Gas Insulated Transformer Market Share

Gas Insulated Transformer Market Research Report Information By Voltage Rating (Medium, High and Extra High), By End-Use (Utility, Industrial and Commercial), By Type (Instrument Transformer and Others), By Type of Cooling (Gas Directed Air Natural Cooling, Gas Directed Air Forced Cooling and Gas Directed Water Forced Cooling), By Installation (Outdoor and Indoor), And By Region (North America,...

Market Summary

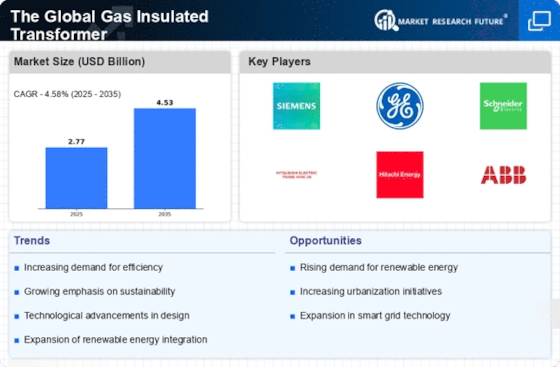

The Global Gas Insulated Transformer Market is projected to grow from 2.77 USD Billion in 2024 to 4.53 USD Billion by 2035, reflecting a robust CAGR of 4.57%.

Key Market Trends & Highlights

Global Gas Insulated Transformer Key Trends and Highlights

- The market valuation is expected to reach 4.53 USD Billion by the year 2035. From 2025 to 2035, the market is anticipated to grow at a compound annual growth rate of 4.57%. in 2024, the market is valued at 2.77 USD Billion, indicating a strong foundation for future growth. Growing adoption of gas insulated transformers due to their compact design and efficiency is a major market driver.

Market Size & Forecast

| 2024 Market Size | 2.77 (USD Billion) |

| 2035 Market Size | 4.53 (USD Billion) |

| CAGR (2025-2035) | 4.58% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

<p>ABB Ltd. (Switzerland), General Electric (US), Mitsubishi Electric Corporation (Japan), Siemens AG (Germany), Toshiba Corporation (Japan), Arteche (Spain), Meidensha Corporation (Japan), Takaoka Toko Co. Ltd (Japan), Fuji Electric co. Ltd. (Japan), Chint Group (China)</p>

Market Trends

Expansion of power transmission and distribution (T&D) is driving the market growth

The gas insulated transformer market is seeing changes driven by the expansion of power transmission and distribution (T&D). APAC is one of the most significant areas seeing many changes in the target market. Industrial growth directly impacts urbanization since it leads to more people building homes and businesses. Due to its rapidly expanding population and rising disposable income, India has one of the highest rates of urbanization in the world. China is likewise seeing comparable urbanization tendencies. Among the other regions of the world, South America, particularly Brazil, one of the top developing nations, are undergoing enormous economic changes.

Despite being under construction and rapidly urbanizing, the manufacturing sector in these places has tremendous expansion potential.

However, these nations will develop into major hubs for manufacturing automobiles and other goods, which will raise the demand for power. The beginning of planned capacity expansion projects by industry and government power companies in several places has been made possible by activity. These initiatives demonstrate the rising rate of electricity usage. Due to its strong safety properties, sulfur hexafluoride (SF6) is added to gas insulated transformers to increase its acceptance in power distribution. These elements will propel the gas insulated transformer market CAGR expansion during the forecast timeframe.

The market for gas insulated transformers is primarily characterized by growing vendor strategic alliances. Market players have been collaborating and signing agreements for gas insulated transformers to diversify their product offerings. For example, Toshiba and Meshaiden Corporation have been collaborating since 2020 on the joint development of gas insulated switchgear for 72 kV and 84 kV using natural gas without SF6. Due to the market's rising need for environmentally friendly products, businesses agreed to hasten the development and commercialization of this gas-insulated switchgear in June 2021.

Furthermore, Siemens and Mitsubishi signed a Memorandum of Understanding in June 2021 to perform a feasibility study on developing high voltage switches with low global warming potential (GWP), which employ clean air rather than greenhouse gases for insulation. Both organizations will research ways to increase the clean-air insulation technology's application at greater voltages. Thus, during the projected period, the market under consideration will benefit from such techniques employed by the industry's vendors. Thus, driving the gas insulated transformer market revenue.

