Healthcare Edge Computing Size

Market Size Snapshot

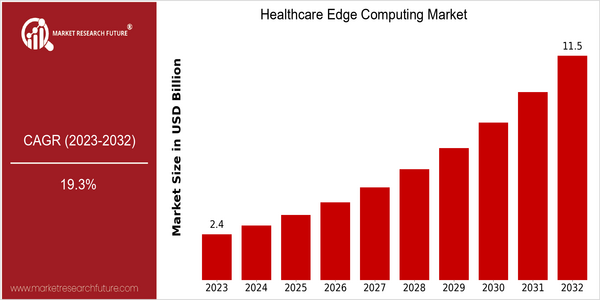

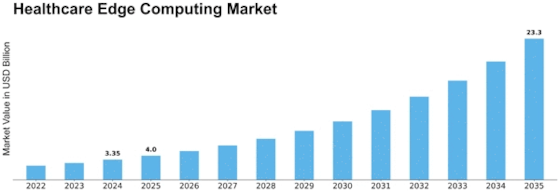

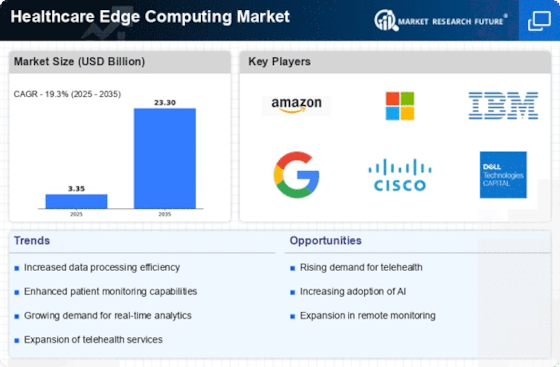

| Year | Value |

|---|---|

| 2023 | USD 2.35 Billion |

| 2032 | USD 11.47 Billion |

| CAGR (2022-2032) | 19.3 % |

Note – Market size depicts the revenue generated over the financial year

EDGE COMPUTING The Edge Computing market is expected to grow at a CAGR of 19.3 per cent from 2022 to 2032. This growth is driven by the need for real-time data and analytics in the healthcare industry, owing to the need for improved patient outcomes and operational efficiencies. Moreover, the increasing adoption of IoT and telemedicine solutions will drive the demand for edge computing, as it will enable faster data processing and reduce latency in critical applications such as remote monitoring and diagnostics. Also driving this growth are the advancements in artificial intelligence and machine learning, which will further enhance the capabilities of edge computing systems. In addition, the growing focus on data security and privacy in the healthcare industry is expected to drive the adoption of edge computing to process sensitive data closer to the source, thereby reducing the risks of data breaches. The key players in the market, such as IBM, Microsoft, and GE, are investing in R&D and forming strategic alliances to enhance their edge computing offerings. The growing collaboration between technology companies and the healthcare industry will help develop customised edge computing solutions that address specific healthcare challenges, which will further drive the market growth.

Regional Market Size

Regional Deep Dive

The market for the Edge of the Cloud in the field of medical care is growing significantly in all regions. The increasing need for real-time data processing and analysis in the medical field is driving the market. The integration of edge-computing technology is improving patient care, reducing the delay in data transmission and enabling better medical care processes. Each region has its own characteristics, influenced by technological developments, legal frameworks and the medical care system. The combined influence of these factors on the market dynamics and growth potential is different.

Europe

- The digital single market strategy of the European Union is to promote the use of edge computing in the health care sector, with the goal of facilitating the cross-border sharing of data and interoperability. As a result, companies such as Siemens Healthineers are investing in edge computing technology to improve diagnostic and patient management systems.

- The importance of data privacy, particularly with the advent of the General Data Protection Regulation (GDPR), is driving the development of edge solutions that prioritise security. The growing compliance focus is expected to drive the need for local data processing in healthcare.

Asia Pacific

- India and China are now embracing the latest in edge computing to meet their challenges of ageing populations and urbanization. Companies like Huawei are developing edge computing solutions for the medical industry, which can help improve the quality of medical care in remote areas.

- In India, the National Digital Health Mission is promoting the integration of digital health and edge computing to improve the delivery of health services. This will lead to increased investment in digital health IT in the region.

Latin America

- Latin America is gradually converting to digital health solutions. Brazil and Mexico are using edge computing to enhance the delivery of care. There are many local companies specializing in telehealth and remote patient monitoring that are increasingly using edge computing.

- The governments of the region are encouraging the development of digital health and are fostering the adoption of new tools. These initiatives are expected to encourage the development of edge computing solutions for the health sector.

North America

- The use of telehealth is growing rapidly in the United States, and this has led to a need for ad hoc solutions that enable a better management of the data coming from the patient’s remote devices. IBM and Microsoft are leading the way in the integration of edge computing into existing health systems, in order to improve security and compliance with the HIPAA rules.

- The emergence of new regulatory trends, such as the FDA’s guidelines on software as a medical device (SaMD), is encouraging the development of edge computing applications and enabling a faster deployment of health care solutions. This regulatory support is expected to foster closer collaboration between technology companies and health care service providers, and drive the growth of the market.

Middle East And Africa

- The Middle East is witnessing an upsurge in the development of smart health-care solutions. The United Arab Emirates has already made a sizeable investment in digital health-care initiatives, and this is expected to grow. In Dubai, the Health Authority is deploying edge computing to improve the management of patient data and the delivery of care.

- Moreover, in Africa, the development of mHealth applications is driving the need for edge computing to reduce the latency of data transmission. The mPharma project, for example, is using edge computing to manage the supply chain for medicines, which is expected to help improve access to essential medicines.

Did You Know?

“By 2025, it is estimated that over 75% of healthcare data will be generated outside traditional healthcare settings, highlighting the critical role of edge computing in managing this influx of data.” — Gartner

Segmental Market Size

The market for edge computing in the health sector is experiencing significant growth as it plays a crucial role in enhancing data processing at the point of care. The increasing demand for real-time data analysis, the growing number of IoT devices in the health sector, and the need to improve patient outcomes are driving this market. Regulations promoting data security and privacy are also increasing the demand as health care organizations seek to comply with stringent regulations while taking advantage of new technology. At present, edge computing in the health sector is in the deployment phase, with Philips and GE Health applying edge computing to their medical devices and medical imaging equipment. The most common applications are remote patient monitoring, telehealth, and clinical data analytics. The spread of the epidemic influenza, COVID 19, has increased the trend towards digital health, and government requirements for interoperability and data sharing are accelerating the growth. The main driving forces are the combination of artificial intelligence, 5G, and cloud computing.

Future Outlook

“The edge-computing market is projected to increase from $2.3 billion to $11.4 billion between 2023 and 2032, at a robust CAGR of 19.3 percent,” said the report. “This growth is driven by the growing demand for real-time data processing and analytics in healthcare settings, which is essential for enhancing patient care and operational efficiency.” IoT devices and telehealth will only accelerate this trend. “Technological advancements, such as the integration of artificial intelligence and machine learning with edge-computing systems, will further drive the market,” said the report. These developments will enable “predictive analytics and personalized medicine,” enabling health care professionals to tailor treatment to the needs of individual patients. Supportive government policies and investment in digital health infrastructure will also encourage the market’s expansion. The report also cited “the rise in remote patient monitoring and the growing focus on data security and privacy” as factors that will influence the adoption of edge-computing systems.

Leave a Comment