Recent developments in the Contraceptive Drugs Market reflect significant changes and growth among leading companies like Sanofi, GSK, AbbVie, Teva Pharmaceutical Industries, Bayer, and others. The market is experiencing an increased demand for contraceptive options, driven by changing social attitudes toward family planning and reproductive health. Companies are investing in research and development to offer innovative and more effective products.

Notably, Bayer has expanded its contraceptive portfolio, while HRA Pharma introduced advancements in hormonal contraceptives that emphasize safety and efficacy. In terms of mergers and acquisitions, there have been notable activities, such as AbbVie pursuing strategic partnerships to broaden its contraceptive offerings. The competition in the market is intensifying, prompting Mylan and Pfizer to enhance their product lines to capture emerging consumer needs. Furthermore, the valuation of these companies is on an upward trajectory, suggesting robust growth potential in the contraceptive sector.

As this market evolves, these organizations must adapt to regulatory changes and consumer preferences, further impacting their market positioning in the coming years.

Contraceptive Drugs Market Drivers

Increasing Awareness and Acceptance of Family Planning

The growing global awareness regarding family planning and reproductive health is one of the foremost drivers boosting the Contraceptive Drugs Market Industry. As individuals and couples become more knowledgeable about their reproductive choices, there is an increasing acceptance of contraceptive methods. Educational programs and campaigns initiated by governments, non-governmental organizations, and healthcare providers have played a significant role in informing the public about the various contraceptive options available.

This heightened awareness has led to a decline in stigma associated with the use of contraceptives, encouraging more people to consider these options as a critical aspect of their health care. Furthermore, the emphasis placed on gender equality and women's empowerment continues to foster discussions surrounding reproductive rights, propelling the demand for contraceptive drugs. With a projected robust market growth over the next decade, driven by changing societal norms and positive shifts in public perception, the Contraceptive Drugs Market is expected to see increased investments in product development, expanding options and accessibility for consumers worldwide.

The health benefits associated with proper family planning are increasingly recognized, including improved maternal and child health outcomes, more informed reproductive decisions, and a reduction in unintended pregnancies. As healthcare systems prioritize comprehensive reproductive health services, the demand for a wide range of contraceptive drugs is anticipated to surge, reinforcing the industry's growth trajectory.

Innovation and Development of New Contraceptive Technologies

Technological advancements and continuous innovation play a critical role in shaping the Contraceptive Drugs Market Industry. The emergence of novel drug formulations and alternative delivery mechanisms has expanded the variety of contraceptive choices available to consumers. Innovative methods, such as long-acting reversible contraceptives (LARCs), mini pills, and hormonal intrauterine devices, are increasingly preferred due to their high efficacy and user-friendliness.

Additionally, ongoing research and development efforts in contraceptive technologies aim to address the changing needs and preferences of consumers, streamline usage, and minimize side effects, ultimately leading to higher adoption rates. As pharmaceutical companies invest in the development of better and more effective contraceptive options, the market will witness significant growth, resulting in an expanded user base and improved health outcomes.

Supportive Government Initiatives and Policies

Government assistance and supportive policies are becoming fundamental drivers of the Contraceptive Drugs Market Industry. Increasingly, governments worldwide are recognizing the importance of accessible reproductive health services, prompting them to implement policies aimed at promoting family planning. Initiatives that seek to expand access to contraceptive methods through subsidized programs, health education, and awareness campaigns are essential in driving market growth.

Additionally, in regions with high population growth rates, governments are pushing for strategies that empower individuals to make informed reproductive choices, as they understand that effective family planning can contribute to economic stability and improved quality of life. This focus on reproductive health and supportive measures to facilitate contraceptive access directly influences the expansion of the contraceptive drugs market, leading to an upward trend in overall market value.

Contraceptive Drugs Market Segment Insights:

Contraceptive Drugs Market Drug Type Insights

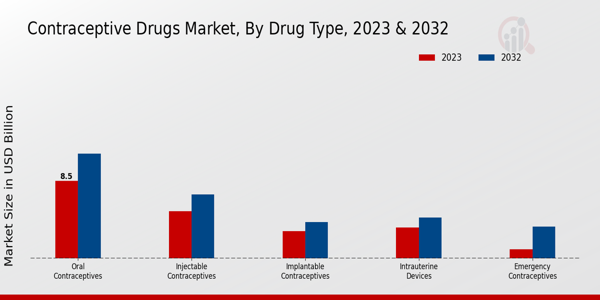

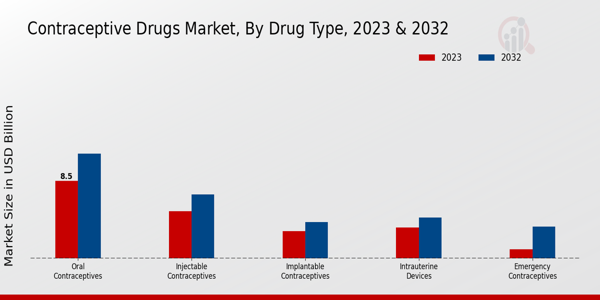

The Contraceptive Drugs Market segment focused on Drug Type consists of various categories, including Oral Contraceptives, Injectable Contraceptives, Implantable Contraceptives, Intrauterine Devices, and Emergency Contraceptives, each playing a crucial role in reproductive health. In 2023, the overall market was valued at 22.12 USD Billion, showcasing the significant demand for contraceptive methods worldwide.

Among these types, Oral Contraceptives hold a prominent position, valued at 8.5 USD Billion in 2023 and projected to rise to 11.5 USD Billion by 2032. This category is essential due to its high acceptance and ease of use, making it a preferred choice for many women around the globe. Injectable Contraceptives, valued at 5.2 USD Billion in 2023, followed closely, offering a reliable alternative that provides long-term protection with fewer doses, thus serving a significant demographic in the contraceptive landscape.

Implantable Contraceptives, valued at 3.0 USD Billion in 2023, also cater to users looking for long-term solutions without the need for daily adherence, though they capture a smaller segment due to the need for medical procedures for insertion and removal. Intrauterine Devices, valued at 3.42 USD Billion in 2023, represent another important method in the market as they offer extended protection with a low failure rate, appealing to women who prefer a non-hormonal option or a long-lasting solution.

Emergency Contraceptives, while the smallest segment with a valuation of 1.0 USD Billion in 2023, serve a crucial purpose in preventing unintended pregnancies after unprotected intercourse, thus highlighting the importance of accessible reproductive health options. Overall, the Contraceptive Drugs Market revenue reflects growing awareness and access to various contraceptive methods, with trends indicating that more women are seeking reliable forms of birth control tailored to their lifestyles, leading to significant opportunities for growth across all categories in the coming years.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Contraceptive Drugs Market Mechanism of Action Insights

Leave a Comment