-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the

- Research Objectives

- Assumptions & Limitations

-

Study

-

Markets Structure

-

Market Research Methodology

-

Research

-

Process

-

Primary Research

-

Secondary Research

-

Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Raw

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- End-Use

- Bargaining

- Bargaining Power

- Threat of Substitutes

- Intensity of Competitive Rivalry

-

Material Suppliers

-

Merchants

-

Porter’s Five Forces Analysis

-

Threat of New Entrants

-

Power of Buyers

-

of Suppliers

-

Market Price Analysis 2023-2030

-

Industry Overview

-

of the Global Fluoropolymer Coating Market

-

Introduction

-

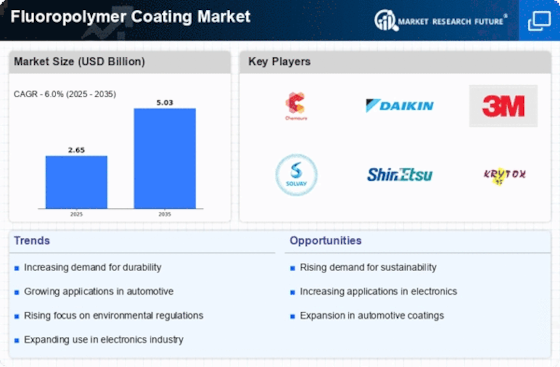

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

Market Trends

-

Introduction

-

Growth Trends

-

Impact Analysis

-

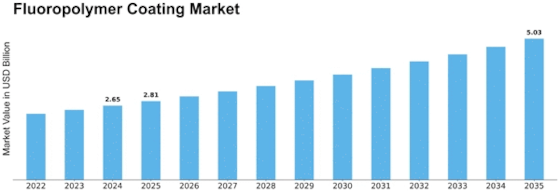

Global Fluoropolymer

-

Flouropolymer Coating Market, by Resin

-

Introduction

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Flouropolymer Coating Market, by Region, 2023-2030

- Market Estimates

- Market Estimates & Flouropolymer Coating Market, by Region,

-

Polyvinyl Fluoride (PVF)

-

Polytetrafluoroethylene (PTFE)

-

& Forecast, 2023-2030

-

Fluorinated Ethylene Propylene (FEP)

- Market Estimates & Forecast, 2023-2030

- Market Estimates

-

& Flouropolymer Coating Market, by Region, 2023-2030

-

Ethylene Tetrafluoroethylene

- Market Estimates & Forecast, 2023-2030

- Market Estimates & Flouropolymer Coating Market, by Region, 2023-2030

- Market Estimates

- Market Estimates & Flouropolymer Coating Market, by Region,

-

(ETFE)

-

Perfluoroalkoxy Alkanes (PFA)

-

& Forecast, 2023-2030

-

Others

- Market

- Market Estimates & Flouropolymer Coating Market,

-

Estimates & Forecast, 2023-2030

-

by Region, 2023-2030

-

Flouropolymer Coating Market, by End-Use Industry

-

Introduction

-

Building and Construction

- Market Estimates & Forecast, 2023-2030

- Market Estimates &

-

Flouropolymer Coating Market, by Region, 2023-2030

-

Automotive

- Market Estimates & Forecast, 2023-2030

- Market Estimates

-

& Flouropolymer Coating Market, by Region, 2023-2030

-

Aerospace

- Market Estimates & Forecast, 2023-2030

- Market Estimates

-

& Flouropolymer Coating Market, by Region, 2023-2030

-

Electrical

- Market Estimates & Forecast, 2023-2030

- Market Estimates

-

& Flouropolymer Coating Market, by Region, 2023-2030

-

Food Processing

- Market Estimates & Forecast, 2023-2030

-

Market Estimates & Flouropolymer Coating Market, by Region, 2023-2030

-

Others

- Market Estimates & Forecast, 2023-2030

-

Market Estimates & Flouropolymer Coating Market, by Region, 2023-2030

-

Global

-

Flouropolymer Coating Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast,

- Market Estimates & Forecast by Resin, 2023-2030

- Canada

-

Market Estimates & Forecast by End-Use Industry, 2023-2030

-

US

-

Estimates & Forecast by Resin, 2023-2030

-

Forecast by End-Use Industry, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

by Resin, 2023-2030

-

Europe

- Market

- Market Estimates & Forecast by

- Market Estimates & Forecast by End-Use Industry,

- Germany

- France

- Spain

- UK

- Russia

- Rest of Europe

-

Estimates & Forecast, 2023-2030

-

Resin, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

by Resin, 2023-2030

-

Forecast, 2023-2030

-

Italy

-

Market Estimates & Forecast by Resin, 2023-2030

-

& Forecast by End-Use Industry, 2023-2030

-

& Forecast by Resin, 2023-2030

-

by End-Use Industry, 2023-2030

-

Estimates & Forecast, 2023-2030

-

by Resin, 2023-2030

-

Forecast, 2023-2030

-

Netherlands

-

Market Estimates & Forecast by Resin, 2023-2030

-

& Forecast by End-Use Industry, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

Forecast by Resin, 2023-2030

-

Industry, 2023-2030

-

Asia-Pacific

- Market Estimates &

- Market Estimates & Forecast by End-Use

- China

- India

- Japan

- Thailand

- Malaysia

- Rest

-

Market Estimates & Forecast, 2023-2030

-

Forecast by Resin, 2023-2030

-

Industry, 2023-2030

-

& Forecast, 2023-2030

-

Estimates & Forecast by End-Use Industry, 2023-2030

-

& Forecast by Resin, 2023-2030

-

by End-Use Industry, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

by Resin, 2023-2030

-

Forecast, 2023-2030

-

Vietnam

-

Market Estimates & Forecast by Resin, 2023-2030

-

& Forecast by End-Use Industry, 2023-2030

-

of Asia-Pacific

-

Market Estimates & Forecast by Resin, 2023-2030

-

& Forecast by End-Use Industry, 2023-2030

-

Middle

- Market Estimates & Forecast,

- Market Estimates & Forecast by Resin, 2023-2030

- UAE

- Africa

- Rest of the Middle East & Africa

-

East & Africa

-

Market Estimates & Forecast by End-Use Industry, 2023-2030

-

Saudi Arabia

-

Market Estimates & Forecast by Resin, 2023-2030

-

& Forecast by End-Use Industry, 2023-2030

-

& Forecast by Resin, 2023-2030

-

by End-Use Industry, 2023-2030

-

Market Estimates & Forecast, 2023-2030

-

by Resin, 2023-2030

-

& Forecast by Resin, 2023-2030

-

by End-Use Industry, 2023-2030

-

Latin America

- Market Estimates & Forecast

- Market Estimates & Forecast by End-Use Industry,

- Brazil

- Argentina

- Rest

-

Market Estimates & Forecast, 2023-2030

-

by Resin, 2023-2030

-

& Forecast, 2023-2030

-

Market Estimates & Forecast by End-Use Industry, 2023-2030

-

Mexico

-

Market Estimates & Forecast by Resin, 2023-2030

-

& Forecast by End-Use Industry, 2023-2030

-

of Latin America

-

Estimates & Forecast by End-Use Industry, 2023-2030

-

Competitive

-

Landscape

-

Introduction

-

Market Key Strategies

-

Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New

-

Developments/Agreements/Investments)

-

Company Profiles

-

Daikin Industries Ltd

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

Product/Business Segment Overview

-

PPG Industries Inc.

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

The Chemours Company

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

KCC Corporation

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

Kansai Paints Co. Ltd

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

The Sherwin-Williams Company

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

Walter Wurdack Inc.

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

Axalta Coating Systems Ltd

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

Whitford Corporation

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Product/Business Segment Overview

-

Praxair Surface Technologies Inc.

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

Product/Business Segment Overview

-

Conclusion

-

LIST OF TABLES

-

Table 1

-

Flouropolymer Coating Market, by Region, 2023-2030

-

Table

-

North America: Flouropolymer Coating Market, by Country, 2023-2030

-

Europe: Flouropolymer Coating Market, by Country,

-

Asia-Pacific: Fluoropolymer Coating

-

Flouropolymer Coating Market, by Country, 2023-2030

-

Middle East

-

& Africa: Flouropolymer Coating Market, by Country, 2023-2030

-

Table

-

Latin America: Flouropolymer Coating Market, by Country, 2023-2030

-

Flouropolymer Coating Market, by Region,

-

North America: Fluoropolymer Coating

-

Flouropolymer Coating Market, by Country, 2023-2030

-

Europe:

-

Flouropolymer Coating Market, by Country, 2023-2030

-

Table 10

-

Asia-Pacific: Flouropolymer Coating Market, by Country, 2023-2030

-

Middle East & Africa: Fluoropolymer Coating

-

Flouropolymer Coating Market, by Country, 2023-2030

-

Latin

-

America: Flouropolymer Coating Market, by Country, 2023-2030

-

Table

-

Flouropolymer Coating Market, by Region, 2023-2030

-

North America: Fluoropolymer Coating End-Use

-

Flouropolymer Coating Market, by Country, 2023-2030

-

Europe:

-

Flouropolymer Coating Market, by Country, 2023-2030

-

Table

-

Asia-Pacific: Flouropolymer Coating Market,

-

by Country, 2023-2030

-

Middle East & Africa:

-

Flouropolymer Coating Market, by Country, 2023-2030

-

Table

-

Latin America: Flouropolymer Coating Market,

-

by Country, 2023-2030

-

LIST OF FIGURES

-

Fluoropolymer Coating Market Segmentation

-

Forecast Methodology

-

Porter’s Five

-

Forces Analysis of Fluoropolymer Coating Market

-

Supply Chain

-

of Fluoropolymer Coating Market

-

Share of Fluoropolymer Coating

-

Flouropolymer Coating Market, by Country, 2023 (%)

-

Global Fluoropolymer Coating Market,

-

Sub Segments of Resin

-

Fluoropolymer

-

Flouropolymer Coating Market, by Resin, 2023 (%)

-

Share of Fluoropolymer

-

Flouropolymer Coating Market, by Resin, 2023-2030

-

Sub Segments of End-Use

-

Industry

-

Flouropolymer Coating Market, by End-Use Industry,

-

Flouropolymer Coating Market, by End-Use Industry,

-

Sub Segments of End-Use Industry

-

FIGURE 14

-

Flouropolymer Coating Market, by End-Use Industry, 2023 (%)

-

FIGURE

-

Flouropolymer Coating Market, by End-Use Industry, 2023-2030

Leave a Comment