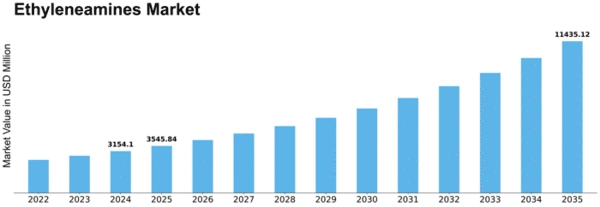

Ethyleneamines Size

Ethyleneamines Market Growth Projections and Opportunities

The Ethyleneamines market is influenced by various factors, both internal and external, that shape its dynamics and performance. One of the primary market factors is the demand-supply balance. Ethyleneamines find extensive applications across diverse industries such as automotive, construction, agriculture, and personal care, driving the demand for the product. Factors like population growth, urbanization, and economic development contribute significantly to the rising demand for end products, consequently impacting the demand for ethyleneamines. Moreover, the availability of raw materials, particularly ethylene oxide, directly influences production volumes and, subsequently, market dynamics.

Ethyleneamines are organic compounds containing ethylene linkages between amine groups. They are primarily used as building block chemicals and in epoxy resin curing agents. They have wide range of applications due to their unique combination of reactivity, surface activity, and basicity.

Market competition also plays a crucial role in shaping the Ethyleneamines market. The presence of key players, their market strategies, technological advancements, and product innovations contribute to market competitiveness. Additionally, regulatory frameworks and compliance standards impact market dynamics. Stringent regulations related to environmental standards, product safety, and health regulations influence production processes, product formulations, and market entry barriers, thereby affecting market growth and competitiveness.

Economic factors such as GDP growth rates, inflation rates, and currency fluctuations also significantly impact the Ethyleneamines market. Economic downturns can lead to reduced consumer spending and industrial activities, consequently affecting the demand for ethyleneamines. On the other hand, rapid economic growth in emerging markets can create lucrative opportunities for market expansion and investment.

Technological advancements and innovations play a pivotal role in driving market growth and competitiveness. Ongoing research and development efforts aimed at enhancing product efficiency, performance, and sustainability contribute to market expansion and product differentiation. Moreover, technological advancements in manufacturing processes, such as process optimization, automation, and scale-up capabilities, influence production efficiency, cost-effectiveness, and market competitiveness.

Environmental factors, including sustainability concerns and regulatory initiatives, are increasingly influencing the Ethyleneamines market. Growing awareness regarding environmental pollution and carbon footprint has led to a shift towards sustainable practices and eco-friendly products. As a result, there is a rising demand for bio-based ethyleneamines and eco-friendly manufacturing processes. Regulatory initiatives aimed at reducing emissions, promoting energy efficiency, and enforcing environmental standards also impact market dynamics and product formulations.

Market trends and consumer preferences also shape the Ethyleneamines market. Changing consumer lifestyles, preferences for convenience, and increasing demand for high-performance products drive innovation and product development in the ethyleneamines market. Moreover, shifting industry trends towards lightweight materials, energy-efficient technologies, and sustainable solutions create new opportunities and challenges for market players.

Global geopolitical developments and trade policies also influence the Ethyleneamines market. Trade tensions, tariffs, and geopolitical conflicts can disrupt supply chains, affect raw material prices, and impact market dynamics. Additionally, regional dynamics such as demographic trends, cultural preferences, and market maturity levels influence market growth trajectories and business strategies.

Leave a Comment