Market Share

Introduction: Navigating the Competitive Landscape of Healthcare Edge Computing

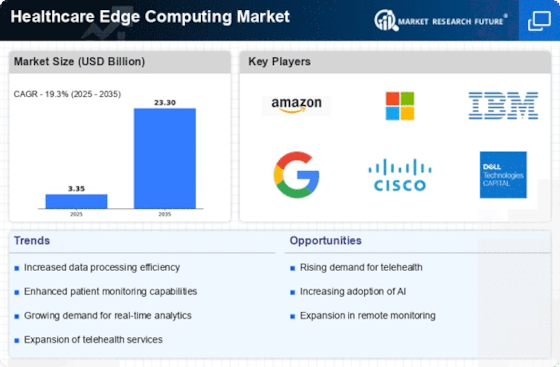

The health care edge computing market is experiencing unprecedented competition due to the rapid development of technology, the emergence of regulatory frameworks, and the increasing demand for real-time data access and individualised care. A number of players, including system vendors, IT systems integrators, and new AI companies, are trying to establish a leadership position by using advanced data analytics, automation, and IoT integration. These differentiators not only improve operational efficiency but also help deliver superior patient outcomes, influencing market positioning. As organisations increasingly focus on green IT and data security, the competitive landscape is also shaped by strategic alliances and collaborations. North America and Asia-Pacific are expected to be the fastest-growing regions in terms of market size.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions that integrate hardware, software, and services for healthcare edge computing.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Cisco | Strong networking capabilities | Networking and security solutions | Global |

| AWS | Leading cloud services provider | Cloud computing and edge services | Global |

| Dell Technologies | Robust hardware and software integration | Infrastructure and cloud solutions | Global |

| HPE | Innovative edge computing solutions | Hybrid cloud and edge computing | Global |

| IBM | AI-driven healthcare solutions | AI and data analytics | Global |

| Microsoft | Comprehensive cloud ecosystem | Cloud services and edge computing | Global |

Specialized Technology Vendors

These vendors focus on niche technologies that enhance edge computing capabilities in healthcare.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Advanced AI and machine learning | AI and data processing | Global | |

| Litmus Automation | Real-time data processing | IoT and edge analytics | Global |

| ClearBlade | Rapid IoT deployment | IoT platform solutions | Global |

| Fastly | Edge cloud platform | Content delivery and security | Global |

| StackPath | Edge security and performance | Edge computing and CDN | Global |

| Vapor IO | Innovative edge data centers | Edge infrastructure | North America |

Infrastructure & Equipment Providers

These vendors supply the necessary hardware and infrastructure to support edge computing in healthcare.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Huawei | Comprehensive telecom solutions | Telecom and networking equipment | Asia, Europe |

| Intel | Leading semiconductor technology | Processors and hardware solutions | Global |

| Nokia | Strong telecom infrastructure | Networking and edge solutions | Global |

| ADLINK | Industrial IoT expertise | Embedded computing solutions | Global |

| Moxa | Industrial networking solutions | Networking and automation | Global |

| Sierra Wireless | IoT connectivity solutions | Wireless communication | Global |

Emerging Edge Innovators

These vendors are pioneering new technologies and approaches in the healthcare edge computing space.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Capgemini | Consulting and digital transformation | IT services and consulting | Global |

| Juniper Networks | AI-driven networking solutions | Networking and security | Global |

| EdgeConnex | Dedicated edge data centers | Edge data center solutions | North America |

| Belden | Robust connectivity solutions | Networking and connectivity | Global |

| Saguna Networks | Edge cloud solutions | Edge computing and CDN | Global |

| Edge Intelligence | Real-time data insights | Data analytics and processing | Global |

| Edgeworx | Open-source edge solutions | Edge computing platforms | Global |

| Sunlight.io | Lightweight virtualization | Virtualization and cloud solutions | Global |

| Mutable | Dynamic edge computing | Edge computing solutions | Global |

| Hivecell | Simplified edge deployment | Edge computing hardware | Global |

| Section | Customizable edge solutions | Edge computing and CDN | Global |

| EdgeIQ | IoT device management | IoT and edge management | Global |

Emerging Players & Regional Champions

- Edgewise, a specialist in edge computing for medical data management, has teamed up with a major hospital group to secure patient data at the edge. The company is challenging the big vendors by offering a more agile and cost-effective solution.

- Qventus, Inc., is an American company that has developed an edge-computing system that manages hospital operations in real time. Qventus has recently implemented its system in several large health systems, complementing the offerings of the big EHR vendors by improving work processes and reducing costs.

- CureMetrix (US): CureMetrix, which specializes in radiology, has recently signed up with many hospitals to improve the accuracy of diagnosis, and has a close relationship with the old and new radiology companies.

- TeleTracking (US): Provides solutions for the localization of patient flow and the management of hospital resources, recently expanded its service to several hospitals in the area, and its products complement traditional hospital management systems with real-time data analysis and insight.

- Nvidia (global): Although known primarily for its hardware, Nvidia's edge-computing solutions for health care are gaining traction, with the recent establishment of a number of health care alliances to deploy AI models at the edge of the network, thereby complementing cloud-based solutions.

Regional Trends: In 2023, there will be a notable increase in the use of edge computing solutions in North America, driven by the need for real-time data processing and the need for enhanced patient care. Europe will also grow, especially in countries such as Germany and the UK, where regulations are favourable to the use of digital health. The Asia-Pacific region is also growing rapidly. India and China are investing heavily in IT, which will lead to the emergence of local edge solutions adapted to the specificities of the region.

Collaborations & M&A Movements

- IBM and Philips entered into a partnership to integrate AI-driven analytics into healthcare edge computing solutions, aiming to enhance patient outcomes and streamline operations in hospitals.

- Amazon Web Services (AWS) acquired healthcare data analytics firm HealthNautica to bolster its edge computing capabilities in the healthcare sector, positioning itself as a leader in cloud-based healthcare solutions.

- Microsoft and Cerner collaborated to develop a new edge computing platform that leverages real-time patient data to improve clinical decision-making and operational efficiency in healthcare facilities.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | IBM, Microsoft | Several hospitals have already installed biometric identification systems by means of which the patient is identified and waiting times are reduced. In the case of Microsoft, the biometric data can be seamlessly integrated into the Azure cloud environment, thus enhancing security and efficiency. |

| AI-Powered Ops Mgmt | Google Cloud, Amazon Web Services | Artificial intelligence tools are used to optimize patient flow, and the allocation of resources is made by means of big data. Amazon Web Services offers a variety of services to optimize and automate administrative tasks. |

| Data Security and Compliance | Cisco, Palo Alto Networks | Health care has widely adopted the Cisco security solution for protecting sensitive patient data. Case studies show that incidents of data theft are reducing. And, because the solution is tailored to health care, it helps ensure regulatory compliance. |

| Remote Patient Monitoring | Philips, Medtronic | In the meantime, Philips has developed a wide range of remote monitoring solutions, which can be integrated into its health platforms. These solutions help to manage chronic diseases better. Likewise, Medtronic’s devices are used widely for remote patient monitoring, which has proven its effectiveness in improving the quality of care. |

| Interoperability Solutions | Epic Systems, Cerner | Epic Systems leads in interoperability with its robust EHR systems that facilitate data sharing across platforms. Cerner's open architecture allows for seamless integration with third-party applications, enhancing patient care coordination. |

| Edge Analytics | Edgeworx, NVIDIA | Edgeworx provides edge computing solutions that enable real-time data processing at the source, improving decision-making in clinical settings. NVIDIA's GPUs are leveraged for high-performance edge analytics, particularly in imaging and diagnostics. |

Conclusion: Navigating the Competitive Edge in Healthcare

In 2023, the edge-computing market for health care is characterized by high competition and a large degree of fragmentation, with both old and new companies vying for dominance. Localized data-processing capabilities are especially in demand in North America and Europe, where regulations are changing to support edge solutions. These capabilities must be used strategically to create a difference for the vendors. The old companies are concentrating on integrating edge computing with their existing systems, while the new ones are trying to create a difference by focusing on agile solutions that meet specific health care needs. As the market matures, the ability to exploit these capabilities will be decisive for establishing a leadership and ensuring long-term success in this fast-moving environment.

Leave a Comment