<p>The increasing demand for efficient and compact energy solutions is driving the adoption of gas insulated transformers, which are recognized for their reliability and reduced environmental impact in urban settings.</p>

U.S. Department of Energy

Gas Insulated Transformer Market Market Drivers

Rising Electricity Demand

The continuous rise in global electricity demand is a fundamental driver for the Global Gas Insulated Transformer Market Industry. As economies grow and populations expand, the need for reliable and efficient power distribution systems becomes increasingly critical. Gas insulated transformers, with their ability to operate in confined spaces and under extreme conditions, are well-positioned to meet this demand. This trend is particularly pronounced in emerging markets, where electrification efforts are underway. The growing electricity consumption is likely to sustain the market's upward trajectory, contributing to its projected growth and reinforcing the necessity for advanced transformer solutions.

Technological Advancements

Technological innovations in the design and manufacturing of gas insulated transformers are enhancing their performance and reliability, thus driving the Global Gas Insulated Transformer Market Industry. Recent advancements include the development of eco-friendly insulating gases and improved materials that extend the lifespan of transformers. These innovations not only reduce maintenance costs but also enhance operational efficiency. As utilities and industries seek to modernize their electrical systems, the adoption of these advanced transformers is likely to increase. The anticipated compound annual growth rate of 4.57% from 2025 to 2035 underscores the importance of technological progress in shaping the market landscape.

Market Trends and Projections

The Global Gas Insulated Transformer Market Industry is poised for substantial growth, with projections indicating a market value of 2.77 USD Billion in 2024 and an anticipated increase to 4.53 USD Billion by 2035. The compound annual growth rate of 4.57% from 2025 to 2035 highlights the sustained interest in gas insulated transformers. This growth is driven by various factors, including the increasing demand for renewable energy, urbanization, and technological advancements. The market dynamics suggest a robust future for gas insulated transformers as they become integral to modern electrical infrastructure.

Growing Demand for Renewable Energy

The Global Gas Insulated Transformer Market Industry is experiencing a surge in demand driven by the increasing integration of renewable energy sources. As countries strive to meet their energy transition goals, the need for efficient and reliable power transmission becomes paramount. Gas insulated transformers, known for their compact design and high reliability, are particularly suited for renewable energy applications. For instance, the deployment of wind and solar power plants necessitates advanced grid solutions, which gas insulated transformers provide. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 2.77 USD Billion in 2024.

Government Initiatives and Regulations

Government policies aimed at promoting energy efficiency and reducing carbon emissions are significantly influencing the Global Gas Insulated Transformer Market Industry. Many countries are implementing stringent regulations that encourage the adoption of cleaner technologies in power generation and distribution. Gas insulated transformers, which offer lower environmental impact compared to traditional oil-filled transformers, are becoming a preferred choice for utilities. Incentives and subsidies for renewable energy projects further bolster the demand for these transformers. As regulatory frameworks evolve, the market is expected to benefit from increased investments in sustainable energy infrastructure.

Urbanization and Infrastructure Development

Rapid urbanization across the globe is a key driver for the Global Gas Insulated Transformer Market Industry. As cities expand, the demand for robust electrical infrastructure intensifies. Gas insulated transformers, with their space-saving attributes, are increasingly favored in urban settings where land is at a premium. This trend is particularly evident in developing nations, where urban centers are witnessing unprecedented growth. The need for reliable power distribution in these densely populated areas is likely to propel the market forward. By 2035, the market is projected to reach 4.53 USD Billion, reflecting the critical role of gas insulated transformers in modern urban infrastructure.

Market Segment Insights

Gas Insulated Transformer Voltage Rating Insights

<p>The global gas insulated transformer market segmentation, based on voltage rating includes Medium, High and Extra High. The medium segment dominated the market. Transformers for medium voltage with gas insulation and distribution capabilities can reach 72.5 kV. SF6 gas, an SF6 gas sleeve, a transformer on-load voltage regulation switch, a gas temperature gauge, a sudden pressure relay, a plate radiator, a pressure monitoring device, an airflow indicator, a winding temperature gauge, a cooling system intelligent control box, a gas circulation pump, and a blowing device are among the components of medium voltage gas insulated transformers.</p>

Gas Insulated Transformer End-Use Insights

<p>The global gas insulated transformer market segmentation, based on end-use, includes Utility, Industrial and Commercial. The utility category generated the most income. The trend of relocating massive substations underground in overpopulated urban areas has been sparked by the expanding demand for electricity in cities worldwide, the shortage of available land to build new substations or renovate those already present close to the load centers, and unfavorable environmental conditions. To avoid accidents and guarantee the compactness of equipment, a developing market for large-capacity, incombustible, and nonexplosive gas insulated transformers (GIT) has emerged.</p>

Gas Insulated Transformer Type Insights

<p>The global gas insulated transformer market segmentation, based on type includes Instrument Transformer and Others. The instrument transformer segment dominated the market. An electrical device known as an instrument transformer uses the ferromagnetic properties of alternating currents and materials.</p>

