Market Trends

Key Emerging Trends in the Freeze of Gait Market

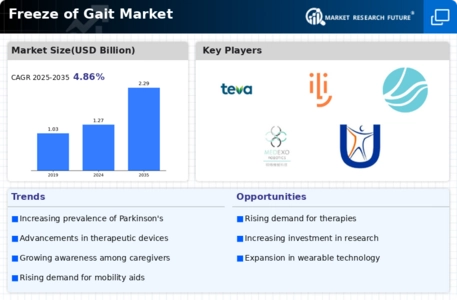

The market for Freeze of Gait (FOG), a phenomenon commonly associated with Parkinson's disease, is undergoing notable trends driven by advancements in medical research, technology, and a heightened focus on improving the quality of life for individuals experiencing FOG. Understanding these trends is crucial for healthcare professionals, researchers, and companies developing interventions for this challenging motor symptom. Wearables such as motion sensors and accelerometers are assisting in one the main application area in dealing with FOG. The medical market suggests wearable devices which are able to detect seizures and monitor the patients' condition, such devices directly provide the doctors with real-time data for more substantial and specific solutions. FOG market has got on the example of incorporating robotic assists which may assist people who suffer from freezing episodes. ROBOTIC suits and tools with warning assist to provide external support and improve gait stability. As such, MFOG will affect less daily life. VR is being utilized as a rehabilitation approach for courses Aimed at taming FOG. The VR technology gives the opportunity for people to walk in-depth simulated-environments in order to perfect and enhance their gait patterns. In this way, the individuals will have a secure and controlled setting to address FOG-related difficulties. In the ATG treatment, pharmaceutical remains one of the most prominent approaches. Markets give impetus to researches into medications and neurotransmitter modulation so as to find out the causes associated with fog which are deep-rooted hence as a result providing specific medicine that aim to achieve better targeting. Rehabilitative interventions with cognitive focus, frequently, are on the rise in order to address the symptoms of FOG. Such approaches as cognitive involvement and dual-task practices take into consideration the aspect of how these processes and motional are coordinated which helps prevent the case of freezing phenomena.

Neurofeedback and brain-computer interfaces are emerging as innovative approaches to address FOG. Market trends indicate research into technologies that provide real-time feedback on brain activity, allowing individuals to learn to modulate their neural patterns and potentially reduce the occurrence of freezing episodes. The integration of artificial intelligence is shaping market trends in FOG interventions. AI algorithms are being employed to analyze complex datasets from wearable devices, enabling personalized treatment plans and enhancing the precision of therapeutic interventions based on individual patient profiles.

Leave a Comment