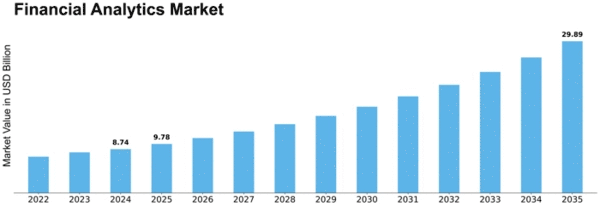

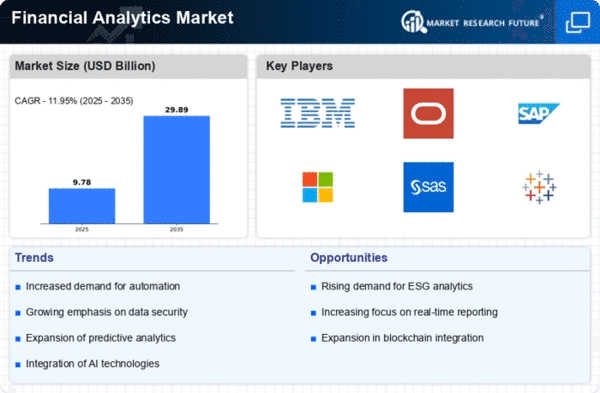

Financial Analytics Size

Financial Analytics Market Growth Projections and Opportunities

In the dynamic landscape of the Financial Analytics Market, companies employ various market share positioning strategies to gain a competitive edge and maximize their presence. One common approach is differentiation, where companies distinguish their financial analytics solutions from competitors through unique features or specialized services. By offering innovative functionalities or catering to specific niche needs, companies can carve out a distinct market space.

Another pivotal strategy is cost leadership, wherein organizations aim to provide financial analytics solutions at a lower cost than their competitors. This can involve streamlining processes, leveraging economies of scale, or adopting cost-efficient technologies. Cost leadership not only attracts price-sensitive customers but also allows companies to achieve higher profit margins through operational efficiency.

Furthermore, a focus on customer segmentation plays a crucial role in market share positioning. Tailoring financial analytics solutions to meet the unique requirements of different customer segments allows companies to address specific market needs effectively. Whether targeting small businesses, large enterprises, or specific industries, a segmented approach enables companies to deliver more personalized and relevant solutions.

Strategic partnerships and collaborations also feature prominently in market share positioning. By forming alliances with other businesses, companies can expand their reach, access new markets, and enhance their overall capabilities. This approach fosters synergies, combining strengths from different entities to create a more comprehensive and competitive offering in the financial analytics space.

Moreover, geographical expansion is a strategic move employed by companies to increase market share. By entering new regions or countries, organizations can tap into untapped markets and diversify their customer base. This may involve adapting solutions to local regulations and preferences, ensuring a seamless integration into the new market while staying competitive.

Innovation is a cornerstone of successful market share positioning in the Financial Analytics Market. Companies that invest in research and development to continually enhance their solutions and stay ahead of technological trends are better positioned to capture market share. Whether through advancements in artificial intelligence, machine learning, or data visualization, staying at the forefront of innovation enables companies to meet evolving customer demands and preferences.

Furthermore, customer-centric strategies contribute significantly to market share growth. Establishing strong customer relationships, providing excellent support, and actively seeking customer feedback allow companies to refine their offerings based on actual user experiences. This approach not only fosters loyalty but also positions a company as a trusted partner in the financial analytics realm.

Lastly, effective marketing and brand positioning are essential components of market share strategies. Building a strong brand presence, communicating value propositions clearly, and creating compelling marketing campaigns contribute to attracting and retaining customers. A well-defined brand identity helps establish trust and recognition, influencing customers' choices in a crowded market.

In conclusion, the Financial Analytics Market is highly competitive, and companies employ diverse strategies to position themselves favorably and capture market share. Whether through differentiation, cost leadership, customer segmentation, strategic partnerships, geographical expansion, innovation, customer-centric approaches, or effective branding, each strategy plays a vital role in shaping a company's standing in the dynamic landscape of financial analytics. Successful market share positioning requires a thoughtful combination of these strategies, adapted to the specific challenges and opportunities presented by the ever-evolving market.

Leave a Comment