Electric Vehicle Motor Market Analysis

Electric Vehicle Motor Market Research Report Information By Power Rating (>80 Kw, 40 Kw-80 Kw, and <40 kW), By Motor Type (Brushless Motors, DC Brushed Motors, Induction (Asynchronous) Motors, Switched Reluctance Motors, and Synchronous Motors), and By Region (North America, Europe, Asia-Pacific, and Rest Of The World) – Global Industry Size, Share, Growth, Trends and Forecast To 2030

Market Summary

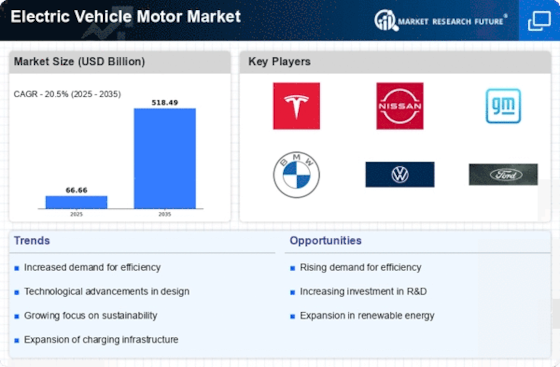

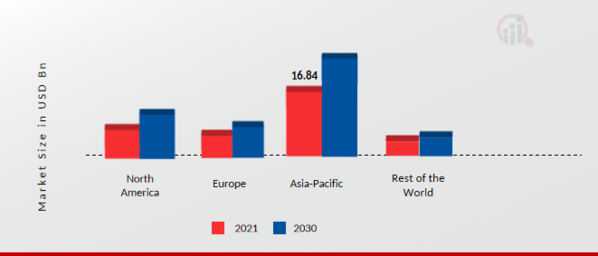

As per Market Research Future Analysis, the global electric vehicle motor market was valued at USD 38.1 billion in 2021 and is projected to grow from USD 45.91 billion in 2022 to USD 169.36 billion by 2030, with a CAGR of 20.50% during the forecast period. Key drivers include rising demand for energy-efficient motors and stringent government regulations aimed at reducing carbon emissions. The Asia-Pacific region accounted for USD 16.84 billion in 2021, with China holding the largest market share. The DC brushed motors segment dominated the market in 2021, while brushless motors are expected to grow the fastest due to their energy efficiency. However, high initial costs and regulatory challenges may hinder market growth.

Key Market Trends & Highlights

The electric vehicle motor market is witnessing significant trends driven by efficiency and regulatory compliance.

- Market size in 2021: USD 38.1 billion.

- Projected market size by 2030: USD 169.36 billion.

- CAGR from 2022 to 2030: 20.50%.

- Asia-Pacific market size in 2021: USD 16.84 billion.

Market Size & Forecast

| 2021 Market Size | USD 38.1 Billion |

| 2022 Market Size | USD 45.91 Billion |

| 2030 Market Size | USD 169.36 Billion |

| CAGR (2022-2030) | 20.50% |

| Largest Regional Market Share in 2021 | Asia-Pacific. |

Major Players

Key players include Continental AG, Hitachi Automotive Systems Ltd., Tesla Inc., BYD Auto Co. Ltd., Denso Corporation, and Siemens AG.

Market Trends

Rising demand for energy-efficient motors to boost the market growth

As per the US Department of Energy (DOE), in March 2020, electric vehicle motor were responsible for half of the energy utilization in the US manufacturing sector. Electric vehicle motor used in industrial and infrastructure applications are responsible for 53% of the world's total electricity consumption. Thus, various regulations have been implemented to ensure efficient and effective energy utilization. The International Electrotechnical Commission (IEC), a European regulatory authority, has set energy efficiency norms. Various countries have started implementing such regulations to enhance the energy efficiency of electric vehicle motor.

IEC has created a set of motor effectiveness regulations, known as IE1, IE2, IE3, and IE4, for decreasing carbon emissions.

Further, Development in the electric vehicle motor and an enhancement in government regulations and guidelines concerning vehicular emanations are the major reasons driving the electric vehicle motor industry. Nonetheless, the high starting cost of an electric engine and the high support costs related to an electric vehicle motor limit the development of the market.

Additionally, the electric vehicle powertrain control frameworks significantly affect the electric vehicle's range. The utilization of strict administrative restrictions is another major factor in industry expansion. Various governments have established stringent discharge standards to decrease GHG emissions and mitigate the causes of unnatural weather change. It thus expected automakers to develop zero-discharge automobiles to abide by more difficult emission regulations. These regulations have resulted in a more effective focus on producing the more capable electric car, which will boost market for electric vehicle motor during the forecast period.

However, Speedy urbanization, which adds a premium for financial transportation mediums like electric vehicles, is a key driver impacting the market expansion. When standing out from IC vehicles, electric vehicles are all the more monetarily clever and have a lower environmental impact. Thus, speedy urbanization drives the growth of the electric vehicle motor market revenue.

The transition towards electric vehicles is poised to reshape the automotive landscape, driven by advancements in motor technology and increasing regulatory support for sustainable transportation solutions.

U.S. Department of Energy

Electric Vehicle Motor Market Market Drivers

Market Growth Projections

The Global Electric Vehicle Motor Market Industry is on a trajectory of remarkable growth, with projections indicating a substantial increase in market size. By 2035, the market is expected to reach 430.3 USD Billion, reflecting a robust demand for electric vehicle motors. This growth is supported by various factors, including technological advancements, government incentives, and increasing consumer awareness of environmental issues. The anticipated compound annual growth rate (CAGR) of 18.77% from 2025 to 2035 further underscores the potential for expansion within the industry. Such projections highlight the dynamic nature of the market and the opportunities it presents for stakeholders.

Rising Demand for Electric Vehicles

The Global Electric Vehicle Motor Market Industry is experiencing a surge in demand driven by the increasing adoption of electric vehicles (EVs) worldwide. As consumers become more environmentally conscious, the shift towards EVs is evident. In 2024, the market is projected to reach 64.9 USD Billion, reflecting a growing preference for sustainable transportation solutions. Governments are also incentivizing EV purchases through subsidies and tax breaks, further propelling market growth. This trend is expected to continue, with the market anticipated to expand significantly as more manufacturers enter the EV space, enhancing the overall appeal of electric mobility.

Government Regulations and Incentives

The Global Electric Vehicle Motor Market Industry is significantly influenced by government regulations aimed at reducing carbon emissions and promoting sustainable transportation. Many countries are implementing stringent emission standards, which compel automotive manufacturers to invest in electric vehicle technologies. Incentives such as tax credits, rebates, and grants for EV purchases further stimulate consumer interest. This regulatory environment is expected to foster a robust growth trajectory for the market, with a projected compound annual growth rate (CAGR) of 18.77% from 2025 to 2035. Such policies not only support the transition to electric mobility but also enhance the overall market landscape.

Technological Advancements in Motor Design

Technological innovations in electric motor design are pivotal to the Global Electric Vehicle Motor Market Industry. Enhanced efficiency and performance are achieved through advancements such as the development of permanent magnet synchronous motors and improved battery integration. These innovations not only increase the range and performance of electric vehicles but also reduce manufacturing costs. As a result, the market is likely to witness a substantial transformation, with projections indicating a growth to 430.3 USD Billion by 2035. The continuous evolution of motor technology is essential for meeting the demands of modern consumers and ensuring the competitiveness of electric vehicles in the automotive sector.

Growing Infrastructure for Electric Vehicles

The expansion of charging infrastructure is a critical driver for the Global Electric Vehicle Motor Market Industry. As more charging stations are established globally, consumer confidence in electric vehicles increases, alleviating range anxiety. This infrastructure development is supported by both public and private investments, which are essential for facilitating the widespread adoption of electric vehicles. The availability of fast-charging stations and home charging solutions enhances the practicality of owning an EV. Consequently, the market is poised for significant growth, as improved infrastructure is likely to attract more consumers to electric mobility, thereby contributing to the overall market expansion.

Environmental Awareness and Sustainability Trends

The Global Electric Vehicle Motor Market Industry is increasingly shaped by heightened environmental awareness among consumers. As climate change concerns grow, individuals are more inclined to choose electric vehicles over traditional combustion engines. This shift is not merely a trend but a fundamental change in consumer behavior, driven by the desire for sustainable living. The market is expected to benefit from this shift, as electric vehicles are perceived as a cleaner alternative. With the market projected to reach 64.9 USD Billion in 2024, it is evident that sustainability is becoming a core value in the automotive industry, influencing purchasing decisions and driving market growth.

Market Segment Insights

Electric Vehicle Motor Power Rating Insights

The electric vehicle motor market segmentation, based on power rating, includes >80 Kw, 40 Kw-80 Kw, and <40 kW. The >80 Kw segment held the majority share 2021 of the electric vehicle motor revenue. This is primarily due to low maintenance and can produce high torque at low speeds. However, 40 Kw-80 Kw is the fastest-growing category in the market due to its cost-effectiveness.

Figure 1: Electric Vehicle Motor Market, by Power Rating, 2021 & 2030 (USD Million)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Electric Vehicle Motor Type Insights

The electric vehicle motor market segmentation is based on motor type, brushless motors, DC brushed motors, induction (Asynchronous) motors, switched reluctance motors, and synchronous motors. The DC brushed motors segment dominated the market for electric vehicle motor in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. They are utilized extensively in small DC motors and, to a growing extent, in traction applications. A characteristic of series motors is that the motor develops a huge amount of starting torque.

However, brushless motors are the fastest-growing category as they are more energy-efficient than brushed drills and can run on batteries for up to 50 percent longer.

Get more detailed insights about Electric Vehicle Motor Market Research Report- Forecast 2030

Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World. Asia-Pacific electric vehicle motor market accounted for USD 16.84 billion in 2021 and is expected to exhibit a significant CAGR growth during the study period. Due to developing industrialization, Asia Pacific countries are moving toward web-based modern exercises in all areas. The GSM Association reports that Asia Pacific nations like Australia, Japan, and South Korea are progressively investigating the conceivable outcomes of recent administrations and related items. The district's car market is, in like manner, flourishing.

Asia Pacific is the globe's most noteworthy producer of cars. Moreover, China electric vehicle motor market held the largest market share, and India electric vehicle motor was the fastest-growing market in the Asia-Pacific region.

Further, the major countries studied in the electric vehicle motor market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Electric Vehicle Motor Market Share By Region 2021 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe electric vehicle motor market accounts for the second-largest market share due to the steps taken by the regional government to reduce carbon emissions have been the driving factor for the growth of the market in Europe. Further, the Germany electric vehicle motor market held the largest market share, and the UK electric vehicle motor market was the fastest-growing market in the European region.

The North America electric vehicle motor market is anticipated to grow at the fastest CAGR from 2022 to 2030. This is attributed to the presence of emerging players in these regions that are focused on developing electric vehicle motor technologies and increasing the efficiency of electric motors to increase the cruising range of electric vehicle motor. Moreover, US electric vehicle motor market held the largest market share, and the Canada electric vehicle motor market was the fastest-growing market in the North America region.

Key Players and Competitive Insights

Major market players are spending a lot on R&D to increase their product lines, which will help to grow the electric vehicle motor market data. Market participants are also taking a range of strategic initiatives to grow their footprint ly, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, expand its investments, and collaboration with other organizations. Competitors in the electric vehicle motor industry must provide cost-effective items to expand and survive in an increasingly competitive and growing environment for electric vehicle motor market.

One of the primary business strategies manufacturers adopt in the electric vehicle motor industry to benefit clients and expand the market sector is manufacturing locally to reduce operating costs. In the electric vehicle motor market, major players such as Continental AG (Germany), Hitachi Automotive Systems Ltd. (Japan), Tesla Inc. (US) and others are working on expanding the electric vehicle motor market demand by investing in research and development activities and expanding the electric vehicle motor market revenue.

ABB Ltd is a technology leader in electrification and automation, allowing a more sustainable and resource-efficient future. The firm solutions connect engineering know-how and software to optimize how things are moved, manufactured, powered and operated. Building on more than 130 years of greatness, ABB's 105,000 employees are determined to drive innovations that fuel industrial transformation. In August 2022, ABB announced that it had signed an acquisition to purchase Siemen's low-voltage NEMA motor business. With manufacturing operations in Guadalajara, Mexico, this acquisition provides a well-regarded product portfolio, a longstanding North American customer base, and experienced operations, sales, and management team.

Also, WEG is a electric-electronic equipment firm, operating majorly in the capital goods sector with solutions in electric machines, automation and paints for several sectors, including infrastructure, steel, pulp and paper, oil and gas, and mining, among many others. WEG stands out in innovation by constantly developing solutions to meet the major trends in energy efficiency, renewable energy and electric mobility. With manufacturing units in 12 countries and present in more than 135 countries, the company has more than 36,900 employees worldwide.

In July 2022, WEG launched the W12 electric vehicle motor, designed for high-performance industrial applications while offering versatility and efficiency.

Key Companies in the Electric Vehicle Motor Market market include

Industry Developments

- Q2 2024: Nidec to build new EV motor plant in Mexico to supply North American automakers Nidec Corporation announced plans to construct a new electric vehicle motor manufacturing facility in Mexico, aiming to strengthen its supply chain for North American EV makers and meet growing regional demand.

- Q2 2024: Bosch acquires U.S. startup Seeo to boost solid-state EV motor technology Bosch completed the acquisition of Seeo, a California-based startup specializing in advanced solid-state motor and battery technology, to accelerate its development of next-generation electric vehicle motors.

- Q3 2024: Tesla signs multi-year supply agreement with LG Innotek for high-efficiency EV motors Tesla entered into a multi-year contract with LG Innotek to source high-efficiency electric vehicle motors for its upcoming models, enhancing its supply chain resilience and motor performance.

- Q3 2024: General Motors opens new EV motor production line at Ramos Arizpe plant General Motors inaugurated a new production line dedicated to electric vehicle motors at its Ramos Arizpe facility in Mexico, expanding its EV manufacturing capabilities in North America.

- Q4 2024: BorgWarner launches next-generation 800V electric drive module for global EV market BorgWarner unveiled its new 800V electric drive module, designed to deliver higher efficiency and power density for electric vehicles, targeting both existing and new automotive customers worldwide.

- Q4 2024: Rivian secures $1.2 billion in funding to expand EV motor R&D and production Rivian announced a $1.2 billion funding round led by institutional investors, with proceeds earmarked for expanding research, development, and manufacturing of advanced electric vehicle motors.

- Q1 2025: Hyundai Motor Group opens new EV motor R&D center in South Korea Hyundai Motor Group officially opened a state-of-the-art research and development center focused on electric vehicle motor innovation, aiming to accelerate the development of next-generation propulsion systems.

- Q1 2025: Magna International wins major contract to supply EV motors to Volkswagen Magna International secured a significant contract to supply electric vehicle motors for Volkswagen’s new global EV platform, marking a major win for the Canadian auto parts supplier.

- Q2 2025: Siemens and Tata Motors announce joint venture for EV motor manufacturing in India Siemens and Tata Motors formed a joint venture to establish a large-scale electric vehicle motor manufacturing facility in India, targeting both domestic and export markets.

- Q2 2025: ZF Friedrichshafen launches new compact EV motor for urban mobility segment ZF Friedrichshafen introduced a new compact electric vehicle motor designed specifically for urban mobility solutions, aiming to capture growing demand in the small EV segment.

- Q2 2025: BYD opens new EV motor plant in Brazil to serve Latin American market BYD inaugurated a new electric vehicle motor manufacturing facility in Brazil, expanding its production footprint to better serve the rapidly growing Latin American EV market.

- Q3 2025: Lucid Motors appoints new CTO to lead next-gen EV motor development Lucid Motors announced the appointment of a new Chief Technology Officer, tasking the executive with spearheading the development of next-generation electric vehicle motor technologies.

Future Outlook

Electric Vehicle Motor Market Future Outlook

The Global Electric Vehicle Motor Market is poised for robust growth, driven by technological advancements and increasing demand, with an anticipated 18.77% CAGR from 2024 to 2035.

New opportunities lie in:

- Invest in R&D for high-efficiency motor technologies to enhance vehicle performance.

- Develop partnerships with automotive manufacturers for integrated motor solutions.

- Explore emerging markets for electric vehicle infrastructure to capture new customer segments.

By 2035, the market is expected to reach unprecedented levels, reflecting substantial growth and innovation.

Market Segmentation

Electric Vehicle Motor Type Outlook

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Electric Vehicle Motor Regional Outlook

- US

- Canada

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Middle East

- Africa

- Latin America

Electric Vehicle Motor Power Rating Outlook

- >80 kW

- 40 kW-80 Kw

- <40 kW

Report Scope

| Attribute/Metric | Details |

| Market Size 2021 | USD 38.1 billion |

| Market Size 2022 | USD 45.91 billion |

| Market Size 2030 | USD 169.36 billion |

| Compound Annual Growth Rate (CAGR) | 20.50% (2022-2030) |

| Base Year | 2021 |

| Market Forecast Period | 2022-2030 |

| Historical Data | 2018 & 2020 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Operating Platforms, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Continental AG (Germany), Hitachi Automotive Systems Ltd. (Japan), Tesla Inc. (US), BYD Auto Co. Ltd. (China), Denso Corporation (Japan), Metric Mind Corporation (US), Mitsubishi Electric Corporation (Japan), Allied Motion Technologies Inc. (US), Robert Bosch GmbH (Germany), and Siemens AG (Germany). |

| Key Market Opportunities | Emerging robotic technology will increase the demand for electric vehicle motor. |

| Key Market Dynamics | The rise in demand for electric vehicle motor Stringent safety regulations set by the government for the automotive industry |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the electric vehicle motor market?

The electric vehicle motor market size was valued at USD 38.1 Billion in 2021.

What is the growth rate of the electric vehicle motor market?

The market is projected to grow at a CAGR of 4.7% during the forecast period 2022-2030.

Which region held the largest market share in the electric vehicle motor market?

North America had the largest share of the market

Who are the key players in the electric vehicle motor market?

The electric vehicle motor key players are Continental AG (Germany), Hitachi Automotive Systems Ltd. (Japan), Tesla Inc. (US), BYD Auto Co. Ltd. (China), Denso Corporation (Japan), and Metric Mind Corporation (US).

Which power rating led the electric vehicle motor market?

The >80 Kw category dominated the market in 2021.

Which motor type had the largest market share in the electric vehicle motor market?

The DC brushed motors had the largest share in the market.

-

'TABLE OF CONTENTS 1 EXECUTIVE SUMMARY

-

2 SCOPE OF THE REPORT

- MARKET DEFINITION

-

SCOPE OF THE STUDY

- DEFINITION

- RESEARCH OBJECTIVE

- ASSUMPTIONS

- LIMITATIONS

-

RESEARCH PROCESS

- PRIMARY RESEARCH

- SECONDARY RESEARCH

- MARKET SIZE ESTIMATION

- FORECAST MODEL 3 MARKET LANDSCAPE

-

PORTER’S FIVE FORCES ANALYSIS

-

THREAT OF NEW ENTRANTS

- BARGAINING POWER OF BUYERS

-

THREAT OF NEW ENTRANTS

-

BARGAINING POWER OF SUPPLIERS

-

THREAT OF SUBSTITUTES

- SEGMENT RIVALRY

-

THREAT OF SUBSTITUTES

-

VALUE CHAIN/SUPPLY CHAIN ANALYSIS 4 MARKET DYNAMICS

- INTRODUCTION

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- MARKET TRENDS 5 GLOBAL

-

ELECTRIC VEHICLE MOTOR MARKET, BY MOTOR TYPE

- INTRODUCTION

-

DC BRUSHED MOTORS

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2022-2030

-

DC BRUSHLESS MOTORS

- MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET

-

ESTIMATES & FORECAST BY REGION, 2022-2030

-

INDUCTION (ASYNCHRONOUS) MOTOR

- MARKET

-

INDUCTION (ASYNCHRONOUS) MOTOR

-

ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2022-2030

-

SYNCHRONOUS MOTOR

- MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET

-

ESTIMATES & FORECAST BY REGION, 2022-2030

-

SWITCHED RELUCTANCE MOTOR

- MARKET

-

SWITCHED RELUCTANCE MOTOR

-

ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST

-

BY REGION, 2022-2030

-

6 GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY POWER RATING

- INTRODUCTION

-

<40 KW

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2022-2030

-

40 KW-80 KW

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2022-2030

-

>80 KW

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST BY REGION, 2022-2030 7

-

GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY REGION

- INTRODUCTION

-

NORTH AMERICA

- MARKET

-

ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST

-

BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING

- THE U.S

-

MARKET ESTIMATES & FORECAST BY POWER RATING

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

- CANADA

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

- MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

EUROPE

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST

-

BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING

- U.K

-

MARKET ESTIMATES & FORECAST BY POWER RATING

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

- GERMANY

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

- FRANCE

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

- ITALY

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

- REST OF EUROPE

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

- MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

ASIA PACIFIC

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST

-

BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING

- CHINA

-

MARKET ESTIMATES & FORECAST BY POWER RATING

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

- JAPAN

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

- INDIA

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY MOTOR TYPE, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

MARKET ESTIMATES & FORECAST BY POWER RATING, 2022-2030

-

REST OF ASIA PACIFIC

-

MARKET ESTIMATES & FORECAST, 2022-2030

- MARKET

-

MARKET ESTIMATES & FORECAST, 2022-2030

-

ESTIMATES & FORECAST BY MOTOR TYPE, 2022-2030

- MARKET ESTIMATES

-

FORECAST BY POWER RATING, 2022-2030

-

REST OF THE WORLD

- MARKET

-

REST OF THE WORLD

-

ESTIMATES & FORECAST, 2022-2030

- MARKET ESTIMATES & FORECAST

-

BY MOTOR TYPE, 2022-2030

- MARKET ESTIMATES & FORECAST BY POWER RATING

-

2022-2030 8 COMPETITIVE LANDSCAPE 9 COMPANY PROFILE

-

CONTINENTAL AG (GERMANY)

- COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

CONTINENTAL AG (GERMANY)

-

HITACHI AUTOMOTIVE SYSTEMS, LTD. (JAPAN)

-

COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

TESLA, INC. (U.S.)

- COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

COMPANY OVERVIEW

-

BYD AUTO CO., LTD. (CHINA)

-

COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

DENSO CORPORATION (JAPAN)

- COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

COMPANY OVERVIEW

-

METRIC MIND CORPORATION (U.S.)

-

COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

COMPANY OVERVIEW

-

MITSUBISHI ELECTRIC CORPORATION (JAPAN)

-

COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

COMPANY OVERVIEW

-

ALLIED MOTION TECHNOLOGIES INC. (U.S)

-

COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

COMPANY OVERVIEW

-

ROBERT BOSCH GMBH (GERMANY)

-

COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

SIEMENS AG (GERMANY)

- COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERING

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- STRATEGY

- SWOT ANALYSIS

-

COMPANY OVERVIEW

-

1 GLOBAL ELECTRIC VEHICLE MOTOR MARKET: BY REGION, 2022-2030

-

VEHICLE MOTOR MARKET: BY COUNTRY, 2022-2030 ELECTRIC VEHICLE MOTOR MARKET: BY COUNTRY, 2022-2030 PACIFIC ELECTRIC VEHICLE MOTOR MARKET: BY COUNTRY, 2022-2030 ROW ELECTRIC VEHICLE MOTOR MARKET: BY COUNTRY, 2022-2030 GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY MOTOR TYPE, BY REGIONS, 2022-2030

-

7 NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET

-

BY MOTOR TYPE, BY COUNTRY, 2022-2030 ELECTRIC VEHICLE MOTOR MARKET, BY MOTOR TYPE, BY COUNTRY, 2022-2030 ASIA PACIFIC ELECTRIC VEHICLE MOTOR MARKET BY MOTOR TYPE, BY COUNTRY, 2022-2030

-

10 ROW ELECTRIC VEHICLE MOTOR MARKET BY MOTOR TYPE, BY COUNTRY

-

2022-2030

-

11 GLOBAL ELECTRIC VEHICLE MOTOR MARKET BY APPLICATION: BY REGIONS

-

2022-2030

-

12 NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET BY APPLICATION:

-

BY COUNTRY, 2022-2030 APPLICATION: BY COUNTRY, 2022-2030 VEHICLE MOTOR MARKET BY APPLICATION: BY COUNTRY, 2022-2030 ELECTRIC VEHICLE MOTOR MARKET BY APPLICATION: BY COUNTRY, 2022-2030 GLOBAL ELECTRIC VEHICLE MOTOR MARKET: BY REGION, 2022-2030 NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY COUNTRY AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY MOTOR TYPE VEHICLE MOTOR MARKET, BY APPLICATION MOTOR MARKET, BY COUNTRY BY MOTOR TYPE

-

22 EUROPE: ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION

-

ASIA PACIFIC: ELECTRIC VEHICLE MOTOR MARKET, BY COUNTRY ASIA PACIFIC: ELECTRIC VEHICLE MOTOR MARKET, BY MOTOR TYPE ASIA PACIFIC: ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION ROW: ELECTRIC VEHICLE MOTOR MARKET, BY REGION MARKET, BY MOTOR TYPE

-

28 ROW ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION LIST OF FIGURES

-

TOP DOWN & BOTTOM UP APPROACH ANALYSIS: MARKET DRIVERS PORTER’S FIVE FORCES ANALYSIS GLOBAL ELECTRIC VEHICLE MOTOR MARKET SHARE, BY MOTOR TYPE, 2020 (%) GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY TECHNOLOGY MOTOR TYPE, 2022-2030 (USD MILLION)

-

10 GLOBAL ELECTRIC VEHICLE MOTOR MARKET SHARE (%), BY REGION

-

11 GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY REGION, 2022-2030 (USD MILLION)

-

12 NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET SHARE (%), 2020

-

NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET BY COUNTRY, 2022-2030 (USD MILLION) EUROPE ELECTRIC VEHICLE MOTOR MARKET SHARE (%), 2020 MOTOR MARKET BY COUNTRY, 2022-2030 (USD MILLION) VEHICLE MOTOR MARKET SHARE (%), 2020 MOTOR MARKET BY COUNTRY, 2022-2030 (USD MILLION) VEHICLE MOTOR MARKET SHARE (%), 2020 MOTOR MARKET BY COUNTRY, 2022-2030 (USD MILLION)'

Electric Vehicle Motor Market Segmentation

Electric Vehicle Motor Power Rating Outlook (USD Million, 2018-2030)

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

Electric Vehicle Motor Type Outlook (USD Million, 2018-2030)

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Electric Vehicle Motor Regional Outlook (USD Million, 2018-2030)

North America Outlook (USD Million, 2018-2030)

- North America Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- North America Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

US Outlook (USD Million, 2018-2030)

- US Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- US Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

CANADA Outlook (USD Million, 2018-2030)

- CANADA Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- CANADA Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

- North America Electric Vehicle Motor by Power Rating

Europe Outlook (USD Million, 2018-2030)

- Europe Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Europe Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Germany Outlook (USD Million, 2018-2030)

- Germany Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Germany Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

France Outlook (USD Million, 2018-2030)

- France Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- France Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

UK Outlook (USD Million, 2018-2030)

- UK Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- UK Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

ITALY Outlook (USD Million, 2018-2030)

- ITALY Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- ITALY Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

SPAIN Outlook (USD Million, 2018-2030)

- Spain Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Spain Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Rest Of Europe Outlook (USD Million, 2018-2030)

- Rest Of Europe Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- REST OF EUROPE Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

- Europe Electric Vehicle Motor by Power Rating

Asia-Pacific Outlook (USD Million, 2018-2030)

- Asia-Pacific Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Asia-Pacific Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

China Outlook (USD Million, 2018-2030)

- China Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- China Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Japan Outlook (USD Million, 2018-2030)

- Japan Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Japan Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

India Outlook (USD Million, 2018-2030)

- India Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- India Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Australia Outlook (USD Million, 2018-2030)

- Australia Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Australia Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Rest of Asia-Pacific Outlook (USD Million, 2018-2030)

- Rest of Asia-Pacific Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Rest of Asia-Pacific Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

- Asia-Pacific Electric Vehicle Motor by Power Rating

Rest of the World Outlook (USD Million, 2018-2030)

- Rest of the World Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Rest of the World Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

- Rest of the World Electric Vehicle Motor by Power Rating

Middle East Outlook (USD Million, 2018-2030)

- Middle East Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Middle East Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Africa Outlook (USD Million, 2018-2030)

- Africa Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Africa Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Latin America Outlook (USD Million, 2018-2030)

- Latin America Electric Vehicle Motor by Power Rating

- >80 Kw

- 40 Kw-80 Kw

- <40 Kw

- Latin America Electric Vehicle Motor by Type

- Brushless Motors

- DC Brushed Motors

- Induction (Asynchronous) Motor

- Switched Reluctance Motor

- Synchronous Motor

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment