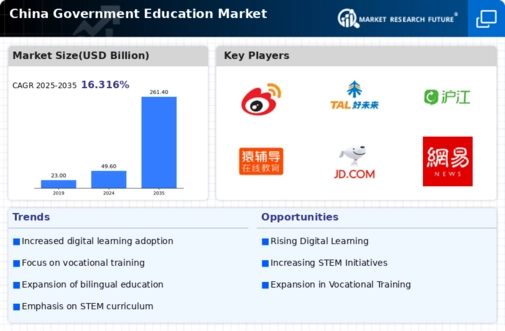

The China Government Education Market has emerged as a significant sector driven by various government initiatives aimed at improving educational standards across the country. With a focus on the integration of technology in education, the market is populated by companies that leverage digital platforms to enhance learning experiences. The competitive landscape is characterized by rapid innovation, diverse offerings, and strategic partnerships. As more students and educational institutions seek to harness digital resources, companies are vying for market share by providing tailored solutions that align with government policies and educational goals.

The push towards modernizing education in China has led to an influx of competitors, creating a dynamic environment where firms must adapt swiftly to stay relevant.

Sina Weibo has established itself as a prominent platform within the China Government Education Market by offering a unique blend of social networking and educational content. With its large user base, Sina Weibo remains influential in shaping discussions around educational reforms, sharing resources, and engaging various stakeholders in the educational landscape. The platform serves as a vital communication tool for educators, students, and policymakers, enabling the seamless exchange of ideas and information. Furthermore, its strengths lie in its ability to facilitate real-time interactions whilst promoting educational initiatives, government announcements, and policy updates to broader audiences.

By fostering a community that prioritizes educational advancement, Sina Weibo successfully enhances its position in this competitive market.

The TAL Education Group operates as a leading provider in the China Government Education Market, particularly known for its extensive range of educational services, including after-school tutoring, online learning platforms, and customized learning solutions for students. With a robust market presence, TAL Education Group focuses on educational quality and innovation, reflecting the evolving demands of students and parents alike. Its strength lies in its commitment to leveraging technology to improve student engagement and learning outcomes. The company has made notable strides through strategic mergers and acquisitions, allowing it to expand its offerings and enhance its reach across various demographics.

TAL Education Group continues to refine its key products and services, adapting to meet the expectations set by the government's educational reform policies while solidifying its position as a trusted name in the education sector within China.