Market Analysis

Healthcare Edge Computing Market (Global, 2023)

Introduction

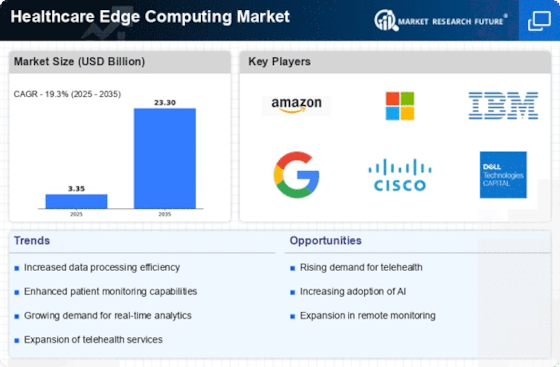

The Edge Computing Market is destined to revolutionize the landscape of medical data management and patient care by bringing the power of decentralized computing to the edge of the network. Since the digitalization of health care is on the rise, the demand for real-time data processing and analysis is on the rise, driven by the need for improved patient outcomes, increased efficiency, and better decision-making. Edge computing enables the processing of vast amounts of data generated by medical devices, wearables, and IoT applications, enabling health care professionals to deliver timely, tailored care. The market is characterized by the convergence of several advanced technologies, including artificial intelligence, machine learning, and the Internet of Medical Things (IoMT). Furthermore, the growing importance of data security and privacy in health care is fostering the adoption of edge computing solutions. Since these solutions offer local data processing, they minimize the risks associated with cloud-based data transmission. The growing awareness of the potential of edge computing to address key challenges in the health care system is expected to accelerate the development of the market, which will in turn foster innovation and improve the quality of health care.

PESTLE Analysis

- Political

- In 2023, the health sector is strongly influenced by government policies that aim to develop the digital health care system. The U.S. government allocates approximately $2.5 billion to support the implementation of advanced health care technology, including edge-computing solutions. In addition, the European Union has set a goal of digitalizing at least 70% of health care institutions by 2025.

- Economic

- The economic environment for edge computing in the medical sector is shaped by rising health expenditures, which in 2023 will amount to $4.3tn. In part, this increase is due to the growing need for efficient data processing and storage in medical settings. Annually, the cost of medical information services per physician is estimated at around $1,200.

- Social

- Social factors play an important role in the adoption of edge computing in the health sector, especially in terms of patients’ expectations. Surveys in 2023 show that 85% of patients prefer to use a health care service that uses advanced technology to provide a better service. This social trend towards a digital health society is reflected in the increasing use of edge computing.

- Technological

- The market for medical edge computing is being driven by technological developments. In 2023, the number of connected medical devices is expected to reach 50 billion, creating a huge demand for edge computing to process the data closer to the point of collection. Artificial intelligence (AI) in edge computing systems is set to grow by 30 per cent this year, making it possible to make real-time decisions in medical settings.

- Legal

- Legal issues are paramount in the healthcare edge-computing market, particularly concerning data privacy and security. By 2023, it is estimated that the annual cost of HIPAA compliance will be $1.4 billion for healthcare organizations. Regulations require that edge-computing solutions protect sensitive patient data and, as a result, have an impact on the design and implementation of these solutions.

- Environmental

- The environment is becoming an increasingly important consideration in the field of health care, with the emphasis on sustainable development. By 2023, the use of energy-efficient edge computing is expected to reduce the carbon footprint of health care facilities by 20 percent. The aim is to reduce waste and to improve resource management.

Porter's Five Forces

- Threat of New Entrants

- The barriers to entry in the medical edge computing market are moderate due to the high technical knowledge and regulatory standards required. The growing demand for edge computing in the medical field offers opportunities for new players, but established companies with their existing infrastructure and customer relationships are a challenge for newcomers.

- Bargaining Power of Suppliers

- Suppliers in the health care edge computing market generally have little bargaining power. The market is characterized by a large number of suppliers and components, which makes it easy for companies to change suppliers. Also, new suppliers are constantly entering the market as a result of rapid technological change.

- Bargaining Power of Buyers

- The bargaining power of buyers in the healthcare edge computing market is high, because of the large number of solutions and vendors. Moreover, healthcare organizations are increasingly seeking cost-effective and efficient solutions, which allows them to negotiate better terms. The increasing emphasis on security and compliance gives buyers the power to demand higher standards from vendors.

- Threat of Substitutes

- The threat of substitutes in the health care edge computing market is moderate. In general, cloud computing is an alternative to edge computing, but cloud computing does not provide the same level of real-time data processing and low-latency as edge computing. However, cloud computing is developing rapidly, and hybrid solutions are emerging that may pose a threat to the adoption of edge computing.

- Competitive Rivalry

- Competition in the health care edge computing market is high, driven by the presence of many established players and new entrants. These companies are constantly innovating and improving their offerings to capture more market share. This has resulted in aggressive marketing and price wars. Competition is further intensified by the rapid evolution of technology, as companies strive to differentiate themselves from their competitors.

SWOT Analysis

Strengths

- Enhanced data processing speed and reduced latency for real-time healthcare applications.

- Improved patient outcomes through timely access to critical health data.

- Increased security and privacy of sensitive health information through localized data processing.

Weaknesses

- High initial investment costs for healthcare providers to implement edge computing solutions.

- Limited interoperability with existing healthcare IT systems and infrastructure.

- Potential skill gaps in workforce regarding edge computing technologies.

Opportunities

- Growing demand for telemedicine and remote patient monitoring solutions.

- Advancements in IoT devices and wearables driving the need for edge computing.

- Government initiatives and funding aimed at digital transformation in healthcare.

Threats

- Rapid technological changes leading to potential obsolescence of current solutions.

- Regulatory challenges and compliance issues related to data privacy and security.

- Increased competition from established tech companies entering the healthcare space.

Summary

In 2023 the health care edge computing market is expected to show significant growth, with the major growth drivers being enhanced data processing and improved patient outcomes. The major challenges include high implementation costs and interoperability issues. Opportunities are created by the development of telehealth and the Internet of Things. The threat is the speed of technological change and regulatory issues. The focus of attention for all participants in this market is on overcoming the weaknesses and taking advantage of the opportunities.

Leave a Comment