Gas Insulated Transformer Type of Cooling Insights

<p>The global gas insulated transformer market segmentation, based on type of cooling includes Gas Directed Air Natural Cooling, Gas Directed Air Forced Cooling and Gas Directed Water Forced Cooling. The gas directed air natural cooling segment dominated the market. Gas-insulated transformers use a cooling technique called "Gas Directed Air Natural Cooling" (GDANC). The advantages of gas and directed air natural cooling are combined in the cutting-edge cooling technique, GDANC.</p>

Gas Insulated Transformer Installation Insights

<p>The global gas insulated transformer market segmentation, based on installation includes Outdoor and Indoor. The indoor segment dominated the market. Gas-insulated transformers are widely used for cities' subterranean or indoor installations because of their small size, reduced noise level, and low electromagnetic radiation output. Indoor installation of gas-insulated transformers is frequently done in underground spaces beneath public parks and commercial structures to conserve space, maintain safety, and offer a consistent electricity supply. In addition, indoor gas-insulated transformers are suitable for use in establishments that prioritize fire safety, including hotels, schools, factories, department stores, chemical plants, and hospitals.</p>

<p>Figure 1: Global Gas Insulated Transformer Market, by Installation, 2024 & 2032 (USD Billion)</p>

<p>Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review</p>

Get more detailed insights about Gas Insulated Transformer Market Research Report-Global Forecast till 2032

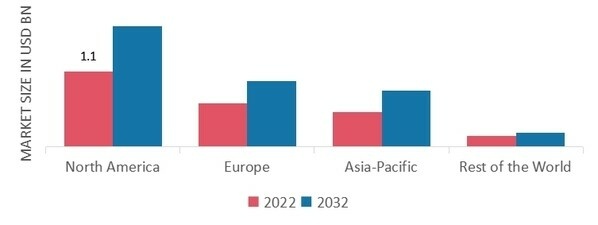

Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American gas insulated transformer market area will dominate this market. Electricity in the region is produced, transmitted, distributed, and used in drastically altering ways. The energy markets have undergone major reorganization, particularly in the transmission and distribution networks, which has prepared the way for the increased demand for cutting-edge technologies like gas-insulated transformers.

Rising energy consumption and ageing power infrastructure are expected to be the key forces behind the transmission and distribution sector development, which will promote the local expansion of gas-insulated transformers.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Global Gas Insulated Transformer Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe gas insulated transformer market accounts for the second-largest market share. In Europe, many countries are investing in renewable technologies like solar photovoltaic and wind power to reduce their reliance on fossil fuels due to the region's energy diversification. In addition, governments have implemented a number of laws to boost renewable energy in response to the rising worries over carbon emissions. Due to the regulations' considerable impact on the market's growth and integration of renewable energy into national grids, the market for gas-insulated transformers is projected to expand.

Further, the German gas insulated transformer market held the largest market share, and the UK gas insulated transformer market was the fastest growing market in the European region

The Asia-Pacific Gas insulated transformer Market is expected to grow at the fastest CAGR from 2023 to 2032. The tremendous industrialization and urbanization of the area over the last few years has resulted in a major rise in the power demand. As a result, over the same period, investments in T&D infrastructure have significantly increased. Gas-insulated transformers are also becoming increasingly common as long-distance T&D projects attempt to be more ecologically friendly by reducing their negative environmental effects and enhancing safety by constructing underground networks and smaller substations.

Moreover, China’s gas insulated transformer market held the largest market share, and the Indian gas insulated transformer market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the gas insulated transformer market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, gas insulated transformer industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the insulated Voltage Transformers industry to benefit clients and increase the market sector. In recent years, the gas insulated transformer industry has offered some of the most significant advantages to market. Major players in the Gas-insulated Station service market attempting to increase market demand by investing in research and development operations include ABB Ltd. (Switzerland), General Electric (US), Mitsubishi Electric Corporation (Japan), Siemens AG (Germany), Toshiba Corporation (Japan), Arteche (Spain), Meidensha Corporation (Japan), Takaoka Toko Co. Ltd (Japan), Fuji Electric co.

Ltd. (Japan) and Chint Group (China).

Chint Electrics is a producer of low-voltage electrical goods based in Zhejiang, China. It produces and sells a variety of low-voltage items with different specifications. Moulded case circuit breakers, modular din-rail products, control products, transformers, soft starters, inverters, automatic voltage regulators, power relays, capacitors, and switch disconnectors are among the company's product offerings. The company provides services to a number of industries, including petrochemical, building, electric power, machinery, railroad, communication, metallurgy, and HVAC.

The company Mitsubishi Electric Corp. creates, produces, and sells electrical and electronic equipment. The company's product line includes air conditioning systems, household goods, space systems, industrial automation systems, automobile equipment, visual information systems, transportation systems, semiconductors and devices, building systems, energy systems, information and communication systems, and public systems. Additionally, it provides network, infrastructure, and maintenance services. Mitsubishi Electric provides services to the information processing and communications, satellite communications, industrial technology, construction equipment, consumer electronics, energy, and transportation industries.

Key Companies in the Gas Insulated Transformer Market market include

Industry Developments

April 2023- Hyosung Heavy Industries recently disclosed that it secured 3.5101 trillion won (US$2.6752 billion) in sales and 143.2 billion won (US$109.1 million) in operating profit in 2022, thanking the rise in global demand for power generation equipment. This signified a rise of 23.1 billion won (US$17.6 million) in operating profit compared to 2021. The organization anticipates continued development because of the rise in new power generation sources and escalating demand for transmission and distribution in the global power market.

May 2022: After completing all procedures to establish Arteche Hitachi Energy Instrument Transformers S.L., the replacement for Arteche Gas Insulated Transformers (AGIT), Arteche and Hitachi Energy received regulatory permission. Through this partnership, Arteche and Hitachi Energy are hastening the creation of environmentally friendly, sustainable gas insulated transformers.

Meidensha Corporation (Meiden), in September 2022, entered into a sustainability-linked loan (SLL) agreement with Sumitomo Mitsui Banking Corporation (SMBC).

An Econiq 420 kv circuit breaker was released by Hitachi Energy in August 2022.

In May 2022, Arteche and Hitachi Energy obtained regulatory authorization, thereby completing all the formalities for the taking over of Arteche Gas Insulated Transformers (AGIT) to become Arteche Hitachi Energy Instrument Transformers S.L. Consequently, both companies are fast-tracking their green gas-insulated transformers journey through the establishment of a joint venture called Arteche Hitachi Energy Instrument Transformers S.L. The development is expected to foster the wide use of renewable energy sources and sustainable, environmentally friendly gas-insulated transformers.

A range of power transformers was introduced by General Electric in January 2022 to facilitate the adoption of renewable energy sources, such as the GE-Mistral-14, which operates between 275 kV and 400 kV, two large power transformers rated at 340 MVA each and MBH Power transformer. These have been deployed in various wind farms in many countries. GE’s range encompasses various voltage levels, suitable for applications like power generation, transmission and distribution.

Pfiffner and Trench had issued a joint statement on SF6-free instrument transformers as manufacturers, As SF6 has traditionally been used for safety purposes in AIS High Voltage Instrument Transformers. Nonetheless, SF6, when leaked, is viewed as one of its kind that results in a global warming problem.

The power minister of Goa state, India, announced plans to build to state's first gas-insulated substation in November 2021, which cost around USD4.3 million. This is intended to benefit consumers residing in Davorilm, Navelim as well as Margao and Curtorim areas. Furthermore, there have been proposals to deploy GIS technology throughout the area.

Collaboratively, Meidensha Corporation joined Toshiba in June 2021 with the plan of commercializing by March 2023 new GIS solutions for gas-insulated transformers based on natural origin gases.

Future Outlook

Gas Insulated Transformer Market Future Outlook

<p>The Global Gas Insulated Transformer Market is projected to grow at a 4.58% CAGR from 2025 to 2035, driven by urbanization, renewable energy integration, and technological advancements.</p>

New opportunities lie in:

- <p>Invest in R&D for eco-friendly insulating gases to meet regulatory standards. Expand service offerings in maintenance and retrofitting for aging infrastructure. Leverage digital technologies for predictive maintenance and operational efficiency.</p>

<p>By 2035, the market is poised for robust growth, reflecting increased demand and innovation.</p>

Market Segmentation

Gas Insulated Transformer Type Outlook (USD Billion, 2018-2032)

- Instrument Transformer

- Others

Gas Insulated Transformer End-Use Outlook (USD Billion, 2018-2032)

- Utility

- Industrial

- Commercial

Gas Insulated Transformer Regional Outlook (USD Billion, 2018-2032)

- {""=>["US"

- "Canada"]}

- {""=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {""=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {""=>["Middle East"

- "Africa"

- "Latin America"]}

Gas Insulated Transformer Installation Outlook (USD Billion, 2018-2032)

- Outdoor

- Indoor

Gas Insulated Transformer Voltage Rating Outlook (USD Billion, 2018-2032)

- Medium

- High

- Extra High

Gas Insulated Transformer Type Of Cooling Outlook (USD Billion, 2018-2032)

- Gas Directed Air Natural Cooling

- Gas Directed Air Forced Cooling

- Gas Directed Water Forced Cooling

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 2.77 Billion |

| Market Size 2035 | 4.53 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 4.58% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Voltage Rating, End-Use, Type, Type of Cooling, Installation, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | ABB Ltd. (Switzerland), General Electric (US), Mitsubishi Electric Corporation (Japan), Siemens AG (Germany), Toshiba Corporation (Japan), Arteche (Spain), Meidensha Corporation (Japan), Takaoka Toko Co. Ltd (Japan), Fuji Electric co. Ltd. (Japan) and Chint Group (China) |

| Key Market Opportunities | New product launches and R&D amongst major key players |

| Key Market Dynamics | Rise in the awareness of environmental concernsRise in the utility of medium voltage and high voltage applications, such as hydroelectric power plant, underground shopping centers and thermal power plant. |

| Market Size 2025 | 2.90 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the gas insulated transformer market?

The global gas insulated transformer market size was valued at USD 2.63 Billion in 2023.

What is the growth rate of the gas insulated transformer market?

The global market is projected to grow at a CAGR of 4.58% during the forecast period, 2024-2032.

Which region held the largest market share in the gas insulated transformer market?

North America had the largest share in the global market

Who are the key players in the gas insulated transformer market?

The key players in the market are ABB Ltd. (Switzerland), General Electric (US), Mitsubishi Electric Corporation (Japan), Siemens AG (Germany), Toshiba Corporation (Japan), Arteche (Spain), Meidensha Corporation (Japan), Takaoka Toko Co. Ltd (Japan), Fuji Electric co. Ltd. (Japan) and Chint Group (China).

Which installation led the gas insulated transformer market?

The indoor category dominated the market in 2022.

Which end-use had the largest market share in the gas insulated transformer market?

The utility category had the largest share in the global market.

-

List of Tables and Figures

- |-

- Table of Content 1. Executive Summary 2. Scope of the Report 2.1 Market Definition 2.2 Scope of the Study 2.2.1 Definition 2.2.2 Research Objective 2.2.3 Assumptions 2.2.4 Limitations 2.3 Research Process 2.3.1 Primary Research 2.3.2 Secondary Research 2.4 Market size Estimation 2.5 Forecast Model 3. Market Landscape 3.1 Porter’s Five Forces Analysis 3.1.1 Threat of New Entrants 3.1.2 Bargaining power of buyers 3.1.3 Bargaining power of suppliers 3.1.4 Threat of substitutes 3.1.5 Segment rivalry 3.2 Supply Chain Analysis 4. Market Dynamics 4.1 Introduction 4.2 Market Drivers 4.3 Market Restraints 4.4 Market Opportunities 4.5 Market Trends 5. Global Gas Insulated Transformer Market, By Type 5.1 Introduction 5.2 Instrument Transformer 5.2.1 Market Estimates & Forecast, 2023-2032 5.2.2 Market Estimates & Forecast by Region, 2023-2032 5.3 Others 5.3.1 Market Estimates & Forecast, 2023-2032 5.3.2 Market Estimates & Forecast by Region, 2023-2032 6. Global Gas Insulated Transformer Market, By Voltage Rating 6.1 Introduction 6.2 Medium Voltage 6.2.1 Market Estimates & Forecast, 2023-2032 6.2.2 Market Estimates & Forecast by Region, 2023-2032 6.3 High Voltage 6.3.1 Market Estimates & Forecast, 2023-2032 6.3.2 Market Estimates & Forecast by Region, 2023-2032 6.4 Extra High Voltage 6.4.1 Market Estimates & Forecast, 2023-2032 6.4.2 Market Estimates & Forecast by Region, 2023-2032 7. Global Gas Insulated Transformer Market, By Installation 7.1 Introduction 7.2 Outdoor 6.2.1 Market Estimates & Forecast, 2023-2032 6.2.2 Market Estimates & Forecast by Region, 2023-2032 7.3 Indoor 6.3.1 Market Estimates & Forecast, 2023-2032 6.3.2 Market Estimates & Forecast by Region, 2023-2032 8. Global Gas Insulated Transformer Market, By End-User 8.1 Introduction 8.2 Utility 8.2.1 Market Estimates & Forecast, 2023-2032 8.2.2 Market Estimates & Forecast by Region, 2023-2032 8.3 Industrial 8.3.1 Market Estimates & Forecast, 2023-2032 8.3.2 Market Estimates & Forecast by Region, 2023-2032 8.4 Commercial 8.4.1 Market Estimates & Forecast, 2023-2032 8.4.2 Market Estimates & Forecast by Region, 2023-2032 9. Global Gas Insulated Transformer Market, By Type of Cooling 9.1 Introduction 9.2 Gas directed Air natural cooling 9.2.1 Market Estimates & Forecast, 2023-2032 9.2.2 Market Estimates & Forecast by Region, 2023-2032 9.3 Gas directed Air forced cooling 9.3.1 Market Estimates & Forecast, 2023-2032 9.3.2 Market Estimates & Forecast by Region, 2023-2032 9.4 Gas directed water forced cooling 9.4.1 Market Estimates & Forecast, 2023-2032 9.4.2 Market Estimates & Forecast by Region, 2023-2032 10. Global Gas Insulated Transformer Market, By Region 10.1 Introduction 10.2 North America 10.2.1 Market Estimates & Forecast, 2023-2032 10.2.2 Market Estimates & Forecast by Type, 2023-2032 10.2.3 Market Estimates & Forecast by Voltage Rating, 2023-2032 10.2.4 Market Estimates & Forecast Installation, 2023-2032 10.2.5 Market Estimates & Forecast by End-User, 2023-2032 10.2.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.2.5 U.S. 10.2.5.1 Market Estimates & Forecast, 2023-2032 10.2.5.2 Market Estimates & Forecast by Type, 2023-2032 10.2.5.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.2.5.4 Market Estimates & Forecast By Installation, 2023-2032 10.2.5.5 Market Estimates & Forecast by End-User, 2023-2032 10.2.5.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.2.6 Canada 10.2.6.1 Market Estimates & Forecast, 2023-2032 10.2.6.2 Market Estimates & Forecast by Type, 2023-2032 10.2.6.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.2.6.4 Market Estimates & Forecast By Installation, 2023-2032 10.2.6.5 Market Estimates & Forecast by End-User, 2023-2032 10.2.6.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.3 Europe 10.3.1 Market Estimates & Forecast, 2023-2032 10.3.2 Market Estimates & Forecast by Type, 2023-2032 10.3.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.3.4 Market Estimates & Forecast By Installation, 2023-2032 10.3.5 Market Estimates & Forecast by End-User, 2023-2032 10.3.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.3.5 UK 10.3.5.1 Market Estimates & Forecast, 2023-2032 10.3.5.2 Market Estimates & Forecast by Type, 2023-2032 10.3.5.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.3.5.4 Market Estimates & Forecast By Installation, 2023-2032 10.3.5.5 Market Estimates & Forecast by End-User, 2023-2032 10.3.5.