Research Methodology on Anti Corrosion Coating Market

Introduction

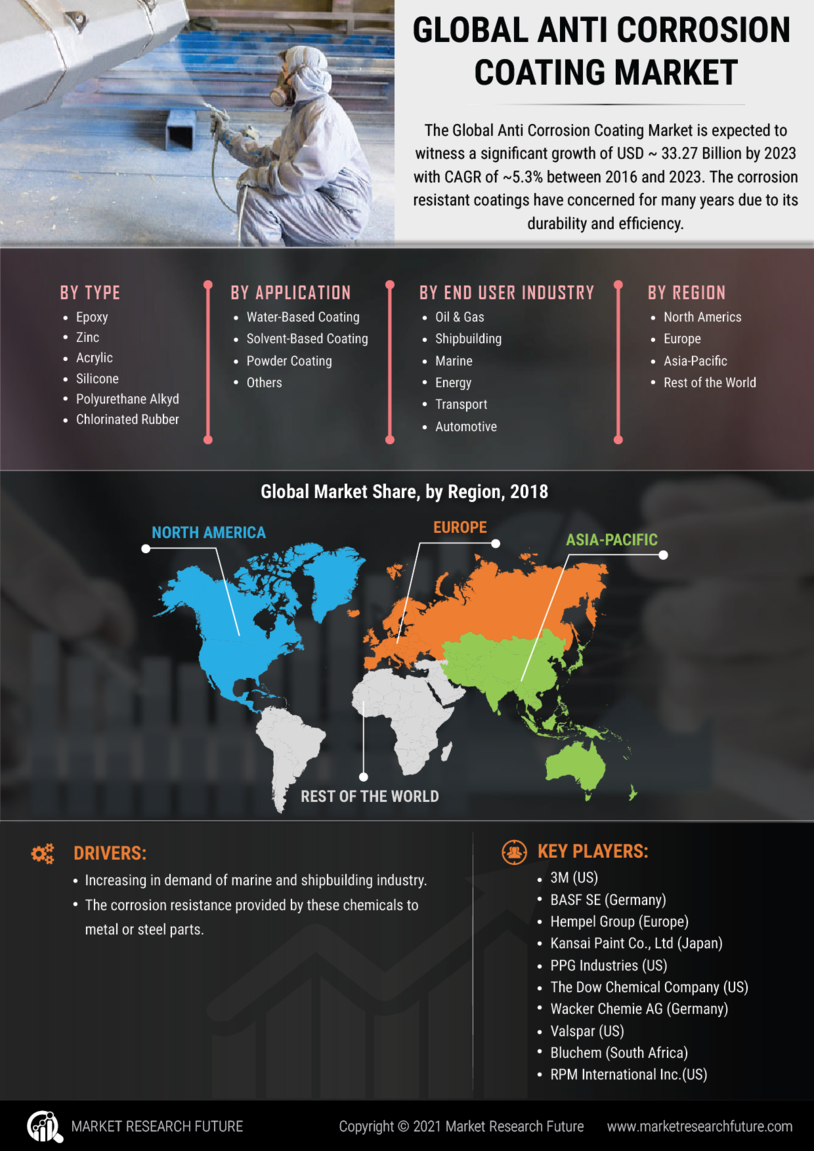

The global Anti-Corrosion Coating Market is anticipated to expand substantially over the forecast period between 2025 and 2034. Corrosion is a hydro chemical process that happens over time when metal or other materials react with their environment.

The reaction can cause weakening, swelling, deformation, cracking and other types of mechanical structural failure. To prevent these physical damages in metals, Anti-Corrosion Coating is used. Corrosion protection has become an important field in engineering design and construction material science. The growth of this market is propelled by the rising threat of corrosion in the construction and energy sectors. Anti-Corrosion Coatings are widely used in oil & gas, energy, industrial, offshore & marine and other sectors to reduce the effects of corrosion.

Research Methodology

The proposed research includes a comprehensive literature review on the global Anti-Corrosion Coating market, followed by an analysis of the key market trends and drivers. This is supplemented by an in-depth market assessment of the competitive landscape, including current and potential competitors and their growth strategies.

Primary Research

Primary research involves quantitative and qualitative assessment of the market to determine its size, develop a clear understanding of current market trends, and determine the competitiveness of the market landscape. This work will comprise direct interviews and surveys with industry experts and stakeholders from producers, suppliers, marketing and distribution companies, contractors and other participants in the supply chain. The interviews also include financial executives and analysts, strategic analysts, industry consultants, and other industry professionals. From these interviews, suggestions, industry/business insights and outcome of data is collected and documented.

Secondary Research

The secondary research involves an in-depth review of the existing published reports, company's historical financial statements, trade journals, press releases, government documents and other related industry publications. This source of data is used to supplement the primary research process and to assist in the validation of industry estimates and forecasts.

Data Analysis

The collected data is utilized to generate a detailed analysis of the global Anti-Corrosion Coating market. Analysis of the key market segments and developments is conducted based on the interview responses and the secondary research. A Descriptive and inferential analysis is used to assess the industry size, competitive intensity and the competitive landscape. The resulting data is used to arrive at a set of actionable recommendations that are presented in the final report.

Conclusion

The proposed research methodology outlined in this document is designed to assess and analyze the global Anti-Corrosion Coating market. A combination of primary and secondary research methods is used to collect data and generate insights into the market. An In-depth analysis of the collected data is conducted to assess the industry size, competitive intensity and the competitive landscape. The resulting data is used to arrive at a set of actionable recommendations.