Data Security Concerns

Data security remains a critical concern for healthcare organizations, driving the Global Healthcare Information Governance Solution Market Industry. With the rise of cyber threats and data breaches, healthcare providers are increasingly investing in solutions that safeguard sensitive patient information. The need for comprehensive data governance frameworks is underscored by the fact that healthcare data breaches can lead to substantial financial losses and reputational damage. As organizations prioritize data security, the market for information governance solutions is anticipated to expand, potentially reaching 62.6 USD Billion by 2035, reflecting a growing recognition of the importance of protecting healthcare data.

Market Growth Projections

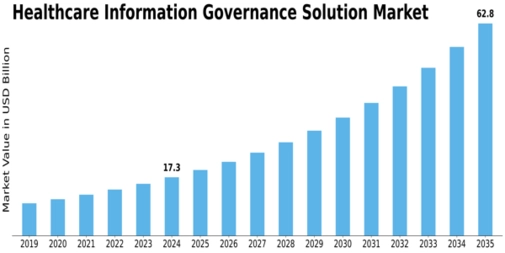

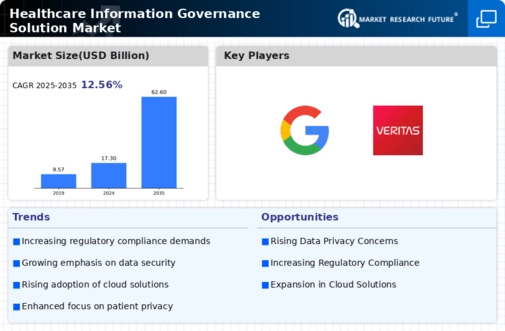

The Global Healthcare Information Governance Solution Market Industry is poised for substantial growth, with projections indicating a market value of 17.3 USD Billion in 2024 and an anticipated increase to 62.6 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 12.43% from 2025 to 2035, driven by various factors such as regulatory compliance, data security concerns, and the integration of advanced technologies. As healthcare organizations continue to prioritize effective information governance, the market is likely to expand, presenting opportunities for innovation and investment in governance solutions.

Patient-Centric Care Models

The shift towards patient-centric care models is reshaping the Global Healthcare Information Governance Solution Market Industry. Healthcare organizations are increasingly focusing on delivering personalized care, which necessitates comprehensive data management strategies. Effective information governance enables providers to access and analyze patient data efficiently, leading to improved outcomes and enhanced patient experiences. As the healthcare landscape evolves, organizations are likely to adopt governance solutions that align with patient-centric approaches, thereby driving market growth. This trend underscores the importance of integrating governance frameworks that prioritize patient data while adhering to regulatory standards.

Regulatory Compliance Demands

The increasing emphasis on regulatory compliance is a primary driver in the Global Healthcare Information Governance Solution Market Industry. Governments worldwide are implementing stringent regulations to ensure the protection of patient data and the integrity of healthcare information. For instance, the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandates strict guidelines for data handling. As healthcare organizations strive to meet these requirements, the demand for robust information governance solutions rises. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 17.3 USD Billion in 2024.

Rising Demand for Interoperability

The growing demand for interoperability among healthcare systems is a significant driver in the Global Healthcare Information Governance Solution Market Industry. As healthcare providers increasingly seek to share information across platforms, the need for effective governance solutions becomes paramount. Interoperability facilitates seamless data exchange, improving patient care and operational efficiency. Governments and industry stakeholders are advocating for standardized data formats and protocols to enhance interoperability. This trend is expected to propel the market forward, as organizations invest in governance solutions that support data sharing while ensuring compliance with regulatory requirements.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Global Healthcare Information Governance Solution Market Industry. These technologies enable healthcare organizations to automate data management processes, enhance decision-making, and improve compliance with regulations. For example, AI-driven analytics can identify patterns in data that may indicate compliance risks, allowing organizations to proactively address potential issues. This technological evolution is likely to drive market growth, with a projected compound annual growth rate (CAGR) of 12.43% from 2025 to 2035, as organizations seek innovative solutions to manage their information governance needs.

Leave a Comment