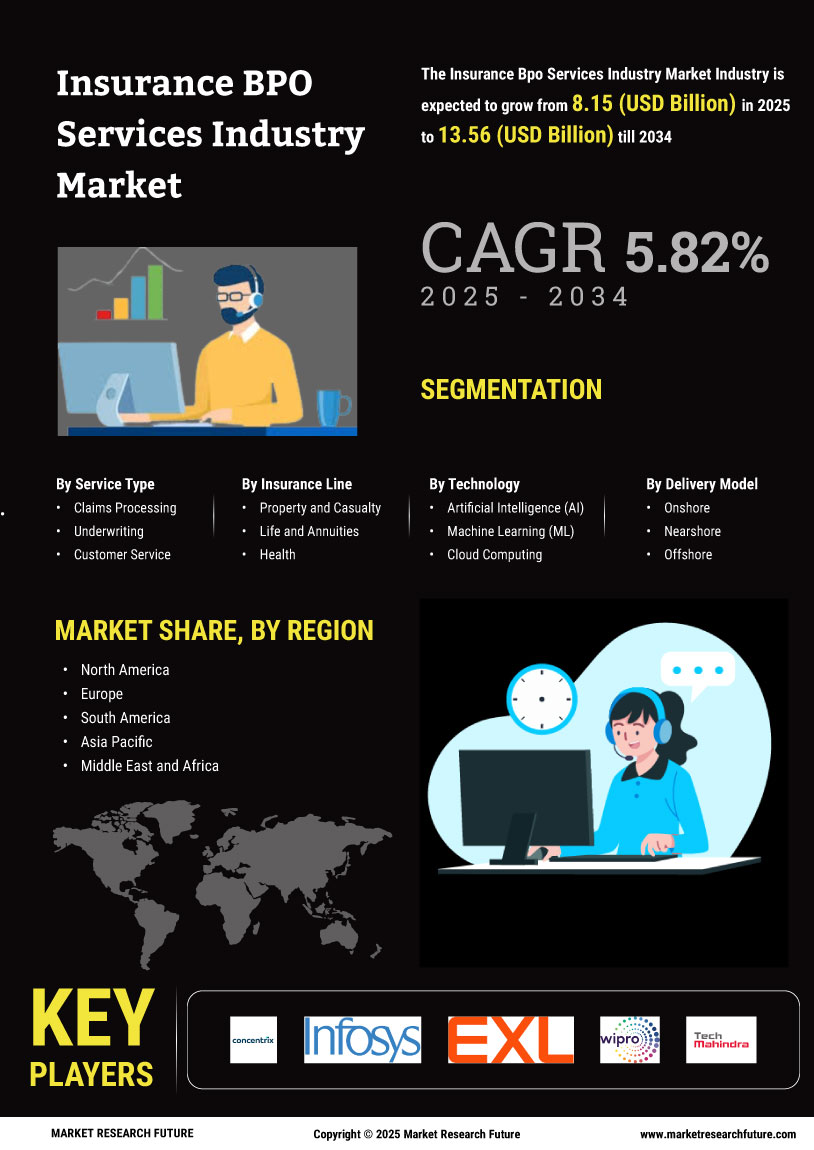

Expansion of Insurance Markets

The Insurance BPO Services Industry is poised for growth due to the expansion of insurance markets in emerging economies. As these markets develop, there is an increasing need for efficient operational support to manage rising customer demands. BPO services provide insurers with the scalability required to enter new markets without incurring substantial fixed costs. Reports indicate that the insurance sector in emerging markets is expected to grow at a CAGR of 8% over the next five years. This expansion presents a lucrative opportunity for BPO providers to offer tailored solutions that cater to the unique needs of insurers operating in diverse regulatory and cultural environments.

Rising Demand for Cost Efficiency

The Insurance BPO Services Industry experiences a notable surge in demand for cost efficiency as insurers seek to optimize operational expenditures. By outsourcing non-core functions, insurance companies can significantly reduce overhead costs. Reports indicate that organizations can save up to 30% on operational costs through effective BPO partnerships. This trend is driven by the need to allocate resources towards core competencies, such as underwriting and claims management, while leveraging the expertise of BPO providers. As competition intensifies, the focus on cost efficiency becomes paramount, prompting insurers to explore innovative outsourcing solutions that enhance profitability and operational agility.

Growing Focus on Customer Experience

The Insurance BPO Services Industry is increasingly oriented towards enhancing customer experience. Insurers recognize that customer satisfaction is a critical differentiator in a saturated market. By outsourcing customer service functions to specialized BPO providers, insurers can ensure 24/7 support and personalized interactions. Recent studies indicate that companies prioritizing customer experience see a 10-15% increase in customer retention rates. This growing emphasis on customer-centricity compels insurers to collaborate with BPO partners that can deliver tailored solutions, thereby fostering loyalty and driving long-term growth in an increasingly competitive environment.

Regulatory Changes and Compliance Needs

The Insurance BPO Services Industry faces mounting pressure from evolving regulatory frameworks. Insurers must navigate complex compliance requirements, which can be resource-intensive. Outsourcing compliance-related functions to BPO providers allows insurers to leverage specialized expertise and ensure adherence to regulations. Data suggests that firms utilizing BPO services for compliance management can reduce the risk of regulatory penalties by up to 40%. As regulatory landscapes continue to shift, the demand for BPO services that offer compliance solutions is likely to grow, enabling insurers to focus on core business activities while maintaining regulatory integrity.

Technological Advancements in Service Delivery

Technological advancements play a pivotal role in shaping the Insurance BPO Services Industry. The integration of advanced technologies, such as artificial intelligence and machine learning, enhances service delivery and operational efficiency. For instance, AI-driven chatbots and automated claims processing systems streamline customer interactions and reduce processing times. Data from industry reports suggests that insurers leveraging these technologies can improve customer satisfaction rates by up to 25%. As technology continues to evolve, BPO providers are expected to adopt more sophisticated tools, thereby transforming traditional service models and enabling insurers to remain competitive in a rapidly changing landscape.