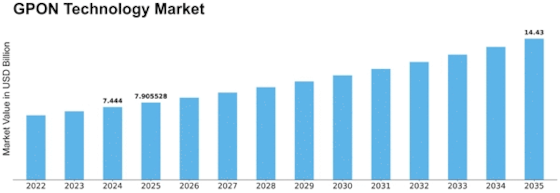

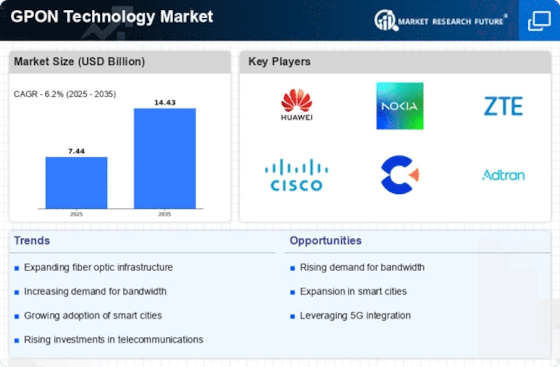

Gpon Technology Size

GPON Technology Market Growth Projections and Opportunities

The Gigabit Passive Optical Network (GPON) technology market is witnessing dynamic shifts that are reshaping the landscape of broadband connectivity. GPON, a fiber-optic communication technology, is gaining widespread adoption due to its ability to deliver high-speed internet access, voice, and video services over a single fiber-optic connection. One significant factor driving the market is the fast-growing need of people for super-speed broadband services as such services enable residential and business users to support constant bandwidth needs. GPON technology empowers the service providers to support the growing demand for fast internet connections delivering gigabit speeds and ensuring all the interactive applications including the video streaming, online gaming and so on are done without any lag.

The market supply of GPON technology, on the other hand, is also affected by the nature of responsive cities and IoT push worldwide. GPON acts as a pillar for smart city implementations, this is because GPON facilitates integration of different services like smart lightening, traffic management, and environmental observation. Furthermore, GPON offers outstanding qualities such as increased bandwidth, smart network, and resilient. The scalability and enormous band width features of GPON permit it to be relevant for the application of smart city systems and therefore make it possible to cover all the needs of connectivity that such applications require and this contribution will be done through the efficient development of urban infrastructure.

Yet one of the greatest forces in market dynamics that GPON has brought to developing countries is the adoption of GPON technology. While aiming to narrow the digital divide and deliver more high-speed broadband connections, GPON offers an economic and scalable choice to build such networks. Governments as well as telecom operators in these emerging regions are investing in GPON technology to ensure stable broadband connection that are capable of delivering high performance internet services which support the local communities in making the economy grow through to improved education and medical services provision.

We should bear in mind the fact that the technology of GPON is in the process of constant development, and the new waves of revolutionary innovations have already appeared by the names of XGS-PON (10 Gigabit Symmetrical Passive Optical Network) and NG-PON2 (Next-Generation Passive Optical Network 2). These advancements in GPON standards aim to deliver even higher data rates and improved performance, meeting the future demands of bandwidth-intensive applications and services. Market dynamics are shaped by the competitive landscape among equipment vendors and service providers to adopt and implement these advanced GPON technologies, ensuring they stay at the forefront of delivering cutting-edge broadband services.

Leave a Comment