Commercial Airport Baggage Handling Systems Market Trends

Commercial Airport Baggage Handling Systems Market Research Report Information By Airport Class (A, B And C), By Technology (Barcode and RFID), By Service (Self-Service and Assisted-Service), By Type (Conveyors and Destination-Coded Vehicles) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035.

Market Summary

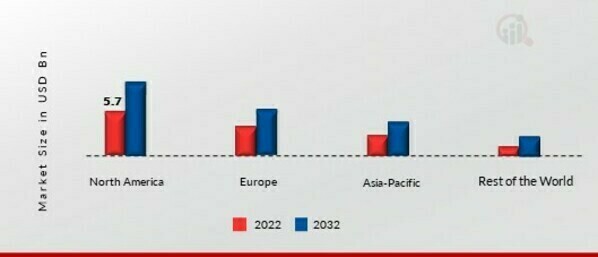

As per Market Research Future Analysis, the Global Commercial Airport Baggage Handling Systems Market was valued at USD 15.30 billion in 2024 and is projected to grow to USD 41.66 billion by 2035, with a CAGR of 9.53% from 2025 to 2035. Key drivers include increased airport operational effectiveness and rising passenger numbers. However, challenges such as high maintenance costs and a 24% increase in baggage mishandling are impacting growth. The market is segmented by airport class, technology, service, and type, with Class C airports and RFID technology leading in market share. North America dominates the market, followed by Europe and Asia-Pacific, with significant growth expected in the latter due to expanding airport infrastructure.

Key Market Trends & Highlights

The market is witnessing several trends that are shaping its future.

- Market Size in 2024: USD 15.30 billion.

- Projected Market Size by 2035: USD 41.66 billion.

- CAGR from 2025 to 2035: 9.53%.

- 24% increase in baggage mishandling reported.

Market Size & Forecast

| 2024 Market Size | USD 15.30 billion |

| 2035 Market Size | USD 41.66 billion |

| CAGR (2025-2035) | 9.53% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Key players include Pteris Limited, Grenzebach Maschinenbau GMBH, G&S Airport Conveyor, Logplan LLC, Beumer Group, Daifuku Company Ltd, Siemens AG, and Vanderlande Industries.

Market Trends

Market CAGR for commercial airport baggage handling systems is being driven by increase in airport infrastructure development investments to accommodate rising passenger traffic. Market expansion is expected to be aided by rising disposable income and a growing population. Furthermore, investors are installing more sophisticated baggage handling systems to improve operational effectiveness, which is likely to encourage market revenue growth. However, high maintenance costs and baggage mishandling at airports are impeding revenue growth. Misplaced baggage increased by 24% as airports and airlines struggled to keep up with passenger demand.

Social media users have shared photos of unclaimed bags, and angry anecdotes have accumulated. One traveller used an Apple Air Tag to track her misplaced bag from Toronto to St. John Airport for five days. Someone saw his rucksack leave for England, Germany, and Iceland without him. As an increasing number of travellers return to flying, the industry is closely examining the future of luggage management.

The ongoing advancements in automation and technology within the commercial airport baggage handling systems market are poised to enhance operational efficiency and improve passenger experience, reflecting a broader trend towards modernization in the aviation sector.

Federal Aviation Administration (FAA)

Commercial Airport Baggage Handling Systems Market Market Drivers

Market Growth Projections

The Global Commercial Airport Baggage Handling Systems Market Industry is projected to experience substantial growth in the coming years. With a market value of 15.3 USD Billion in 2024, it is anticipated to reach 41.7 USD Billion by 2035, reflecting a compound annual growth rate of 9.53% from 2025 to 2035. This growth trajectory indicates a robust demand for innovative baggage handling solutions as airports adapt to increasing passenger traffic and evolving technological landscapes. The market dynamics suggest that stakeholders must remain agile and responsive to emerging trends to capitalize on the opportunities presented by this expanding industry.

Sustainability Initiatives

Sustainability initiatives are increasingly shaping the Global Commercial Airport Baggage Handling Systems Market Industry. Airports are under pressure to reduce their environmental footprint, prompting investments in eco-friendly baggage handling solutions. These initiatives may include energy-efficient systems and the use of sustainable materials in baggage handling equipment. As airports strive to achieve sustainability goals, the demand for innovative solutions that align with these objectives is likely to rise. This trend not only contributes to environmental conservation but also enhances the overall operational efficiency of baggage handling systems, positioning airports as responsible entities in the aviation sector.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Commercial Airport Baggage Handling Systems Market Industry. The integration of automation, artificial intelligence, and IoT technologies enhances operational efficiency and reduces human error. For instance, automated baggage handling systems can significantly decrease the time taken for baggage processing, thereby improving passenger satisfaction. Airports are increasingly investing in these technologies to streamline operations and manage the complexities of modern air travel. As the industry evolves, the adoption of smart baggage handling solutions is likely to become a standard practice, further driving market growth and ensuring that airports can meet the demands of an expanding passenger base.

Increasing Air Travel Demand

The Global Commercial Airport Baggage Handling Systems Market Industry is experiencing growth driven by the rising demand for air travel. As more passengers opt for air transportation, airports are compelled to enhance their baggage handling capabilities. In 2024, the market is valued at 15.3 USD Billion, reflecting the need for efficient systems to manage increased baggage volumes. This trend is projected to continue, with the market expected to reach 41.7 USD Billion by 2035. The compound annual growth rate of 9.53% from 2025 to 2035 indicates a robust expansion, necessitating advanced technologies and systems to accommodate the growing passenger traffic.

Expansion of Airport Infrastructure

The expansion of airport infrastructure is a crucial driver for the Global Commercial Airport Baggage Handling Systems Market Industry. As global air travel continues to grow, many airports are undergoing significant upgrades and expansions to accommodate increased passenger volumes. This includes the development of new terminals and the enhancement of existing facilities, which necessitates the installation of advanced baggage handling systems. The ongoing investments in airport infrastructure are expected to create substantial opportunities for market players, as airports seek to implement state-of-the-art systems that can efficiently manage the complexities of modern air travel.

Regulatory Compliance and Safety Standards

The Global Commercial Airport Baggage Handling Systems Market Industry is influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. Airports must adhere to these regulations to ensure the safety and security of passengers and their belongings. Compliance with international standards necessitates the implementation of advanced baggage handling systems that can efficiently manage security checks and minimize risks. This focus on safety not only enhances operational reliability but also fosters passenger trust in air travel. As regulations evolve, airports are likely to invest in upgrading their baggage handling systems to meet these requirements, thereby driving market growth.

Market Segment Insights

Commercial Airport Baggage Handling Systems Airport Class Insights

Commercial Airport Baggage Handling Systems Service Insights

Get more detailed insights about Commercial Airport Baggage Handling Systems Market Research Report - Global Forecast to 2034

Regional Insights

- Commercial Airport Baggage Handling Systems Regional Insights

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America dominates the commercial airport baggage handling systems market and is projected to maintain its position over the forecast period. This expansion can be ascribed to early adoption of these technologies as well as increased government investment in airport infrastructure. Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: COMMERCIAL AIRPORT BAGGAGE HANDLING SYSTEMS MARKET SHARE BY REGION 2023 (%)

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe’s commercial airport baggage handling systems market accounts for the second-largest market share due to stricter airport security regulations and increased expenditure in terminal expansions. Further, the German commercial airport baggage handling systems market held the largest market share, and the UK commercial airport baggage handling systems market was the fastest-growing market in the European region. The Asia-Pacific Commercial Airport Baggage Handling Systems Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to the expansion of airport infrastructure to support the region's rising airline passenger numbers in recent years.

Moreover, China’s commercial airport baggage handling systems market held the largest market share, and the Indian commercial airport baggage handling systems market was the fastest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in R&D in order to expand their product lines, which will help the commercial airport baggage handling systems market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the commercial airport baggage handling systemsindustry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the commercial airport baggage handling systems industry to benefit clients and increase the market sector.

In recent years, the commercial airport baggage handling systems industry has offered some of the most significant advantages to medicine. Major players in the commercial airport baggage handling systems market, including Pteris Limited (Sir gapore), Grenzebach Maschinenbau GMBH (Germany), G&S Airport Conveyor (U.S.), Logplan LLC (U.S.) and others, are attempting to increase market demand by investing in R&D operations. Kuala Lumpur International Airport is Malaysia's primary international airport. It is located in the Sepang District of Selangor, roughly 45 kilometers (28 miles) south of Kuala Lumpur and serves the city's broader conurbation. Malaysia's largest and busiest airport is KLIA.

It handled 13,156,363 passengers, 505,184 tonnes of cargo, and 124,529 aircraft movements in 2020. It is the world's 23rd busiest airport by total passenger traffic. In December 2022, Kuala Lampur International Airport in Malaysia announced that Siemens Logistics and local company T7 have been contracted to update the baggage handling system (BHS) at Terminal 1. The contract calls for the systematic decommissioning of the present system as well as the design, installation, and commissioning of new baggage handling systems. Siemens will provide VarioTray and VarioBelt technology, as well as VarioStore early bag storage and high-performance controlling software.

The VarioBelt conveyor will also be available in the baggage handling systems industry. SITA is a worldwide information technology business that provides information technology and telecommunications services to the airline sector. The corporation claims to serve around 400 members and 2,500 customers ly, accounting for approximately 90% of the world's airline industry. SITA technology is used on practically every passenger aircraft across the world. In June 2022, SITA announced a collaboration agreement with Alstef Group, a well-known baggage handling company, to create Swift Drop, a revolutionary self-bag drop system that dramatically improves the experience of travellers checking their bags.

The quick and simple interface allows customers to check their bags quickly, avoiding huge lines at traditional check-in locations.

Key Companies in the Commercial Airport Baggage Handling Systems Market market include

Industry Developments

For Instance, In December 2022,

Kuala Lampur International Airport in Malaysia announced that Siemens Logistics and local company T7 have been contracted to update the baggage handling system (BHS) at Terminal 1. The contract calls for the systematic decommissioning of the present system as well as the design, installation, and commissioning of new baggage handling systems. Siemens will provide VarioTray and VarioBelt technology, as well as VarioStore early bag storage and high-performance controlling software. The VarioBelt conveyor will also be available in the baggage handling systems industry.

For Instance, In August 2022

Alstef announced the launch of a new mobile robot for baggage handling at airports. The BAGXone is a novel machine with a high-speed automated guided vehicle designed to handle individual bags. It can travel short distances, such as from the check-in area to the screening machines, or from the screening machines to an early bag store, reconciliation room, and make-up carousel.

For Instance, In April 2021

Siemens Logistics, a subsidiary of Siemens AG, received a contract from Incheon International Airport Corporation to expand the baggage handling system at Terminal 2 of Incheon Airport. In addition to the installation of baggage conveying and sorting technology, the company will provide technical project management, layout design, and software solutions and integrate the new equipment into the existing system.

Future Outlook

Commercial Airport Baggage Handling Systems Market Future Outlook

The Commercial Airport Baggage Handling Systems Market is projected to grow at a 9.53% CAGR from 2025 to 2035, driven by technological advancements, increasing air travel demand, and enhanced operational efficiency.

New opportunities lie in:

- Invest in AI-driven automation technologies to optimize baggage sorting processes.

- Develop sustainable baggage handling solutions to meet environmental regulations.

- Expand service offerings to include real-time tracking and customer engagement features.

By 2035, the market is expected to achieve robust growth, reflecting advancements in efficiency and customer satisfaction.

Market Segmentation

Outlook

- Conveyors

- Destination-Coded Vehicles

by Technology Outlook

- Barcode

- RFID

Commercial Airport Baggage Handling Systems Regional Outlook

- US

- Canada

Commercial Airport Baggage Handling Systems Market by service Outlook

- Self-Service

- Assisted-Service

Commercial Airport Baggage Handling Systems Market by Airport Class Outlook

- A

- B

- C

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 15.30 billion |

| Market Size 2025 | USD 16.76 billion |

| Market Size 2035 | 41.66 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 9.53% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Airport Class, Technology, Service, Type and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Beumer Group (Germany), Daifuku Company Ltd (Japan), Fives Group (France), Pteris Limited (Sir gapore), Grenzebach Maschinenbau GMBH (Germany), G&S Airport Conveyor (U.S.), Logplan LLC (U.S.), BCS Group (Hew Zealand), Siemens AG (Germany), and Vanderlande Industries (Netherlands). |

| Key Market Opportunities | Al is increasingly being used to ensure airport safety |

| Key Market Dynamics | Increases in the number of passengers flying. |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the commercial airport baggage handling systems market?

The commercial airport baggage handling system’s market size was valued at USD 13.97 Billion in 2023.

What is the growth rate of the commercial airport baggage handling systems market?

The market is projected to grow at a CAGR of 9.5% during the forecast period, 2025-2034.

Which region held the largest market share in the commercial airport baggage handling systems market?

North America had the largest share in the market.

Who are the key players in the commercial airport baggage handling systems market?

The key players in the market are Pteris Limited (Sir gapore), Grenzebach Maschinenbau GMBH (Germany), G&S Airport Conveyor (U.S.), Logplan LLC (U.S.).

Which type led the commercial airport baggage handling systems market?

The destination-coded vehicles (DCV) category dominated the market in 2022.

Which technology had the largest market share in the commercial airport baggage handling systems market?

RFID had the largest share of the market.

-

List of Tables and Figures

- 1 Executive Summary 2 Scope Of The Report 2.1. Market Definition 2.2. Scope of the Study 2.3. Market Structure 2.4. Key Takeaways 2.5. Key Buying Criteria 3 Research Methodology 3.1. Research Process 3.2. Primary Research 3.3. Secondary Research 3.4. Market Size Estimation 3.5. Forecast Model 3.6. List Of Assumptions 4 Market Dynamics 4.1. Introduction 4.2. Market Drivers 4.2.1. Driver Impact Analysis 4.3. Market Restraints 4.3.1. Restraint Impact Analysis 4.4. Market Opportunities 4.5. Technological Trends 4.6. Patent Analysis 4.7. Regulatory Landscape 4.8. Market Life Cycle 5 Market Factor Analysis 5.1. Porter’s Five Forces Analysis 5.1.1. Threat Of New Entrants 5.1.2. Bargaining Power Of Buyers 5.1.3. Threat Of Substitutes 5.1.4. Rivalry 5.1.5. Bargaining Power Of Suppliers 5.2. Supply Chain Analysis 6 Global Commercial Airport Baggage Handling Systems Market, By Airport Class 6.1. Introduction 6.2. Class A 6.2.1. Market Estimates & Forecast, 2025-2034 6.2.2. Market Estimates & Forecast, By Region, 2025-2034 6.3. Class B 6.3.1. Market Estimates & Forecast, 2025-2034 6.3.2. Market Estimates & Forecast, By Region, 2025-2034 6.4. Class B 6.4.1. Market Estimates & Forecast, 2025-2034 6.4.2. Market Estimates & Forecast, By Region, 2025-2034 7 Global Commercial Airport Baggage Handling Systems Market, By Technology 7.1. Introduction 7.2. Barcode 7.2.1. Market Estimates & Forecast, 2025-2034 7.2.2. Market Estimates & Forecast, By Region, 2025-2034 7.3. RFID 7.3.1. Market Estimates & Forecast, 2025-2034 7.3.2. Market Estimates & Forecast, By Region, 2025-2034 8 Global Commercial Airport Baggage Handling Systems Market, By Type 8.1. Introduction 8.2. Conveyors 8.2.1. Market Estimates & Forecast, 2025-2034 8.2.2. Market Estimates & Forecast, By Region, 2025-2034 8.3. Destination-Coded Vehicles 8.3.1. Market Estimates & Forecast, 2025-2034 8.3.2. Market Estimates & Forecast, By Region, 2025-2034 9 Global Commercial Airport Baggage Handling Systems Market, By Service 9.1. Introduction 9.2. Self-Service 9.2.1. Market Estimates & Forecast, 2025-2034 9.2.2. Market Estimates & Forecast, By Region, 2025-2034 9.3. Assisted-Service 9.3.1. Market Estimates & Forecast, 2025-2034 9.3.2. Market Estimates & Forecast, By Region, 2025-2034 10 Global Commercial Airport Baggage Handling Systems Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Market Estimates & Forecast, By Country, 2025-2034 10.2.2. Market Estimates & Forecast, By Airport Class, 2025-2034 10.2.3. Market Estimates & Forecast, By Technology, 2025-2034 10.2.4. Market Estimates & Forecast, By Service, 2025-2034 10.2.5. Market Estimates & Forecast, By Type, 2025-2034 10.2.6. US 10.2.6.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.2.6.2. Market Estimates & Forecast, By Technology, 2025-2034 10.2.6.3. Market Estimates & Forecast, By Service, 2025-2034 10.2.6.4. Market Estimates & Forecast, By Type, 2025-2034 10.2.7. Canada 10.2.7.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.2.7.2. Market Estimates & Forecast, By Technology, 2025-2034 10.2.7.3. Market Estimates & Forecast, By Type, 2025-2034 10.2.7.4. Market Estimates & Forecast, By Service, 2025-2034 10.3. Europe 10.3.1. Market Estimates & Forecast, By Country, 2025-2034 10.3.2. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.3. Market Estimates & Forecast, By Technology, 2025-2034 10.3.4. Market Estimates & Forecast, By Type, 2025-2034 10.3.5. Market Estimates & Forecast, By Service, 2025-2034 10.3.6. UK 10.3.6.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.6.2. Market Estimates & Forecast, By Technology, 2025-2034 10.3.6.3. Market Estimates & Forecast, By Type, 2025-2034 10.3.6.4. Market Estimates & Forecast, By Service, 2025-2034 10.3.7. Germany 10.3.7.