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.3.6 Germany 10.3.6.1 Market Estimates & Forecast, 2023-2032 10.3.6.2 Market Estimates & Forecast by Type, 2023-2032 10.3.6.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.3.6.4 Market Estimates & Forecast By Installation, 2023-2032 10.3.6.4 Market Estimates & Forecast by End-User, 2023-2032 10.2.6.5 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.3.7 France 10.3.7.1 Market Estimates & Forecast, 2023-2032 10.3.7.2 Market Estimates & Forecast by Type, 2023-2032 10.3.7.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.3.7.4 Market Estimates & Forecast By Installation, 2023-2032 10.3.7.5 Market Estimates & Forecast by End-User, 2023-2032 10.3.7.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.3.10 Italy 10.3.10.1 Market Estimates & Forecast, 2023-2032 10.3.10.2 Market Estimates & Forecast by Type, 2023-2032 10.3.10.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.3.10.4 Market Estimates & Forecast By Installation, 2023-2032 10.3.10.5 Market Estimates & Forecast by End-User, 2023-2032 10.2.10.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.3.10 Rest of Europe 10.3.10.1 Market Estimates & Forecast, 2023-2032 10.3.10.2 Market Estimates & Forecast by Type, 2023-2032 10.3.10.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.3.10.4 Market Estimates & Forecast By Installation, 2023-2032 10.3.10.5 Market Estimates & Forecast by End-User, 2023-2032 10.3.10.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.4 Asia-Pacific 10.4.1 Market Estimates & Forecast, 2023-2032 10.4.2 Market Estimates & Forecast by Type, 2023-2032 10.4.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.4.4 Market Estimates & Forecast By Installation, 2023-2032 10.4.5 Market Estimates & Forecast by End-User, 2023-2032 10.5.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.4.5 China 10.4.5.1 Market Estimates & Forecast, 2023-2032 10.4.5.2 Market Estimates & Forecast by Type, 2023-2032 10.4.5.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.4.5.4 Market Estimates & Forecast By Installation, 2023-2032 10.4.5.5 Market Estimates & Forecast by End-User, 2023-2032 10.4.5.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.4.6 Japan 10.4.6.1 Market Estimates & Forecast, 2023-2032 10.4.6.2 Market Estimates & Forecast by Type, 2023-2032 10.4.6.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.4.6.4 Market Estimates & Forecast By Installation, 2023-2032 10.4.6.4 Market Estimates & Forecast by End-User, 2023-2032 10.4.6.4 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.4.7 India 10.4.7.1 Market Estimates & Forecast, 2023-2032 10.4.7.2 Market Estimates & Forecast by Type, 2023-2032 10.4.7.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.4.7.4 Market Estimates & Forecast By Installation, 2023-2032 10.4.7.5 Market Estimates & Forecast by End-User, 2023-2032 10.4.7.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.4.8 Rest of Asia-Pacific 10.4.8.1 Market Estimates & Forecast, 2023-2032 10.4.8.2 Market Estimates & Forecast by Type, 2023-2032 10.4.8.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.4.8.4 Market Estimates & Forecast By Installation, 2023-2032 10.4.8.5 Market Estimates & Forecast by End-User, 2023-2032 10.4.8.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 10.5 Rest of the World 10.5.1 Market Estimates & Forecast, 2023-2032 10.5.2 Market Estimates & Forecast by Type, 2023-2032 10.5.3 Market Estimates & Forecast By Voltage Rating, 2023-2032 10.5.4 Market Estimates & Forecast by Installation,2023-2032 10.5.4 Market Estimates & Forecast by End-User, 2023-2032 10.2.6 Market Estimates & Forecast by Type of Cooling, 2023-2032 11. Competitive Landscape 12. Company Profile 12.1 ABB Ltd. (Switzerland) 12.1.1 Company Overview 12.1.2 Product/Services Offering 12.1.3 Financial Overview 12.1.4 Key Developments 12.1.5 Strategy 12.1.6 SWOT Analysis 12.2 General Electric (US) 12.2.1 Company Overview 12.2.2 Product /Services Offering 12.2.3 Financial Overview 12.2.4 Key Developments 12.2.5 Strategy 12.2.6 SWOT Analysis 12.3 Mitsubishi Electric Corporation (Japan) 12.3.1 Company Overview 12.3.2 Product /Services Offering 12.3.3 Financial Overview 12.3.4 Key Developments 12.3.5 Strategy 12.3.6 SWOT Analysis 12.4 Siemens AG (Germany) 12.4.1 Company Overview 12.4.2 Product /Services Offering 12.4.3 Financial Overview 12.4.4 Key Developments 12.4.5 Strategy 12.4.6 SWOT Analysis 12.5 Toshiba Corporation (Japan) 12.5.1 Company Overview 12.5.2 Product /Services Offering 12.5.3 Financial Overview 12.5.4 Key Developments 12.5.5 Strategy 12.5.6 SWOT Analysis 12.6 Arteche (Spain) 12.6.1 Company Overview 12.6.2 Product /Services Offering 12.6.3 Financial Overview 12.6.4 Key Developments 12.6.5 Strategy 12.6.6 SWOT Analysis 12.7 Meidensha Corporation (Japan) 12.7.1 Company Overview 12.7.2 Product /Services Offering 12.7.3 Financial Overview 12.7.4 Key Developments 12.7.5 Strategy 12.7.6 SWOT Analysis 12.8 Takaoka Toko co., ltd (Japan) 12.8.1 Company Overview 12.8.2 Product /Services Offering 12.8.3 Financial Overview 12.8.4 Key Developments 12.8.5 Strategy 12.8.6 SWOT Analysis 12.9 Fuji Electric co., Ltd. (Japan) 12.9.1 Company Overview 12.9.2 Product /Services Offering 12.9.3 Financial Overview 12.9.4 Key Developments 12.9.5 Strategy 12.9.6 SWOT Analysis 12.12 Chint Group (China) 12.12.1 Company Overview 12.12.2 Product /Services Offering 12.12.3 Financial Overview 12.12.4 Key Developments 12.12.5 Strategy 12.12.6 SWOT Analysis List of Tables

- Table 1 Global Gas Insulated Transformer Market: By Region, 2023-2032

- Table 2 North America Gas Insulated Transformer Market: By Country, 2023-2032

- Table 3 Europe Gas Insulated Transformer Market: By Country, 2023-2032

- Table 4 Asia-Pacific Gas Insulated Transformer Market: By Country, 2023-2032

- Table 5 RoW Gas Insulated Transformer Market: By Country, 2023-2032

- Table 6 Global Gas Insulated Transformer Market by Type: By Regions, 2023-2032

- Table 7 North America Gas Insulated Transformer Market by Type: By Country, 2023-2032

- Table 8 Europe Gas Insulated Transformer Market by Type: By Country, 2023-2032

- Table 9 Asia-Pacific Gas Insulated Transformer Market by Type: By Country, 2023-2032

- Table 10 RoW Gas Insulated Transformer Market by Type: By Country, 2023-2032

- Table 10 Global Gas Insulated Transformer Market, by Voltage Rating, By Regions, 2023-2032

- Table 12 North America Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

- Table 13 Europe Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

- Table 14 Asia-Pacific Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

- Table 15 RoW Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

- Table 16 Global Gas Insulated Transformer Market, by Installation, By Regions, 2023-2032

- Table 17 North America Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

- Table 18 Europe Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

- Table 19 Asia-Pacific Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

- Table 20 RoW Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

- Table 21 Global Gas Insulated Transformer Market, By End Use, By Regions, 2023-2032

