Construction Fabrics Market Share

Construction Fabrics Market Research Report Information by Type (Needle Punched Nonwoven, Woven Monofilament, and Woven Slit), Material (PVC, PE, PP, PTFE, ETFE), Application (Tensile Architecture, Awnings & Canopies, and Facades) and Region Forecast till 2035

Market Summary

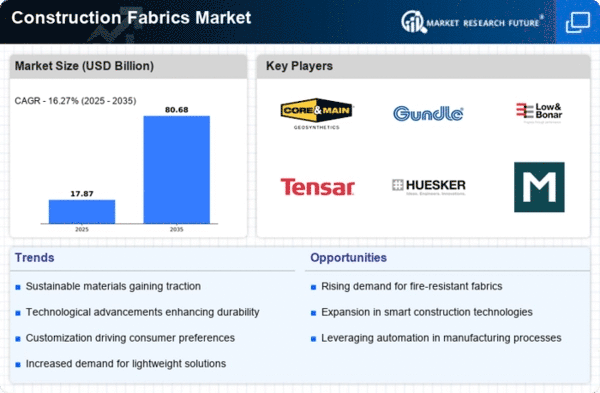

The Global Construction Fabrics Market is projected to grow significantly from 1.95 USD Billion in 2024 to 7.25 USD Billion by 2035.

Key Market Trends & Highlights

Construction Fabrics Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 12.69% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 7.25 USD Billion, indicating robust growth potential.

- In 2024, the market is valued at 1.95 USD Billion, reflecting a strong starting point for future expansion.

- Growing adoption of advanced construction technologies due to increased infrastructure development is a major market driver.

Market Size & Forecast

| 2024 Market Size | 1.95 (USD Billion) |

| 2035 Market Size | 7.25 (USD Billion) |

| CAGR (2025-2035) | 12.69% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Saint-Gobain (France), Sioen Industries NV (Belgium), Low & Bonar (UK), Sattler AG (Austria), Koninklijke Ten Cate bv (the Netherlands), Fibertex Nonwovens A/S (Denmark), Serge Ferrari (France), HIRAOKA & CO. LTD. (Japan), Endutex Coated Technical Textiles (Portugal), Seaman Corporation (US), Stylepark AG (Germany)

Market Trends

The ongoing evolution in construction methodologies appears to be driving a heightened demand for innovative construction fabrics, which are increasingly recognized for their potential to enhance durability and sustainability in building projects.

U.S. Department of Commerce

Construction Fabrics Market Market Drivers

Market Growth Projections

The Global Construction Fabrics Market Industry is poised for substantial growth, with projections indicating a market size of 1.95 USD Billion in 2024 and an impressive increase to 7.25 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 12.69% from 2025 to 2035, driven by various factors including technological advancements, urbanization, and increased safety regulations. The market's expansion is indicative of the rising importance of construction fabrics in modern building practices, as they play a crucial role in enhancing structural integrity and sustainability. These projections highlight the dynamic nature of the industry and its potential for future development.

Increased Focus on Safety and Compliance

Safety regulations and compliance standards in the construction industry are becoming increasingly stringent, thereby driving the demand for specialized construction fabrics. The Global Construction Fabrics Market Industry is responding to this need by offering materials that meet or exceed safety standards, such as fire resistance and structural integrity. This heightened focus on safety not only protects workers but also enhances the longevity of structures. As a result, manufacturers are likely to invest in research and development to create fabrics that comply with evolving regulations. This trend is indicative of a broader commitment to safety within the industry, which is expected to support sustained growth in the Global Construction Fabrics Market.

Technological Advancements in Fabric Manufacturing

Technological innovations in fabric manufacturing are significantly influencing the Global Construction Fabrics Market Industry. Advanced production techniques, such as 3D weaving and smart textiles, enhance the performance and durability of construction fabrics. These innovations not only improve the quality of materials but also reduce production costs, making them more accessible to a broader range of construction projects. As the industry evolves, the integration of technology is likely to attract new investments and foster competitive advantages. This trend is expected to contribute to a compound annual growth rate of 12.69% from 2025 to 2035, reflecting the dynamic nature of the Global Construction Fabrics Market.

Growing Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development across the globe is a key driver for the Global Construction Fabrics Market Industry. As urban populations continue to swell, the demand for housing, transportation, and public facilities escalates, necessitating the use of high-performance construction fabrics. Governments and private sectors are investing heavily in infrastructure projects, which in turn fuels the need for durable and versatile materials. This trend is likely to sustain the market's growth trajectory, with projections indicating a rise to 1.95 USD Billion in 2024 and a potential increase to 7.25 USD Billion by 2035, underscoring the critical role of construction fabrics in modern development.

Rising Demand for Sustainable Construction Materials

The Global Construction Fabrics Market Industry is witnessing a notable shift towards sustainable construction materials, driven by increasing environmental awareness and regulatory pressures. As governments worldwide implement stricter building codes and sustainability initiatives, the demand for eco-friendly construction fabrics is expected to rise. This trend aligns with the projected market growth, with the industry anticipated to reach 1.95 USD Billion in 2024 and potentially expand to 7.25 USD Billion by 2035. The emphasis on reducing carbon footprints and enhancing energy efficiency in construction projects further propels the adoption of sustainable materials, indicating a robust future for the Global Construction Fabrics Market.

Expansion of the Construction Sector in Emerging Economies

Emerging economies are experiencing rapid growth in their construction sectors, which is significantly impacting the Global Construction Fabrics Market Industry. Countries in Asia-Pacific, Latin America, and Africa are investing in large-scale infrastructure projects, driven by urbanization and economic development. This expansion creates a substantial demand for construction fabrics that can withstand diverse environmental conditions. As these markets mature, the need for innovative and high-quality materials is likely to increase, presenting opportunities for manufacturers. The anticipated growth in these regions aligns with the overall market projections, suggesting a robust future for the Global Construction Fabrics Market.

Market Segment Insights

By Type Insights

The construction fabrics market segmentation, based on type, is needle-punched nonwoven, woven monofilament, and woven slit. The construction fabrics market growth was prominently high under the needle-punched nonwoven category in 2021. Nonwovens that have been needle-punched are frequently utilized in applications that require reinforcing and cushioning against subgrade surface imperfections. As per the market segmentation, the woven slit segment witnessed significant growth over the forecast period. Woven slit films are utilized for reinforcement and stabilization when dealing with problematic subgrade soils. They are also used to isolate rock from the subgrade in building openings.

By Material Insights

The construction fabrics market segmentation, based on material, is PVC, PE, PP, PTFE, and ETFE. The ETFE segment of the market is estimated to have the highest share in 2021. A novel and lightweight alternative to glass panels are made using ETFE, a polymeric polymer with a fluorine base. The market for construction fabrics experienced the greatest CAGR of about 10.1% in the PTFE sector throughout the forecast period. Due to its superior fire resistance, PTFE is frequently used to coat non-woven and flexible woven materials, including woven wire, glass fiber cloth, and aramid textiles.

By Application Insights

Based on application, the market has been divided into tensile architecture, awnings & canopies, and facades. On the basis of value, it is anticipated that in 2021, the tensile architecture application sector will rule the total construction textiles business. The tensile architecture offers flexibility, pre-fabrication convenience, and the capacity to span enormous distances. However, as per the market segmentation, the fascades experienced considerable growth in 2021. Urbanization and modernization are both crucial factors in the market's expansion. Several aspects, such as waterproofing, fabrication, durability, and resilience to extreme conditions, come into play when building facades.

the market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific accounted for the most extensive market share. The greatest CAGR is anticipated for North America during the review period.

The market is expected to be dominated by the Asia-Pacific region due to rising consumer disposable income and rising living standards in emerging nations. A significant market trend in the market is the growing use of construction fabrics in manufacturing a variety of denim items, including jeans, shirts, jackets, and other denim products. Cotton's ubiquitous accessibility has spurred the rise of the region's construction fabrics business. Building textiles are in high demand due to preferential market access, another major element boosting Bangladesh's textile sector.

In 2021, North America held the second-largest market share due to the substantial demand for construction. North America currently holds a dominant position in the market due to its robust building sector and easy access to fabrics. The appealing and useful characteristics of building fabrics support the industry. The market will be driven by the end-user industries' adoption of these textiles for protective and flame-resistant clothing due to the strict regulations governing worker safety.

The market includes tier-1, tier-2, and local players. The tier-1 and tier-2 players have reach with diverse product portfolios. Companies such as Saint-Gobain (France), Sioen Industries NV (Belgium), Low & Bonar (UK), Sattler AG (Austria), Koninklijke Ten Cate bv (the Netherlands), and Fibertex Nonwovens A/S (Denmark) dominate the market due to product differentiation, financial stability, strategic developments, and diversified regional presence. The players are concentrating on supporting research and development. For instance, in September 2022, Saint-Gobain received approval from all relevant competition authorities for its December 6, 2021, acquisition of GCP Applied Technologies, a key operator in building chemicals.

Get more detailed insights about Construction Fabrics Market Research Report - Global Forecast till 2030

Regional Insights

Key Companies in the Construction Fabrics Market market include

Industry Developments

Future Outlook

Construction Fabrics Market Future Outlook

The Global Construction Fabrics Market is poised for growth at 12.69% CAGR from 2024 to 2035, driven by urbanization, infrastructure investments, and technological advancements.

New opportunities lie in:

- Develop eco-friendly construction fabrics to meet sustainability demands.

- Leverage smart textiles for enhanced functionality in construction applications.

- Expand into emerging markets with tailored solutions for local construction needs.

By 2035, the market is expected to exhibit robust growth, reflecting evolving construction demands and innovation.

Market Segmentation

By Type Outlook

- Needle Punched Nonwoven

- Woven Monofilament

- Woven Slit

By Region Outlook

- North America US Canada Mexico

- US

- Canada

- Mexico

- Europe UK Germany France Italy Spain Rest of Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific China India Japan Australia and New Zealand Rest of Asia-Pacific

- China

- India

- Japan

- Australia and New Zealand

- Rest of Asia-Pacific

- Rest of the World South America Middle East Africa

- South America

- Middle East

- Africa

- Construction Fabrics Market Forecast & Size

- Market Landscape and Trends

- Market Influencing Factors

- Impact of COVID-19

- Company Profiling

By Material Outlook

- PVC

- PE

- PP

- PTFE

- ETFE

By Application Outlook

- Tensile Architecture

- Awnings & Canopies

- Facades

Report Scope

| Report Attribute/Metric | Details |

| Market Size | 2030: USD 5.79 billion |

| (CAGR) | 7.8% CAGR (2024-2032) |

| Base year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Material, and Application |

| Geographies Covered | North America, Europe, Asia-Pacific, and the Rest of the World (RoW) |

| Key Vendors | Seaman Corporation (US), Serge Ferrari (France), Sattler AG (Austria), and Saint-Gobain (France) |

| Key Market Opportunities | Increasing demand in emerging economies can open up profitable market prospects |

| Key Market Drivers | An increase in the demand for construction fabrics among various raw materials |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the study period of the construction fabrics market report?

The construction fabrics market forecast period is 2024 - 2032

What araWhat is the construction fabrics market Growth rate? e the different applications of construction fabrics?

The market is expected to register a CAGR of ~7.8% over the next 10 years, according to construction fabrics market research.

Which region has the highest market growth rate?

North America is expected to register the highest CAGR during 2022 - 2030

Which region has the largest share of the market?

Asia-Pacific held the largest share in 2023

What is the expected construction fabrics market size by 2032?

The market size is expected to be USD 5.79 billion billion by 2032

Who are the key players in the market?

Seaman Corporation (US), Serge Ferrari (France), Sattler AG (Austria), and Saint-Gobain (France) are the major companies operating in the market.

-

Table of Contents

-

Executive Summary

-

Scope of the Report

- Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

- Market Structure

-

Market Research Methodology

- Research Process

- Secondary Research

- Primary Research

- Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- End-Users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Intensity of Competitive Rivalry

-

Supply Chain Analysis

-

Market Dynamics of Global Construction Fabrics Market

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

- Trends/Strategies

-

Global Construction Fabrics Market, by Type

- Introduction

-

Needle Punched Nonwoven

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Woven Monofilament

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Woven Slit

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Global Construction Fabrics Market, by Materials

- Introduction

-

PVC

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

PE

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

PP

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

PTFE

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

ETFE

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Others

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Global Construction Fabrics Market, by Application

- Introduction

-

Tensile Architecture

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Awnings & Canopies

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Hoardings & Signages

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Scaffolding Nets

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Facades

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Region, 2022–2030

-

Global Construction Fabrics Market, by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Materials, 2022–2030

- Market Estimates & Forecast, by Application, 2022–2030

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Materials, 2022–2030

- Market Estimates & Forecast, by Application, 2022–2030

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Poland

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Materials, 2022–2030

- Market Estimates & Forecast, by Application, 2022–2030

- China

- India

- Japan

- Australia & New Zealand

- Indonesia & South Korea

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Materials, 2022–2030

- Market Estimates & Forecast, by Application, 2022–2030

- GCC

- Israel

- North Africa

- Turkey

- Rest of the Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2022–2030

- Market Estimates & Forecast, by Type, 2022–2030

- Market Estimates & Forecast, by Materials, 2022–2030

- Market Estimates & Forecast, by Application, 2022–2030

- Brazil

- Mexico

- Argentina

- Rest of Latin America

-

Company Landscape

- Introduction

- Market Strategy

- Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New Materials Developments/Agreements/Investments)

-

Company Profiles

-

Saint-Gobain

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Sioen Industries NV

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Low & Bonar

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Sattler AG

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Koninklijke Ten Cate bv

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Fibertex Nonwovens A/S

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Serge Ferrari

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

HIRAOKA & CO., LTD.

