Market Trends

Key Emerging Trends in the Immersive Technology in Enterprise Market

In the dynamic landscape of the Immersive Technology in Enterprise Market, market share positioning strategies play a pivotal role in determining a company's success. Immersive technologies, such as virtual reality (VR) and augmented reality (AR), have witnessed significant growth in recent years, transforming the way businesses operate and engage with their stakeholders. To effectively navigate this competitive terrain, companies employ various strategies to secure a favorable market share.

One prevalent strategy is differentiation, where companies strive to distinguish their products or services from competitors. This may involve the development of unique features, cutting-edge technology, or specialized applications tailored to specific industry needs. By offering something distinct, a company can carve out its niche in the market, attracting customers seeking specific immersive solutions that cater to their requirements.

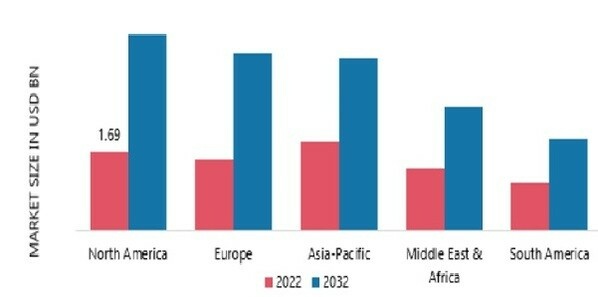

Geographic expansion is a strategy often deployed to increase market reach. As the demand for immersive technology grows globally, companies may focus on expanding their presence in new markets. This expansion could involve establishing regional offices, partnering with local distributors, or customizing products to align with specific cultural preferences and regulations. By broadening their geographical footprint, companies position themselves to tap into diverse customer bases and capitalize on emerging market opportunities.

Customer-centric approaches are also instrumental in market share positioning within the immersive technology sector. Understanding the unique needs and pain points of customers allows companies to tailor their solutions accordingly. Providing excellent customer support, training programs, and ongoing updates ensures customer satisfaction and loyalty, contributing to long-term market success. Moreover, positive customer experiences can lead to word-of-mouth recommendations, further solidifying a company's market position.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Leave a Comment