Shift Towards Value-Based Care Models

The shift towards value-based care models is reshaping the Healthcare Information Governance Solution Market. As healthcare providers transition from volume-based to value-based care, there is an increasing need for effective data management and governance solutions. In 2025, it is estimated that value-based care will account for over 50% of healthcare spending, highlighting the importance of accurate data for measuring outcomes and improving patient care. This paradigm shift necessitates the implementation of robust information governance frameworks that ensure data integrity and facilitate performance measurement. Consequently, organizations that embrace value-based care are likely to drive demand for innovative governance solutions that align with their strategic objectives.

Regulatory Changes and Compliance Requirements

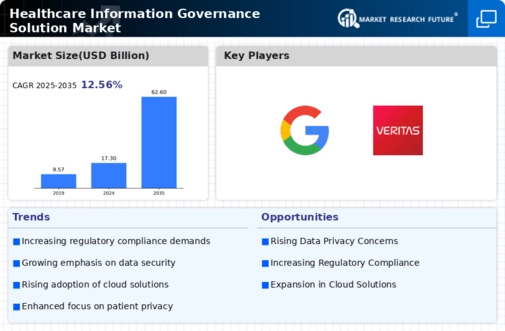

Regulatory changes and evolving compliance requirements are significant drivers of the Healthcare Information Governance Solution Market. As governments and regulatory bodies introduce new standards for data management and protection, healthcare organizations must adapt their governance strategies accordingly. In 2025, it is projected that compliance-related costs for healthcare organizations could exceed 30 billion dollars, underscoring the necessity for effective governance solutions. Organizations that proactively address these regulatory challenges are better positioned to avoid penalties and enhance their operational efficiency. Thus, the demand for comprehensive information governance solutions that facilitate compliance with evolving regulations is likely to surge in the coming years.

Rising Data Breaches and Cybersecurity Threats

The increasing frequency of data breaches and cybersecurity threats is a critical driver for the Healthcare Information Governance Solution Market. As healthcare organizations face heightened scrutiny regarding data protection, the demand for robust governance solutions intensifies. In 2025, it is estimated that healthcare data breaches could cost the industry over 4 billion dollars, prompting organizations to invest in comprehensive information governance frameworks. These frameworks not only safeguard sensitive patient information but also ensure compliance with stringent regulations. Consequently, the need for effective governance solutions becomes paramount, as organizations strive to mitigate risks associated with data vulnerabilities and enhance their overall security posture.

Growing Emphasis on Patient Privacy and Data Protection

The growing emphasis on patient privacy and data protection is a pivotal driver for the Healthcare Information Governance Solution Market. As patients become increasingly aware of their rights regarding personal health information, healthcare organizations are compelled to adopt stringent governance measures. In 2025, it is anticipated that over 70% of patients will prioritize data privacy when choosing healthcare providers. This shift in consumer behavior necessitates the implementation of comprehensive information governance solutions that not only protect patient data but also build trust between patients and providers. Consequently, organizations that prioritize patient privacy are likely to gain a competitive advantage in the evolving healthcare landscape.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the Healthcare Information Governance Solution Market. These advanced technologies enable healthcare organizations to analyze vast amounts of data efficiently, thereby improving decision-making processes. In 2025, the market for AI in healthcare is projected to reach approximately 36 billion dollars, indicating a significant shift towards data-driven governance solutions. By leveraging AI and ML, organizations can enhance data accuracy, streamline workflows, and ensure compliance with regulatory standards. This technological evolution not only optimizes operational efficiency but also fosters a culture of proactive information governance, ultimately benefiting patient care and organizational performance.