- Table 22 North America Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

- Table 23 Europe Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

- Table 24 Asia-Pacific Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

- Table 25 RoW Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

- Table 26 Global Gas Insulated Transformer Market, by type of cooling, By Regions, 2023-2032

- Table 27 North America Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

- Table 28 Europe Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

- Table 29 Asia-Pacific Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

- Table 30 RoW Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

- Table 31 Global Gas Insulated Transformer Market: By Region, 2023-2032

- Table 32 North America Gas Insulated Transformer Market, By Country

- Table 33 North America Gas Insulated Transformer Market, by Type

- Table 34 North America Gas Insulated Transformer Market, By Voltage Rating

- Table 35 North America Gas Insulated Transformer Market, By Installation

- Table 36 North America Gas Insulated Transformer Market, By Type of Cooling

- Table 37 North America Gas Insulated Transformer Market, By End Use

- Table 38 Europe: Gas Insulated Transformer Market, By Country

- Table 39 Europe: Gas Insulated Transformer Market, by Type

- Table 40 Europe: Gas Insulated Transformer Market, By Application

- Table 41 Europe: Gas Insulated Transformer Market, By End-Use

- Table 42 Europe: Gas Insulated Transformer Market, By Type of Cooling

- Table 43 Europe: Gas Insulated Transformer Market, By End Use

- Table 44 Asia-Pacific: Gas Insulated Transformer Market, By Country

- Table 45 Asia-Pacific: Gas Insulated Transformer Market, by Type

- Table 46 Asia-Pacific: Gas Insulated Transformer Market, By Application

- Table 47 Asia-Pacific: Gas Insulated Transformer Market, By End-Use

- Table 48 Asia-Pacific: Gas Insulated Transformer Market, By Type of Cooling

- Table 49 Asia-Pacific: Gas Insulated Transformer Market, By End Use

- Table 50 RoW: Gas Insulated Transformer Market, By Region

- Table 51 RoW Gas Insulated Transformer Market, by Type

- Table 52 RoW Gas Insulated Transformer Market, By Application

- Table 53 RoW Gas Insulated Transformer Market, By End-Use

- Table 54 RoW Gas Insulated Transformer Market, By Type of Cooling

- Table 55 RoW Gas Insulated Transformer Market, By End Use List of Figures

- FIGURE 1 RESEARCH PROCESS OF MRFR

- FIGURE 2 TOP DOWN & BOTTOM UP APPROACH

- FIGURE 3 MARKET DYNAMICS

- FIGURE 4 IMPACT ANALYSIS: MARKET DRIVERS

- FIGURE 5 IMPACT ANALYSIS: MARKET RESTRAINTS

- FIGURE 6 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 7 SUPPLY CHAIN ANALYSIS

- FIGURE 8 GLOBAL GAS INSULATED TRANSFORMER MARKET SHARE, BY TYPE, 2023 (%)

- FIGURE 9 GLOBAL GAS INSULATED TRANSFORMER MARKET, TYPE, 2023-2032 (USD MILLION)

- FIGURE 10 GLOBAL GAS INSULATED TRANSFORMER MARKETSHARE, BY VOLTAGE RATING, 2023 (%)

- FIGURE 11 GLOBAL GAS INSULATED TRANSFORMER MARKET, BY INSTALLATION, 2023-2032 (USD MILLION)

- FIGURE 12 GLOBAL GAS INSULATED TRANSFORMER MARKET, BY TYPE OF COOLING, 2023-2032 (USD MILLION)

- FIGURE 13 GLOBAL GAS INSULATED TRANSFORMER MARKET, BY END USE, 2023-2032 (USD MILLION)

- FIGURE 14 GLOBAL GAS INSULATED TRANSFORMER MARKET SHARE (%), BY REGION, 2023

- FIGURE 15 GLOBAL GAS INSULATED TRANSFORMER MARKET, BY REGION, 2023-2032 (USD MILLION)

- FIGURE 16 NORTH AMERICA GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

- FIGURE 15 NORTH AMERICA GAS INSULATED TRANSFORMER MARKET BY COUNTRY, 2023-2032 (USD MILLION)

- FIGURE 17 EUROPE GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

- FIGURE 18 EUROPE GAS INSULATED TRANSFORMER MARKETBY COUNTRY, 2023-2032 (USD MILLION)

- FIGURE 19 ASIA-PACIFIC GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

- FIGURE 20 ASIA-PACIFIC GAS INSULATED TRANSFORMER MARKET BY COUNTRY, 2023-2032 (USD MILLION)

- FIGURE 21 REST OF THE WORLD GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

- FIGURE 22 REST OF THE WORLD GAS INSULATED TRANSFORMER MARKET BY COUNTRY, 2023-2032 (USD MILLION)

Gas Insulated Transformer Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment