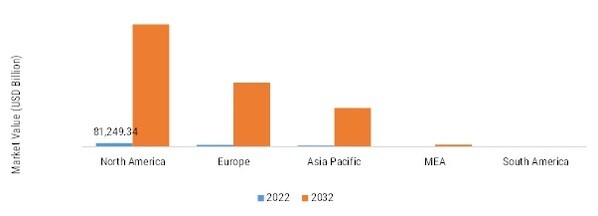

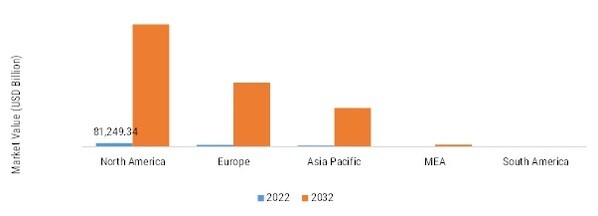

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the South America. The North America Generative AI in Media and Entertainment market accounted for ~54.0% in 2022. the region's large Generative AI in Media and Entertainment industries, as well as the growing popularity of sports. The use of Generative AI in Media and Entertainment is expected to grow significantly in the coming years as companies seek to improve efficiency, productivity, and safety in their material handling and transportation operations.

One of the key factors driving the demand for Generative AI in Media and Entertainment in North America is the region's large Generative AI in Media and Entertainment industry. The Media and Entertainment sector is experiencing significant growth in North America, spurred by various factors such as the increasing demand for immersive experiences, advancements in content delivery, the imperative to enhance user engagement, and the adoption of cutting-edge technologies. This burgeoning landscape is witnessing a surge in innovation and adoption of Generative AI technologies. North America, by country, has been segmented into the US, Canada, and Mexico.

The US is leading the market, while Canada is expected to witness a high growth rate in the coming future.

FIGURE 3: GENERATIVE AI IN MEDIA AND ENTERTAINMENT MARKET SIZE BY REGION 2022 VS 2032 (USD Million)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe market accounts for the second-largest market share. The continuous rise in demand for immersive experiences and entertainment options has led to a remarkable uptick in the integration of Generative AI solutions. For instance, major entertainment hubs like Hollywood Studios in Los Angeles are leveraging Generative AI to create lifelike digital avatars for actors, revolutionizing filmmaking and virtual storytelling experiences. The need to enhance user engagement and deliver personalized content experiences is pushing media companies to invest in AI-driven recommendation engines and content creation tools that dynamically generate tailored content based on user preferences.

The infusion of cutting-edge technologies like Artificial Intelligence (AI) and Machine Learning (ML) has redefined content creation and audience engagement strategies. Media companies are harnessing Generative AI to develop hyper-personalized content, predictive analytics for audience behavior, and AI-generated storytelling formats. For example, major sports networks are leveraging AI-powered analytics tools to enhance viewer experiences by providing real-time insights, player statistics, and interactive visualizations during live sports events, thereby revolutionizing the viewer's engagement.

Leave a Comment