Digital Payment Healthcare Market Trends

Digital Payment in Healthcare Market Research Report Information By Component Solution (Solution, Service), By Deployment (On-Premise, Cloud), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Industry Forecast Till 2035

Market Summary

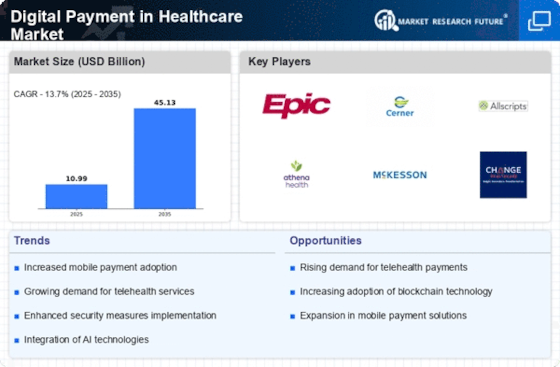

As per Market Research Future Analysis, the Digital Payment in Healthcare Market is set to grow from USD 10.99 billion in 2024 to USD 30.69 billion by 2032, reflecting a CAGR of 13.70% from 2024 to 2032. The market was valued at USD 9.66 billion in 2023. Key drivers include the need for efficiency, technological advancements, and the growing adoption of digital payment solutions across various sectors, particularly healthcare. The solution segment leads the market due to its ability to streamline payment processes, while cloud deployment is favored for its scalability and cost-effectiveness. North America holds the largest market share, followed by Europe and Asia-Pacific, with significant growth expected in the latter region due to increased adoption in manufacturing.

Key Market Trends & Highlights

The Digital Payment in Healthcare Market is influenced by several key trends.

- Market size in 2024: USD 10.99 billion; projected to reach USD 30.69 billion by 2032.

- CAGR of 13.70% during the forecast period (2024 - 2032).

- Cloud solutions dominate due to scalability and cost-effectiveness.

- North America leads the market share, followed by Europe and Asia-Pacific.

Market Size & Forecast

| 2023 Market Size | USD 9.66 billion |

| 2024 Market Size | USD 10.99 billion |

| 2032 Market Size | USD 30.69 billion |

| CAGR | 13.70% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Key players include Fiserv, Inc., Aliant Payments, First Data Corporation, Wirecard AG, Stripe, Worldpay, LLC, Payments Direct, Inc., and PayPal.

Market Trends

Technological advancements are driving the market growth

The expansion of digital payment in the healthcare industry during the forecast period is being driven by the most recent technology to facilitate corporate operations. Companies are eager to implement these technologies to increase their scalability and flexibility and lower overall operating costs. With the aid of software as a service, businesses are outsourcing their business operations to a third-party company so they can concentrate on their core capabilities. Additionally, automation of corporate operations is aided by artificial intelligence and machine learning. This factor drives the market CAGR.

Additionally, the growth of digital payment in the healthcare market is driven by several factors, including the need to adopt new IT solutions aligned with consumer trends, the demand for simplified procurement processes by enterprises, and the management of compliance policies and agreements. However, outsourcing risks and management difficulties could be improved to market growth. On the other hand, technological advancements, increased demand from the manufacturing sectors, and the adoption of AI and big data technologies present promising opportunities for market growth in the forecast period. Thus, driving the Digital Payment in Healthcare market revenue.

The ongoing shift towards digital payment solutions in healthcare is reshaping the financial landscape, enhancing efficiency and accessibility for patients and providers alike.

U.S. Department of Health and Human Services

Digital Payment Healthcare Market Market Drivers

Market Growth Projections

Government Initiatives and Support

Government initiatives play a crucial role in shaping the Global Digital Payment in Healthcare Market Industry. Various countries are implementing policies to promote digital payments in healthcare, aiming to improve efficiency and reduce fraud. For instance, regulatory frameworks are being established to ensure secure transactions and protect patient data. These initiatives often include funding for technology upgrades and incentives for healthcare providers to adopt digital payment systems. As a result, the market is likely to witness accelerated growth, with a projected CAGR of 13.7% from 2025 to 2035, reflecting the positive impact of government support on the industry.

Growing Focus on Patient-Centric Care

The Global Digital Payment in Healthcare Market Industry is increasingly driven by a growing focus on patient-centric care. Healthcare providers are recognizing the importance of enhancing patient experiences, which includes simplifying payment processes. By offering user-friendly digital payment options, providers can improve patient satisfaction and loyalty. This shift towards patient-centricity is prompting healthcare organizations to invest in advanced payment technologies, thereby facilitating smoother transactions. As the industry evolves, the emphasis on patient-centric care is expected to contribute to the overall growth of the digital payment market, aligning with broader trends in healthcare delivery.

Rising Demand for Contactless Payments

The Global Digital Payment in Healthcare Market Industry experiences a notable shift towards contactless payment methods. This trend is driven by consumer preferences for convenience and safety, as patients increasingly favor digital transactions over traditional cash or card payments. In 2024, the market is projected to reach 11.0 USD Billion, reflecting a growing acceptance of mobile wallets and QR code payments. Healthcare providers are adapting to this demand by integrating these technologies into their systems, enhancing patient experience while ensuring secure transactions. This evolution in payment methods is likely to contribute to the overall growth of the industry.

Emergence of Innovative Payment Solutions

The Global Digital Payment in Healthcare Market Industry is witnessing the emergence of innovative payment solutions that cater to the unique needs of healthcare providers and patients. Technologies such as blockchain and artificial intelligence are being integrated into payment systems to enhance security and efficiency. These innovations not only streamline payment processes but also provide valuable insights into patient behavior and preferences. As healthcare organizations adopt these advanced solutions, the market is poised for substantial growth, with projections indicating a potential market size of 45.1 USD Billion by 2035. The continuous evolution of payment technologies is likely to reshape the industry landscape.

Increased Adoption of Telehealth Services

The Global Digital Payment in Healthcare Market Industry is significantly influenced by the rising adoption of telehealth services. As healthcare providers expand their digital offerings, the need for efficient payment solutions becomes paramount. Patients utilizing telehealth platforms require seamless payment options to facilitate consultations and treatments. The integration of digital payment systems into telehealth services not only streamlines the payment process but also enhances patient satisfaction. This trend is expected to bolster the market, as telehealth continues to gain traction, potentially leading to a market valuation of 45.1 USD Billion by 2035.

Market Segment Insights

Digital Payment in Healthcare Component Solution Insights

The Digital Payment in Healthcare market segmentation, based on component solutions, includes solutions and services. The solution segment dominated the market because solutions streamline payment processes by allowing patients to electronically make secure and convenient transactions. They eliminate the need for manual paperwork, reduce administrative costs, and improve overall efficiency. Additionally, digital payment solutions provide greater transparency and accuracy in financial transactions, enhancing the patient experience.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Digital Payment in Healthcare Deployment Insights

Based on Deployment, the Digital Payment in Healthcare market segmentation includes on-premise and Cloud. The dominance of the cloud segment in the digital payment in the healthcare market can be attributed to its inherent benefits, such as scalability, flexibility, cost-effectiveness, and ease of implementation. Cloud-based solutions enable organizations to access services and data seamlessly, anytime and anywhere, using any device, providing convenience and accessibility.

Digital Payment in Healthcare Organization Size Insights

Based on organization size, the Digital Payment in Healthcare market segmentation includes small and medium-sized enterprises (SMEs) and large enterprises. The large enterprise segment dominated the market because large enterprises typically have more complex needs, higher transaction volumes, and larger budgets, making outsourcing a more viable option for them. Large enterprises often have diverse supplier networks, operations, and the need for specialized digital expertise.

Get more detailed insights about Digital Payment in Healthcare Market Research Report - Global Forecast till 2032

Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Digital Payment in the Healthcare market will dominate due to the increased need to drive efficiency and effectiveness and will boost the market growth in this Region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: DIGITAL PAYMENT IN HEALTHCARE MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe's Digital Payment in the Healthcare market accounts for the second-largest market share because digital payment in healthcare is witnessing growth across various verticals, including energy and utilities, healthcare, and life sciences. The increased adoption of digital payment in healthcare services in these industries contributes to market expansion. Further, the German Digital Payment in the Healthcare market held the largest market share, and the UK Digital Payment in the Healthcare market was the fastest-growing market in the European Region.

The Asia-Pacific Digital Payment in Healthcare Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to adoption in the manufacturing vertical. The verticals include retail and consumer goods, manufacturing, IT, and telecommunications. Moreover, China’s Digital Payment in the Healthcare market held the largest market share, and Indian Digital Payment in the Healthcare market was the fastest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help digital payment in the healthcare market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To thrive in the increasingly competitive healthcare industry, digital payment solutions must provide cost-effective options to expand their reach and meet the growing market demands.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the Digital Payment in the Healthcare industry to benefit clients and increase the market sector. In recent years, the Digital Payment in Healthcare industry has offered some of the most significant advantages to medicine.

Major players in the Digital Payment in the Healthcare market, including Aurus Inc. (US), Aliant Payments (US), Stripe (US), ACI Worldwide, Inc. (US), Payments Direct, Inc. (US), First Data Corporation (US), PayPal (US), Worldpay, LLC (UK), Wirecard AG (Germany), Fiserv, Inc. (US), InstaMed (US), Billing Tree (US), Change Healthcare (US), Elavon Inc. (US), and Zelis Payments (US)., and To boost market demand, some companies are focusing on enhancing their research and development capabilities.

ParkMobile, a subsidiary of EasyPark Group, is a leading provider of smart parking and mobility solutions in North America. It offers a contactless approach that enables millions of users to easily locate, reserve, and pay for parking through their mobile devices. With a wide presence in over 3,000 locations, including 39 of the top 100 U.S. cities, ParkMobile has gained popularity among more than 40 million consumers. Its services encompass various parking options such as on- and off-street parking, airport and event reservations, transient reservations, and municipal parking permit solutions.

Recently, ParkMobile announced a partnership with EasyPark, a cooperative specializing in office solutions.

Aliant is an international law firm comprised of carefully selected elite law firms worldwide. These independent firms combine expertise in cross-border transactions and litigation, combining knowledge with local understanding to deliver top-notch legal advice. In a pioneering move, Aliant became one of the first payment processors to offer a cryptocurrency payment solution called CryptoBucks. This strategic initiative aims to expand partnerships with major retailers, fintech companies, and software developers, fostering greater adoption of cryptocurrency payments.

Key Companies in the Digital Payment Healthcare Market market include

Industry Developments

- Q1 2025: Digital Payment Evolution Reshapes Healthcare Financial Landscape TrustCommerce published a new national study in January 2025 revealing a dramatic shift toward digital payment preferences in healthcare, with 96% of surveyed organizations now accepting credit card payments and 69% offering flexible payment plans.

- Q3 2025: Survey: 60% of Adults 60+ Use Digital Payments for Healthcare TrustCommerce announced survey results in August 2025 showing that nearly 60% of Americans aged 60 and older are at least somewhat comfortable using digital payments for healthcare, highlighting increased adoption among older adults.

Future Outlook

Digital Payment Healthcare Market Future Outlook

The Digital Payment in Healthcare Market is projected to grow at a 13.7% CAGR from 2024 to 2035, driven by technological advancements, increased demand for convenience, and regulatory support.

New opportunities lie in:

- Develop blockchain-based payment solutions for enhanced security and transparency.

- Implement AI-driven analytics to optimize payment processes and reduce fraud.

- Expand mobile payment platforms tailored for telehealth services and remote patient management.

By 2035, the market is expected to achieve substantial growth, reflecting a robust digital transformation in healthcare.

Market Segmentation

Digital Payment in Healthcare Regional Outlook

- US

- Canada

Digital Payment in Healthcare By Deployment Outlook

- On-Premise

- Cloud

Digital Payment in Healthcare By Organization Size Outlook

- Small and medium-sized enterprises (SMEs)

- Large enterprises

Digital Payment in Healthcare By Component Solution Outlook

- Solution

- Service

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | USD 9.66 Billion |

| Market Size 2024 | USD 10.99 Billion |

| Market Size 2032 | USD 30.69 Billion |

| Compound Annual Growth Rate (CAGR) | 13.70% (2024-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Component Solution, Deployment, Organization Size, and Region |

| Geographies Covered | North America, Europe, AsiaPacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Aurus Inc. (US), Aliant Payments (US), Stripe (US), ACI Worldwide, Inc. (US), Payments Direct, Inc. (US), First Data Corporation (US), PayPal (US), Worldpay, LLC (UK), Wirecard AG (Germany), Fiserv, Inc. (US), InstaMed (US), Billing Tree (US), Change Healthcare (US), Elavon Inc. (US), and Zelis Payments (US) |

| Key Market Opportunities | Digital payment solutions in healthcare are witnessing a notable rise in adoption across various industries, including energy and utilities, healthcare, and life sciences. |

| Key Market Dynamics | Increased need to drive efficiency and effectiveness |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is Digital Payment in the Healthcare market?

The Digital Payment in Healthcare market size was valued at USD 9.66 Billion in 2023.

What is the growth rate of Digital Payment in the Healthcare market?

The market is projected to grow at a CAGR of 13.70% during the forecast period, 2024-2032.

Which Region witnessed the largest market share in Digital Payment in the Healthcare market?

North America witnessed the largest share of the market

Who are the major players in Digital Payment in the Healthcare market?

The major players in the market are Aurus Inc. (US), Aliant Payments (US), Stripe (US), ACI Worldwide, Inc. (US), Payments Direct, Inc. (US), First Data Corporation (US), PayPal (US), Worldpay, LLC (UK), Wirecard AG (Germany), Fiserv, Inc. (US).

Which Component Solution Led the Digital Payment in the Healthcare Market?

The Solution Digital Payment in the Healthcare category dominated the market in 2022.

Which Deployment had the largest market share in Digital Payment in the Healthcare market?

The Cloud had the largest share of the market.

-

Table of Contents

-

1 Executive Summary

-

Market Attractiveness Analysis

- Global Digital Payment

-

in Healthcare Market, by Component

- Global Digital Payment

-

in Healthcare Market, by Organization Size

- Global Digital

-

Payment in Healthcare Market, by Deployment

- Digital Payment

-

in Healthcare Market, by Region

-

2 Market Introduction

- Definition

- Scope of the Study

- Market Structure

-

3 Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size

-

Estimation

- Forecast Model

- List

-

of Assumptions

-

4 Market Insights

-

5 Market

-

Dynamics

- Introduction

-

Drivers

- Digital Transformation of Healthcare Vertical

-

Growing Digital Payments in Health Insurance

- Growing

-

Number of Smartphones

- Drivers Impact Analysis

-

Restraints

-

Domination of Paper-based Billing

- Concerns Regarding Security of Data

-

Domination of Paper-based Billing

-

Restraints Impact Analysis

-

Opportunities

- Demand for Fast and Hassle-Free Transaction Services

-

Challenges

- Rising Cyber Attacks

- Technological Trends

- Regulatory

-

Opportunities

-

Landscape / Standards

-

6 Market Factor Analysis

-

Supply/Value Chain Analysis

- Porter’s Five

-

Forces Model

-

Threat of New Entrants

-

Threat of New Entrants

-

Bargaining Power of Suppliers

- Bargaining Power

-

of Buyers

-

Threat of Substitutes

-

Threat of Substitutes

-

Intensity of Rivalry

-

7 Global Digital Payment

- Overview

-

Solutions

- Solutions: Market Estimates & Forecast

-

by Region/Country, 2020–2027

-

Services

-

Services

-

Services: Market Estimates & Forecast by Region/Country, 2020–2027

-

Intelligence

- Intelligence:

-

Intelligence

-

Market Estimates & Forecast by Region/Country, 2020–2027

-

8

-

Global Digital Payment in Healthcare Market, By Organization Size

-

Overview

-

Large Enterprise

-

Large Enterprise

-

Large Enterprise: Market Estimates & Forecast by Region/Country, 2020–2027

-

Small and Medium-Sized Enterprise

-

Small and Medium-Sized Enterprise

-

Small and Medium-Sized Enterprise: Market Estimates & Forecast by Region/Country,

-

2020–2027

-

9 Global Digital Payment in Healthcare

-

Market, By Deployment

- Overview

-

On-Premise

- On-Premise: Market Estimates & Forecast by Region/Country,

-

Cloud

- Cloud:

-

10 Global Digital Payment in Healthcare Market, By Region

- Overview

-

North America

-

Market Estimates & Forecast, by Country, 2020–2027

-

Market Estimates & Forecast, by Component, 2020–2027

-

Market Estimates & Forecast, by Organization Size, 2020–2027

-

Market Estimates & Forecast, by Deployment, 2020–2027

- Market Estimates & Forecast, by Vertical, 2020–2027

- US

-

Market Estimates & Forecast, by Deployment, 2020–2027

-

Component, 2020–2027

- Market Estimates & Forecast, by Organization

-

Size, 2020–2027

-

Market Estimates & Forecast, by Deployment,

- Market Estimates & Forecast, by Vertical, 2020–2027

- Canada

-

Market Estimates & Forecast, by Deployment,

-

by Component, 2020–2027

- Market Estimates & Forecast, by

-

Organization Size, 2020–2027

- Market Estimates & Forecast,

-

by Deployment, 2020–2027

- Market Estimates & Forecast, by

-

Vertical, 2020–2027

- Mexico

-

Market Estimates & Forecast, by Component, 2020–2027

- Market

-

Estimates & Forecast, by Organization Size, 2020–2027

- Market

-

Estimates & Forecast, by Deployment, 2020–2027

- Market Estimates

-

& Forecast, by Vertical, 2020–2027

-

Europe

- Market Estimates & Forecast, by Country, 2020–2027

- Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Organization Size,

- Market Estimates & Forecast, by

-

Europe

-

Deployment, 2020–2027

- Market Estimates &

-

Forecast, by Vertical, 2020–2027

-

UK

- Market Estimates & Forecast, by Component, 2020–2027

-

UK

-

Market Estimates & Forecast, by Organization Size, 2020–2027

-

Market Estimates & Forecast, by Deployment, 2020–2027

- Market

-

Estimates & Forecast, by Vertical, 2020–2027

-

Germany

-

Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Organization Size, 2020–2027

-

Market Estimates & Forecast, by Component, 2020–2027

-

Market Estimates & Forecast, by Vertical, 2020–2027

-

France

-

Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Organization Size, 2020–2027

-

Market Estimates & Forecast, by Component, 2020–2027

-

Rest of Europe

-

Market Estimates & Forecast, by Component,

- Market Estimates & Forecast, by Organization Size,

-

Asia-Pacific

- Market Estimates

-

Market Estimates & Forecast, by Component,

-

& Forecast, by Country, 2020–2027

- Market

-

Estimates & Forecast, by Component, 2020–2027

-

- Market Estimates & Forecast, by Deployment, 2020–2027

- Market Estimates & Forecast, by Vertical, 2020–2027

- China

- Japan

- India

-

-

Rest of Asia-Pacific

-

Market Estimates & Forecast, by Component,

- Market Estimates & Forecast, by Organization Size,

-

Rest of the World

- Market

-

Market Estimates & Forecast, by Component,

-

Estimates & Forecast, by Country, 2020–2027

-

Market

- Market Estimates & Forecast, by Deployment, 2020–2027

- Market Estimates & Forecast, by Vertical, 2020–2027

- South America

-

Market

-

Forecast, by Component, 2020–2027

- Market Estimates & Forecast,

-

by Organization Size, 2020–2027

-

Market Estimates & Forecast, by

- Middle East &

-

Market Estimates & Forecast, by

-

Africa

-

Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Organization Size, 2020–2027

-

Market Estimates & Forecast, by Component, 2020–2027

-

11

-

Competitive Landscape

- Competitive Overview

- Competitor Dashboard

- Major

-

Growth Strategy in the Global Digital Payment in Healthcare Market

-

Competitive Benchmarking

-

12 Company Profiles

-

InstaMed

- Company Overview

- Financial Overview

- Product

-

InstaMed

-

Offerings

-

Key Development

-

Key Development

-

SWOT Analysis

- Key Strategies

-

BillingTree

-

Company Overview

-

Company Overview

-

Financial Overview

-

Product Offerings

-

Product Offerings

-

Key Development

-

SWOT Analysis

-

SWOT Analysis

-

Key Strategies

-

Change Healthcare

-

Change Healthcare

-

Company Overview

-

Financial Overview

-

Financial Overview

-

Product Offerings

-

Key Development

- Key Strategies

-

Key Development

-

Elavon Inc.

-

Company Overview

- Product Offerings

- SWOT Analysis

-

Zelis Payments

- Financial Overview

- Key Development

- Key Strategies

-

Company Overview

-

Aliant Payments

-

Company Overview

- Product Offerings

- SWOT Analysis

-

Aurus Inc.

- Financial Overview

- Key Development

- Key Strategies

-

Company Overview

-

Stripe

-

Company Overview

- Product Offerings

- SWOT Analysis

-

ACI Worldwide, Inc.

- Financial Overview

- Key Development

- Key Strategies

-

Company Overview

-

Global Payments Direct, Inc.

-

Company Overview

- Financial

-

Company Overview

-

Overview

-

Product Offerings

- Key Development

-

Product Offerings

-

SWOT Analysis

- Key Strategies

- First Data

-

Corporation

-

Company Overview

- Financial Overview

-

Company Overview

-

Product Offerings

-

Key Development

- SWOT Analysis

-

Key Development

-

Key Strategies

-

PayPal

- Company Overview

- Financial Overview

- Product Offerings

- Key Development

- SWOT Analysis

- Key Strategies

- Worldpay,

-

PayPal

-

LLC

-

Company Overview

- Financial Overview

- Product

- Key Development

- SWOT Analysis

- Key

-

Company Overview

-

Strategies

-

Wirecard AG

- Company Overview

- Financial Overview

- Product Offerings

- Key Development

- SWOT Analysis

- Key Strategies

- Fiserv,

-

Wirecard AG

-

Inc.

-

Company Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Company Overview

-

** Note: Details on financial overview, SWOT analysis, and key

-

strategies might not be captured in case of unlisted companies as their financial

-

details are not disclosed due to private ownership or unavailability of financial

-

data on public domain or any other reliable source.

-

13 Industry

-

Insights

- Technological Impact Analysis

-

Use Cases

- Best Practices

-

14

-

Appendix

- List of Abbreviation

-

Related Research Market Study

-

-

LIST OF TABLES

-

Table

-

1 Global Digital Payment in Healthcare Market,

-

by Region, 2020–2027

-

Table 2 North

-

America: Global Digital Payment in Healthcare Market, by Country, 2020–2027

-

Table 3 Europe: Global Digital Payment in

-

Healthcare Market, by Country, 2020–2027

-

Table 4

-

Asia-Pacific: Global Digital Payment in Healthcare Market, by Country, 2020–2027

-

Table 5 Rest of the World: Global Digital

-

Payment in Healthcare Market, by Country, 2020–2027

-

Table 6

-

North America: Global Digital Payment in Healthcare Component

-

Market, by Country, 2020–2027

-

Table 7

-

Europe: Global Digital Payment in Healthcare Component Market, by Country,

-

Table 8 Asia-Pacific:

-

Global Digital Payment in Healthcare Component Market, by Country, 2020–2027

-

Table 9 Rest of the World: Global Digital

-

Payment in Healthcare Component Market, by Country, 2020–2027

-

Table 10

-

Global Digital Payment in Healthcare Organization Size

-

Market, by Region, 2020–2027

-

Table 11

-

North America: Global Digital Payment in Healthcare Organization Size Market,

-

by Country, 2020–2027

-

Table 12 Europe:

-

Global Digital Payment in Healthcare Organization Size Market, by Country, 2020–2027

-

Table 13 Asia-Pacific: Global Digital Payment

-

in Healthcare Organization Size Market, by Country, 2020–2027

-

Table 14

-

Rest of the World: Global Digital Payment in Healthcare

-

Organization Size Market, by Country, 2020–2027

-

Table 15

-

Global Digital Payment in Healthcare Deployment Market,

-

Table 16 North

-

America: Global Digital Payment in Healthcare Deployment Market, by Country, 2020–2027

-

Table 17 Europe: Global Digital Payment in

-

Healthcare Deployment Market, by Country, 2020–2027

-

Table 18

-

Asia-Pacific: Global Digital Payment in Healthcare Deployment

-

Table 19

-

Rest of the World: Global Digital Payment in Healthcare Deployment Market,

-

LIST OF FIGURES

-

FIGURE 1

-

Global Digital Payment in Healthcare Market Segmentation

-

FIGURE

-

Forecast Methodology

-

FIGURE 3 Porter’s

-

Five Forces Analysis of Global Digital Payment in Healthcare Market

-

Value Chain/Supply Chain of Global Digital Payment in Healthcare

-

Market

-

FIGURE 5 Share of the Global Digital Payment in Healthcare

-

Market in 2020, by Country (in %)

-

FIGURE 6 Global Digital

-

Payment in Healthcare Market, 2020–2027

-

FIGURE 7 Sub-segments

-

of Component

-

FIGURE 8 Global Digital Payment in Healthcare

-

Market Size, by Component, 2020

-

FIGURE 9 Share of the Global

-

Digital Payment in Healthcare Market, by Component, 2020 to 2027

-

FIGURE 10

-

Global Digital Payment in Healthcare Market Size, by Deployment,

-

2020

-

FIGURE 11 Share of the Global Digital Payment in Healthcare

-

Market, by Deployment, 2020 to 2027

-

FIGURE 12 Global Digital

-

Payment in Healthcare Market Size, by Organization Size, 2020

-

FIGURE 13

-

Share of the Global Digital Payment in Healthcare Market, by Organization

-

Size, 2020 to 2027

Digital Payment in Healthcare Market Segmentation

Digital Payment in Healthcare Component Solution Outlook (USD Billion, 2018-2032)

- Solution

- Service

Digital Payment in Healthcare Deployment Outlook (USD Billion, 2018-2032)

- On-Premise

- Cloud

Digital Payment in Healthcare Organization Size Outlook (USD Billion, 2018-2032)

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Digital Payment in Healthcare Regional Outlook (USD Billion, 2018-2032)

North AmericaOutlook (USD Billion, 2018-2032)

- North America Digital Payment in Healthcare by Component Solution

- Solution

- Service

- North America Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- North America Digital Payment in Healthcare by Organization Size

- North America Digital Payment in Healthcare by Component Solution

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

US Outlook (USD Billion, 2018-2032)

- US Digital Payment in Healthcare by Component Solution

- Solution

- Service

US Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- US Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

CANADA Outlook (USD Billion, 2018-2032)

- CANADA Digital Payment in Healthcare by Component Solution

- Solution

- Service

CANADA Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- CANADA Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Europe Outlook (USD Billion, 2018-2032)

- Europe Digital Payment in Healthcare by Component Solution

- Solution

- Service

- Europe Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Europe Digital Payment in Healthcare by Organization Size

- Europe Digital Payment in Healthcare by Component Solution

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Germany Outlook (USD Billion, 2018-2032)

- Germany Digital Payment in Healthcare by Component Solution

- Solution

- Service

- Germany Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Germany Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

France Outlook (USD Billion, 2018-2032)

- France Digital Payment in Healthcare by Component Solution

- Solution

- Service

France Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- France Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

UK Outlook (USD Billion, 2018-2032)

- UK Digital Payment in Healthcare by Component Solution

- Solution

- Service

- UK Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- UK Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

ITALY Outlook (USD Billion, 2018-2032)

- ITALY Digital Payment in Healthcare by Component Solution

- Solution

- Service

ITALY Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- ITALY Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

SPAIN Outlook (USD Billion, 2018-2032)

- Spain Digital Payment in Healthcare by Component Solution

- Solution

- Service

- Spain Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Spain Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Digital Payment in Healthcare by Component Solution

- Solution

- Service

REST OF EUROPE Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- REST OF EUROPE Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Digital Payment in Healthcare by Component Solution

- Solution

- Small and medium-sized enterprises (SMEs)

Asia-Pacific Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Asia-Pacific Digital Payment in Healthcare by Organization Size

- Asia-Pacific Digital Payment in Healthcare by Component Solution

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

China Outlook (USD Billion, 2018-2032)

- China Digital Payment in Healthcare by Component Solution

- Solution

- Service

- China Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- China Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Japan Outlook (USD Billion, 2018-2032)

- Japan Digital Payment in Healthcare by Component Solution

- Solution

- Service

- Japan Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Japan Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

India Outlook (USD Billion, 2018-2032)

- India Digital Payment in Healthcare by Component Solution

- Solution

- Service

India Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- India Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Australia Outlook (USD Billion, 2018-2032)

- Australia Digital Payment in Healthcare by Component Solution

- Solution

- Service

Australia Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Australia Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Digital Payment in Healthcare by Component Solution

- Solution

- Service

- Rest of Asia-Pacific Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Rest of Asia-Pacific Digital Payment in Healthcare by Organization Size

- Small and medium-sized enterprises (SMEs)

- Large enterprises

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Digital Payment in Healthcare by Component Solution

- Solution

- Service

Rest of the World Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Rest of the World Digital Payment in Healthcare by Organization Size

- Rest of the World Digital Payment in Healthcare by Component Solution

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Digital Payment in Healthcare by Component Solution

- Solution

- Service

Middle East Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Middle East Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Africa Outlook (USD Billion, 2018-2032)

- Africa Digital Payment in Healthcare by Component Solution

- Solution

- Service

Africa Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Africa Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Digital Payment in Healthcare by Component Solution

- Solution

- Service

- Latin America Digital Payment in Healthcare by Deployment

- On-Premise

- Cloud

- Latin Digital Payment in Healthcare by Organization Size

- Small and Medium-Sized Enterprises (SMES)

- Large Enterprises

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment