Regulatory Changes and Incentives

Regulatory changes and government incentives significantly influence the automotive finance market in France. Recent policies have introduced various financial incentives for consumers, particularly for electric and hybrid vehicles. For instance, the government offers rebates of up to €7,000 for EV purchases, which encourages consumers to seek financing options that facilitate these transactions. Such incentives not only stimulate demand but also create opportunities for financial institutions to develop tailored products that meet the needs of environmentally conscious consumers. As regulations evolve, the automotive finance market must remain agile to adapt to these changes, ensuring compliance while maximizing growth potential.

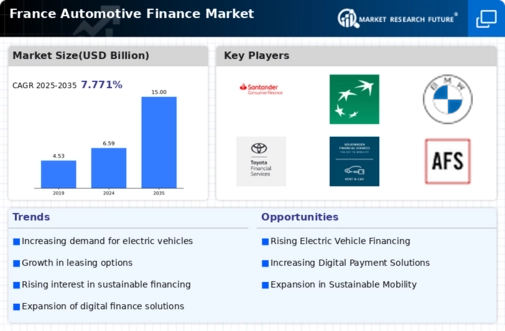

Increasing Consumer Demand for Vehicles

The automotive finance market in France is seeing a surge in consumer demand for vehicles. This increase is driven by economic recovery and changing consumer preferences. As disposable incomes rise, more individuals are inclined to purchase new vehicles, leading to an increase in financing options. In 2025, the demand for new cars is projected to grow by approximately 5%, which directly impacts the automotive finance market. This trend suggests that financial institutions may need to adapt their offerings to cater to a more diverse clientele, including younger buyers who prefer flexible financing solutions. Additionally, the growing interest in electric vehicles (EVs) is likely to further stimulate the market, as consumers seek financing options that align with their sustainability goals.

Rising Interest Rates and Economic Factors

The automotive finance market in France is currently navigating a landscape characterized by rising interest rates, which could impact consumer borrowing behavior. As the European Central Bank adjusts rates to combat inflation, financing costs for consumers may increase, leading to a potential slowdown in vehicle purchases. In 2025, average interest rates for auto loans are projected to rise by approximately 1.5%, which may deter some buyers from seeking financing. This situation compels financial institutions to reconsider their lending strategies, possibly offering more competitive rates or alternative financing solutions to attract customers. The interplay between economic factors and consumer sentiment will be crucial in shaping the future of the automotive finance market.

Shift Towards Sustainable Mobility Solutions

The automotive finance market in France is witnessing a shift towards sustainable mobility solutions. This change is driven by consumer preferences and regulatory pressures. As environmental awareness grows, consumers are increasingly seeking financing options for electric and hybrid vehicles. In 2025, it is anticipated that the market share of EVs will reach 25%, prompting financial institutions to develop specialized products that cater to this segment. This shift not only reflects changing consumer values but also aligns with government initiatives aimed at reducing carbon emissions. Consequently, the automotive finance market must adapt to these evolving demands, ensuring that financing solutions are accessible and appealing to environmentally conscious consumers.

Technological Advancements in Financing Solutions

Technological advancements are reshaping the automotive finance market in France, enabling more efficient and user-friendly financing solutions. The integration of digital platforms and mobile applications allows consumers to access financing options with greater ease. In 2025, it is estimated that over 60% of consumers will prefer online financing applications, reflecting a shift towards digitalization in the automotive finance market. This trend indicates that financial institutions must invest in technology to enhance customer experience and streamline processes. Moreover, the rise of data analytics enables lenders to assess creditworthiness more accurately, potentially reducing risks and improving loan approval rates.