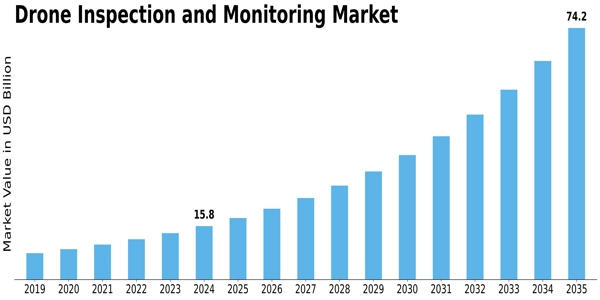

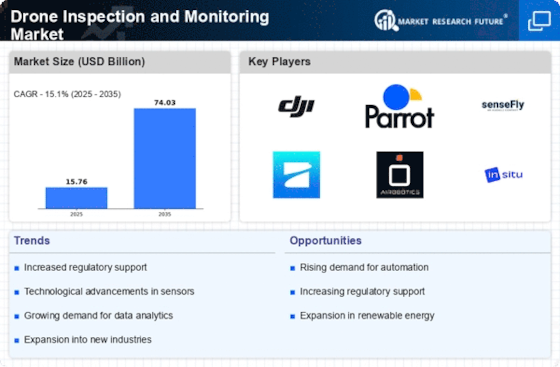

Drone Inspection Monitoring Size

Drone Inspection Monitoring Market Growth Projections and Opportunities

The drone inspection and monitoring market are influenced by several key factors that drive its growth and development. One significant factor is the increasing demand for cost-effective and efficient inspection solutions across various industries. Traditional methods of inspection and monitoring, such as manual inspections or manned aircraft surveys, are often time-consuming, labor-intensive, and expensive. In contrast, drones offer a versatile and accessible alternative, enabling companies to conduct aerial inspections and surveys quickly, safely, and at a fraction of the cost. As industries such as oil and gas, utilities, infrastructure, agriculture, and construction seek to improve asset management, safety, and operational efficiency, there is a growing adoption of drone-based inspection and monitoring solutions to streamline processes, reduce downtime, and minimize risk.

Moreover, technological advancements play a crucial role in shaping the drone inspection and monitoring market. The rapid development of drone technology, including advancements in airframe design, sensor capabilities, battery life, and autonomous flight capabilities, has significantly expanded the capabilities and applications of drones for inspection and monitoring purposes. Modern drones are equipped with high-resolution cameras, thermal imaging sensors, LiDAR scanners, and other specialized sensors that enable detailed and accurate data capture for various inspection tasks, such as infrastructure inspection, crop monitoring, asset surveillance, and environmental monitoring. Additionally, advancements in software algorithms and data analytics enable companies to process, analyze, and interpret drone-captured data to extract actionable insights and make informed decisions, driving market demand for integrated drone solutions that offer end-to-end inspection and monitoring capabilities.

Furthermore, regulatory frameworks and safety standards significantly influence market dynamics in the drone inspection and monitoring sector. Aviation authorities, such as the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA) in Europe, impose regulations and guidelines that govern the operation of drones for commercial purposes, including inspection and monitoring activities. Compliance with these regulations is essential to ensure safe and responsible drone operations, mitigate risks to airspace safety, and protect public safety and privacy. Companies operating in the drone inspection and monitoring market must adhere to certification requirements, obtain necessary permits and licenses, and implement safety protocols to ensure compliance with regulatory requirements and build trust with customers and stakeholders.

Additionally, market demand for drone inspection and monitoring solutions is driven by factors such as aging infrastructure, asset maintenance requirements, and the need for predictive maintenance strategies. Many industries, including utilities, oil and gas, transportation, and manufacturing, rely on critical infrastructure assets, such as pipelines, power lines, bridges, and industrial facilities, to support their operations. As these assets age and deteriorate over time, there is a growing need for proactive inspection and maintenance strategies to identify potential issues, assess asset condition, and prioritize maintenance activities. Drone-based inspection solutions offer a cost-effective and efficient means of conducting routine inspections, detecting defects, and monitoring asset health, enabling companies to implement data-driven maintenance strategies that minimize downtime, reduce costs, and extend asset lifespan.

Moreover, market factors such as environmental regulations, sustainability goals, and the rise of digitalization drive innovation and adoption in the drone inspection and monitoring market. With increasing awareness of environmental risks, companies are under pressure to comply with environmental regulations, minimize environmental impact, and adopt sustainable practices in their operations. Drone-based inspection and monitoring solutions offer environmentally friendly alternatives to traditional inspection methods, reducing the need for ground-based vehicles, equipment, and personnel, and minimizing disruption to ecosystems. Additionally, the digitization of inspection data and integration with enterprise asset management systems enable companies to optimize asset performance, improve regulatory compliance, and enhance decision-making processes, driving market demand for digital inspection solutions that offer seamless integration with existing workflows and systems.

Furthermore, the impact of the COVID-19 pandemic has accelerated market growth and adoption of drone inspection and monitoring solutions. With travel restrictions, social distancing measures, and remote work arrangements in place, companies are increasingly turning to drones to conduct inspections and surveys remotely, without the need for onsite personnel or physical presence. Drones offer a safe and efficient means of conducting inspections in challenging or hazardous environments, such as remote or confined spaces, without exposing workers to unnecessary risks. Additionally, the pandemic has highlighted the importance of resilience, agility, and digitalization in business operations, driving market demand for drone-based inspection solutions that offer remote access, real-time data capture, and digital collaboration capabilities.

Leave a Comment