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.7.2. Market Estimates & Forecast, By Technology, 2025-2034 10.3.7.3. Market Estimates & Forecast, By Type, 2025-2034 10.3.7.4. Market Estimates & Forecast, By Service, 2025-2034 10.3.8. France 10.3.8.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.8.2. Market Estimates & Forecast, By Technology, 2025-2034 10.3.8.3. Market Estimates & Forecast, By Type, 2025-2034 10.3.8.4. Market Estimates & Forecast, By Service, 2025-2034 10.3.9. Italy 10.3.9.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.9.2. Market Estimates & Forecast, By Technology, 2025-2034 10.3.9.3. Market Estimates & Forecast, By Type, 2025-2034 10.3.9.4. Market Estimates & Forecast, By Service, 2025-2034 10.3.10. Russia 10.3.10.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.10.2. Market Estimates & Forecast, By Technology, 2025-2034 10.3.10.3. Market Estimates & Forecast, By Type, 2025-2034 10.3.10.4. Market Estimates & Forecast, By Service, 2025-2034 10.3.11. Turkey 10.3.11.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.11.2. Market Estimates & Forecast, By Technology, 2025-2034 10.3.11.3. Market Estimates & Forecast, By Type, 2025-2034 10.3.11.4. Market Estimates & Forecast, By Service, 2025-2034 10.3.12. Rest Of Europe 10.3.12.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.3.12.2. Market Estimates & Forecast, By Technology, 2025-2034 10.3.12.3. Market Estimates & Forecast, By Type, 2025-2034 10.3.12.4. Market Estimates & Forecast, By Service, 2025-2034 10.4. Asia-Pacific 10.4.1. Market Estimates & Forecast, By Country, 2025-2034 10.4.2. Market Estimates & Forecast, By Airport Class, 2025-2034 10.4.3. Market Estimates & Forecast, By Technology, 2025-2034 10.4.4. Market Estimates & Forecast, By Type, 2025-2034 10.4.5. Market Estimates & Forecast, By Service, 2025-2034 10.4.6. China 10.4.6.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.4.6.2. Market Estimates & Forecast, By Technology, 2025-2034 10.4.6.3. Market Estimates & Forecast, By Type, 2025-2034 10.4.6.4. Market Estimates & Forecast, By Service, 2025-2034 10.4.7. Japan 10.4.7.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.4.7.2. Market Estimates & Forecast, By Technology, 2025-2034 10.4.7.3. Market Estimates & Forecast, By Type, 2025-2034 10.4.7.4. Market Estimates & Forecast, By Service, 2025-2034 10.4.8. India 10.4.8.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.4.8.2. Market Estimates & Forecast, By Technology, 2025-2034 10.4.8.3. Market Estimates & Forecast, By Type, 2025-2034 10.4.8.4. Market Estimates & Forecast, By Service, 2025-2034 10.4.9. South Korea 10.4.9.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.4.9.2. Market Estimates & Forecast, By Technology, 2025-2034 10.4.9.3. Market Estimates & Forecast, By Type, 2025-2034 10.4.9.4. Market Estimates & Forecast, By Service, 2025-2034 10.4.10. Rest Of Asia-Pacific 10.4.10.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.4.10.2. Market Estimates & Forecast, By Technology, 2025-2034 10.4.10.3. Market Estimates & Forecast, By Type, 2025-2034 10.4.10.4. Market Estimates & Forecast, By Service, 2025-2034 10.5. Middle East & Africa 10.5.1. Market Estimates & Forecast, By Country, 2025-2034 10.5.2. Market Estimates & Forecast, By Airport Class, 2025-2034 10.5.3. Market Estimates & Forecast, By Technology, 2025-2034 10.5.4. Market Estimates & Forecast, By Type, 2025-2034 10.5.5. Market Estimates & Forecast, By Service, 2025-2034 10.5.6. UAE 10.5.6.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.5.6.2. Market Estimates & Forecast, By Technology, 2025-2034 10.5.6.3. Market Estimates & Forecast, By Type, 2025-2034 10.5.6.4. Market Estimates & Forecast, By Service, 2025-2034 10.5.7. South Arabia 10.5.7.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.5.7.2. Market Estimates & Forecast, By Technology, 2025-2034 10.5.7.3. Market Estimates & Forecast, By Type, 2025-2034 10.5.7.4. Market Estimates & Forecast, By Service, 2025-2034 10.5.8. Israel 10.5.8.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.5.8.2. Market Estimates & Forecast, By Technology, 2025-2034 10.5.8.3. Market Estimates & Forecast, By Type, 2025-2034 10.5.8.4. Market Estimates & Forecast, By Service, 2025-2034 10.5.9. Rest Of The Middle East And Africa 10.5.9.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.5.9.2. Market Estimates & Forecast, By Technology, 2025-2034 10.5.9.3. Market Estimates & Forecast, By Type, 2025-2034 10.5.9.4. Market Estimates & Forecast, By Service, 2025-2034 10.6. Latin America 10.6.1. Market Estimates & Forecast, By Country, 2025-2034 10.6.2. Market Estimates & Forecast, By Airport Class, 2025-2034 10.6.3. Market Estimates & Forecast, By Technology, 2025-2034 10.6.4. Market Estimates & Forecast, By Type, 2025-2034 10.6.5. Market Estimates & Forecast, By Service, 2025-2034 10.6.6. Rest Of The Middle East And Africa 10.6.6.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.6.6.2. Market Estimates & Forecast, By Technology, 2025-2034 10.6.6.3. Market Estimates & Forecast, By Type, 2025-2034 10.6.6.4. Market Estimates & Forecast, By Service, 2025-2034 10.6.7. Brazil 10.6.7.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.6.7.2. Market Estimates & Forecast, By Technology, 2025-2034 10.6.7.3. Market Estimates & Forecast, By Type, 2025-2034 10.6.7.4. Market Estimates & Forecast, By Service, 2025-2034 10.6.8. Mexico 10.6.8.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.6.8.2. Market Estimates & Forecast, By Technology, 2025-2034 10.6.8.3. Market Estimates & Forecast, By Type, 2025-2034 10.6.8.4. Market Estimates & Forecast, By Service, 2025-2034 10.6.9. Rest Of Latin America 10.6.9.1. Market Estimates & Forecast, By Airport Class, 2025-2034 10.6.9.2. Market Estimates & Forecast, By Technology, 2025-2034 10.6.9.3. Market Estimates & Forecast, By Type, 2025-2034 10.6.9.4. Market Estimates & Forecast, By Service, 2025-2034 11 Competitive Landscape 11.1. Competitive Scenario 11.2. Market Share Analysis 11.3. Mergers & Acquisitions 11.4. Company Mapping 11.5. Competitive Benchmarking 11.6. Competitor Dashboard 12 Company Profiles 12.1. Beumer Group 12.1.1. Company Overview 12.1.2. Product Offering 12.1.3. Financial Overview 12.1.4. Key Developments 12.1.5. Swot Analysis 12.1.6. Strategy 12.2. Daifuku Company Ltd 12.2.1. Company Overview 12.2.2. Product Offering 12.2.3. Financial Overview 12.2.4. Key Developments 12.2.5. Swot Analysis 12.2.6. Strategy 12.3. Fives Group 12.3.1. Company Overview 12.3.2. Product Offering 12.3.3. Financial Overview 12.3.4. Key Developments 12.3.5. Swot Analysis 12.3.6. Strategy 12.4. Pteris Global Limited 12.4.1. Company Overview 12.4.2. Product Offering 12.4.3. Financial Overview 12.4.4. Key Developments 12.4.5. Swot Analysis 12.4.6. Strategy 12.5. Grenzebach Maschinenbau GMBH 12.5.1. Company Overview 12.5.2. Product Offering 12.5.3. Financial Overview 12.5.4. Key Developments 12.5.5. Swot Analysis 12.5.6. Strategy 12.6. G&S Airport Conveyor 12.6.1. Company Overview 12.6.2. Product Offering 12.6.3. Financial Overview 12.6.4. Key Developments 12.6.5. Swot Analysis 12.6.6. Strategy 12.7. Logplan LLC 12.7.1. Company Overview 12.7.2. Product Offering 12.7.3. Financial Overview 12.7.4. Key Developments 12.7.5. Swot Analysis 12.7.6. Strategy 12.8. BCS Group 12.8.1. Company Overview 12.8.2. Product Offering 12.8.3. Financial Overview 12.8.4. Key Developments 12.8.5. Swot Analysis 12.8.6. Strategy 12.9. Siemens AG 12.9.1. Company Overview 12.9.2. Product Offering 12.9.3. Financial Overview 12.9.4. Key Developments 12.9.5. Swot Analysis 12.9.6. Strategy 12.10. Vanderlande Industries 12.10.1. Company Overview 12.10.2. Product Offering 12.10.3. Financial Overview 12.10.4. Key Developments 12.10.5. Swot Analysis 12.10.6. Strategy 13 Appendix 13.1. References 13.2. Related Reports 13.3. List Of Abbreviations 14 List Of Tables

- Table 1 Global Commercial Airport Baggage Handling Systems Market, By Region, 2025-2034

- Table 2 North America: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 3 Europe: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 4 Asia-Pacific: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 5 Middle East & Africa: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 6 Latin America: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 7 Global Commercial Airport Baggage Handling Systems Market, By Region, 2025-2034

- Table 8 North America: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 9 Europe: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 10 Asia-Pacific: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 11 Middle East & Africa: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 12 Latin America: Commercial Airport Baggage Handling Systems Market, By Country, 2025-2034

- Table 13 Global Electronic Warfare Airport Class Market, By Region, 2025-2034

- Table 14 North America: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 15 Europe: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 16 Asia-Pacific: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 17 Middle East & Africa: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 18 Latin America: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 19 Global Electronic Warfare Airport Class Market, By Region, 2025-2034

- Table 20 North America: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 21 Europe: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 22 Asia-Pacific: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 23 Middle East & Africa: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 24 Latin America: Electronic Warfare Airport Class Market, By Country, 2025-2034

- Table 25 Global Commercial Airport Baggage Handling Systems Market, By Region, 2025-2034

- Table 26 Global Commercial Airport Baggage Handling Systems Market, By Technology, 2025-2034

- Table 27 Global Commercial Airport Baggage Handling Systems Market, By Type, 2025-2034

- Table 28 Global Commercial Airport Baggage Handling Systems Market, By Airport Class, 2025-2034

- Table 29 Global Commercial Airport Baggage Handling Systems Market, By Service, 2025-2034

- Table 30 North America: Commercial Airport Baggage Handling Systems Market, By Country

- Table 31 North America: Commercial Airport Baggage Handling Systems Market, By Technology

- Table 32 North America: Commercial Airport Baggage Handling Systems Market, By Type

- Table 33 North America: Commercial Airport Baggage Handling Systems Market, By Airport Class

- Table 34 North America: Commercial Airport Baggage Handling Systems Market, By Service

- Table 35 Europe: Commercial Airport Baggage Handling Systems Market, By Country

- Table 36 Europe: Commercial Airport Baggage Handling Systems Market, By Technology

- Table 37 Europe: Commercial Airport Baggage Handling Systems Market, By Type

- Table 38 Europe: Commercial Airport Baggage Handling Systems Market, By Airport Class

- Table 39 Europe: Commercial Airport Baggage Handling Systems Market, By Service

- Table 40 Asia-Pacific: Commercial Airport Baggage Handling Systems Market, By Country

- Table 41 Asia-Pacific: Commercial Airport Baggage Handling Systems Market, By Technology

- Table 42 Asia-Pacific: Commercial Airport Baggage Handling Systems Market, By Type

- Table 43 Asia-Pacific: Commercial Airport Baggage Handling Systems Market, By Airport Class

- Table 44 Asia-Pacific: Commercial Airport Baggage Handling Systems Market, By Service

- Table 45 Middle East & Africa: Commercial Airport Baggage Handling Systems Market, By Region

- Table 46 Middle East & Africa: Commercial Airport Baggage Handling Systems Market, By Technology

- Table 47 Middle East & Africa: Commercial Airport Baggage Handling Systems Market, By Type

- Table 48 Middle East & Africa: Commercial Airport Baggage Handling Systems Market, By Service

- Table 49 Latin America: Commercial Airport Baggage Handling Systems Market, By Region

- Table 50 Latin America: Commercial Airport Baggage Handling Systems Market, By Technology

- Table 51 Latin America: Commercial Airport Baggage Handling Systems Market, By Type

- Table 52 Latin America: Commercial Airport Baggage Handling Systems Market, By Airport Class

- Table 53 Latin America: Commercial Airport Baggage Handling Systems Market, By Service 15 List Of Figures

- FIGURE 1 Research Process Of MRFR

- FIGURE 2 Top-Down & Bottom-up Approaches

- FIGURE 3 Market Dynamics

- FIGURE 4 Impact Analysis: Market Drivers

- FIGURE 5 Impact Analysis: Market Restraints

- FIGURE 6 Porter's Five Forces Analysis

- FIGURE 7 Value Chain Analysis

- FIGURE 8 Global Commercial Airport Baggage Handling Systems Market Share, By Airport Class, 2024 (%)

- FIGURE 9 Global Commercial Airport Baggage Handling Systems Market, By Airport Class, 2025-2034 (USD Billion)

- FIGURE 10 Global Commercial Airport Baggage Handling Systems Market Share, By Technology, 2024 (%)

- FIGURE 11 Global Commercial Airport Baggage Handling Systems Market, By Technology, 2025-2034 (USD Billion)

- FIGURE 12 Global Commercial Airport Baggage Handling Systems Market Share, By Type, 2024 (%)

- FIGURE 13 Global Commercial Airport Baggage Handling Systems Market, By Type, 2025-2034 (USD Billion)

- FIGURE 14 Global Commercial Airport Baggage Handling Systems Market Share, By Service, 2024 (%)

- FIGURE 15 Global Commercial Airport Baggage Handling Systems Market, By Service, 2025-2034 (USD Billion)

- FIGURE 16 Global Commercial Airport Baggage Handling Systems Market Share (%), By Region, 2024

- FIGURE 17 Global Commercial Airport Baggage Handling Systems Market, By Region, 2025-2034 (USD Billion)

- FIGURE 18 North America: Commercial Airport Baggage Handling Systems Market Share (%), 2024

- FIGURE 19 North America: Commercial Airport Baggage Handling Systems Market By Country, 2025-2034 (USD Billion)

- FIGURE 20 Europe: Commercial Airport Baggage Handling Systems Market Share (%), 2024

- FIGURE 21 Europe: Commercial Airport Baggage Handling Systems Market By Country, 2025-2034 (USD Billion)

- FIGURE 22 Asia-Pacific: Commercial Airport Baggage Handling Systems Market Share (%), 2024

- FIGURE 23 Asia-Pacific: Commercial Airport Baggage Handling Systems Market By Country, 2025-2034 (USD Billion)

- FIGURE 24 Middle East & Africa Commercial Airport Baggage Handling Systems Market Share (%), 2024

- FIGURE 25 Middle East & Africa Commercial Airport Baggage Handling Systems Market By Country, 2025-2034 (USD Billion)

- FIGURE 26 Latin America Commercial Airport Baggage Handling Systems Market Share (%), 2024

- FIGURE 27 Latin America Commercial Airport Baggage Handling Systems Market By Country, 2025-2034 (USD Billion)

Market Segmentation Tab

Commercial Airport Baggage Handling Systems Market by Airport Class Outlook (USD Billion, 2019-2032)

- A

- B

- C

Commercial Airport Baggage Handling Systems Market by Technology Outlook (USD Billion, 2019-2032)

- Barcode

- RFID

Commercial Airport Baggage Handling Systems Market by service Outlook (USD Billion, 2019-2032)

- Self-Service

- Assisted-Service

Commercial Airport Baggage Handling Systems Market by Type Outlook (USD Billion, 2019-2032)

- Conveyors

- Destination-Coded Vehicles

North America Outlook (USD Billion, 2019-2032)

North America Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

North America Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

North America Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

North America Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

US Outlook (USD Billion, 2019-2032)

US Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

US Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

US Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

US Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

CANADA Outlook (USD Billion, 2019-2032)

CANADA Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

CANADA Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

CANADA Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

CANADA Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Europe Outlook (USD Billion, 2019-2032)

Europe Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Europe Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Europe Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Europe Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Germany Outlook (USD Billion, 2019-2032)

Germany Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Germany Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Germany Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Germany Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

France Outlook (USD Billion, 2019-2032)

France Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

France Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

France Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

France Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

UK Outlook (USD Billion, 2019-2032)

UK Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

UK Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

UK Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

UK Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

ITALY Outlook (USD Billion, 2019-2032)

ITALY Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

ITALY Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

ITALY Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

ITALY Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

SPAIN Outlook (USD Billion, 2019-2032)

Spain Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Spain Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Spain Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Spain Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Rest Of Europe Outlook (USD Billion, 2019-2032)

Rest Of Europe Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

REST OF EUROPE Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

REST OF EUROPE Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

REST OF EUROPE Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Asia-Pacific Outlook (USD Billion, 2019-2032)

Asia-Pacific Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Asia-Pacific Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Asia-Pacific Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Asia-Pacific Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

China Outlook (USD Billion, 2019-2032)

China Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

China Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

China Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

China Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Japan Outlook (USD Billion, 2019-2032)

Japan Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Japan Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Japan Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Japan Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

India Outlook (USD Billion, 2019-2032)

India Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

India Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

India Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

India Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Australia Outlook (USD Billion, 2019-2032)

Australia Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Australia Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Australia Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Australia Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Rest of Asia-Pacific Outlook (USD Billion, 2019-2032)

Rest of Asia-Pacific Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Rest of Asia-Pacific Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Rest of Asia-Pacific Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Rest of Asia-Pacific Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Rest of the World Outlook (USD Billion, 2019-2032)

Rest of the World Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Rest of the World Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Rest of the World Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Rest of the World Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Middle East Outlook (USD Billion, 2019-2032)

Middle East Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Middle East Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Middle East Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Middle East Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Africa Outlook (USD Billion, 2019-2032)

Africa Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Africa Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Africa Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Africa Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Latin America Outlook (USD Billion, 2019-2032)

Latin America Commercial Airport Baggage Handling Systems Market By Airport Class

- A

- B

- C

Latin America Commercial Airport Baggage Handling Systems Market By Technology

- Barcode

- RFID

Latin America Commercial Airport Baggage Handling Systems Market By service

- Self-Service

- Assisted-Service

Latin America Commercial Airport Baggage Handling Systems Market By Type

- Conveyors

- Destination-Coded Vehicles

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment