Market Analysis

In-depth Analysis of Freeze of Gait Market Industry Landscape

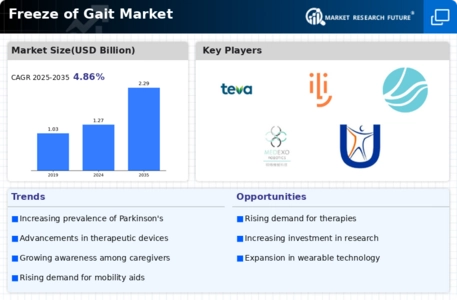

Freeze of gait (FOG) is a neurological phenomenon often associated with Parkinson's disease, characterized by a sudden and temporary inability to initiate or continue walking. Analyzing the market dynamics of freeze of gait involves exploring factors such as prevalence, diagnostic technologies, treatment options, and the impact of advancements in neurology. The trends start with a consideration of the Freezing of gait that is frequently a characteristic of the unusual neurological cases such as Parkinson’s Disease. Growing numbers of patients affected by Parkinson's disease on the planet add to the role of "FOG" in terms of its understanding and alienation worldwide. This is elongated by the unique developments in the diagnostic technologies that are used to identify and assess the severity of freeze of gait. The choice of neuroimaging methods, wearable devices and motion-sensing technologies to measure FOG regarding the correct diagnosis and its advancement will be the role regardless of the alternative. The dynamic of neuro-research sheds light on the deeper involved mechanisms and causes of Foster of gait. The interaction between the market dynamics and the underlying mechanism of FOG is sparked by the insights into the issues related to neurological pathways and brain functions. This results in a comprehensive understanding and ultimately in targeted medication and intervention. The marketplace for dopa deficiency fluctuates as a result of the pharmaceutical interventions that are designed to control the symptoms related to neurological disorders. Disorders related to motor control, balance and gait defects are mostly treated by medications. Such medications are one of the key components of the treatment strategies. Scientific discoveries and developments are mainly based on developing the medications that can calm or even decrease the scale of freeze of gait. Rehabilitation and the exercise therapy system also hold a part in the administration of a freezing of gait. The market forces for this product are governed by the demand for efficacious therapeutic interventions as a potential option to overcome movement difficulties and the adverse impact of FOG on normal living. Rehabilitation approaches which are cutting edge and the application of these technologies results in better outcomes in the patients. The devices and specific technologies worn on the body and utilized as assistive technologies locate Freezing of gait in the center of their work. Devices such as smart shoes, sensors, forward-mobile aids, are applied in order to facilitate immediate monitoring and intervention. The market answers to technology usage being integrated which is now being taken seriously by individuals who experience FOG. The market is driven by patient-centered techniques, where the real-life stories and expectations of the freeze of gait sufferers are taken into consideration by being the directions of the treatment strategies. Delivery of healthcare solutions which are based on patients’ individual requirements boost compliance with healthcare applications and maximize the patients’ level of satisfaction. An interdisciplinary group of experts, including neurologists, physiotherapists, and rehabilitation professionals, influences behavioral responses faced by the neuroscience market. Coordinated care approaches administer numerous kinds of interventions, ranging from the neuroglycolysis of gait to the improvement of quality of life. The environmental conditions that are regulated when it comes to neuroscience therapies and devices are a critical facet that affects business. The standards, approvals and healthcare regulations compatible with regulations and government support for new techniques, devices or medicines are the key to availability and implementation of innovations for freezing gait.

Market dynamics are influenced by healthcare accessibility and global trends in neurology care. Disparities in access to specialized care and the adoption of emerging trends, such as telemedicine and remote monitoring, can affect the delivery of interventions for freeze of gait. Patient advocacy groups and awareness campaigns contribute to market dynamics by educating both healthcare professionals and the public about freeze of gait. Increased awareness fosters early diagnosis, timely interventions, and a supportive community for individuals affected by FOG.

Leave a Comment