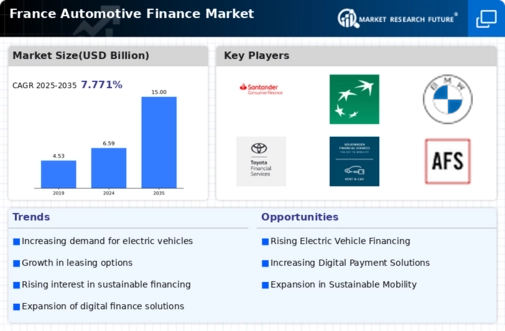

The France Automotive Finance Market is a vibrant segment characterized by intense competition and innovation as various financial institutions strive to capture a greater share of the growing demand for automotive financing. With the automotive industry undergoing a transformation towards electric vehicles, advanced technology, and eco-friendly options, the financing models are also evolving. The competitive landscape is marked by traditional banks, specialized finance companies, and fintechs, each offering an array of financing solutions ranging from personal loans and leasing options to tailored financial services for dealerships and consumers alike.

Key players are leveraging technology to enhance customer experience, streamline processes, and expand their service offerings, thus fostering a dynamic environment where agility and responsiveness to market needs play essential roles in achieving competitive advantages.Santander Consumer Finance has established a solid presence in the France Automotive Finance Market, leveraging its extensive experience and a wide range of products to cater to the financial needs of both consumers and automotive dealers. The company is known for its efficient loan approval processes and competitive interest rates, which attract a diverse customer base.

Santander's strength lies in its ability to offer flexible financing solutions tailored specifically for the automotive sector, including financing options for both new and used vehicles.

With robust partnerships with various automotive manufacturers and dealerships throughout France, Santander Consumer Finance enhances its market reach while providing customers with seamless financing options. This extensive network positions the company favorably, allowing it to deepen its market penetration and maintain a competitive edge in the automotive finance space.BNP Paribas stands out in the France Automotive Finance Market with its comprehensive suite of financial services tailored to the automotive sector. The company offers a variety of products, including personal loans, vehicle leasing, and finance solutions for automotive dealers, designed to meet the strategic needs of customers across the buying cycle.

BNP Paribas's strong market presence is supported by its branch network and digital platforms, which facilitate easy access to financing.

The company's strengths lie in its strong brand reputation, extensive expertise in risk assessment, and customer service excellence. Moreover, BNP Paribas has engaged in several strategic mergers and acquisitions, enhancing its competency within the automotive finance arena and enabling the company to offer innovative solutions that align with evolving consumer preferences and technologies. Overall, BNP Paribas plays a pivotal role in shaping the financial landscape of the automotive market in France, focusing on sustainability and technological integration in its offerings.