Market Trends

Introduction

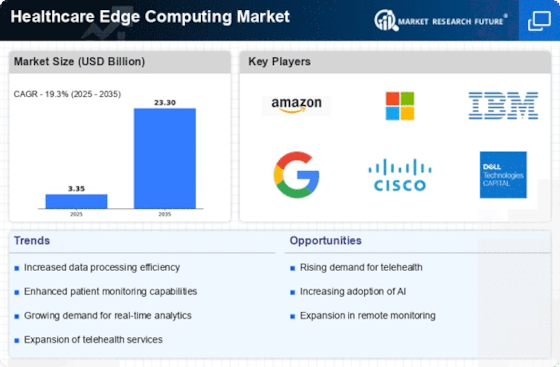

Towards 2023, the healthcare edge computing market is expected to experience significant transformation, driven by a confluence of macro-economic factors, such as rapid technological developments, changing regulatory frameworks, and shifting consumer behavior. These factors are pushing healthcare organizations to adopt edge computing solutions to improve operational efficiency and patient care. The increasing regulatory burden is also compelling the industry to focus on data security and compliance, while consumers are demanding more accessible and individualized services. These are strategic issues for the industry as it seeks to navigate the complexities of digital transformation in the healthcare industry and remain responsive to the needs of both consumers and healthcare organizations.

Top Trends

-

Increased Adoption of AI and Machine Learning

Artificial intelligence and machine learning are increasingly used in the field of health care. Artificial intelligence and machine learning are being used in hospitals to analyze patient data in real time and thus improve diagnostic accuracy. A study showed that the use of artificial intelligence can reduce diagnostic errors by up to 30 percent. This trend will lead to more individualized treatments and greater efficiency in the delivery of health care. -

Enhanced Data Security and Compliance

With the advent of edge computing, health care institutions are putting data security at the forefront of their concerns, especially in view of the HIPAA regulations. Companies are deploying advanced encryption and access control methods to protect sensitive patient data. A recent study shows that more than 70 percent of health care organizations view data security as their top priority. However, even more robust security frameworks and real-time threat detection systems may be needed. -

Telemedicine and Remote Patient Monitoring

The ravages of the COVID-19 epidemic accelerated the development of telemedicine, and edge computing made it possible to process real-time data for the purpose of remote patient monitoring. For example, wearables can now send health information directly to the medical profession. In 2020, telehealth consultations increased by a factor of 154. The trend is likely to continue, improving patient compliance and reducing hospital visits. -

Interoperability and Data Integration

Interoperability is the goal of the medical system to ensure smooth data transfer between various end devices and platforms. It is gaining ground with initiatives like the FHIR standard. In a survey, 80 percent of health care managers said that interoperability was essential for better patient care. The future development may lead to more standardized protocols and closer collaboration among the various parties. -

Real-time Analytics for Decision Making

Real-time analysis is a major advantage of edge computing. It enables health professionals to make decisions quickly. For example, emergency departments use real-time analysis to classify patients by severity. Real-time analysis has been shown to improve patient outcomes by up to 25 per cent. This trend is likely to result in more sophisticated data tools and dashboards. -

Growth of IoT Devices in Healthcare

IoT devices are changing the way we provide care. The emergence of edge computing facilitates the management of these devices. Using these sensors, hospitals monitor vital signs and the environment. By 2025, the number of connected medical devices is expected to exceed 50 billion. This trend will lead to better patient monitoring and greater operational efficiency. -

Decentralized Clinical Trials

The edge computing is enabling the decentralization of clinical trials. In recent trials, we have seen an increase of 40 per cent in the engagement of the patient. This trend is expected to reduce the cost of clinical trials and to make research more efficient and more accessible. -

Focus on Patient-Centric Care

HEALTHCARE CENTERS ARE TURNING TO PATIENT-CENTRIC CARE MODELS, WHICH ARE DEPLOYING EDGE COMPUTING TO IMPROVE PATIENT EXPERIENCES. APPS THAT ARE PERSONALIZED TO EACH PATIENT ARE ONE EXAMPLE. A recent survey shows that 75% of patients prefer personalized care. This trend is likely to drive innovations in patient engagement tools and services. -

Collaboration with Technology Partners

The exploitation of edge computing is becoming more and more the focus of health care organizations. Partnerships with technology companies make it possible to implement advanced solutions, such as predictions and artificial intelligence in diagnostics. According to a study, 60 percent of health care managers are planning to invest in these collaborations. This trend can lead to more innovations in health care and better results for the patient. -

Sustainability and Energy Efficiency

Edge computing is a solution that offers an energy-efficient alternative to a central data center. Several hospitals have reported energy savings of up to 30 percent. This trend is expected to contribute to the development of more sustainable health care practices and tools.

Conclusion: Navigating the Competitive Edge in Healthcare

The Edge of the Medical Devices Market by 2023 is characterized by a high level of competition and fragmentation, and both the new and old players are competing. Regionally, the trend is to process data locally, especially in North America and Europe, where the regulatory framework is evolving to support edge solutions. The vendors must strategically position themselves by focusing on advanced capabilities such as AI, automation, and flexibility. The old players are focusing on integrating edge solutions into existing networks, while new players are launching agile, tailored solutions that meet the specific needs of the medical industry. As the market matures, the ability to use these capabilities will be critical to establishing leadership and long-term success in the rapidly changing environment.

Leave a Comment