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

ENDUTEX COATED TECHNICAL TEXTILES

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Seaman Corporation

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Stylepark AG

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

seele

- Company Overview

- Financial Updates

- Materials/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Saint-Gobain

-

Conclusion

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Construction Fabrics Market, by Region, 2022–2030

- Table 2 North America: Construction Fabrics Market, by Country, 2022–2030

- Table 3 Europe: Construction Fabrics Market, by Country, 2022–2030

- Table 4 Asia-Pacific: Construction Fabrics Market, by Country, 2022–2030

- Table 5 Middle East & Africa: Construction Fabrics Market, by Country, 2022–2030

- Table 6 Latin America: Construction Fabrics Market, by Country, 2022–2030

- Table 7 Global Construction Fabrics Type Market, by Region, 2022–2030

- Table 8 North America: Construction Fabrics Type Market, by Country, 2022–2030

- Table 9 Europe: Construction Fabrics Type Market, by Country, 2022–2030 Table10 Asia-Pacific: Construction Fabrics Type Market, by Country, 2022–2030 Table11 Middle East & Africa: Construction Fabrics Type Market, by Country, 2022–2030 Table12 Latin America: Construction Fabrics Type Market, by Country, 2022–2030 Table13 Global Construction Fabrics Materials Market, by Region, 2022–2030 Table14 North America: Construction Fabrics Materials Market, by Country, 2022–2030 Table15 Europe: Construction Fabrics Materials Market, by Country, 2022–2030 Table16 Asia-Pacific: Construction Fabrics Materials Market, by Country, 2022–2030 Table17 Middle East & Africa: Construction Fabrics Materials Market, by Country, 2022–2030 Table18 Latin America: Construction Fabrics Materials Market, by Country, 2022–2030 Table19 Global Construction Fabrics Application Market, by Region, 2022–2030 Table20 North America: Construction Fabrics Application Market, by Country, 2022–2030 Table21 Europe: Construction Fabrics Application Market, by Country, 2022–2030 Table22 Asia-Pacific: Construction Fabrics Application Market, by Country, 2022–2030 Table23 Middle East & Africa: Construction Fabrics Application Market, by Country, 2022–2030 Table24 Latin America: Construction Fabrics Application Market, by Country, 2022–2030 Table25 Global Type Market, by Region, 2022–2030 Table26 Global Materials Market, by Region, 2022–2030 Table27 Global Application Market, by Region, 2022–2030 Table28 North America: Construction Fabrics Market, by Country Table29 North America: Construction Fabrics Market, by Type Table30 North America: Construction Fabrics Market, by Materials Table31 North America: Construction Fabrics Market, by Application Table32 Europe: Construction Fabrics Market, by Country Table33 Europe: Construction Fabrics Market, by Type Table34 Europe: Construction Fabrics Market, by Materials Table35 Europe: Construction Fabrics Market, by Application Table36 Asia-Pacific: Construction Fabrics Market, by Country Table37 Asia-Pacific: Construction Fabrics Market, by Type Table38 Asia-Pacific: Construction Fabrics Market, by Materials Table39 Asia-Pacific: Construction Fabrics Market, by Application Table40 Middle East & Africa: Construction Fabrics Market, by Country Table41 Middle East & Africa Construction Fabrics Market, by Type Table42 Middle East & Africa Construction Fabrics Market, by Materials Table43 Middle East & Africa: Construction Fabrics Market, by Application Table44 Latin America: Construction Fabrics Market, by Country Table45 Latin America Construction Fabrics Market, by Type Table46 Latin America Construction Fabrics Market, by Materials Table47 Latin America: Construction Fabrics Market, by Application LIST OF FIGURES

- FIGURE 1 Global Construction Fabrics Market Segmentation

- FIGURE 2 Forecast Research Methodology

- FIGURE 3 Porter’s Five Forces Analysis of Global Construction Fabrics Market

- FIGURE 4 Value Chain of Global Construction Fabrics Market

- FIGURE 5 Share of Global Construction Fabrics Market in 2022, by Country (%)

- FIGURE 6 Global Construction Fabrics Market, 2022–2030,

- FIGURE 7 Global Construction Fabrics Market Size by Types, 2022

- FIGURE 8 Share of Global Construction Fabrics Market, by Type, 2022–2030

- FIGURE 9 Global Construction Fabrics Market Size, by Materials, 2022

- FIGURE 10 Share of Global Construction Fabrics Market, by Materials, 2022–2030

- FIGURE 11 Global Construction Fabrics Market Size, by Application, 2022

- FIGURE 12 Share of Global Construction Fabrics Market, by Application, 2022–2030

Construction Fabrics Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment