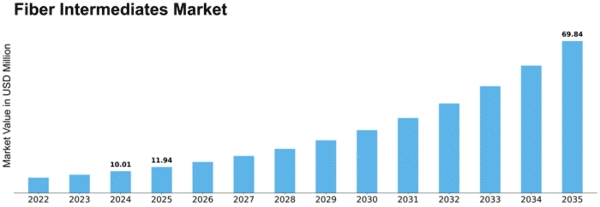

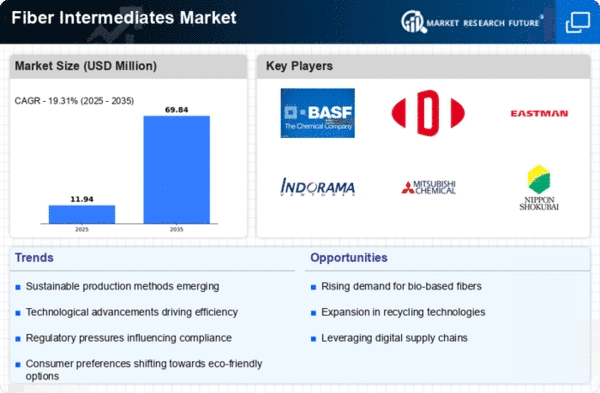

Fiber Intermediates Size

Fiber Intermediates Market Growth Projections and Opportunities

The fiber intermediates market is influenced by a variety of factors that collectively shape its dynamics and demand across the textile and related industries. The following key points outline the market factors contributing to the evolution and demand for fiber intermediates:

Foundation of Textile Industry: Fiber intermediates serve as the foundation of the textile industry, playing a pivotal role in the production of synthetic fibers such as polyester and nylon. The demand for these fibers is driven by the textile and apparel sectors, influencing the overall market for fiber intermediates.

Growth in Apparel and Textile Consumption: The increasing global population and rising consumer affluence contribute to the growth in apparel and textile consumption. As more people seek affordable and diverse clothing options, the demand for synthetic fibers produced from fiber intermediates experiences a corresponding increase.

Expanding Polyester Fiber Market: Polyester, derived from fiber intermediates, is one of the most widely used synthetic fibers. The expansion of the polyester fiber market is a significant factor driving the demand for fiber intermediates, with applications ranging from clothing and home textiles to industrial uses.

Rising Demand for Nylon Fibers: Nylon, another key synthetic fiber, is produced from fiber intermediates. The demand for nylon fibers is driven by applications in textiles, automotive components, and industrial products, contributing to the overall growth of the fiber intermediates market.

Innovation in Sustainable Fibers: The market is witnessing a trend towards sustainable and eco-friendly fibers. Manufacturers are exploring bio-based alternatives and recycling processes for fiber intermediates to address environmental concerns and meet the growing demand for sustainable textiles.

Technological Advancements in Production: Ongoing technological advancements in the production of fiber intermediates contribute to improved efficiency and cost-effectiveness. Innovations in manufacturing processes, catalyst technologies, and raw material utilization enhance the overall competitiveness of the fiber intermediates market.

Automotive Industry Applications: Fiber intermediates find applications in the automotive industry for the production of synthetic fibers used in automotive textiles, carpets, and interior components. The growth of the automotive sector globally positively impacts the demand for fiber intermediates.

Geopolitical and Economic Factors: Global economic conditions and geopolitical factors influence the fiber intermediates market. Trade policies, currency fluctuations, and regional economic developments impact the cost of raw materials and the overall competitiveness of fiber intermediates in the global market.

Consumer Preferences for Performance Textiles: Changing consumer preferences for high-performance textiles drive the demand for synthetic fibers produced from fiber intermediates. Performance attributes such as durability, moisture-wicking, and stain resistance contribute to the popularity of these fibers in various applications.

Shift in Fashion Industry Trends: The fashion industry's evolving trends influence the demand for specific types of fibers. The adaptability of fiber intermediates to changing fashion preferences, including the demand for athleisure and sustainable fashion, contributes to their continued relevance in the market.

Raw Material Availability and Pricing: The availability and pricing of raw materials, such as petrochemical feedstocks, impact the cost structure of fiber intermediates. Fluctuations in raw material prices and supply chain dynamics influence the overall competitiveness and profitability of the market.

Focus on Circular Economy: The emphasis on a circular economy in the textile industry influences the development of recycling processes for fiber intermediates. Manufacturers are investing in technologies to recycle post-consumer and post-industrial waste, contributing to a more sustainable and circular approach in fiber production.

Regulatory Landscape: The regulatory landscape, including environmental and safety standards, plays a crucial role in the fiber intermediates market. Compliance with regulations governing chemical manufacturing and environmental impact is essential for market participants to ensure sustainable and responsible practices.

Global Supply Chain Considerations: The fiber intermediates market is part of a complex global supply chain. Factors such as transportation costs, logistics, and supply chain disruptions impact the movement of raw materials and finished products, influencing the overall market dynamics.

Leave a Comment