuances. The increasing interconnectedness of global markets is likely to drive demand for BPO services, enabling insurers to scale their operations efficiently. This globalization trend may contribute to the industry's projected growth, with a market valuation expected to reach 541.32 USD Billion by 2035.

Regulatory Compliance Requirements

Regulatory compliance remains a critical driver in the Global Insurance BPO Services Industry, as insurers face increasing scrutiny from regulatory bodies. Outsourcing compliance-related tasks to specialized BPO providers enables insurance companies to navigate complex regulations more effectively. This trend is underscored by the necessity for insurers to adhere to evolving legal frameworks, which can vary significantly across regions. By leveraging BPO services, companies can ensure compliance while minimizing the risk of penalties and reputational damage. As regulatory landscapes continue to shift, the demand for BPO services that specialize in compliance is likely to grow, further solidifying the industry's relevance.