Government Initiatives and Funding

Government initiatives play a crucial role in the expansion of the Fiber to the Premises Market. Various countries have recognized the importance of broadband connectivity as a driver of economic growth and social inclusion. As a result, numerous governments have launched funding programs aimed at subsidizing the deployment of fiber optic networks, particularly in underserved areas. For instance, recent reports indicate that public funding for broadband infrastructure has increased, with billions allocated to enhance connectivity. These initiatives not only stimulate private investment but also create a favorable regulatory environment for fiber deployment, thus fostering growth in the Fiber to the Premises Market.

Technological Advancements in Fiber Optics

Technological advancements are significantly influencing the Fiber to the Premises Market. Innovations in fiber optic technology, such as the development of higher-capacity cables and improved installation techniques, have made it more feasible for service providers to expand their networks. Recent advancements have led to the introduction of passive optical networks (PON), which allow for more efficient data transmission and reduced operational costs. As these technologies continue to evolve, they enable providers to offer faster internet speeds and more reliable services, thereby attracting more customers. This technological evolution is likely to drive further investment in the Fiber to the Premises Market.

Growing Adoption of Smart Home Technologies

The growing adoption of smart home technologies is influencing the Fiber to the Premises Market. As households increasingly integrate smart devices into their daily lives, the demand for robust and reliable internet connections has intensified. Smart home technologies, such as security systems, smart appliances, and home automation systems, require high-speed internet to function optimally. This trend is driving consumers to seek out fiber optic solutions that can support multiple devices simultaneously without compromising performance. Consequently, service providers are recognizing the potential of this market segment and are investing in fiber infrastructure to cater to the needs of tech-savvy consumers, thereby fostering growth in the Fiber to the Premises Market.

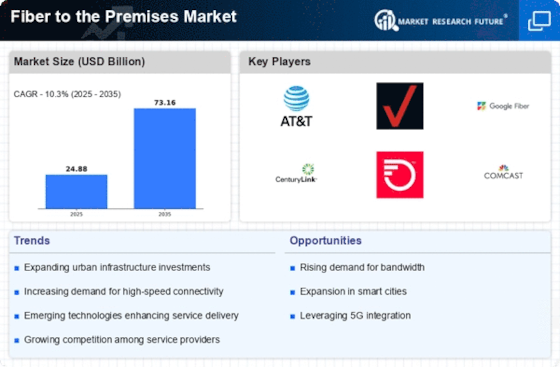

Rising Demand for High-Speed Internet Access

The Fiber to the Premises Market is experiencing a notable surge in demand for high-speed internet access. As consumers increasingly rely on digital services for work, education, and entertainment, the need for faster and more reliable internet connections has become paramount. Recent data indicates that the number of households requiring broadband speeds exceeding 100 Mbps has risen significantly, with projections suggesting that this trend will continue. This demand is not only driven by individual consumers but also by businesses seeking to enhance productivity through improved connectivity. Consequently, service providers are compelled to invest in fiber optic infrastructure to meet these expectations, thereby propelling growth within the Fiber to the Premises Market.

Increased Competition Among Service Providers

The Fiber to the Premises Market is characterized by heightened competition among service providers. As more companies enter the market, they are compelled to differentiate their offerings through pricing, service quality, and customer support. This competitive landscape has led to aggressive pricing strategies, which can benefit consumers by providing more affordable options for high-speed internet access. Additionally, competition encourages innovation, as providers seek to enhance their service offerings to attract and retain customers. This dynamic environment is likely to stimulate further growth in the Fiber to the Premises Market as companies strive to capture market share.