Human Milk Oligosaccharides Size

Human Milk Oligosaccharides Market Growth Projections and Opportunities

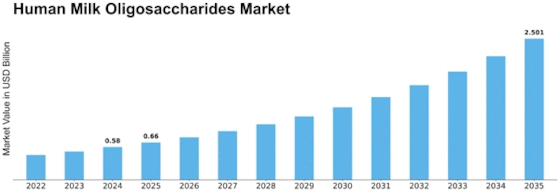

The Human Milk Oligosaccharides (HMOs) Market is influenced by various factors that collectively shape its dynamics. One of the primary drivers is the increasing awareness of the health benefits associated with HMOs. The Global Human Milk Oligosaccharides Market is expected to register a significant Compound Annual Growth Rate (CAGR) of 14.4% throughout the forecast period, which means that it will demonstrate robust growth in the coming years. According to estimates, by 2030, this market may achieve a considerable amount of USD 32.4 million. This upward trend is linked to factors like the growing demand for sophisticated infant nutrition products and the preference for other forms of alternative feeding that imitate human milk in composition terms. Moreover, awareness about enhancing immune system functionality through human milk oligosaccharides has been mounting, driving market expansion. Research and development activities are likely to be one of the crucial factors contributing to driving up market size as well as technological advancements in production techniques for human milk oligosaccharides. HMOs are an essential component in breast milk, and they are increasingly being incorporated into infant formulas to enhance their nutritional profiles, among many other benefits. Regulatory pressures also influence HMOs' market positioning. Infant formulas and related products have strict regulations regarding the ingredients used in them. Manufacturers need to comply with health and safety standards while also getting regulatory approvals from relevant bodies involved in making such decisions across nations where they are selling since failure can easily make them lose their intended markets either temporarily or permanently because any slight mistake can put life at risk due wrong feeding causing death especially infants who are most vulnerable beings in an exposed planet hence any error concerning infant foods could lead these companies into danger zones putatively leading to collapse should they not take corrective measures if possible will further continue exploiting loopholes emerging after that and sometimes even immediate closure failing which court cases shall ensue unless industrial espionage sets in since this can be the only way to save their image before customers within such industry. Meanwhile, market influences such as the global economy and population growth also have a significant influence on HMOs. In particular, regions with challenging or low levels of breastfeeding often see an increasing demand for other forms of nutrition for infants. A significant driver of the HMO industry is the healthcare and medical sectors. Studies regarding the health benefits of HMOs beyond feeding infants are ongoing, and they include managing gastrointestinal problems and immune-related issues, among others. Another current trend in the HMO market is environmental sustainability. Nowadays, with increasing awareness about ecologically friendly practices, people are choosing companies that apply sustainable sourcing methods and adopt eco-friendly production techniques. It would be appropriate to mention that consumer education and campaigns help shape the direction taken by developers.

Leave a Comment